Market Overview by FXCC

Forex Technical & Market Analysis FXCC Oct 24 2013

Flash PMIs will dictate the market mood on Thursday

The DJIA closed down 0.35% on Wednesday, the recent rally, due to a temporary solution regarding the debt ceiling issue being agreed, may have now faded. The SPX closed down 0.47% and the NASDAQ down 0.57%. In Europe the STOXX index closed down 0.94%, reacting badly to the coming bank tests, the FTSE closed down 0.32%, CAC down 0.81%, DAX down 0.31%. The IBEX reacted badly to the bank test news despite crawling out of a deep recession, down 1.84% on the day. The MIB closed down 2.38%, with the Athens exchange hurting the most, down 3.82% on the day. Commodities once again endured a sell off on Wednesday, improved crude oil reserve numbers for the USA, up to 5.2 million barrels, caused WTI oil to fall by 1.22% to end at $97.10 per barrel on the day. The critical psyche level of $100 per barrel now being breached substantially with new medium term support levels being established. NYMEX natural rose by 1.06% to $3.62 per therm. COMEX gold was down 0.72% at $1333.00, with silver on COMEX down 1.01%. Equity index futures are pointing to a negative open in Europe followed by New York opening down. The DJIA equity index future is currently down 0.38%, NASDAQ down 0.42%, STOXX down 0.96%, FTSE down 0.40%, DAX down 0.35% The yen gained 0.8 percent to 134.12 per euro late in New York, after climbing as much as 1.2 percent, the biggest intraday advance since Aug. 27th. It depreciated to 135.51 Wednesday, the weakest level since November 2009. Japan’s currency strengthened 0.8 percent to 97.34 per dollar and touched 97.16, breaching its 200-day moving average at 97.28. The yen strengthened the most in eight weeks versus the euro as borrowing costs for Chinese banks jumped by the most since July affecting demand for safer assets.

http://blog.fxcc.com/market-analysis

FOREX ECONOMIC CALENDAR :

2013-10-24 07:58 GMT | EMU Markit Services PMI (Oct)

2013-10-24 14:00 GMT | US New Home Sales (MoM) (Sep)

2013-10-24 16:45 GMT | UK BOE's Governor Carney speech

2013-10-24 23:30 GMT | JP National Consumer Price Index (YoY) (Sep)

FOREX NEWS :

2013-10-24 05:07 GMT | EUR/USD continues to consolidate around 1.3780 area

2013-10-24 04:47 GMT | NZD/USD rejected off 0.8440 resistance, NZ Treasury report weighs

2013-10-24 04:20 GMT | USD/CHF breaks 2012 lows despite upbeat Chinese PMI

2013-10-24 03:06 GMT | GBP/JPY on EMA20 at 157.60

---------------------

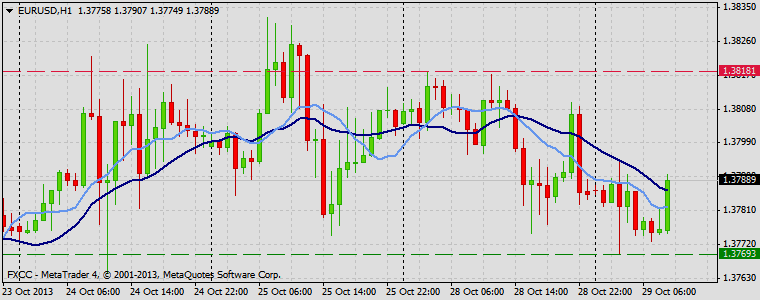

EURUSD :

HIGH 1.37931 LOW 1.37733 BID 1.37921 ASK 1.37924 CHANGE 0.12% TIME 08:51:48

OUTLOOK SUMMARY : Up

TREND CONDITION : Sideway

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : Medium

MARKET ANALYSIS - Intraday Analysis

Upwards scenario: Possibility of further market appreciation is seen above the resistance level at 1.3794 (R1). Break here is required to validate next targets at 1.3821 (R2) and 1.3846 (R3) Downwards scenario: On the other hand, progress below the initial support level at 1.3761 (S1) might initiate bearish pressure and expose our intraday targets at 1.3735 (S2) and 1.3710 (S3) later on today.

Resistance Levels: 1.3794, 1.3821, 1.3846

Support Levels: 1.3761, 1.3735, 1.3710

-----------------

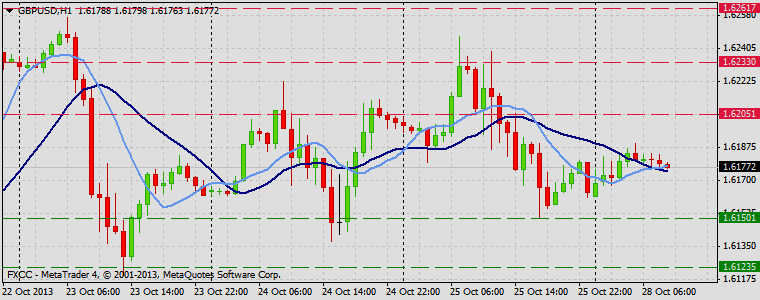

GBPUSD :

HIGH 1.62025 LOW 1.61623 BID 1.61914 ASK 1.61917 CHANGE 0.18% TIME 08:51:49

OUTLOOK SUMMARY : Up

TREND CONDITION : Upward penetration

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : Medium

Upwards scenario: Measures of resistance might be activating if the pair approaches 1.6225 (R1) price level. Break here would suggest next interim target at 1.6257 (R2) and If the price keeps its momentum we expect an exposure of 1.6287 (R3). Downwards scenario: Possible downward penetration is limited now to support level at 1.6157 (S1). If the price manages to surpass it, we would suggest next intraday targets at 1.6128 (S2) and 1.6099 (S3).

