Market Overview by FXCC

Forex Technical & Market Analysis FXCC May 15 2013

EU gives the go-ahead to Spanish bank restructuring plan

The European Commission announced on Wednesday its approval of the plans to restructure Spain's four nationalized banks: Bankia, Nova Caixa Galicia, Catalunya Caixa and Banco de Valencia. Vice President of the European Commission responsible for Competition Policy Joaquín Almunia said in the European morning that the injection of 37 billion euros of the bank rescue would require a 60% reduction in the size of the nationalized financial institutions by 2017.

Joaquín Almunia informed that during the negotiations with Spanish authorities and the banks in question it was established that the recapitalization funds would be distributed as follows: 18 billion euros for Bankia, 9 billion for Catalunya Caixa, 5.5 billion for Nova Caixa Galicia and 4.5 billion for Banco de Valencia. The four nationalized financial institutions should abandon conceding loans for high risk activities and should transfer 45 billion euros of toxic assets to the newly created bad bank. Catalunya Caixa and Nova Caixa Galicia are expected to be sold before 2017.

http://blog.fxcc.com/forex-technical...s-may-15-2013/

FOREX ECONOMIC CALENDAR :

2012-11-29 08:55 GMT | Germany. Unemployment Change (Nov)

2012-11-29 10:30 GMT | United Kingdom. BoE's Governor King Speech

2012-11-29 13:30 GMT | United States. Gross Domestic Product Annualized (Q3)

2012-11-29 15:00 GMT | United States. Pending Home Sales (MoM) (Oct)

FOREX NEWS :

2012-11-29 06:12 GMT | EUR/GBP flat below 0.8100, 50% Fibo

2012-11-29 05:36 GMT | GBP/USD trying to push higher, eyeing 1.6020

2012-11-29 05:25 GMT | NZD/USD higher on US 'fiscal cliff' optimism

2012-11-29 04:09 GMT | EUD/USD bullish while above 1.2885 – Scotiabank

--------------------

Forex Technical Analysis EURUSD :

MARKET ANALYSIS – Intraday Analysis

Upwards scenario: Next on tap, resistance level at 1.2962 (R1). A break higher could open the door for an attack to next target at 1.2980 (R2) and final immediate resistance is seen at 1.2996 (R3). Downwards scenario: Further retracement formation on the medium-term might occur below the support level at 1.2939 (S1), break here is required to put focus on actual targets at 1.2921 (S2) and 1.2903 (S3).

Resistance Levels: 1.2962, 1.2980, 1.2996

Support Levels: 1.2939, 1.2921, 1.2903

------------------

Forex Technical Analysis GBPUSD :

Upwards scenario: Upside risk aversion is seen above the resistance at 1.6021 (R1). Any violation of that level would be considered as signal of possible uptrend formation towards to our targets at 1.6031 (R2) and 1.6042 (R3).Downwards scenario: Though, our medium-term outlook is bearish. A break through support level at 1.6005 (S1) is possible en route towards to our intraday targets at 1.5994 (S2) and 1.5983 (S3).

Resistance Levels: 1.6021, 1.6031, 1.6042

Support Levels: 1.6005, 1.5994, 1.5983

-------------------

Forex Technical Analysis USDJPY :

Upwards scenario: The pair might face key resistive bastion at 82.22 (R1). A break above it might activate upside pressure and suggest the short-term targets at 82.30 (R2) and 82.39 (R3). Downwards scenario: On a slightly longer term focus has returned to the support at 82.00 (S1). If the market manages to overcome it, next hurdle lies at 81.91 (S2) and 81.82 (S3).

Resistance Levels: 82.22, 82.30, 82.39

Support Levels: 82.00, 81.91, 81.82

Source: FX Central Clearing Ltd,( http://www.fxcc.com )

Forex Technical & Market Analysis FXCC May 16 2013

BoE sees a modest and sustained recovery over the next three years

The quarterly Inflation Report released by the Bank of England on Wednesday suggests that UK inflation should rise above 3% in June and that it will possibly remain above the 2% target for the next two years. As for the GDP, it is “likely to pick up gradually over the next year or so, supported by past asset purchases, an easing in credit conditions aided by the Funding for Lending Scheme, and a continuing improvement in the global environment.”

The BoE MPC expects GDP growth of 0.3% in the first quarter of 2013. In the current quarter they see quarterly GDP expanding by 0.5%, while year-on-year GDP is projected to grow by 2.2% (compared with the previous forecast of 2%). Nevertheless, the MPC recognizes that the recovery is still “weak and uneven.” The report states that in the light of the growth and inflation forecasts more stimulus might be required. No rate hike should be carried out before 2016 however. Following the release of the report, BoE Governor Mervyn King presented it at a press conference. He pointed out that there are many obstacles on UK's road to recovery, the most important being the Eurozone crisis and rising unemployment. He stressed that UK policymakers should continue their efforts to boost the recovery as “this is no time to be complacent.” http://blog.fxcc.com/forex-technical...s-may-16-2013/

FOREX ECONOMIC CALENDAR :

