Market Overview by FXCC

Forex Technical & Market Analysis FXCC Jun 13 2013

IMF approves €657 million bailout tranche for Portugal

The International Monetary Fund (IMF) approved the seventh tranche of Portugal's bailout Wednesday and gave the country more time to meet its budget-cutting goals. The IMF will disburse the next tranche worth €657 million after the successful review of a bailout program that started in 2011. Meanwhile, the fund eased conditions, allowing Portugal to lower its budget deficit to 3% of GDP by 2015 from 6.4% in 2012, instead of by 2014. "The Portuguese authorities have put forward a program that is economically well-balanced and has growth and job creation at its center", IMF acting Managing Director John Lipsky wrote in a statement.

With Chinese markets back in business after a 5 day weekend closed over holidays, local share markets were dumped with Nikkei index leading the way lower losing at one point more than -6%. USD posted fresh 4-month lows at 80.66 DXY with USD/JPY printing fresh 2-month lows at 94.36, and EUR/USD 3-month highs above 1.3360. Gold and Oil showed little changes on the move. Australian job market surprised to the upside adding 1.1k more jobs to the economy when -10k were expected, making AUD/USD dip below the 0.9450 level. RBNZ left interest rates unchanged at 2.5%, with NZD/USD hanging around the 0.79 figure.

http://blog.fxcc.com/forex-technical...-june-13-2013/

FOREX ECONOMIC CALENDAR :

2013-06-13 08:00 GMT | EMU. ECB Monthly Report

2013-06-13 12:30 GMT | USA. Retail Sales (MoM) (May)

2013-06-13 14:00 GMT | USA. Business Inventories (Apr)

2013-06-13 23:50 GMT | Japan. BoJ Monetary Policy Meeting Minutes

FOREX NEWS :

2013-06-13 04:55 GMT | USD/JPY technical set up continues to deteriorate as bears maintain control

2013-06-13 04:27 GMT | GBP/USD resting below 1.57 figure

2013-06-13 03:49 GMT | EUR/JPY cracks 127.00, further selling pressure revealed

2013-06-13 03:15 GMT | USD/CAD, sustained weakness below 1.0170/75 needed – TDS

--------------------

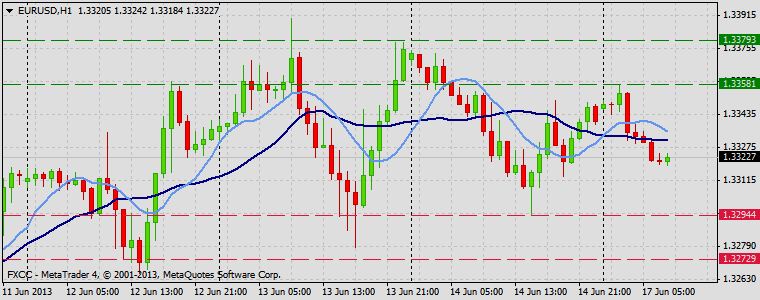

Forex Technical Analysis EURUSD :

MARKET ANALYSIS – Intraday Analysis

Upwards scenario: Uptrend evolvement remains in power. Further appreciation above the resistive barrier at 1.3371 (R1) is compulsory to commence positive market structure and validate next intraday targets at 1.3395 (R2) and 1.3418 (R3). Downwards scenario: Any downside fluctuations remains for now limited to the key support barrier at 1.3335 (S1). Only clear break here would be a signal of possible market easing towards to our targets at 1.3311 (S2) and 1.3288 (S3) in potential.

Resistance Levels: 1.3371, 1.3395, 1.3418

Support Levels: 1.3335, 1.3311, 1.3288

---------------------------

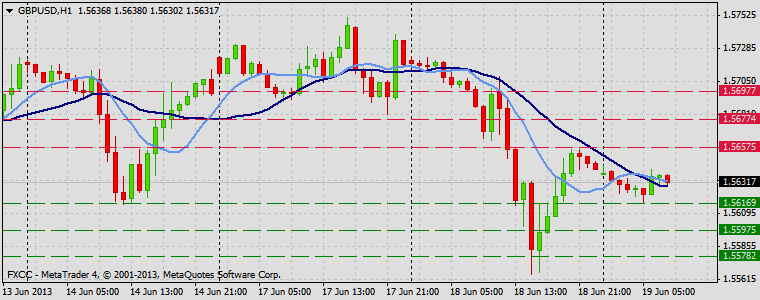

Forex Technical Analysis GBPUSD :

MARKET ANALYSIS – Intraday Analysis

Upwards scenario: market looks overbought and possibility of retracement is high. Though loss of the next resistive barrier at 1.5706 (R1) might push the price towards to our targets at 1.5733 (R2) and 1.5761 (R3) later on today. Downwards scenario: We placed our support level right above the Monday high at 1.5654 (S1). Clearance here is required to open way towards to our interim target at 1.5626 (S2) and then final aim locates at 1.5598 (S3).

Resistance Levels: 1.5706, 1.5733, 1.5761

Support Levels: 1.5654, 1.5626, 1.5598

-------------------------

Forex Technical Analysis USDJPY :

MARKET ANALYSIS – Intraday Analysis

Upwards scenario: Medium term bias is clearly negative on USDJPY however we expect see some recovery action later on today. Key resistive bastion lies at 95.12 (R1). If the price manages to break it, we would suggest next targets at 95.67 (R2) and 96.21 (R3). Downwards scenario: Risk of price depreciation is seen below the support level at 93.90 (S1). A fall below it might prolong the weakness towards to next target at 93.40 (S2) and any further market decline would then be limited to final support at 92.91 (S3).

Resistance Levels: 95.12, 95.67, 96.21

Support Levels: 93.90, 93.40, 92.91

Source: FX Central Clearing Ltd,( Currency Trading Blog | Best ECN Broker | Forex Trading System | FXCC )

Forex Technical & Market Analysis FXCC Jun 14 2013

Draghi says OMT necessary, effective and within ECB mandate

Mario Draghi defended the Outright Monetary Transactions (OMT) a day after the ECB and the Bundesbank confronted in a public hearing at Germany's top court on the legality of the bond-buying program. ECB President said the program was necessary, effective and in line with the ECB mandate. He pointed that benefits are 'visible to everybody' across Europe including Germany, in particular, falling bond yields in Italy and Spain.