Resistance Levels: 1.6225, 1.6257, 1.6287

Support Levels: 1.6157, 1.6128, 1.6099

-------------------

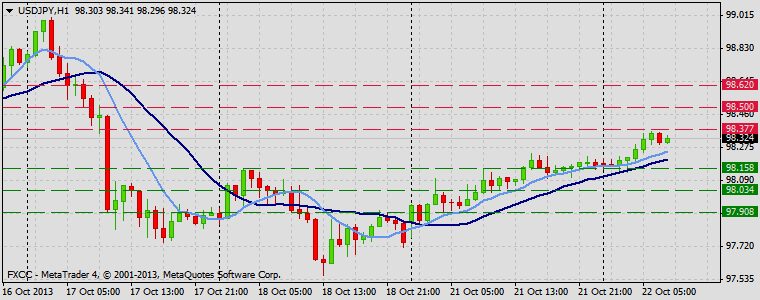

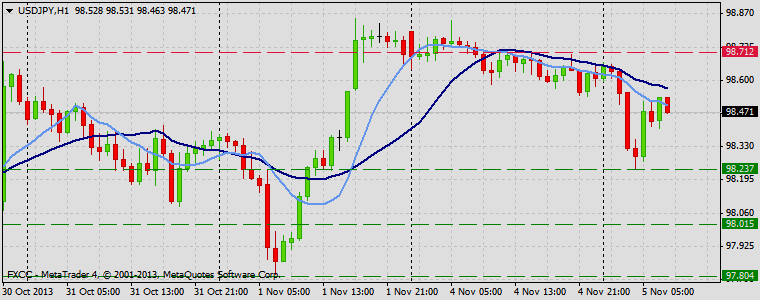

USDJPY :

HIGH 97.617 LOW 97.175 BID 97.597 ASK 97.599 CHANGE 0.24% TIME 08:51:50

OUTLOOK SUMMARY : Down

TREND CONDITION : Sideway

TRADERS SENTIMENT : Bullish

IMPLIED VOLATILITY : Medium

Upwards scenario: Corrective action is possible today. Clearance of next resistance level at 97.56 (R1) would suggest next intraday targets at 97.75 (R2) and 97.96 (R3) later on today. Downwards scenario: On the other side, current price pattern suggests bearish potential if the instrument manages to overcome key support level at 97.15 (S1). Further price regress is liable to expose our initial targets at 96.96 (S2) and 96.77 (S3).

Resistance Levels: 97.56, 97.75, 97.96

Support Levels: 97.15, 96.96, 96.77

Source: FX Central Clearing Ltd,( http://www.fxcc.com )

Forex Technical & Market Analysis FXCC Oct 25 2013

Will the UK's GDP figure beat the expectation of 0.8%?

A major publication, that could impact on the UK FTSE and the value of sterling, is the latest UK preliminary GDP figure, published courtesy of the UK's ONS. The expectation is that the print will come in at 0.8%, up from 0.7% in the previous quarter. The German IFO business index is predicted to come in at an improved 108.2. The EU economic summit is worth keeping aware of given the potential for a surprise policy announcement. Core durable goods orders in the USA are expected to come in at 0.6% up from the -0.1% figure last month. The dollar lost 0.2 percent to $1.3801 per euro late in New York and reached $1.3825, the weakest since November 2011. It fell 0.1 percent to 97.28 yen after touching 97.16 Wednesday, the lowest since Oct. 9th. Europe’s shared currency gained 0.1 percent to 134.26 yen after rising as much as 0.5 percent earlier and weakening 0.2 percent. The dollar slid to a two-year low versus the euro as weaker-than-forecast economic data and concern that U.S. growth was hurt by a government shutdown added to bets the Federal Reserve will delay slowing stimulus until next year. The loonie, as the Canadian dollar is known, fell by 0.4 percent to C$1.0422 per U.S. dollar in Toronto. It has dropped as much as 1.5 percent during the past two days and reaching the weakest since Sept. 9th. One loonie buys 95.95 U.S. cents. The Canadian dollar had the biggest two-day slump in four months after the central bank altered its forward guidance narrative regarding future interest-rate rises that had been in place for more than a year, as risks of a worsening economy have increased.

http://blog.fxcc.com/market-analysis

FOREX ECONOMIC CALENDAR :

24h | European Council meeting

2013-10-25 08:00 GMT | DE IFO - Current Assessment (Oct)

2013-10-25 08:30 GMT | UK Gross Domestic Product (YoY)

2013-10-25 12:30 GMT | US Durable Goods Orders (Sep)

FOREX NEWS :

2013-10-25 05:03 GMT | USD/JPY collapses in tandem with Nikkei on highest Shibor since July

2013-10-25 04:15 GMT | NZD/USD falls sharply amidst a better mood in Asian markets

2013-10-25 04:14 GMT | EUR/USD keeps on testing 1.3820, break allows 1.3865

2013-10-25 03:03 GMT | AUD/USD recovers support above 0.96

------------------

EURUSD :

HIGH 1.38323 LOW 1.37851 BID 1.38189 ASK 1.38193 CHANGE 0.13% TIME 08 : 37:41

OUTLOOK SUMMARY : Up

TREND CONDITION : Up trend

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : Medium

MARKET ANALYSIS - Intraday Analysis

Upside risk aversion is seen above the next resistance level at 1.3846 (R1). Appreciation above it might lead to the positive intraday bias formation towards to our next targets at 1.3874 (R2) and 1.3902 (R3) in potential. Downwards scenario: Possible downside extension is limited now to the support level at 1.3785 (S1). Break here is required to open a route towards to next target at 1.3758 (S2) and then any further easing would be targeting final support at 1.3729 (S3).

Resistance Levels: 1.3846, 1.3874, 1.3902

Support Levels: 1.3785, 1.3758, 1.3729

-------------------

GBPUSD :

HIGH 1.62469 LOW 1.61795 BID 1.62296 ASK 1.62298 CHANGE 0.18% TIME 08 : 37:42

OUTLOOK SUMMARY : Up

TREND CONDITION : Upward penetration

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : Medium

Upwards scenario: Current positive bias development might face next resistive measure at 1.6257 (R1). If the price manages to overcome it we would suggest next intraday targets at 1.6287 (R2) and 1.6318 (R3). Downwards scenario: On the other hand, if the price clear the supportive measure at 1.6178 (S1), we would suggest next target at 1.6148 (S2) and then final attractive point could be found at 1.6117 (S3) later on today.

Resistance Levels: 1.6257, 1.6287, 1.6318

Support Levels: 1.6178, 1.6148, 1.6117

----------------------

USDJPY :

HIGH 97.433 LOW 96.944 BID 97.062 ASK 97.064 CHANGE -0.22% TIME 08 : 37:43

OUTLOOK SUMMARY : Down

TREND CONDITION : Down trend

TRADERS SENTIMENT : Bullish

IMPLIED VOLATILITY : Medium

Upwards scenario: Medium term bias remains negative and possible price appreciation is limited now to resistive barrier at 97.37 (R1). Clearance of that level would suggest next intraday targets at 97.55 (R2) and 97.73 (R3). Downwards scenario: On the downside next challenge is seen at 96.93 (S1). Breakthrough here would open road for a price depreciation towards to our initial targets at 96.75 (S2) and 96.57 (R3) in potential.