2013-05-15 09:00 GMT | EMU. Consumer Price Index

2013-05-15 12:30 GMT | USA. Consumer Price Index

2013-05-15 14:00 GMT | USA. Philadelphia Fed Manufacturing Survey

2013-05-15 19:05 GMT | USA. FOMC Member Williams speech

FOREX NEWS :

2013-05-15 19:24 GMT | EUR/USD seen at 1.2600 in 3 months – UBS

2013-05-15 18:55 GMT | GBP/JPY is unable to break above 156.00

2013-05-15 18:41 GMT | USD/CHF retests daily lows

2013-05-15 18:19 GMT | AUD/USD's recovery capped at 0.9920, back to 0.9870

--------------------

Forex Technical Analysis EURUSD :

MARKET ANALYSIS – Intraday Analysis

Upwards scenario: Next on tap, resistance level at 1.2962 (R1). A break higher could open the door for an attack to next target at 1.2980 (R2) and final immediate resistance is seen at 1.2996 (R3). Downwards scenario: Further retracement formation on the medium-term might occur below the support level at 1.2939 (S1), break here is required to put focus on actual targets at 1.2921 (S2) and 1.2903 (S3).

Resistance Levels: 1.2962, 1.2980, 1.2996

Support Levels: 1.2939, 1.2921, 1.2903

---------------------

Forex Technical Analysis GBPUSD :

Upwards scenario: Upside risk aversion is seen above the resistance at 1.6021 (R1). Any violation of that level would be considered as signal of possible uptrend formation towards to our targets at 1.6031 (R2) and 1.6042 (R3).Downwards scenario: Though, our medium-term outlook is bearish. A break through support level at 1.6005 (S1) is possible en route towards to our intraday targets at 1.5994 (S2) and 1.5983 (S3).

Resistance Levels: 1.6021, 1.6031, 1.6042

Support Levels: 1.6005, 1.5994, 1.5983

--------------------------

Forex Technical Analysis USDJPY :

Upwards scenario: The pair might face key resistive bastion at 82.22 (R1). A break above it might activate upside pressure and suggest the short-term targets at 82.30 (R2) and 82.39 (R3). Downwards scenario: On a slightly longer term focus has returned to the support at 82.00 (S1). If the market manages to overcome it, next hurdle lies at 81.91 (S2) and 81.82 (S3).

Resistance Levels: 82.22, 82.30, 82.39

Support Levels: 82.00, 81.91, 81.82

Source: FX Central Clearing Ltd,( ECN Broker Account | Currency Converter | Forex Blog | FXCC )

Forex Technical & Market Analysis FXCC May 17 2013

Talking Down the EUR

The euro came under selling pressure today against the U.S. dollar after European Industry Commissioner Tajani tried to talk down the currency. As the head of an agency whose goal is to protect the export sector, Tajani complained that the euro is too strong and called on the central bank to manage the currency in a way that would help exports. Considering that the euro has been in a downtrend since the beginning of the month and has lost over 5% since the beginning of February, some investors may be surprised by the timing of Tajani's comments. However it is clear that underperformance of the Eurozone economy, which is currently in recession is a big motivation for industry officials, politicians and central bankers to make overtures to weaken the euro now versus February. In addition, with the currency in a downtrend, comments such as these will have a greater impact on the euro. As the ECB considers whether to introduce negative deposit rates or purchases of asset backed securities, a weaker currency will provide additional support to the region's economy.

https://support.fxcc.com/email/technical/17052013/

FOREX ECONOMIC CALENDAR :

2013-05-17 09:00 GMT | EMU. Construction Output w.d.a (YoY) (Mar)

2013-05-17 12:30 GMT | Canada. Consumer Price Index (YoY) (Apr)

2013-05-17 13:55 GMT | USA. Reuters/Michigan Consumer Sentiment Index (May)

2013-05-17 15:00 GMT | USA. CB Leading Indicator (MoM) (Apr)

FOREX NEWS :

2013-05-17 04:58 GMT | Nomura's survey on USDJPY suggest higher quotes

2013-05-17 04:26 GMT | Technical picture continues to become more bearish for EUR/USD

2013-05-17 03:57 GMT | AUD/USD, how far can it go? 0.9750/10 next demand

2013-05-17 02:40 GMT | USD/CHF inching toward hourly resistance trend line at 0.9675

EURUSD :

HIGH 1.28897 LOW 1.2855 BID 1.28676 ASK 1.28680 CHANGE -0.1% TIME 08 : 26:30

OUTLOOK SUMMARY : Down

TREND CONDITION : Sideway

TRADERS SENTIMENT : Bullish

IMPLIED VOLATILITY : Medium

MARKET ANALYSIS - Intraday Analysis

Upwards scenario: 20 SMA acts as next resistance level at 1.2886 (R1). Penetration above that mark might trigger upside pressure and expose our next resistive mean at 1.2911 (R2) en route towards to final target for today at 1.2937 (R3). Downwards scenario: On the other hand, successful retest of our next support level at 1.2843 (S1) Market would create a signal of bearish sentiment and enable our interim target at 1.2819 (S2). Final support for today locates at 1.2794 (S3).