"It is fully in line with our mandate because it is designed to preserve price stability for the euro area and uses instruments foreseen in the Statute," Draghi said according to the transcript of a video statement after receiving the responsible leadership award 2013 from the European School of Management and Technology in Berlin. Meanwhile, Draghi urged eurozone leaders to stick reforms and to push for greater integration "to build a stronger economic and monetary union based on shared sovereignty and greater legitimacy". "For the euro area now to move forward and establish itself on stronger ground, we need all decision makers to take their responsibilities," Draghi said.

https://support.fxcc.com/email/technical/14062013/

FOREX ECONOMIC CALENDAR :

2013-06-14 09:00 GMT | EMU. Consumer Price Index (YoY) (May)

2013-06-14 12:30 GMT | USA. Producer Price Index (YoY) (May)

2013-06-14 13:15 GMT | USA. Industrial Production (MoM) (May)

2013-06-14 13:55 GMT | USA. Reuters/Michigan Consumer Sentiment Index (Jun)

FOREX NEWS :

2013-06-14 04:21 GMT | GBP/USD treading water around 1.57 figure

2013-06-14 03:08 GMT | AUD/USD dealing with 0.9600 bids

2013-06-14 01:06 GMT | USD/JPY knocks on 94.50 session lows

2013-06-14 01:06 GMT | EUR/USD, look for highly corrective pullbacks to join bulls - 2ndSkies

EURUSD :

HIGH 1.33745 LOW 1.33422 BID 1.33468 ASK 1.33474 CHANGE -0.21% TIME 08:20:56

OUTLOOK SUMMARY : Up

TREND CONDITION : Sideway

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : Medium

MARKET ANALYSIS - Intraday Analysis

Upwards scenario: While instrument trades above the 20 SMA, it keeps immediate upside potential. Next resistance is seen at 1.3379 (R1), break above it might extend gains towards to next targets at 1.3412 (R2) and 1.3444 (R3). Downwards scenario: Failure to establish positive bias today might lead to the recovery action in near term perspective. Next immediate support locates at 1.3305 (S1). Break here is required to enable bearish pressure towards to our targets at 1.3272 (S2) and 1.3239 (S3).

Resistance Levels: 1.3379, 1.3412, 1.3444

Support Levels: 1.3305, 1.3272, 1.3239

------------------

GBPUSD :

HIGH 1.57199 LOW 1.56943 BID 1.57021 ASK 1.57034 CHANGE -0.1% TIME 08:20:57

OUTLOOK SUMMARY : Up

TREND CONDITION : Up trend

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : Medium

Upwards scenario: GBPUSD keeps bullish potential. Next hurdle on the upside might be found at 1.5737 (R1). Break here would open road towards to our interim aim at 1.5768 (R2) and enable final intraday resistive measure at 1.5799 (R3). Downwards scenario: Retracement action might occur below the key support level at 1.5671 (S1). Break here would open road towards to next supportive measure at 1.5639 (S2) and then final supportive bastion could be found at 1.5606 (S3).

Resistance Levels: 1.5737, 1.5768, 1.5799

Support Levels: 1.5671, 1.5639, 1.5606

--------------------------

USDJPY :

HIGH 95.797 LOW 94.429 BID 95.309 ASK 95.314 CHANGE -0.05% TIME 08:20:57

OUTLOOK SUMMARY : Down

TREND CONDITION : Upward penetration

TRADERS SENTIMENT : Bullish

IMPLIED VOLATILITY : Medium

Upwards scenario: Instrument resumed consolidation phase from its initial downtrend formation. Resistance level at 95.67 (R1) is a key technical point on the upside. Penetration above it would suggest higher targets at 96.21 (R2) and 96.75 (R3) later on today. Downwards scenario: Market decline below the supportive mean at 94.38 (S1) might trigger bearish pressure and enable lower target at 93.85 (S2). Final target for today locates at 93.26 (R3) price level.

Resistance Levels: 95.67, 96.21, 96.75

Support Levels: 94.38, 93.85, 93.26

Source: FX Central Clearing Ltd,( FX Central Clearing Ltd )

Forex Technical & Market Analysis FXCC Jun 17 2013

Dollar Outlook Next Week Hinges on Bernanke

The month of June has proven to be an extremely volatile period in the forex market as the U.S. dollar fell aggressively against many major currencies. Unfortunately we can't expect the markets to calm anytime soon with a heavy dose of economic data expected from countries around the world. The U.K. and Australia will release monetary policy minutes, the Swiss National Bank will hold a monetary policy meeting and of course - we also have the Federal Reserve's monetary policy announcement on the calendar. In addition to these event risks, Eurozone PMIs, New Zealand GDP, UK retail sales, US manufacturing data and Canadian retail sales are also scheduled for release. Yet there's no question that of all these events, the most important will be the Fed meeting. Much of the volatility in the financial markets has been caused by the uncertainty of Fed policy. There's been a lot of talk about tapering asset purchases, which has caused stocks to weaken but at the same time, central bank officials and noted Fed watchers have stressed that a reduction in Quantitative Easing does not equate to tightening. They are absolutely right and we think that the rest of the market is beginning to realize this connection as well but based on the reaction to Jon Hilsenrath's article this week, there are still a subset who need convincing.

https://support.fxcc.com/email/technical/17062013/

FOREX ECONOMIC CALENDAR :

24h | All. G8 Meeting

2013-06-17 09:00 GMT | EMU. Labour cost (Q1)

2013-06-17 09:00 GMT | EMU. Trade Balance n.s.a. (Apr)

2013-06-17 12:30 GMT | USA. NY Empire State Manufacturing Index (Jun)

FOREX NEWS :

2013-06-17 04:55 GMT | EUR/AUD testing 1.3850 support on Euro weakness

2013-06-17 04:02 GMT | EUR/USD dips to fresh session lows ahead of G-8

2013-06-17 02:23 GMT | USD/JPY extends gains above 94.50

2013-06-17 00:49 GMT | Aussie pops above 0.96 USD

EURUSD :

HIGH 1.33573 LOW 1.33184 BID 1.33187 ASK 1.33191 CHANGE -0.16% TIME 08:14:08

OUTLOOK SUMMARY : Neutral

TREND CONDITION : Sideway

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : Low

MARKET ANALYSIS - Intraday Analysis

Upwards scenario: EURUSD trapped to the consolidation phase. Local high at 1.3358 (R1) offers a key resistance level. Break here is required to take the pair towards to initial targets at 1.3379 (R2) and 1.3399 (R3). Downwards scenario: Penetration below the support level at 1.3294 (S1) might maintain a negative tone and prolong corrective action. Price devaluation would then be targeting our supportive measures at 1.3272 (S2) and 1.3250 (S3) in potential.