Resistance Levels: 97.37, 97.55, 97.73

Support Levels: 96.93, 96.75, 96.57

Source: FX Central Clearing Ltd,( http://www.fxcc.com )

Forex Technical & Market Analysis FXCC Oct 28 2013

China indicates the release of unprecedented economic measures when it holds its next government meeting.

There are several USA high impact news events for Monday that could affect market sentiment. Pending home sales is expected to increase to 0.5% month on month from a surprise fall of -1.6% last month. Industrial production data is expected to increase to 0.5% month on month. Economists forecast no change in purchases, the worst reading in six months, after a 0.2 percent advance in August, according to a survey ahead of Commerce Department figures due Oct. 29th. Sales excluding motor vehicle dealers may have increased 0.4 percent in September, a sign other merchants had more success selling to customers. The RBA governor Stevens speaks later in the afternoon, investors in AUS and speculators in the Aussie will be looking for any clues regarding a base interest rate cut which appeared to be off the table in last week's notes from the RBA. Japan issues a raft of data on Monday; retail sales, unemployment and household spending which if poor the Nikkei could fall with a corresponding rise in yen as a safe haven. Retail sales are expected to rise, unemployment to fall to 4%, but household spending is also predicted to increase by 0.7%.

http://blog.fxcc.com/market-analysis

FOREX ECONOMIC CALENDAR :

2013-10-28 13:15 GMT | US Industrial Production (MoM) (Sep)

2013-10-28 14:00 GMT | US Pending Home Sales (YoY) (Sep)

2013-10-28 22:30 GMT | RBA's Governor Glenn Stevens Speech

2013-10-28 23:30 GMT | JP Unemployment Rate (Sep)

FOREX NEWS :

2013-10-28 06:37 GMT | EUR/GBP opens lower ahead of German data – trading range bound short-term

2013-10-28 06:20 GMT | EUR/USD hovers around 1.3800, ahead of a batch of US data, FOMC

2013-10-28 06:06 GMT | USD/CHF trading higher to start weak; technicians skeptical with 0.8750 downside target

2013-10-28 05:04 GMT | GBP/USD consolidates around 1.6180 area, awaiting the severe storm in UK

------------------------

EURUSD :

HIGH 1.38177 LOW 1.37959 BID 1.38003 ASK 1.38005 CHANGE -0.02% TIME 08 : 49:13

OUTLOOK SUMMARY : Neutral

TREND CONDITION : Sideway

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : Low

MARKET ANALYSIS - Intraday Analysis

Upwards scenario: EURUSD is approaching our key resistive measure at 1.3833 (R1). If the price manages to overcome it we would suggest next intraday targets at 1.3862 (R2) and 1.3892 (R3). Downwards scenario: On the other hand, our next supportive barrier at 1.3775 (S1) prevents possible correction development. Break here is required to enable downside expansion towards to our intraday targets at 1.3745 (S2) and 1.3714 (S3).

Resistance Levels: 1.3833, 1.3862, 1.3892

Support Levels: 1.3775, 1.3745, 1.3714

-------------------

GBPUSD :

HIGH 1.61895 LOW 1.61615 BID 1.61796 ASK 1.61798 CHANGE 0.1% TIME 08 : 49:14

OUTLOOK SUMMARY : Neutral

TREND CONDITION : Sideway

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : Low

Upwards scenario: Possible penetration above the resistance level at 1.6205 (R1) is liable to open way towards to our initial targets at 1.6233 (R2) and 1.6261 (R3). Downwards scenario: In terms of technical levels, risk of price depreciation is seen below the support level at 1.6150 (S1). Loss here would suggest to monitor marks at 1.6123 (S2) and 1.6097 (S3) as possible intraday targets.

Resistance Levels: 1.6205, 1.6233, 1.6261

Support Levels: 1.6150, 1.6123, 1.6097

------------------

USDJPY :

HIGH 97.733 LOW 97.446 BID 97.587 ASK 97.591 CHANGE 0.2% TIME 08 : 49:15

OUTLOOK SUMMARY : Up

TREND CONDITION : Upward penetration

TRADERS SENTIMENT : Bullish

IMPLIED VOLATILITY : Medium

Upwards scenario: Instrument gained momentum on the upside recently, turning short-term bias to the positive side. Further upwards penetration above the resistance at 97.74 (R1) might enable bullish forces and expose our initial targets at 97.87 (R2) and 98.00 (R3). Downwards scenario: Risk of further market decline is seen below the next support level at 97.44 (S1). Loss here is liable to downgrade currency rate towards to the next supportive means at 97.31 (S2) and 97.18 (S3) in potential.

Resistance Levels: 97.74, 97.87, 98.00

Support Levels: 97.44, 97.31, 97.18

Source: FX Central Clearing Ltd,( http://www.fxcc.com )

Forex Technical & Market Analysis FXCC Oct 29 2013

FOMC meeting starts as speculation mounts regarding potential taper of monetary easing programme

Naturally most investor eyes will be fixed on any announcements from the first day of the FOMC meeting, clues as to tapering will be hawkishly observed. Net lending to individuals in the UK should print at 2.5 billion up from 1.6 billion the previous month. Similarly mortgage approvals should rise to 65K from 62K the previous month. Retail sales in the USA are expected to print at 0.2% up, with PPI up 0.2%. Annual house prices in the USA are expected to be up 12.4% year on year. The USA Conference Board sentiment index is expected in at 75.2 a fall from 79.7 the previous month. The bank of Canada governor Poloz is due to testify, along with Senior Deputy Governor Tiff Macklem, before the House of Commons Standing Committee on Finance, in Ottawa. The DJIA closed down 0.01% on Monday, the SPX up 0.13% and the NASDAQ down 0.08%. European indices were mixed, STOXX index down 0.42%, FTSE up 0.07%, CAC down 0.48%, DAX down 0.03%. The Athens exchange once again bucked the trend by closing up 1.37%. Commodities rallied on Monday, ICE WTI oil finished the day up 0.85% at $98.68 per barrel, NYMEX natural down 0.17% at $3.56 per therm, COMEX gold closed up 0.04% on the day at $1352.70 and silver down 0.06% at $22.52 per ounce. Oil rallied amid a drop in Libyan output and bets that central banks in America and Japan will maintain monetary stimulus. Looking towards the European open STOXX equity index future is down 0.36%, FTSE up 0.24%, CAC down 0.46% and DAX down 0.03%. The DJIA equity index future is currently down 0.03%, SPX down 0.02% and the NASDAQ down 0.27%.

http://blog.fxcc.com/market-analysis

FOREX ECONOMIC CALENDAR :

2013-10-29 09:30 GMT | UK Mortgage Approvals (Sep)

2013-10-29 12:30 GMT | US Retail Sales (MoM) (Sep)

2013-10-29 14:00 GMT | US Consumer Confidence (Oct)

2013-10-29 23:50 GMT | JP Industrial Production (YoY) (Sep)

FOREX NEWS :

2013-10-29 03:16 GMT | GBP/USD glued to 1.6085 support

2013-10-29 02:55 GMT | USD/JPY exhausts after recovering session losses around 97.60

2013-10-29 02:03 GMT | AUD/USD emerges from 0.9515 2-week lows; consolidating above 0.9540

2013-10-29 01:21 GMT | EUR/USD pulling back gently. Is it anticipating bad data out of the US?