Resistance Levels: 1.2886, 1.2911, 1.2937

Support Levels: 1.2843, 1.2819, 1.2794

-----------------------

GBPUSD :

HIGH 1.52822 LOW 1.52366 BID 1.52521 ASK 1.52533 CHANGE -0.1% TIME 08 : 26:30

OUTLOOK SUMMARY : Down

TREND CONDITION : Downward penetration

TRADERS SENTIMENT : Bullish

IMPLIED VOLATILITY : Medium

Upwards scenario: A bearish tone dominates during the Asian session however further buying interest might arise above the resistance at 1.5281 (R1). Clearance here would suggest next intraday target at 1.5315 (R2) and if the price holds its momentum we can expect an increase towards to 1.5351 (R3). Downwards scenario: If the price failed to establish further positive bias today, likely we will see retest of our key support level at 1.5228 (S1). Break here is required to enable initial lower targets at 1.5194 (S2) and 1.5163 (S3) in potential.

Resistance Levels: 1.5281, 1.5315, 1.5351

Support Levels: 1.5228, 1.5194, 1.5163

--------------------------

USDJPY :

HIGH 102.371 LOW 102.08 BID 102.291 ASK 102.295 CHANGE 0.04% TIME 08 : 26:31

OUTLOOK SUMMARY : Neutral

TREND CONDITION : Sideway

TRADERS SENTIMENT : Bullish

IMPLIED VOLATILITY : Medium

Upwards scenario: Neutral channel formation remains in play on the hourly chart. Our next resistance level is placed at 102.47 (R1). Strengthening above it would point to resistive structure at 102.81 (R2) onto 103.14 (R3). Downwards scenario: Possible downtrend evolvement might occur below the immediate support level at 102.05 (S1). Clearance here is required to enable our next targets at 101.70 (S2) and 101.36 (S3) in potential.

Resistance Levels: 102.47, 102.81, 103.14

Support Levels: 102.05, 101.70, 101.36

Source: FX Central Clearing Ltd,( ECN Broker List | Forex Trading Account | Currency Converter | FXCC )

Forex Technical & Market Analysis FXCC May 20 2013

Bearish developments on EUR/USD charts continue to take shape

It was a rough week for the EUR/USD, as continued speculation of the Fed tapering QE purchases and worries of economic growth in Europe continued to put pressure on the pair throughout the week. When all was said and done, the pair finished the week down 0.90% to close at 1.2838. Market participants will be focusing on a number reports this week including testimony from Fed Chairman Bernanke, as well as speeches by some regional Fed officials. According to Greg Gibbs, FX Trading Strategist at RBS,“the market will be looking closely at the Fed commentary this week. Bernanke's testimony to Congress on Wednesday is the main focal point, but there are important speeches by doves Evans and Dudley before then. As key supporters of maintaining the current $85bn pace of asset purchases, any shift in their tone will be seen as evidence that the consensus and Bernanke's views have shifted.”

He went on to add, “the commentary by Fed Watcher Hilsenrath just over a week ago and by a Fed dove Williams on Thursday last week has got the market thinking about potential for QE tapering in the summer, which puts into play the 19 June, 31 July or 18 September meetings. The June meeting includes a Bernanke press conference and staff projects, as does the September meeting.”

http://blog.fxcc.com/forex-technical...s-may-20-2013/

FOREX ECONOMIC CALENDAR

2013-05-20 12:30 GMT | US.Chicago Fed National Activity Index (Apr)

2013-05-20 17:00 GMT | US.Fed's Evans Speech

2013-05-20 19:00 GMT | AR.Unemployment Rate (QoQ) (Q1)

2013-05-20 21:45 GMT | NZ.Visitor Arrivals (YoY) (Apr)

FOREX NEWS

2013-05-20 02:45 GMT | Sterling bulls continue to defend the 1.5150 level

2013-05-20 02:32 GMT | AUD/USD higher above 0.9750 on USD weakness

2013-05-20 00:27 GMT | EUR/JPY buyers step in again at 131.00, support remains firm

2013-05-19 23:11 GMT | EUR/USD capped below 1.2850

----------------------

Forex Technical Analysis EURUSD :

MARKET ANALYSIS – Intraday Analysis

Upwards scenario: Bullish market sentiment is slightly improved yesterday however further appreciation needs to clear barrier at 1.2855 (R1) to enable our interim target at 1.2882 (R2) and then any further gains would be limited to last resistance at 1.2908 (R3). Downwards scenario: If the price manages to overcome our next support barrier at 1.2818 (S1), we expect to see further market decline towards to our next target at 1.2800 (S2) and then next stop could be found at 1.2780 (S3) mark.

Resistance Levels: 1.2855, 1.2882, 1.2908

Support Levels: 1.2818, 1.2800, 1.2780

-------------------------------

Forex Technical Analysis GBPUSD :

Upwards scenario: Next immediate resistive barrier is seen at 1.5209 (R1). If instrument gains momentum on the upside and manage to overcome it we would focus on the intraday targets at 1.5241 (R2) and 1.5276 (R3) in potential. Downwards scenario: Any downside extension is limited now to the next support level at 1.5163 (S1). Break here is required to open a route towards to next target at 1.5141 (S2) and then any further easing would be targeting final support at 1.5117 (S3).