Resistance Levels: 1.3358, 1.3379, 1.3399

Support Levels: 1.3294, 1.3272, 1.3250

---------------------

GBPUSD :

HIGH 1.57319 LOW 1.56927 BID 1.56935 ASK 1.56944 CHANGE -0.02% TIME 08:14:09

OUTLOOK SUMMARY : Up

TREND CONDITION : Sideway

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : Low

Upwards scenario: GBPUSD is approaching our next resistive barrier at 1.5737 (R1) on the upside. Surpassing of this level may initiate bullish pressure towards to next visible targets at 1.5768 (R2) and 1.5799 (R3). Downwards scenario: If the price failed to overcome our next resistance level we expect market easing below the support level at 1.5671 (S1). Loss here would shift our intraday outlook to the bearish side with expected targets at 1.5639 (S2) and 1.5606 (S3).

Resistance Levels: 1.5737, 1.5768, 1.5799

Support Levels: 1.5671, 1.5639, 1.5606

----------------------

USDJPY :

HIGH 94.837 LOW 94.098 BID 94.722 ASK 94.726 CHANGE 0.67% TIME 08:14:09

OUTLOOK SUMMARY : Down

TREND CONDITION : Sideway

TRADERS SENTIMENT : Bullish

IMPLIED VOLATILITY : Low

Upwards scenario: Upside formation is limited now to the next resistive barrier at 95.05 (R1). Clearance here is required to provide a space for a move towards to next target at 95.53 (R2) and then final aim would be 96.04 (R3). Downwards scenario: On the other hand, an element of supportive measures could be found at 94.24 (S1). Clearance here would suggest possible downtrend development towards to initial targets, located at 93.75 (S2) and 93.27 (S3).

Resistance Levels: 95.05, 95.53, 96.04

Support Levels: 94.24, 93.75, 93.27

Source: FX Central Clearing Ltd,( Forex Account | Best ECN Forex Brokers | Forex Trading Systems | FXCC )

Forex Technical & Market Analysis FXCC Jun 18 2013

Dollar Strengthens, Stocks Soar as Traders Position for FOMC

Yesterday we saw how much of a difference a few hours can make with the dollar recovering earlier losses to end the North American session higher against most of the major currencies. With only one day to go before the Federal Reserve's monetary policy announcement, the big move in equities and the reversal in currencies suggests that traders are beginning to position for FOMC. Yet taking a look at how the various markets are trading, there seems to be more confusion than clarity on what the central bank will say or do. The rise in the dollar and the increase in U.S. Treasury yields imply that currency and equity traders believe that the main takeaway from this week's meeting will be that the central bank is gearing up to taper. However the rally in U.S. equities suggest that stock traders believe that the Fed will make a point to distinguish tapering from tightening and reassure investors that cheap and easy money will remain available for a very long period of time. If Bernanke is successful in convincing the market that they will take a very gradualist approach to tapering, the U.S. dollar could give up its gains. However if Bernanke emphasizes the central bank's plans for tapering over its difference with tightening, the dollar could extend its rise.

https://support.fxcc.com/email/technical/18062013/

FOREX ECONOMIC CALENDAR :

N/A | UK. BOE Inflation Letter

2013-06-18 06:00 GMT | EMU. ECB President Draghi's Speech

2013-06-18 08:30 GMT | UK. Consumer Price Index (YoY) (May)

2013-06-18 12:30 GMT | USA. Consumer Price Index (YoY) (May)

FOREX NEWS :

2013-06-18 05:03 GMT | GBP/USD capped at 1.57 ahead of UK CPI

2013-06-18 04:38 GMT | EUR/USD braces for volatile week

2013-06-18 03:28 GMT | AUD/JPY hovering above 90.00

2013-06-18 02:58 GMT | GBP/JPY advances remain capped below 149.50

----------------------

EURUSD :

HIGH 1.33676 LOW 1.33466 BID 1.33526 ASK 1.33527 CHANGE -0.1% TIME 08 : 36:46

OUTLOOK SUMMARY : Neutral

TREND CONDITION : Sideway

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : High

MARKET ANALYSIS - Intraday Analysis

Upwards scenario: Current price setup might suggest volatility increase in near term perspective. If the price get acceleration on the upside and manages to surpass our resistive measure at 1.3382 (R1), we would suggest next targets at 1.3402 (R2) and 1.3422 (R3). Downwards scenario: On the other hand, an element of supportive measures could be found at 1.3326 (S1). Clearance here would suggest possible downtrend development towards to initial targets at 1.3307 (S2) and 1.3286 (S3).

Resistance Levels: 1.3382, 1.3402, 1.3422

Support Levels: 1.3326, 1.3307, 1.3286

------------------------

GBPUSD :

HIGH 1.57227 LOW 1.56943 BID 1.56961 ASK 1.56970 CHANGE -0.14% TIME 08 : 36:47

OUTLOOK SUMMARY : Neutral

TREND CONDITION : Downward penetration

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : High

Upwards scenario: Clearance of our next resistive structure at 1.5739 (R1) would open way towards to our initial target at 1.5766 (R2) and any further market rise would then be targeting 1.5796 (R3). Downwards scenario: Any downside fluctuations remains for now limited to the next support level at 1.5679 (S1), only clear break here would be a signal of possible market easing towards to next targets at 1.5652 (S2) and 1.5624 (S3) in potential.