-----------------

EURUSD

HIGH 1.37937 LOW 1.37693 BID 1.37856 ASK 1.37858 CHANGE 0% TIME 08 : 40:07

OUTLOOK SUMMARY : Neutral

TREND CONDITION : Sideway

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : Medium

MARKET ANALYSIS - Intraday Analysis

Upwards scenario: Possibility of market strengthening is seen above the immediate resistive barrier at 1.3818 (R1). Clearance here would suggest next interim target at 1.3845 (R2) and then final aim locates at 1.3872 (R3). Downwards scenario: As long as price stays below the next resistance level our technical outlook would be negative. Next on tap is support level at 1.3769 (S1). Penetration below this mark would suggest next targets at 1.3741 (S2) and 1.3714 (S3).

Resistance Levels: 1.3818, 1.3845, 1.3872

Support Levels: 1.3769, 1.3741, 1.3714

----------------

GBPUSD :

HIGH 1.61442 LOW 1.60643 BID 1.61024 ASK 1.61033 CHANGE -0.24% TIME 08 : 40:07

OUTLOOK SUMMARY : Down

TREND CONDITION : Downward penetration

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : Medium

Upwards scenario: Our next resistance level is placed at 1.6137 (R1). Break here would open route towards to higher target at 1.6161 (R2) and any further price advance would then be limited to 1.6185 (R3).Downwards scenario: On the other hand, possible downside expansion might face next hurdle at 1.6063 (S1). Break here is required to initiate bearish pressure and validate our immediate targets at 1.6040 (S2) and 1.6019 (S3) in potential.

Resistance Levels: 1.6137, 1.6161, 1.6185

Support Levels: 1.6063, 1.6040, 1.6019

---------------

USDJPY :

HIGH 97.717 LOW 97.462 BID 97.540 ASK 97.542 CHANGE -0.14% TIME 08 : 40:08

OUTLOOK SUMMARY : Down

TREND CONDITION : Downward penetration

TRADERS SENTIMENT : Bullish

IMPLIED VOLATILITY : Medium

Upwards scenario: Clearance of our next resistive barrier at 97.74 (R1) might push the price towards to our next visible targets at 97.87 (R2) and 98.00 (R3). Downwards scenario: Activation of bearish forces is possible below the support level at 97.44 (S1). Clearance here would suggest next interim target at 97.31 (S2) and if the price holds its momentum we would suggest final aim at 97.18 (S3).

Resistance Levels: 97.74, 97.87, 98.00

Support Levels: 97.44, 97.31, 97.18

Source: FX Central Clearing Ltd,( http://www.fxcc.com )

Forex Technical & Market Analysis FXCC Oct 30 2013

Tuesday's NFP day, let's be careful out there

The big event of the day is the 18 day late publication of the NFP figures. Traders need to exercise caution as the figure might come in far better than predicted, but be subject to significant revisions due to the temporary govt. shutdown. The anticipation is for a print of 182K jobs created with the unemployment rate remaining steady at 7.3%. The benchmark 10-year yield rose two basis points, or 0.02 percentage point, to 2.60 percent as of 5 p.m in New York. The price of the 2.5 percent note due in August 2023 fell 6/32, or $1.88 per $1,000 face amount, to 99 1/8. The yield declined to 2.54 percent on Oct. 18th, the lowest since July 24th, down from a 2013 high of 3 percent on Sept. 6th.Treasury 10-year notes snapped a three-day advance before the NFP government report on Tuesday.

http://blog.fxcc.com/market-analysis

FOREX ECONOMIC CALENDAR :

2013-10-22 08:30 GMT | UK Public Sector Net Borrowing (Sep)

2013-10-22 12:30 GMT | US Nonfarm Payrolls (Sep)

2013-10-22 12:30 GMT | CA Retail Sales (MoM) (Aug)

2013-10-22 23:00 GMT | AU CB Leading Indicator (Aug)

FOREX NEWS :

2013-10-22 05:15 GMT | Good Chinese data leads to little movement in the markets; traders await US data

2013-10-22 05:09 GMT | Oil sits below $100, gold consolidates

2013-10-22 04:35 GMT | GBP/USD grinds slowly lower ahead of NFP data

2013-10-22 04:12 GMT | NFP likely no to have two-way directionality as usual - Rabobank

------------------

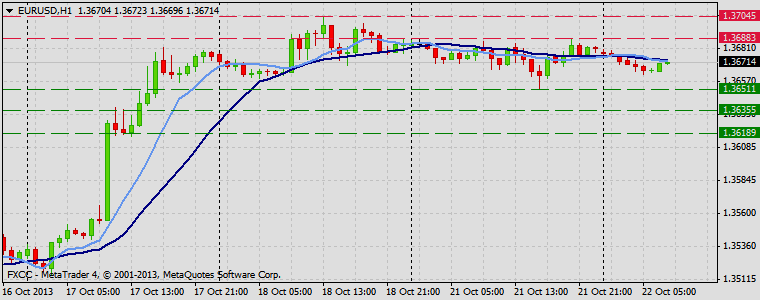

EURUSD :

HIGH 1.36806 LOW 1.36622 BID 1.36711 ASK 1.36713 CHANGE -0.07% TIME 08:43:23

OUTLOOK SUMMARY : Up

TREND CONDITION : Sideway

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : Medium

MARKET ANALYSIS - Intraday Analysis

Upwards scenario: Possibility of further price progress is seen above the next resistance level at 1.3688 (R1). Breakthrough here would suggest interim target at 1.3704 (R2) and then mark at 1.3721 (R3) acts as next attractive point. Downwards scenario: As long as price stays below the 20 SMA our technical outlook would be negative. Extension lower the key support level at 1.3651 (S1) is being able to drive market price towards to our next targets at 1.3635 (S2) and 1.3618 (S3).