Resistance Levels: 1.5209, 1.5241, 1.5276

Support Levels: 1.5163, 1.5141, 1.5117

------------------------

Forex Technical Analysis USDJPY :

Upwards scenario: Possible upwards formation is limited now to resistive measure at 102.87 (R1). A break above it would suggest next intraday target at 103.29 (R2) and if the price holds its momentum we can expect price increase towards to final resistance at 103.75 (R3). Downwards scenario: Pair looks likely to test our supportive means today. Devaluation below the support at 102.62 (S1) would initiate bearish pressure. On the way our next interim support at 102.39 (S2) en route to final target at 102.07 (S3).

Resistance Levels: 102.87, 103.29, 103.75

Support Levels: 102.62, 102.39, 102.07

Source: FX Central Clearing Ltd,( FX Central Clearing Ltd )

Forex Technical & Market Analysis FXCC May 21 2013

Fed-Speak to dominate EUR/USD trading in coming days

The EUR/USD was able to claw back a small portion of its losses suffered last week, finishing the day up 64 pips at 1.2884. Economic news was light on the session with European markets closed and no releases out of the US. Market participants will be expecting volatility to really pick up later in the week when we see Fed Chairman Bernanke’s testimony to Congress, the release of the most recent FOMC minutes, and a number of other regional Fed speakers on the wires. Given the recent market buzz of the prospects of Fed tapering QE, the next few days could help set a more established trend for the pair as we near month end.

According to Marc Chandler, Head Currency Strategist at BBH, “in the US, the FOMC minutes from the April 30/May 1 meeting will be released on Wednesday. Markets will be parsing them very thoroughly for any clues about QE tapering. Those minutes will be sandwiched between another heavy slate of Fed speakers including Bullard and Dudley on Tuesday, Bernanke testimony on Wednesday, and Bullard again on Thursday. Bernanke’s testimony will be the most important, of course. While we expect the key Fed officials to signal steady as she goes with regards to QE, we acknowledge that markets could see some turbulence.” Other analysts also mention to keep a focus on Europe, as we will see a number of important PMI releases from the region later in the week as well as speeches from important European officials including ECB President Draghi.

http://blog.fxcc.com/forex-technical...s-may-21-2013/

FOREX ECONOMIC CALENDAR :

2013-05-21 06:00 GMT | Germany. Producer Price Index (YoY) (Apr)

2013-05-21 08:30 GMT | UK. Consumer Price Index (YoY) (Apr)

2013-05-21 14:00 GMT | USA. Treasury Sec Lew Speech

2013-05-21 23:50 GMT | Japan. Merchandise Trade Balance Total (Apr)

FOREX NEWS :

2013-05-21 04:36 GMT | Fed-Speak to dominate EUR/USD trading in coming days

2013-05-21 04:26 GMT | USD/JPY, break through 103.5 allows 105/105.50 – JPMorgan

2013-05-21 03:19 GMT | EUR/JPY continues to eye upper end of range near 133.00

2013-05-21 01:48 GMT | AUD/USD consolidates below 0.9800 after RBA minutes release

---------------------

Forex Technical Analysis EURUSD :

MARKET ANALYSIS – Intraday Analysis

Upwards scenario: On the upside market might get more incentives above the immediate resistive barrier at 1.2905 (R1). If the price manages to overcome it we would suggest next intraday targets at 1.2930 (R2) and 1.2955 (R3). Downwards scenario: On the other hand, possible downtrend development may encounter supportive measure at 1.2860 (S1). Penetration through this level would targeting then supportive means at 1.2836 (S2) and 1.2811 (S3) later on today.

Resistance Levels: 1.2905, 1.2930, 1.2955

Support Levels: 1.2860, 1.2836, 1.2811

----------------------------

Forex Technical Analysis GBPUSD :

Upwards scenario: While both moving averages are pointing down, medium-term technical outlook would be positive. Key resistance level lie at 1.5281 (R1), above here opens a route towards to our initial targets at 1.5308 (R2) and 1.5336 (R3). Downwards scenario: Local low at 1.5221 (S1) offers next immediate support barrier. Successful penetration below it would open path towards to next intraday targets at 1.5194 (S2) and 1.5165 (S3).

Resistance Levels: 1.5281, 1.5308, 1.5336

Support Levels: 1.5221, 1.5194, 1.5165

---------------------------

Forex Technical Analysis USDJPY :

Upwards scenario: On the upside resistive structure at 102.77 (R1) prevents further gains. Clearance here is required to open route towards to next target at 103.10 (R2) and then final target could be triggered at 103.43 (R3). Downwards scenario: On the other hand, pair keeps the consolidation pattern intact. We see potential to positively retest supportive barrier at 102.19 (S1). Depreciation below it would open route towards to initial targets at 101.86 (S2) and 101.52 (S3) in potential.