Resistance Levels: 1.5739, 1.5766, 1.5796

Support Levels: 1.5679, 1.5652, 1.5624

-------------------------------

USDJPY :

HIGH 94.955 LOW 94.436 BID 94.797 ASK 94.799 CHANGE 0.34% TIME 08 : 36:48

OUTLOOK SUMMARY : Down

TREND CONDITION : Sideway

TRADERS SENTIMENT : Bullish

IMPLIED VOLATILITY : High

Upwards scenario: USDJPY stabilized on the hourly chart however appreciation above the next resistance at 95.23 (R1) might be a good catalyst for a recovery action towards to next targets at 95.66 (R2) and 96.11 (R3). Downwards scenario: On the other hand, if the pair accelerates on the downside and manage to break our next support level at 94.26 (S1), it is likely to trigger our next support level at 93.82 (S2) and 93.37 (S3) later on today.

Resistance Levels: 95.23, 95.66, 96.11

Support Levels: 94.26, 93.82, 93.37

Source: FX Central Clearing Ltd,( Forex Account | Best ECN Forex Brokers | Forex Trading Systems | FXCC )

Forex Technical & Market Analysis FXCC Jun 19 2013

EUR - Lifted by Stronger Investor Confidence

The euro traded higher against all of the major currencies today thanks to the improvement in Eurozone and German investor sentiment. The Eurozone ZEW survey rose to 30.6 from 27.6 and while investors grew less optimistic about current conditions in Germany, their confidence in future conditions improved with the expectations component of the German ZEW rising to 38.5 from 36.4. With the European Central Bank taking additional steps to stimulate the economy, this data indicates that investors are looking for a stronger recovery. In a farewell conference for Bank of Israel Governor Stanley Fischer today, European Central Bank President Mario Draghi talked about ECB monetary policy. He said the central bank would consider non-standard measures including the possibility of negative deposit rates. Draghi said, "We will look with an open mind at these measures that are especially effective in our institutional setup and that fall within our mandate." Yet he warned that these non-standard measures could also lead to unintentional consequences. Parts of the Eurozone have been unresponsive to monetary policy and Draghi has set to regain its steering capacity. He pointed out that the introduction of non-standard policy measures along with standard measures helped prevent the materialization of deflation risk.

https://support.fxcc.com/email/technical/19062013/

FOREX ECONOMIC CALENDAR :

2013-06-19 08:30 GMT | UK. Bank of England Minutes

2013-06-19 18:00 GMT | USA. Fed Interest Rate Decision

2013-06-19 18:30 GMT | USA. Fed's Monetary Policy Statement and press conference

2013-06-19 22:45 GMT | New Zeland. Gross Domestic Product (QoQ) (Q1)

FOREX NEWS :

2013-06-19 04:38 GMT | EUR/USD technical set up favors further upside ahead of FOMC

2013-06-19 03:37 GMT | GBP/JPY trapped inside the 149.50/148.50 range

2013-06-19 03:36 GMT | Bernanke not likely to backtrack on previous tapering comments - NAB

2013-06-19 03:03 GMT | EUR/AUD edging higher towards 1.4200

EURUSD :

HIGH 1.34023 LOW 1.33847 BID 1.33906 ASK 1.33911 CHANGE -0.03% TIME 08 : 30:42

OUTLOOK SUMMARY : Up

TREND CONDITION : Upward penetration

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : High

MARKET ANALYSIS - Intraday Analysis

Upwards scenario: Fresh portion of the economic data releases might increase volatility later on today. Clearance of our next resistive barrier at 1.3402 (R1) is required to push the price towards to our next visible targets at 1.3424 (R2) and 1.3445 (R3). Downwards scenario: On the other hand, the 1.3381 (S1) mark is a key support level on the downside. Below here is a route towards to next supports at 1.3360 (S2) and 1.3339 (S3).

Resistance Levels: 1.3402, 1.3424, 1.3445

Support Levels: 1.3381, 1.3360, 1.3339

-----------------------------

GBPUSD :

HIGH 1.56443 LOW 1.56177 BID 1.56325 ASK 1.56331 CHANGE -0.06% TIME 08 : 30:43

OUTLOOK SUMMARY : Down

TREND CONDITION : Upward penetration

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : High

Upwards scenario: The recent price acceleration on the downside suggests a possible recovery action. Next on tap is resistive barrier at 1.5657 (R1) on the way towards to higher targets at 1.5677 (R2) and 1.5697(R3). Downwards scenario: If the price failed to overcome our next resistance level we expect further market decline below the support level at 1.5616 (S1). Our intraday targets locates at 1.5597 (S2) and 1.5578 (S3).

Resistance Levels: 1.5657, 1.5677, 1.5697

Support Levels: 1.5616, 1.5597, 1.5578

-----------------------------

USDJPY :

HIGH 95.664 LOW 95.177 BID 95.336 ASK 95.339 CHANGE 0.01% TIME 08 : 30:43

OUTLOOK SUMMARY : Up

TREND CONDITION : Upward penetration

TRADERS SENTIMENT : Bullish

IMPLIED VOLATILITY : Medium

Upwards scenario: Current price setup might suggest volatility increase in near term perspective. If the price get acceleration on the upside and manages to surpass our resistive measure at 95.66 (R1), we would suggest next targets at 95.96 (R2) and 96.26 (R3). Downwards scenario: Fractals level at 95.05 (S1) offers a key resistive measure on the downside. Break here is required to enable bearish pressure and validate next target at 94.75 (S2). Final support for today locates at 94.45 (S3).