Resistance Levels: 1.3688, 1.3704, 1.3721

Support Levels: 1.3651, 1.3635, 1.3618

----------------------

GBPUSD :

HIGH 1.61475 LOW 1.61154 BID 1.61274 ASK 1.61277 CHANGE -0.11% TIME 08:43:24

OUTLOOK SUMMARY : Down

TREND CONDITION : Downward penetration

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : Medium

Upwards scenario: Retracement formation remains in power. Our next resistive measure lies at 1.6148 (R1), break here is required to achieve higher targets at 1.6173 (R2) and 1.6199 (R3). Downwards scenario: Our bearish expectations remain intact below the key support level at 1.6115 (S1). Price penetration below it would allow further declines towards to lower targets at 1.6090 (S2) and 1.6065 (S3).

Resistance Levels: 1.6148, 1.6173, 1.6199

Support Levels: 1.6115, 1.6090, 1.6065

USDJPY

HIGH 98.364 LOW 98.136 BID 98.311 ASK 98.313 CHANGE 0.14% TIME 08:43:25

OUTLOOK SUMMARY : Up

TREND CONDITION : Upward penetration

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : Medium

Upwards scenario: Instrument gained momentum on the upside recently, turning short-term bias to the positive side. Next resistive structure on the way lies at 98.37 (R1), break here would suggest next intraday targets at 98.50 (R2) and 98.62 (R3). Downwards scenario: On the other hand, loss of our support level at 98.15 (S1) would open road for a market decline towards to our next target at 98.03 (S2). Any further price weakening would then be limited to final support at 97.90 (S3).

Resistance Levels: 98.37, 98.50, 98.62

Support Levels: 98.15, 98.03, 97.90

Source: FX Central Clearing Ltd,( http://www.fxcc.com )

Forex Technical & Market Analysis FXCC Oct 31 2013

China's top four banks post bad loan surge whilst the markets await data prints on Chinese growth on Thursday evening

In the overnight/early morning session the BOJ of Japan conducts their own version of an FOMC meeting. The results may affect the value of yen and the Nikkei. They'll deliver a monetary policy statement, an outlook report and then conduct a press conference. On Thursday German retail sales are expected to rise by 0.5%, Italy's employment rate is expected to climb to 12.4%, EU unemployment is expected to come in at 12%. Canada's GDP for the month is expected in at 0.2%, whilst USA weekly unemployment claims are expected in at 341K, this print is still liable to potentially deliver a surprise given the temporary USA govt. shutdown might still be working its way through the system. Late in the evening two extremely important prints from China are published. The manufacturing PMI and the HSBC final manufacturing PMI. China’s top four banks have posted their biggest increase in bad loans since 2010 as a five-year credit surge has left companies with excess manufacturing capacity and slower profit growth amid an economic slowdown. Nonperforming loans at Industrial & Commercial Bank of China Ltd, China Construction Bank Corp, Agricultural Bank of China Ltd and Bank of China Ltd rose 3.5 percent in the three months to Sept. 30th from June to a combined 329.4 billion yuan ($54 billion). Profit rose to 209 billion yuan.

http://blog.fxcc.com/market-analysis

FOREX ECONOMIC CALENDAR :

2013-10-31 07:00 GMT | DE Retail Sales (YoY) (Sep)

2013-10-31 10:00 GMT | EMU Consumer Price Index (YoY) (Oct)

2013-10-31 12:30 GMT | US Initial Jobless Claims (Oct 25)

2013-10-31 13:30 GMT | CA Gross Domestic Product (MoM) (Aug)

FOREX NEWS :

2013-10-31 06:32 GMT | EUR/USD downwards on Nowotny Comments, less dovish FOMC than expected

2013-10-31 06:28 GMT | BOJ semi-annual report: QE to achieve inflation goal

2013-10-31 05:57 GMT | FOMC to begin taper at some point in coming quarters - Nomura

2013-10-31 05:39 GMT | GBP/JPY little changed after solid Japanese data, BoJ decision

-------------------------

EURUSD

HIGH 1.37386 LOW 1.36893 BID 1.37035 ASK 1.37038 CHANGE -0.23% TIME 08:43:19

OUTLOOK SUMMARY : Down

TREND CONDITION : Down trend

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : Medium

MARKET ANALYSIS - Intraday Analysis

Upwards scenario: Upwards penetration is limited to the important resistance level at 1.3718 (R1). Clearance here might open a route towards to our initial target at 1.3734 (R2) and then further price appreciation would be targeting resistance at 1.3752 (R3). Downwards scenario: On the other hand, negative development might occur below the immediate support level at 1.3698 (S1). Clearance here would enable our next intraday targets at 1.3674 (S2) and 1.3656 (S3).

Resistance Levels: 1.3718, 1.3734, 1.3752

Support Levels: 1.3698, 1.3674, 1.3656

---------------------

GBPUSD :

HIGH 1.60432 LOW 1.60059 BID 1.60130 ASK 1.60132 CHANGE -0.16% TIME 08:43:20

OUTLOOK SUMMARY : Down

TREND CONDITION : Down trend

TRADERS SENTIMENT : Bullish

IMPLIED VOLATILITY : Medium

Upwards scenario: We see potential to test our resistive barrier at 1.6043 (R1) later on today. Successful penetration above this mark might keep bullish sentiment in play and validate our intraday targets at 1.6077 (R2) and 1.6110 (R3). Downwards scenario: Next support level lies at 1.5994 (S1). Penetration below it might shift short-term tone to the negative side. Our intraday targets locates at 1.5961 (S2) and 1.5928 (S3).

Resistance Levels: 1.6043, 1.6077, 1.6110

Support Levels: 1.5994, 1.5961, 1.5928

---------------------

USDJPY :

HIGH 98.571 LOW 98.272 BID 98.352 ASK 98.356 CHANGE -0.16% TIME 08:43:21

OUTLOOK SUMMARY : Up

TREND CONDITION : Up trend

TRADERS SENTIMENT : Bullish

IMPLIED VOLATILITY : Medium

Upwards scenario: USDJPY is approaching our next resistive measure at 98.67 (R1) on the upside. Break here is required to enable bullish potential and expose our interim target at 98.82 (R2). Further price appreciation would then be limited to last resistance at 98.96 (R3). Downwards scenario: If the price failed to clear the resistive measure we expect to see recovery action. Clearance of our next support level at 98.15 (S1) is required to enable our targets at 97.99 (S2) and 97.84 (S3) in potential.