Resistance Levels: 102.77, 103.10, 103.43

Support Levels: 102.19, 101.86, 101.52

Source: FX Central Clearing Ltd,( ECN FX Broker Platform | Forex Account | Currency Converter | FXCC )

Forex Technical & Market Analysis FXCC May 22 2013

Bernanke testimony, FOMC minutes, & European data to heighten EUR/USD volatility

The EUR/USD finished the day moderately higher, closing up 25 pips at 1.2905 ahead of what is sure to be a volatile session with Fed Chairman Bernanke set to testify in front of congress at 14:00GMT. Furthermore, we will also see the release of the most recent FOMC minutes at 18:00GMT. According to Sean callow of Westpac,“The US calendar is dominated by Fed chairman Bernanke’s testimony on “The Economic Outlook” to the Joint Economic Committee of Congress (10am NY time). He will deliver a prepared text then take numerous questions from both friendly and hostile lawmakers. Volatility over the course of his appearance seems assured, as markets try to quickly decide whether Bernanke is trying to dampen talk of reducing QE some time soon, is affirming such a view or remaining non-committal. USD should gain in the latter two scenarios but we still expect the first outcome – Bernanke arguing that it is too soon to be confident that the economy is recovering sustainably.”

Other analysts are pointing towards European economic data as the additional catalysts for the EUR/USD which may help to break the recent range bound activity. Market participants should be aware that later in the week will see a number of European PMI figured which could also heighten volatility. http://blog.fxcc.com/forex-technical...s-may-22-2013/

FOREX ECONOMIC CALENDAR :

2013-05-22 12:30 GMT | Canada.Retail Sales (MoM) (Mar)

2013-05-22 14:00 GMT | USA.Existing Home Sales (MoM) (Apr)

2013-05-22 14:00 GMT | USA.Fed's Bernanke testifies

2013-05-22 18:00 GMT | USA.FOMC Minutes

FOREX NEWS :

2013-05-22 03:26 GMT | USD/JPY steady near 102.50 after BoJ Monetary Policy release

2013-05-22 02:43 GMT | AUD/USD still around 0.98 despite worsening consumer confidence in | Australia

2013-05-22 02:41 GMT | GBP/JPY – Will buyers have enough force to take out 156.80 resistance?

2013-05-22 00:22 GMT | EUR/USD working its way higher thru 1.2920/40 supply

-----------------------

Forex Technical Analysis EURUSD :

MARKET ANALYSIS – Intraday Analysis

Upwards scenario: Instrument stabilized after the gains provided yesterday. Penetration above the resistive structure at 1.2926 (R1) might encourage protective orders execution and drive market price towards to the next resistive means at 1.2940 (R2) and 1.2955 (R3). Downwards scenario: Measures of support might be activating when the pair approaches the 1.2905 (S1). If it continues to extend its weakening below it we expect next targets to be exposed at 1.2889 (S2) and 1.2877 (S3) later on.

Resistance Levels: 1.2926, 1.2940, 1.2955

Support Levels: 1.2905, 1.2889, 1.2877

----------------------

Forex Technical Analysis GBPUSD :

Upwards scenario: Next actual resistance level is seen at 1.5160 (R1). If the market manages to surge higher, our focus would returned to the next target at 1.5179 (R2) and further recovery action could be exhausted at 1.5197 (R3) intraday. Downwards scenario: Price regress below the support level at 1.5128 (S1) would increase likelihood of failing towards to our key supportive barrier at 1.5110 (S2) and any further market decline would then be targeting final support for today at 1.5092 (S3).

Resistance Levels: 1.5160, 1.5179, 1.5197

Support Levels: 1.5128, 1.5110, 1.5092

---------------------

Forex Technical Analysis USDJPY :

Upwards scenario: Any upside actions looks limited to resistance level at 102.64 (R1). Surpassing of this level might enable next target at 102.73 (R2) and any further gains would then be targeting final mark at 102.86 (R3) in potential. Downwards scenario: Our next support level at 102.44 (S1) limits possible recovery attempts for now. Break here is required to establish negative market sentiment and enable lower target at 102.35 (S2) en route to final target at 102.25 (S3).

Resistance Levels: 102.64, 102.73, 102.86

Support Levels: 102.44, 102.35, 102.25

Source: FX Central Clearing Ltd,( Forex Training | Currency Converter | ECN Forex Trading Accounts | FXCC )

Forex Technical & Market Analysis FXCC May 24 2013

Will German GDP/IFO be the catalyst to take EUR/USD back above 1.3000?

The EUR/USD finished the session sharply higher, mainly benefiting from a better than expected European PMI data print. It will be another busy upcoming economic session in Europe, with German GDP due out at 6:00GMT, followed by German IFO at 8:00GMT. One has to ask, if the print comes in better than expected, will it be enough to take the pair back above the critical resistance level of 1.3000(the 20dma)? According to analysts at Rabobank, “there was a modestly firmer tone, maybe a ‘less downbeat tone’ is a better description because despite improvement they remain sub-50, to the suite of eurozone PMIs. In Germany, the Manufacturing PMI gained to 49.0, up from April’s 48.1 and the Services PMI ticked up to 49.8 from 49.6. France’s Manufacturing PMI increased to 45.5 from 44.4 and the Services PMI held steady at 44.3. For the eurozone as a whole, the Manufacturing PMI gained to 47.8 from April’s 46.7.”