Resistance Levels: 95.66, 95.96, 96.26

Support Levels: 95.05, 94.75, 94.45

Source: FX Central Clearing Ltd,( Forex Trading News | ECN Trading Account | Forex ECN Broker | FXCC )

Forex Technical & Market Analysis FXCC Jun 20 2013

Bernanke: The Fed is ready to start tapering

Following the Fed decision to hold rates and the optimistic FOMC economic projections, Fed Chairman Ben Bernanke indicated that the Fed are ready to start tapering QE. Bernanke began by highlighting the optimistic growth forecasts for 2013 and 2014, making reference to the hotly anticipated exit strategy, commenting, on “setting fed funds target over medium term and continuing purchases of MBS”. Further, he added that an improvement in the unemployment rate to 6.5% should not be considered to be a trigger for an immediate rate hike. He added that he is personally expecting this to occur during 2015.

https://support.fxcc.com/email/technical/20062013/

FOREX ECONOMIC CALENDAR :

2013-06-20 07:30 GMT | Switzerland. SNB Interest Rate Decision

2013-06-20 08:30 GMT | UK. Retail Sales

2013-06-20 12:30 GMT | USA. Initial Jobless Claims

2013-06-20 14:00 GMT | USA. Existing Home Sales Change

FOREX NEWS :

2013-06-20 04:42 GMT | EUR/USD unable to hold a bid after FOMC release deemed hawkish

2013-06-20 04:21 GMT | USD/JPY breaches the 97.00 handle

2013-06-20 03:45 GMT | China's overnight repo surges to 25%

2013-06-20 03:28 GMT | NZD/JPY continues to consolidate around 76.00

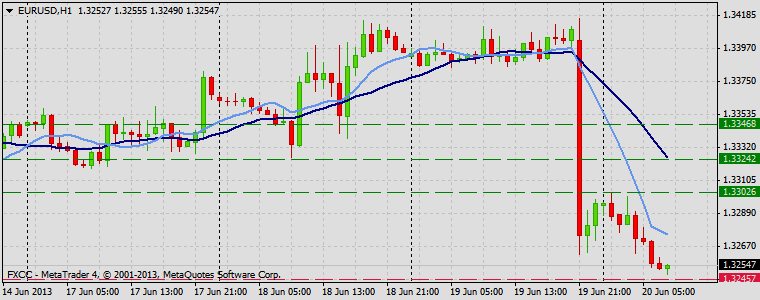

EURUSD :

HIGH 1.3302 LOW 1.32491 BID 1.32493 ASK 1.32496 CHANGE -0.35% TIME 08 : 04:08

OUTLOOK SUMMARY : Down

TREND CONDITION : Down trend

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : Medium

MARKET ANALYSIS - Intraday Analysis

Upwards scenario: EURUSD broke all support levels yesterday and determined clear negative bias. Recovery action is possible above the resistive structure at 1.3302 (R1). Clearance here would enable higher targets at 1.3324 (R2) and 1.3346 (R3). Downwards scenario: Next on tap locates support level at 1.3245 (S1). Possible penetration below it would open way towards to next target at 1.3223 (S2) and then any further market decline would be limited to last mark at 1.3201 (S3).

Resistance Levels: 1.3302, 1.3324, 1.3346

Support Levels: 1.3245, 1.3223, 1.3201

---------------------------

GBPUSD :

HIGH 1.54937 LOW 1.54316 BID 1.54332 ASK 1.54345 CHANGE -0.32% TIME 08 : 04:09

OUTLOOK SUMMARY : Down

TREND CONDITION : Down trend

TRADERS SENTIMENT : Bullish

IMPLIED VOLATILITY : Medium

Upwards scenario: We are not expecting significant volatility on the upside today, however clearance of our next resistive barrier at 1.5503 (R1) might push the price towards to our next visible targets at 1.5531 (R2) and 1.5558 (R3). Downwards scenario: Further downtrend evolvement might get more stimulus below the support level at 1.5417 (S1). Our intraday targets locates at 1.5391 (S2) and 1.5365 (S3).

Resistance Levels: 1.5503, 1.5531, 1.5558

Support Levels: 1.5417, 1.5391, 1.5365

------------------------

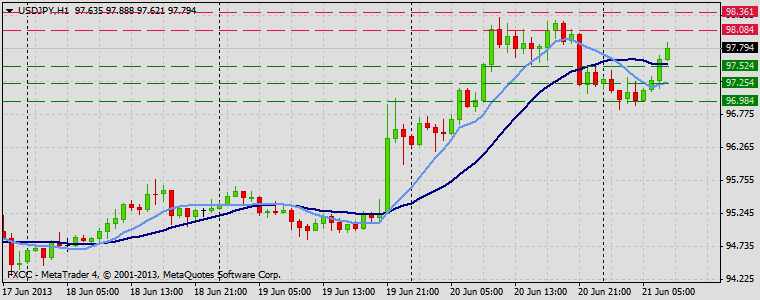

USDJPY :

HIGH 97.181 LOW 96.201 BID 96.899 ASK 96.901 CHANGE 0.48% TIME 08 : 04:09

OUTLOOK SUMMARY : Up

TREND CONDITION : Up trend

TRADERS SENTIMENT : Bullish

IMPLIED VOLATILITY : Medium

Upwards scenario: Measures of resistance might be activating when the pair approaches 97.26 (R1) price level. Break here would suggest next interim target at 97.61 (R2) and If the price keeps its momentum we expect an exposure of 97.93 (R3). Downwards scenario: Possible bull back formation might face next hurdle at 96.39 (S1). Break here is required to open road towards to our next interim target at 96.07 (S2) en route to final aim at 95.75 (S3).

Resistance Levels: 97.26, 97.61, 97.93

Support Levels: 96.39, 96.07, 95.75

Source: FX Central Clearing Ltd,( http://www.fxcc.com )

Forex Technical & Market Analysis FXCC Jun 21 2013

EU Fin Min struck deal on bank bailouts

Eurozone ministers struck a deal over the origin of funds for bank bailouts from now on. While the local government will contribute 20% of the new capital, the ESM (European Stability Mechanism) bailout fund will become the major contributor with an 80%, according to an official cited by Reuters. Moreover, EU finance ministers made an agreement for the ESM to be used as an investment vehicle for banks under stress, with each being assessed individually to become eligible to the aid, Reuters reported. With regards to Cyprus, EU Finance Ministers were clear that Cyprus must live up to its word by fulfilling its financial obligations. Furthermore, President of the Eurogroup Dijsselbloem was quoted on a headline saying "Implementation of agreed Cypriot baliout program is indispensible", noting that implementation is key for the Bank of Cyrus, also adding that there is likely to be a limit of 60bn euro on direct bank recap fund, although this can be reviewed.