Resistance Levels: 98.67, 98.82, 98.96

Support Levels: 98.15, 97.99, 97.84

Source: FX Central Clearing Ltd,( http://www.fxcc.com )

Forex Technical & Market Analysis FXCC Nov 01 2013

USA final manufacturing print scheduled to come in at 51.2 whilst investors await FOMC member Bullard's comments

The latest seasonally adjusted Australian Industry Group Australian Performance of Manufacturing Index (Australian PMI) improved by 1.5 points in October, rising to 53.2 points. This was the second consecutive month that the Australian PMI has moved above 50 points, indicating mild expansion across the manufacturing industry. Several PMIs are published on Friday, the first is the UK's manufacturing PMI expected to come in at 56.3. The USA final manufacturing PMI is scheduled to print at 51.2. In the USA FOMC member Bullard will speak in the afternoon, where we'll also receive the ISM prints for manufacturing. Equity index futures are mainly positive at the time of writing; the DJIA is up 0.21%, SPX up 0.15% and the NASDAQ equity index future is up 0.17%. The if FTSE is down 0.64%, CAC up 0.62% and DAX up 0.23%. The benchmark 10-year yield rose two basis points on Thursday, or 0.02 percentage points, to 2.55 percent at 5 p.m. New York time after touching 2.57 percent, the highest since Oct. 22nd. It earlier fell four basis points to 2.50 percent. The 2.5 percent note maturing in August 2023 dropped 1/8, or $1.25 per $1,000 face amount, to 99 17/32. Ten-year note yields have fallen six basis points this month after sliding 17 basis points in September. Europe’s 17-nation currency slid 1.1 percent to $1.3584 late in New York time Thursday and fell by as much as 1.2 percent, the biggest intraday drop seen since April 17th. The euro sank by 1.3 percent to 133.60 yen. Japan’s currency gained 0.2 percent to 98.36 per dollar after depreciating yesterday to 98.68, the weakest level since Oct. 17th.

http://blog.fxcc.com/market-analysis

FOREX ECONOMIC CALENDAR :

2013-11-01 08:30 GMT | SW SVME - Purchasing Managers' Index (Oct)

2013-11-01 09:28 GMT | UK Markit Manufacturing PMI (Oct)

2013-11-01 13:58 GMT | US Markit Manufacturing PMI (Oct)

2013-11-01 14:00 GMT | US ISM Manufacturing PMI (Oct)

FOREX NEWS :

2013-11-01 06:23 GMT | AUD/USD upwards on beating Chinese Manufacturing PMI

2013-11-01 05:37 GMT | EUR/JPY getting hammered as stops are creating snowball effect; 132.77 is short-term support

2013-11-01 04:04 GMT | USD/JPY sellers blow 98.00 support

2013-11-01 03:56 GMT | GBP/USD still hovering above short-term support at 1.6008; more downside expected

EURUSD :

HIGH 1.35894 LOW 1.35398 BID 1.35504 ASK 1.35509 CHANGE -0.24% TIME 08:47:05

OUTLOOK SUMMARY : Down

TREND CONDITION : Down trend

TRADERS SENTIMENT : Bullish

IMPLIED VOLATILITY : Medium

MARKET ANALYSIS - Intraday Analysis

Upwards scenario: Current price setup is looking for upwards extension possibility. Risk of the price acceleration is seen above the key resistance level at 1.3597 (R1). Clearance here would put immediate focus on the next targets at 1.3629 (R2) and then 1.3662 (R3). Downwards scenario: On the downside, support level at 1.3539 (S1) prevent further downtrend development. Successful penetration below it would open a path towards to next intraday targets at 1.3507 (S2) and 1.3475 (S3).

Resistance Levels: 1.3597, 1.3629, 1.3662

Support Levels: 1.3539, 1.3507, 1.3475

-----------------------

GBPUSD :

HIGH 1.60463 LOW 1.60169 BID 1.60285 ASK 1.60292 CHANGE -0.04% TIME 08:47:05

OUTLOOK SUMMARY : Down

TREND CONDITION : Sideway

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : Medium

Upwards scenario: GBPUSD trapped to the consolidation phase on the hourly chart frame. Break of resistive level at 1.6070 (R1) is required to enable upwards action. Next visible targets are seen at 1.6100 (R2) and 1.6131 (R3). Downwards scenario: Possible descending structure formation might get more stimulus if the price manages to overcome our next support level at 1.5998 (S1). Clearance here would suggest initial targets at 1.5966 (S2) and 1.5935 (S3).

Resistance Levels: 1.6070, 1.6100, 1.6131

Support Levels: 1.5998, 1.5966, 1.5935

-----------------

USDJPY :

HIGH 98.382 LOW 97.809 BID 97.961 ASK 97.965 CHANGE -0.4% TIME 08:47:06

OUTLOOK SUMMARY : Down

TREND CONDITION : Downward penetration

TRADERS SENTIMENT : Bullish

IMPLIED VOLATILITY : Medium

Upwards scenario: From the technical side, short - term tendency is bearish, however price appreciation is possible above the resistance level at 98.09 (R1). Loss here would open way towards to next targets at 98.30 (R2) and 98.51 (R3). Downwards scenario: Possible downtrend development may encounter supportive measure at 97.87 (S1). Penetration through this level would targeting then supportive means at 97.58 (S2) and 97.37 (S3) in potential.

Resistance Levels: 98.09, 98.30, 98.51

Support Levels: 97.78, 97.58, 97.37

Source: FX Central Clearing Ltd,( http://www.fxcc.com )

Forex Technical & Market Analysis FXCC Nov 01 2013

USA final manufacturing print scheduled to come in at 51.2 whilst investors await FOMC member Bullard's comments

The latest seasonally adjusted Australian Industry Group Australian Performance of Manufacturing Index (Australian PMI) improved by 1.5 points in October, rising to 53.2 points. This was the second consecutive month that the Australian PMI has moved above 50 points, indicating mild expansion across the manufacturing industry. Several PMIs are published on Friday, the first is the UK's manufacturing PMI expected to come in at 56.3. The USA final manufacturing PMI is scheduled to print at 51.2. In the USA FOMC member Bullard will speak in the afternoon, where we'll also receive the ISM prints for manufacturing. Equity index futures are mainly positive at the time of writing; the DJIA is up 0.21%, SPX up 0.15% and the NASDAQ equity index future is up 0.17%. The if FTSE is down 0.64%, CAC up 0.62% and DAX up 0.23%. The benchmark 10-year yield rose two basis points on Thursday, or 0.02 percentage points, to 2.55 percent at 5 p.m. New York time after touching 2.57 percent, the highest since Oct. 22nd. It earlier fell four basis points to 2.50 percent. The 2.5 percent note maturing in August 2023 dropped 1/8, or $1.25 per $1,000 face amount, to 99 17/32. Ten-year note yields have fallen six basis points this month after sliding 17 basis points in September. Europe’s 17-nation currency slid 1.1 percent to $1.3584 late in New York time Thursday and fell by as much as 1.2 percent, the biggest intraday drop seen since April 17th. The euro sank by 1.3 percent to 133.60 yen. Japan’s currency gained 0.2 percent to 98.36 per dollar after depreciating yesterday to 98.68, the weakest level since Oct. 17th.