They went on to add,“there’s no particularly strong message in these data but they are consistent with our thinking – and that of the ECB – that Europe’s economy will show some improvement as this year unfolds. Calmer financial market conditions should pay a positive dividend to the real economy over time.” The ‘risk on’ vs. ‘risk off’ sentiment of the equity market will also be something to keep in mind. It was interesting to see the EUR/USD go well bid on a day when the Nikkei dropped 7%. However, its hard to imagine this correlation continuing should US equities start a serious correction. Furthermore, some analysts believe that just because the recent EU PMI data came in better than expected, EU officials will not deviate from the dovish rhetoric which has been plentiful in recent weeks. https://support.fxcc.com/email/technical/24052013/

FOREX ECONOMIC CALENDAR :

2013-05-24 06:00 GMT | Germany. Gfk Consumer Confidence Survey (Jun)

2013-05-24 08:00 GMT | Germany. IFO - Business Climate (May)

2013-05-24 10:00 GMT | Germany. German Buba President Weidmann speech

2013-05-24 12:30 GMT | USA. Durable Goods Orders (Apr)

FOREX NEWS :

2013-05-24 04:14 GMT | USD/JPY breaks below 102 like hot butter once again

2013-05-24 04:03 GMT | AUD/USD gets pounded down to 0.9650

2013-05-24 03:21 GMT | Sterling holds support at previous lows, continues to find aggressive bids near 1.5000

2013-05-24 02:13 GMT | GBP/JPY closes below 20dma for first time since April 5th

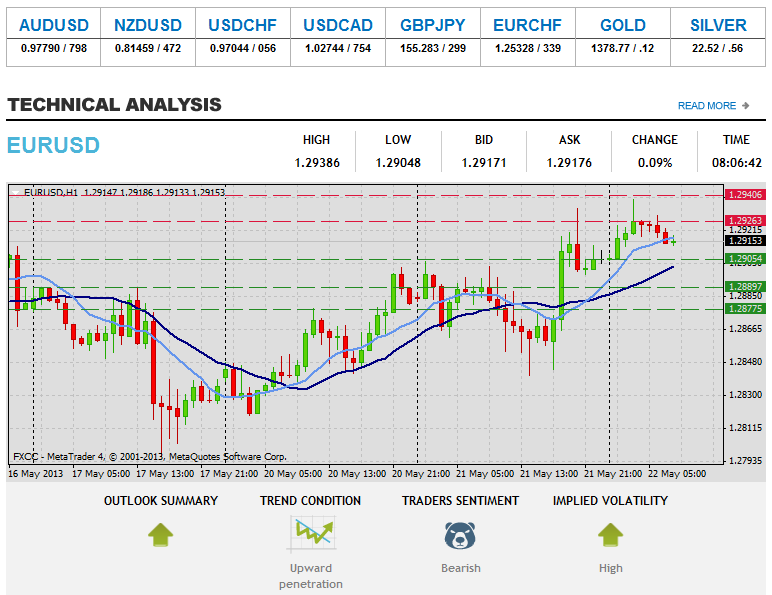

EURUSD :

HIGH 1.2937 LOW 1.29041 BID 1.29290 ASK 1.29294 CHANGE -0.03% TIME 08 : 17:53

OUTLOOK SUMMARY : Up

TREND CONDITION : Upward penetration

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : Medium

MARKET ANALYSIS - Intraday Analysis

Upwards scenario: EURUSD consolidates prior macroeconomic news announcement. Our next resistive barrier is seen at 1.2945 (R1). Break here is required to drive market price towards to next visible targets at 1.2962 (R2) and 1.2978 (R3) later on today. Downwards scenario: Although market players may prefer to increase exposure on the short positions and push the price below the support level at 1.2903 (S1). Possible price devaluation would suggest next initial targets at 1.2886 (S2) and then 1.2867 (S3).

Resistance Levels: 1.2945, 1.2962, 1.2978

Support Levels: 1.2903, 1.2886, 1.2867

----------------------

GBPUSD :

HIGH 1.51139 LOW 1.50639 BID 1.51015 ASK 1.51026 CHANGE -0.02% TIME 08 : 17:53

OUTLOOK SUMMARY : Up

TREND CONDITION : Upward penetration

TRADERS SENTIMENT : Bullish

IMPLIED VOLATILITY : Medium

Upwards scenario: GBPUSD retraced after the initial downtrend formation. Next resistive barrier on the way is mark at 1.5119 (R1). Loss here is required to push the price towards to our targets at 1.5147 (R2) and 1.5177 (R3) later on today. Downwards scenario: Our next support level lies at 1.5062 (S1). Clearance here might resume downtrend expansion. Our intraday target locates at 1.5031 (S2) and 1.5001 (S3).

Resistance Levels: 1.5119, 1.5147, 1.5177

Support Levels: 1.5062, 1.5031, 1.5001

---------------------

USDJPY :

HIGH 102.585 LOW 101.084 BID 101.480 ASK 101.482 CHANGE -0.52% TIME 08 : 17:54

OUTLOOK SUMMARY : Down

TREND CONDITION : Downward penetration

TRADERS SENTIMENT : Bullish

IMPLIED VOLATILITY : Medium

Upwards scenario: Market players may prefer to stay neutral today during limited tier one macroeconomic data flow from Japan, though a break of our resistance at 102.00 (R1) would suggest next targets at 102.35 (R2) and 102.70 (R3). Downwards scenario: A short-term technical structure might turn into negative side below the support level at 101.07 (S1). Possible price depreciation would then be targeting support at 100.76 (S2) en route to final target at 100.43 (S3).