The EUR/USD suffered more losses today, declining another 75 pips and closing at 1.3218. However, it should be noted the pair did trade as low as 1.3160 at one point, but was able to recover a decent portion of its losses before the end of the day. Analysts were discussing the release of the most recent EU PMI figures, which hit the tape during the previous European session.

https://support.fxcc.com/email/technical/21062013/

FOREX ECONOMIC CALENDAR :

24h | EMU. EcoFin Meeting

2013-06-21 06:35 GMT | Japan. Bank of Japan Governor Kuroda Speech

2013-06-21 07:00 GMT | Switzerland. Monthly Statistical Bulletin (Jun)

2013-06-21 12:30 GMT | Canada. Consumer Price Index (YoY)

FOREX NEWS :

2013-06-21 04:25 GMT | EUR/USD attempting to holds its ground, finds firm bids near 1.3160

2013-06-21 03:31 GMT | USD/JPY to revist 100.00 next week - Bank of Tokyo-Mitsubishi UFJ

2013-06-21 02:46 GMT | AUD/USD edging higher towards 0.9250

2013-06-21 02:10 GMT | EUR/JPY advances capped below 130.00

-----------------------------

EURUSD :

HIGH 1.32545 LOW 1.31995 BID 1.32345 ASK 1.32348 CHANGE 0.12% TIME 0 8: 31:10

OUTLOOK SUMMARY : Down

TREND CONDITION : Upward penetration

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : Medium

MARKET ANALYSIS - Intraday Analysis

Upwards scenario: We are not expecting busy session ahead however upwards extension above the resistance at 1.3255 (R1) level would keep the bullish structure intact and validate our next intraday targets at 1.3272 (R2) and 1.3287 (R3). Downwards scenario: Our key support level locates at 1.3223 (S1) mark. Possible penetration below this mark would open way towards to next target at 1.3206 (S2) and then final support locates at 1.3190 (S3) price level.

Resistance Levels: 1.3255, 1.3272, 1.3287

Support Levels: 1.3223, 1.3206, 1.3190

----------------------

GBPUSD :

HIGH 1.55228 LOW 1.54896 BID 1.54975 ASK 1.54987 CHANGE -0.06% TIME 08 : 31:11

OUTLOOK SUMMARY : Down

TREND CONDITION : Upward penetration

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : Medium

Upwards scenario: Local high, formed today offers a key resistive barrier at 1.5525 (R1). If the price manages to overcome it we would suggest next intraday targets at 1.5549 (R2) and 1.5572 (R3). Downwards scenario: Though medium-term perspective remains negative for GBP versus the Dollar. Next on tap is seen support level at 1.5485 (S1), break here is required to enable our initial targets at 1.5462 (S2) and 1.5438 (S3)

Resistance Levels: 1.5363, 1.5388, 1.5413

Support Levels: 1.5301, 1.5276, 1.5251

-----------------------

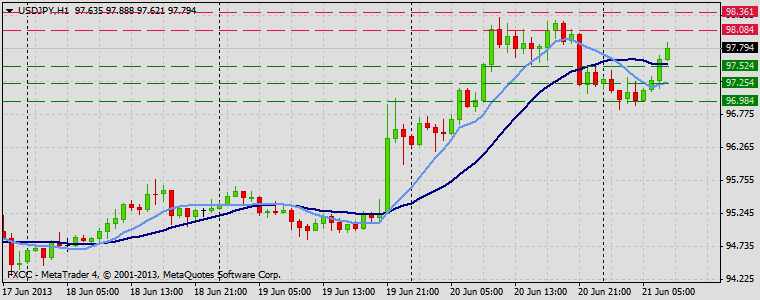

USDJPY :

HIGH 97.888 LOW 96.861 BID 97.833 ASK 97.833 CHANGE 0.6% TIME 08 : 31:12

OUTLOOK SUMMARY : Up

TREND CONDITION : Upward penetration

TRADERS SENTIMENT : Bullish

IMPLIED VOLATILITY : Medium

Upwards scenario: USDJPY remains stable below the 20 SMA. Possible price appreciation is limited to the resistance level at 98.08 (R1). Only clear break here would suggest next intraday targets at 98.36 (R2) and 98.63 (R3). Downwards scenario: Recent upside momentum likely exhausted and we expect some stabilization ahead. Next supportive bastion lies at 97.52 (S1). Prolonged movement below it might then expose our intraday targets at 97.25 (S2) and 96.98 (S3).

Resistance Levels: 98.08, 98.36, 98.63

Support Levels: 97.52, 97.25, 96.98

Source: FX Central Clearing Ltd,( Currency Converter | Forex School | ECN Forex Trading Accounts | FXCC )

Forex Technical & Market Analysis FXCC Jun 21 2013

EU Fin Min struck deal on bank bailouts

Eurozone ministers struck a deal over the origin of funds for bank bailouts from now on. While the local government will contribute 20% of the new capital, the ESM (European Stability Mechanism) bailout fund will become the major contributor with an 80%, according to an official cited by Reuters. Moreover, EU finance ministers made an agreement for the ESM to be used as an investment vehicle for banks under stress, with each being assessed individually to become eligible to the aid, Reuters reported. With regards to Cyprus, EU Finance Ministers were clear that Cyprus must live up to its word by fulfilling its financial obligations. Furthermore, President of the Eurogroup Dijsselbloem was quoted on a headline saying "Implementation of agreed Cypriot baliout program is indispensible", noting that implementation is key for the Bank of Cyrus, also adding that there is likely to be a limit of 60bn euro on direct bank recap fund, although this can be reviewed.