http://blog.fxcc.com/market-analysis

FOREX ECONOMIC CALENDAR :

2013-11-01 08:30 GMT | SW SVME - Purchasing Managers' Index (Oct)

2013-11-01 09:28 GMT | UK Markit Manufacturing PMI (Oct)

2013-11-01 13:58 GMT | US Markit Manufacturing PMI (Oct)

2013-11-01 14:00 GMT | US ISM Manufacturing PMI (Oct)

FOREX NEWS :

2013-11-01 06:23 GMT | AUD/USD upwards on beating Chinese Manufacturing PMI

2013-11-01 05:37 GMT | EUR/JPY getting hammered as stops are creating snowball effect; 132.77 is short-term support

2013-11-01 04:04 GMT | USD/JPY sellers blow 98.00 support

2013-11-01 03:56 GMT | GBP/USD still hovering above short-term support at 1.6008; more downside expected

EURUSD :

HIGH 1.35894 LOW 1.35398 BID 1.35504 ASK 1.35509 CHANGE -0.24% TIME 08:47:05

OUTLOOK SUMMARY : Down

TREND CONDITION : Down trend

TRADERS SENTIMENT : Bullish

IMPLIED VOLATILITY : Medium

MARKET ANALYSIS - Intraday Analysis

Upwards scenario: Current price setup is looking for upwards extension possibility. Risk of the price acceleration is seen above the key resistance level at 1.3597 (R1). Clearance here would put immediate focus on the next targets at 1.3629 (R2) and then 1.3662 (R3). Downwards scenario: On the downside, support level at 1.3539 (S1) prevent further downtrend development. Successful penetration below it would open a path towards to next intraday targets at 1.3507 (S2) and 1.3475 (S3).

Resistance Levels: 1.3597, 1.3629, 1.3662

Support Levels: 1.3539, 1.3507, 1.3475

-----------------------

GBPUSD :

HIGH 1.60463 LOW 1.60169 BID 1.60285 ASK 1.60292 CHANGE -0.04% TIME 08:47:05

OUTLOOK SUMMARY : Down

TREND CONDITION : Sideway

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : Medium

Upwards scenario: GBPUSD trapped to the consolidation phase on the hourly chart frame. Break of resistive level at 1.6070 (R1) is required to enable upwards action. Next visible targets are seen at 1.6100 (R2) and 1.6131 (R3). Downwards scenario: Possible descending structure formation might get more stimulus if the price manages to overcome our next support level at 1.5998 (S1). Clearance here would suggest initial targets at 1.5966 (S2) and 1.5935 (S3).

Resistance Levels: 1.6070, 1.6100, 1.6131

Support Levels: 1.5998, 1.5966, 1.5935

-----------------

USDJPY :

HIGH 98.382 LOW 97.809 BID 97.961 ASK 97.965 CHANGE -0.4% TIME 08:47:06

OUTLOOK SUMMARY : Down

TREND CONDITION : Downward penetration

TRADERS SENTIMENT : Bullish

IMPLIED VOLATILITY : Medium

Upwards scenario: From the technical side, short - term tendency is bearish, however price appreciation is possible above the resistance level at 98.09 (R1). Loss here would open way towards to next targets at 98.30 (R2) and 98.51 (R3). Downwards scenario: Possible downtrend development may encounter supportive measure at 97.87 (S1). Penetration through this level would targeting then supportive means at 97.58 (S2) and 97.37 (S3) in potential.

Resistance Levels: 98.09, 98.30, 98.51

Support Levels: 97.78, 97.58, 97.37

Source: FX Central Clearing Ltd,( http://www.fxcc.com )

Forex Technical & Market Analysis FXCC Nov 05 2013

China's Li sets min GDP at 7,2%, warns against stimulus

The Chinese economy should keep its growth rate levels at 7.2% or above to keep generating enough jobs, said Premier Li Keqiang, also underscoring that relying too much on short term liquidity injections/stimulus should not be the primary focus as it risks similar fiscal problems faced by the Euro zone. Based on early projections, Li said Q3 economic indicators are in line to meet yearly targets, while warning looser policies should be avoided, saying that money supply - M2 - stands at a dangerous CNY100 trillion, twice China's GDP. According to Li, cited by MNI, in comments made in an October 21 speech made public Monday: "We have too much money in the pool. If we print more money, it may cause inflation. We all know bad inflation will not only disturb markets but also have big side effects and pressure people's lives and even cause panic."

http://blog.fxcc.com/market-analysis

FOREX ECONOMIC CALENDAR :

2013-11-05 10:00 GMT | European Commission Releases Economic Growth Forecasts

2013-11-05 15:00 GMT | US ISM Non-Manufacturing PMI (Oct)

2013-11-05 21:45 GMT | NZ Unemployment Rate (Q3)

2013-11-05 23:50 GMT | BoJ Monetary Policy Meeting Minutes

FOREX NEWS :

2013-11-05 06:27 GMT | EUR/JPY tumbles alongside with Nikkei decline

2013-11-05 06:02 GMT | NZD/USD tumbled on RBA comments; now slightly higher

2013-11-05 04:19 GMT | EUR/USD at risk of 1.34 - Westpac

2013-11-05 03:35 GMT | RBA keeps neutral statement, AUD uncomfortably high

----------------------

EURUSD :

HIGH 1.35225 LOW 1.3491 BID 1.34972 ASK 1.34977 CHANGE -0.13% TIME 08:45:23

OUTLOOK SUMMARY : Down

TREND CONDITION : Down trend

TRADERS SENTIMENT : Bullish

IMPLIED VOLATILITY : Medium

MARKET ANALYSIS - Intraday Analysis

Upwards scenario: Price strengthening is possible above the next resistance level at 1.3526 (R1). Our interim target holds at 1.3553 (R2) en route to our final aim for today at 1.3581(R3). Downwards scenario: Opportunity for bearish oriented traders is seen below the important support level at 1.3478 (S1). Loss here would open door for the downtrend expansion towards to interim targets at 1.3453 (S2) and 1.3427 (S3).