Resistance Levels: 102.00, 102.35, 102.70

Support Levels: 101.07, 100.76, 100.43

Source: FX Central Clearing Ltd,( Free Forex Demo Account | Forex Software | Forex Trading Blog | FXCC )

Forex Technical & Market Analysis FXCC May 27 2013

EU gives the go-ahead to Spanish bank restructuring plan

The European Commission announced on Wednesday its approval of the plans to restructure Spain's four nationalized banks: Bankia, Nova Caixa Galicia, Catalunya Caixa and Banco de Valencia. Vice President of the European Commission responsible for Competition Policy Joaquín Almunia said in the European morning that the injection of 37 billion euros of the bank rescue would require a 60% reduction in the size of the nationalized financial institutions by 2017.

Joaquín Almunia informed that during the negotiations with Spanish authorities and the banks in question it was established that the recapitalization funds would be distributed as follows: 18 billion euros for Bankia, 9 billion for Catalunya Caixa, 5.5 billion for Nova Caixa Galicia and 4.5 billion for Banco de Valencia. The four nationalized financial institutions should abandon conceding loans for high risk activities and should transfer 45 billion euros of toxic assets to the newly created bad bank. Catalunya Caixa and Nova Caixa Galicia are expected to be sold before 2017.

http://blog.fxcc.com/forex-technical...s-may-27-2013/

FOREX ECONOMIC CALENDAR :

2012-11-29 08:55 GMT | Germany. Unemployment Change (Nov)

2012-11-29 10:30 GMT | United Kingdom. BoE's Governor King Speech

2012-11-29 13:30 GMT | United States. Gross Domestic Product Annualized (Q3)

2012-11-29 15:00 GMT | United States. Pending Home Sales (MoM) (Oct)

FOREX NEWS :

2012-11-29 06:12 GMT | EUR/GBP flat below 0.8100, 50% Fibo

2012-11-29 05:36 GMT | GBP/USD trying to push higher, eyeing 1.6020

2012-11-29 05:25 GMT | NZD/USD higher on US 'fiscal cliff' optimism

2012-11-29 04:09 GMT | EUD/USD bullish while above 1.2885 – Scotiabank

Forex Technical Analysis EURUSD :

MARKET ANALYSIS – Intraday Analysis

Upwards scenario: Next on tap, resistance level at 1.2962 (R1). A break higher could open the door for an attack to next target at 1.2980 (R2) and final immediate resistance is seen at 1.2996 (R3). Downwards scenario: Further retracement formation on the medium-term might occur below the support level at 1.2939 (S1), break here is required to put focus on actual targets at 1.2921 (S2) and 1.2903 (S3).

Resistance Levels: 1.2962, 1.2980, 1.2996

Support Levels: 1.2939, 1.2921, 1.2903

Forex Technical Analysis GBPUSD :

MARKET ANALYSIS – Intraday Analysis

Upwards scenario: Upside risk aversion is seen above the resistance at 1.6021 (R1). Any violation of that level would be considered as signal of possible uptrend formation towards to our targets at 1.6031 (R2) and 1.6042 (R3).Downwards scenario: Though, our medium-term outlook is bearish. A break through support level at 1.6005 (S1) is possible en route towards to our intraday targets at 1.5994 (S2) and 1.5983 (S3).

Resistance Levels: 1.6021, 1.6031, 1.6042

Support Levels: 1.6005, 1.5994, 1.5983

Forex Technical Analysis USDJPY :

MARKET ANALYSIS – Intraday Analysis

Upwards scenario: The pair might face key resistive bastion at 82.22 (R1). A break above it might activate upside pressure and suggest the short-term targets at 82.30 (R2) and 82.39 (R3). Downwards scenario: On a slightly longer term focus has returned to the support at 82.00 (S1). If the market manages to overcome it, next hurdle lies at 81.91 (S2) and 81.82 (S3).

Resistance Levels: 82.22, 82.30, 82.39

Support Levels: 82.00, 81.91, 81.82

Source: FX Central Clearing Ltd,( Currency Converter | Top ECN Forex Broker | Forex Demo Account | FXCC )

Forex Technical & Market Analysis FXCC May 28 2013

As last week’s volatility in Japanese markets demonstrates central banks do not have it all their own way. Unfortunately for Japan the risk remains that policy makers spur higher yields without accompanying growth, an outcome that would be highly undesirable, especially if it hits economic activity. Equity markets and risk assets in general came under pressure and safe havens found long lost bids, with core bond yields moving lower and JPY and CHF strengthening. The heightened volatility in markets was also partly triggered by concerns about the timing of the tapering off of Fed asset purchases, with Fed Chairman Bernanke setting the cat amongst the pigeons by with commenting about the possibility of reducing asset purchases over the next few meetings. Additionally weaker than forecast Chinese manufacturing confidence data came as another blow to markets. While the market reaction looked a tad overdone in it is notable that the dichotomy between growth and equity market performance has widened over recent weeks.