The EUR/USD suffered more losses today, declining another 75 pips and closing at 1.3218. However, it should be noted the pair did trade as low as 1.3160 at one point, but was able to recover a decent portion of its losses before the end of the day. Analysts were discussing the release of the most recent EU PMI figures, which hit the tape during the previous European session.

https://support.fxcc.com/email/technical/21062013/

FOREX ECONOMIC CALENDAR :

24h | EMU. EcoFin Meeting

2013-06-21 06:35 GMT | Japan. Bank of Japan Governor Kuroda Speech

2013-06-21 07:00 GMT | Switzerland. Monthly Statistical Bulletin (Jun)

2013-06-21 12:30 GMT | Canada. Consumer Price Index (YoY)

FOREX NEWS :

2013-06-21 04:25 GMT | EUR/USD attempting to holds its ground, finds firm bids near 1.3160

2013-06-21 03:31 GMT | USD/JPY to revist 100.00 next week - Bank of Tokyo-Mitsubishi UFJ

2013-06-21 02:46 GMT | AUD/USD edging higher towards 0.9250

2013-06-21 02:10 GMT | EUR/JPY advances capped below 130.00

-----------------------------

EURUSD :

HIGH 1.32545 LOW 1.31995 BID 1.32345 ASK 1.32348 CHANGE 0.12% TIME 0 8: 31:10

OUTLOOK SUMMARY : Down

TREND CONDITION : Upward penetration

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : Medium

MARKET ANALYSIS - Intraday Analysis

Upwards scenario: We are not expecting busy session ahead however upwards extension above the resistance at 1.3255 (R1) level would keep the bullish structure intact and validate our next intraday targets at 1.3272 (R2) and 1.3287 (R3). Downwards scenario: Our key support level locates at 1.3223 (S1) mark. Possible penetration below this mark would open way towards to next target at 1.3206 (S2) and then final support locates at 1.3190 (S3) price level.

Resistance Levels: 1.3255, 1.3272, 1.3287

Support Levels: 1.3223, 1.3206, 1.3190

----------------------

GBPUSD :

HIGH 1.55228 LOW 1.54896 BID 1.54975 ASK 1.54987 CHANGE -0.06% TIME 08 : 31:11

OUTLOOK SUMMARY : Down

TREND CONDITION : Upward penetration

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : Medium

Upwards scenario: Local high, formed today offers a key resistive barrier at 1.5525 (R1). If the price manages to overcome it we would suggest next intraday targets at 1.5549 (R2) and 1.5572 (R3). Downwards scenario: Though medium-term perspective remains negative for GBP versus the Dollar. Next on tap is seen support level at 1.5485 (S1), break here is required to enable our initial targets at 1.5462 (S2) and 1.5438 (S3)

Resistance Levels: 1.5363, 1.5388, 1.5413

Support Levels: 1.5301, 1.5276, 1.5251

-----------------------

USDJPY :

HIGH 97.888 LOW 96.861 BID 97.833 ASK 97.833 CHANGE 0.6% TIME 08 : 31:12

OUTLOOK SUMMARY : Up

TREND CONDITION : Upward penetration

TRADERS SENTIMENT : Bullish

IMPLIED VOLATILITY : Medium

Upwards scenario: USDJPY remains stable below the 20 SMA. Possible price appreciation is limited to the resistance level at 98.08 (R1). Only clear break here would suggest next intraday targets at 98.36 (R2) and 98.63 (R3). Downwards scenario: Recent upside momentum likely exhausted and we expect some stabilization ahead. Next supportive bastion lies at 97.52 (S1). Prolonged movement below it might then expose our intraday targets at 97.25 (S2) and 96.98 (S3).

Resistance Levels: 98.08, 98.36, 98.63

Support Levels: 97.52, 97.25, 96.98

Source: FX Central Clearing Ltd,( Currency Converter | Forex School | ECN Forex Trading Accounts | FXCC )

Forex Technical & Market Analysis FXCC Jun 25 2013

Will Fed Speeches Halt the Dollar Rally?

Based on the sell-off in global equities and rise in bond yields around the world, deleveraging in the financial markets intensified. However in the forex market, the U.S. dollar appears to have stabilized. Early losses for many major currencies against the dollar were recovered by the end of the day. In fact, the AUD/USD even ended the North American trading session in positive territory. Does this mean that the dollar rally has peaked? No. There were no fundamental drivers behind the reversal in the greenback outside of exhaustion. U.S. stocks continued to decline, extending losses that began at the end of May. While the S&P 500 is still up more than 11% year to date, it lost 6% of its value since setting a record high of 1,669.16 on May 21st. With 1,500 in sight more losses are likely for the S&P 500 and additional weakness in equities is a reflection of risk aversion, which could lead to further strength for the greenback.

https://support.fxcc.com/email/technical/25062013/

FOREX ECONOMIC CALENDAR :

2013-06-25 08:30 GMT | UK. BBA Mortgage Approvals (May)

2013-06-25 12:30 GMT | USA. Durable Goods Orders (May)

2013-06-25 13:00 GMT | USA. Housing Price Index (MoM) (May)

2013-06-25 14:00 GMT | USA. New Home Sales (MoM) (May)

FOREX NEWS :

2013-06-25 02:02 GMT | USD/JPY retesting 98.00 as Nikkei jumps 1%

2013-06-25 01:13 GMT | AUD/USD well supported by 0.9250, 1h EMA

2013-06-25 01:01 GMT | GBP/JPY struggling around the 151.00 handle

2013-06-25 00:21 GMT | EUR/JPY structurally bearish, above 128.40 sees relief

EURUSD :

HIGH 1.31356 LOW 1.31105 BID 1.31152 ASK 1.31158 CHANGE -0.03% TIME 08:19:56

OUTLOOK SUMMARY : Down

TREND CONDITION : Upward penetration

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : Low

MARKET ANALYSIS - Intraday Analysis

Upwards scenario: A buying interest might push the pair to attack next resistive measure at 1.3144 (R1). Clearance here is required to resume upside formation, targeting marks at 1.3162 (R2) and 1.3180 (R3) later on today. Downwards scenario: On the other hand, further downtrend formation might commence below the support level at 1.3104 (S1). Break here is required to validate our targets at 1.3087 (S2) and 1.3069 (S3) in potential.

Resistance Levels: 1.3144, 1.3162, 1.3180

Support Levels: 1.3104, 1.3087, 1.3069

-----------------------

GBPUSD :

HIGH 1.5455 LOW 1.5425 BID 1.54402 ASK 1.54410 CHANGE 0.06% TIME 08:19:57

OUTLOOK SUMMARY : Up

TREND CONDITION : Upward penetration

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : Low

Upwards scenario: Upwards penetration is limited to the psychological resistance level at 1.5466 (R1). Clearance here might open a route towards to our initial target at 1.5486 (R2) and then further price appreciation would be targeting resistance at 1.5506 (R3). Downwards scenario: Break of the support at 1.5426 (S1) is required to determine negative intraday bias and enable lower target at 1.5405 (S2). Clearance of this target would open a path towards to final support for today at 1.5385 (S3).