Resistance Levels: 1.3526, 1.3553, 1.3581

Support Levels: 1.3478, 1.3453, 1.3427

-----------------------

GBPUSD :

HIGH 1.59821 LOW 1.59553 BID 1.59649 ASK 1.59657 CHANGE -0.02% TIME 08:45:24

OUTLOOK SUMMARY : Down

TREND CONDITION : Upward penetration

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : Medium

Upwards scenario: GBPUSD is approaching our next resistance level at 1.5983 (R1), keeping the short-term ascending structure intact. The break here is required for the price appreciation towards to next target at 1.6007 (R2) and any further rise would then be targeting to 1.6034 (R3). Downwards scenario: Risk of price depreciation is seen below the support level at 1.5940 (S1). A fall below it might initiate retracement formation towards to next support at 1.5916 (S2) and any further market decline would then be targeting final support at 1.5892 (S3).

Resistance Levels: 1.5983, 1.6007, 1.6034

Support Levels: 1.5940, 1.5916, 1.5892

-----------------------

USDJPY :

HIGH 98.674 LOW 98.24 BID 98.446 ASK 98.448 CHANGE -0.16% TIME 08:45:27

OUTLOOK SUMMARY : Down

TREND CONDITION : Downward penetration

TRADERS SENTIMENT : Bullish

IMPLIED VOLATILITY : Medium

Upwards scenario: Immediate resistance at 98.71 (R1) remains in near-term focus, climb above this level might open way towards to next interim target at 98.92 (R2) and any further rise would then be limited to final resistive measure at 99.15 (R3) Downwards scenario: Any penetration below the support level at 98.23 (S1) might create more scope for the instrument weakness in near-term perspective. We are looking to our immediate supports at 98.01 (S2) and 97.80 (S3) as next possible targets.

Resistance Levels: 98.71, 98.92, 99.15

Support Levels: 98.23, 98.01, 97.80

Source: FX Central Clearing Ltd,( http://www.fxcc.com )

Forex Technical & Market Analysis FXCC Nov 06 2013

Will the European service PMI point to increased growth, or increased stagnation?

We receive a raft of PMIs in the morning trading session on Wednesday; the most eagerly anticipated being the European final services PMI expected to print at 50.9, no change from the previous month. The UK manufacturing and production figures are published, expected in at 1.2% and 0.7% respectively. European retail sales are predicted to fall by 0.3%, whilst Germany's factory orders are expected to rise by 0.6%. Canada's building permits are expected to rise to 7.8% from the disastrous figure of -21.2% the previous month. Later in the evening the unemployment numbers for Australia are published with the expectation that the number will come in at 5.7%. Looking towards the market open/s for Wednesday the DJIA equity index future is currently flat, as is the SPX and NASDAQ. The European equity indices are down; STOXX off 0.82%, FTSE down 0.39%, CAC down 0.88% and DAX down 0.31%. Oil fell badly on Tuesday, ICE WTI oil down 1.32% on the day at $93.37 per barrel. Now that the critical psyche level of $100 per barrel has been breached the commodity appears to be in free-fall. NYMEX natural closed up 0.38% at $3.48 per therm. COMEX gold closed up on the day by 0.28% at $1311.70 per ounce with silver down 0.03% at $21.70 per ounce.

http://blog.fxcc.com/market-analysis

FOREX ECONOMIC CALENDAR :

2013-11-06 09:00 GMT | UK Industrial Production (YoY) (Sep)

2013-11-06 10:00 GMT | EMU Retail Sales (YoY) (Sep)

2013-11-06 12:00 GMT | US MBA Mortgage Applications (Nov 1)

2013-11-06 15:00 GMT | UK NIESR GDP Estimate (3M) (Oct)

FOREX NEWS :

2013-11-06 06:52 GMT | EUR/USD recovers 1.3500

2013-11-06 06:26 GMT | GBP/JPY skyrockets as Nikkei soars on Toyota gains

2013-11-06 04:33 GMT | USD/JPY soars as Nikkei up 1% above 14.400; also boosted by EUR/JPY rally

2013-11-06 03:18 GMT | GBP/USD tripping stops, targets 1.61

-------------------

EURUSD :

HIGH 1.35213 LOW 1.34676 BID 1.35060 ASK 1.35064 CHANGE 0.23% TIME 08 : 50:42

OUTLOOK SUMMARY : Up

TREND CONDITION : Upward penetration

TRADERS SENTIMENT : Bullish

IMPLIED VOLATILITY : Medium

MARKET ANALYSIS - Intraday Analysis

Upwards scenario: Market sentiment has improved for the bullish oriented traders. Fractals level at 1.3524 (R1) offers a key resistance level. Break here would suggest higher targets at 1.3553 (R2) and 1.3581(R3). Downwards scenario: Any downside extension is limited now to the next support level at 1.3478 (S1). Below here we see potential for the price acceleration towards to next targets at 1.3453 (S2) and 1.3427 (S3) in potential.

Resistance Levels: 1.3524, 1.3553, 1.3581

Support Levels: 1.3478, 1.3453, 1.3427

--------------------

GBPUSD :

HIGH 1.60957 LOW 1.60417 BID 1.60849 ASK 1.60855 CHANGE 0.26% TIME 08 : 50:43

OUTLOOK SUMMARY : Up

TREND CONDITION : Upward penetration

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : Medium

Upwards scenario: Further price appreciation is a likely scenario for today according to the technical readings. If the pair manages to clear the barrier at 1.6104 (R1), we would suggest next targets at 1.6127 (R2) and 1.6149 (R3). Downwards scenario: An evidence of possible descending structure could be provided if the GBPUSD manages to surpass next support level at 1.6062 (S1). In such case we would suggest next intraday targets at 1.6040 (S2) and 1.6016 (S3).

Resistance Levels: 1.6104, 1.6127, 1.6149

Support Levels: 1.6062, 1.6040, 1.6016

------------------

USDJPY :

HIGH 98.755 LOW 98.409 BID 98.620 ASK 98.624 CHANGE 0.12% TIME 08 : 50:43

OUTLOOK SUMMARY : Up

TREND CONDITION : Upward penetration

TRADERS SENTIMENT : Bullish

IMPLIED VOLATILITY : Medium

Upwards scenario: USDJPY resumed upwards penetration today and we see potential to expose our intraday targets at 98.95 (R2) and 99.15 (R3) if the price manages to overcome key resistance measure at 98.76 (R1). Downwards scenario: On the other hand, possible correction development would face next hurdle at 98.41 (S1). Break here is required to open road towards to our next interim target at 98.22 (S2), en route to final aim at 98.03 (S3).

Resistance Levels: 98.76, 98.95, 99.15

Support Levels: 98.41, 98.22, 98.03

Source: FX Central Clearing Ltd,( http://www.fxcc.com )