Resistance Levels: 1.5466, 1.5486, 1.5506

Support Levels: 1.5426, 1.5405, 1.5385

-------------------------

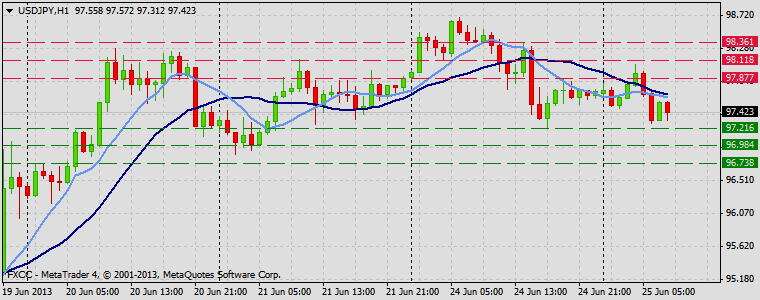

USDJPY :

HIGH 98.065 LOW 97.275 BID 97.436 ASK 97.441 CHANGE -0.28% TIME 08:19:57

OUTLOOK SUMMARY : Neutral

TREND CONDITION : Sideway

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : Low

Upwards scenario: Neutral channel formation remains favored pattern on the hourly chart frame. Possible clearance of our next resistive barrier at 97.87 (R1) would suggest next intraday targets at 98.11 (R2) and 98.36 (R3) in potential. Downwards scenario: On the other hand, loss of our support level at 97.21 (S1) would open road for a market decline towards to our next target at 96.98 (S2). Any further price weakening would then be limited to final support for today at 96.73 (S3).

Resistance Levels: 97.87, 98.11, 98.36

Support Levels: 97.21, 96.98, 96.73

Source: FX Central Clearing Ltd,( ECN Broker Account | Best Forex Trading Platform | Forex Blog | FXCC )

Forex Technical & Market Analysis FXCC Jun 26 2013

Pause Before Another Big Move?

Based on the price action over the past 48 hours in the forex market, volatility has declined as traders and investors wait for a fresh catalyst to drive the dollar higher. Better than expected U.S. economic data helped the greenback hold onto its gains against most of the major currencies but after such an extensive rally, the market is waiting for some confirmation that the Federal Reserve is on track to taper this year and won't do too much damage on the U.S. economy. The latest economic reports suggests that the economy may be able handle less stimulus but that is far from certain. As we said on Monday, the key is whether the other FOMC members are onboard with the idea. Right now, currency traders are in wait and see mode as they look forward to the next big catalyst - which could come from the speeches by Fed officials.

https://support.fxcc.com/email/technical/26062013/

FOREX ECONOMIC CALENDAR :

2013-06-26 06:00 GMT | Germany. Gfk Consumer Confidence Survey (Jul)

2013-06-26 09:30 GMT | UK. BoE's Governor King Speech

2013-06-26 12:30 GMT | USA. Gross Domestic Product. Annualized

2013-06-26 22:45 GMT | New Zeland. Trade Balance (MoM)

FOREX NEWS :

2013-06-26 04:35 GMT | The Greenback awaits next catalyst

2013-06-26 03:41 GMT | EUR/USD feeling the selling pressure; holds above 1.3050

2013-06-26 02:33 GMT | GBP/USD risk skewed to the downside - RBS

2013-06-26 01:59 GMT | USD/JPY dips below 98.00 on Yen strength

--------------------------

EURUSD :

HIGH 1.30872 LOW 1.30569 BID 1.30681 ASK 1.30687 CHANGE -0.1% TIME 08:21:14

OUTLOOK SUMMARY : Down

TREND CONDITION : Down trend

TRADERS SENTIMENT : Bullish

IMPLIED VOLATILITY : Medium

MARKET ANALYSIS - Intraday Analysis

Upwards scenario: Despite the current consolidation pattern, EURUSD remains in downtrend formation on the bigger picture. Clearance of our next resistance level at 1.3102 (R1) might trigger corrective action towards to our initial targets at 1.3129 (R2) and 1.3156 (R3). Downwards scenario: Risk of further price regress is seen below the support level at 1.3054 (S1). Clearance here is required to enable bearish pressure towards to next aims at 1.3029 (S2) and 1.3004 (S3) in potential.

Resistance Levels: 1.3102, 1.3129, 1.3156

Support Levels: 1.3054, 1.3029, 1.3004

--------------------------

GBPUSD :

HIGH 1.54273 LOW 1.54022 BID 1.54215 ASK 1.54227 CHANGE 0.01% TIME 08:21:14

OUTLOOK SUMMARY : Down

TREND CONDITION : Downward penetration

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : Medium

Upwards scenario: Market sentiment has improved for the bullish oriented traders yesterday though medium term bias remains negative. Next visible fractals level at 1.5436 (R1) offers a key resistance level. Break here would suggest higher targets at 1.5458 (R2) and 1.5479 (R3). Downwards scenario: Current price pattern suggests bearish potential if the pair manages to overcome next support level at 1.5397 (S1). Possible price regress could expose our initial targets at 1.5377 (S2) and 1.5356 (S3) later on today.

Resistance Levels: 1.5436, 1.5458, 1.5479

Support Levels: 1.5397, 1.5377, 1.5356

--------------------

USDJPY :

HIGH 98.235 LOW 97.646 BID 97.770 ASK 97.773 CHANGE -0.06% TIME 08:21:15

OUTLOOK SUMMARY : Neutral

TREND CONDITION : Downward penetration

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : Medium

Upwards scenario: Possibility of market strengthening is seen above the immediate resistive barrier at 97.92 (R1). Rise above that level would suggest next interim target at 98.14 (R2) and then final aim locates at 98.37 (R3). Downwards scenario: On the downside our attention is shifted to the immediate support level at 97.39 (S1). Break here is required to enable bearish forces and expose our intraday targets at 97.19 (S2) and 96.99 (S3).

Resistance Levels: 97.92, 98.14, 98.37

Support Levels: 97.39, 97.19, 96.99

Source: FX Central Clearing Ltd,( http://www.fxcc.com )