This week is likely to begin on a calmer note, with holidays in the US and UK today. Data releases in the US will remain encouraging , with May consumer confidence likely to move higher although US Q1 GDP is likely to be revised slightly lower to 2.4% due an inventories hit. In Europe, while the trajectory of recovery is starting from a much lower base there will be some improvement in business confidence in May while inflation will be well contained at 1.3% YoY in May, an outcome that will maintain room for more European Central Bank policy easing. In Japan a sixth straight negative CPI reading will highlight jus how difficult the job is for the Bank of Japan to meet its inflation target. The JPY was a major beneficiary of last week’s volatility helped by short covering as speculative positioning in the currency reached its lowest level since July 2007. A calmer tone to markets ought to ensure that JPY upside will be limited and USD buyers are likely to emerge just below the USD/JPY 100 level. In contrast the EUR has been surprisingly well behaved despite the fact that speculative EUR positioning has also dropped sharply over recent weeks. While the overall trend is lower EUR/USD will find some support on any dip to around 1.2795 this week.

http://blog.fxcc.com/forex-technical...s-may-28-2013/

FOREX ECONOMIC CALENDAR

2013-05-28 06:00 GMT Switzerland. Trade Balance (Apr)

2013-05-28 07:15 GMT Switzerland. Employment Level (QoQ)

2013-05-28 14:00 GMT USA. Consumer Confidence (May)

2013-05-28 23:50 GMT Japan. Retail Trade (YoY) (Apr)

FOREX NEWS

2013-05-28 05:22 GMT USD/JPY offered at 102 figure

2013-05-28 04:23 GMT Bearish chart pattern developments still favor further downside in EUR/USD

2013-05-28 04:17 GMT AUD/USD erased all loses, back above 0.9630

2013-05-28 03:31 GMT GBP/USD chopping around 1.5100 in Asia trade

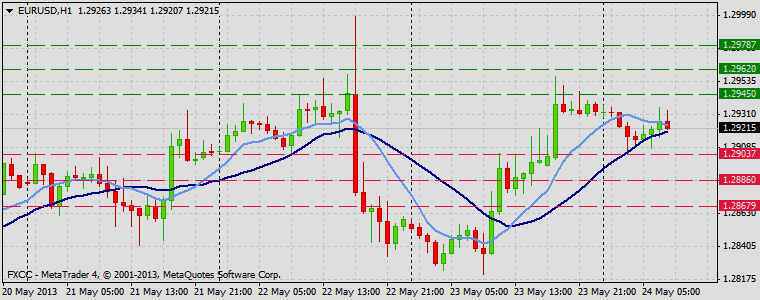

Forex Technical Analysis EURUSD

MARKET ANALYSIS – Intraday Analysis

Upwards scenario: Recently pair gained momentum on the downside however appreciation above the next resistance at 1.2937 (R1) might be a good catalyst for a recovery action towards to next expected targets at 1.2951 (R2) and 1.2965 (R3). Downwards scenario: Any downside penetration is limited now to the initial support level at 1.2883 (S1). A breach of which would open a route towards to next target at 1.2870 (S2) and potentially could expose our final support at 1.2856 (S3) later on today.

Resistance Levels: 1.2937, 1.2951, 1.2965

Support Levels: 1.2883, 1.2870, 1.2856

Forex Technical Analysis GBPUSD

MARKET ANALYSIS – Intraday Analysis

Upwards scenario: New portion of macroeconomic data releases might increase volatility later on today. Our resistances at 1.5139 (R2) and 1.5162 (R3) could be exposed in case of possible upwards penetration. But first, price is required to overcome our key resistive barrier at 1.5117 (R1). Downwards scenario: Downside development remains for now limited to the next technical mark at 1.5085 (S1), clearance here would create a signal of possible market weakening towards to next expected targets at 1.5063 (S2) and 1.5040 (S3).

Resistance Levels: 1.5117, 1.5139, 1.5162

Support Levels: 1.5085, 1.5063, 1.5040

Forex Technical Analysis USDJPY

MARKET ANALYSIS – Intraday Analysis

Upwards scenario: USDJPY upwards penetration is approaching our next resistive barrier at 102.14 (R1). Surpassing of this level may initiate bullish pressure towards to next visible targets at 102.41 (R2) and 102.68 (R3). Downwards scenario: Risk of possible corrective action is seen below the support at 101.65 (S1). With penetration here opens a route towards to our immediate support level at 101.39 (S2) and any further price cut would then be limited to final target at 101.10 (S3).

Resistance Levels: 102.14, 102.41, 102.68

Support Levels: 101.65, 101.39, 101.10

Source: FX Central Clearing Ltd,( FX Central Clearing Ltd )

Forex Technical & Market Analysis FXCC May 29 2013

EUR Succumbs to Rise in U.S. Yields

Demand for U.S. dollars kept pressure on the euro and all major currencies throughout the North American session. Between the recovery in U.S. stocks and the surge in U.S. yields, the dollar is one of the most coveted currencies. Even though we haven’t seen a major pickup in foreign demand for U.S. dollars, particularly from Japan, the longer U.S. yields hold above 2% (10 year yields are at 2.15%), the more tempting it will be for foreign investors. The lack of U.S. data at the front of the week means the lack of threat to the dollar rally. As long as the good news continues to flow in, the dollar will remain in demand. How well the greenback performs against various currencies will of course depend on how economic data from those countries fare. We have seen some recent improvements in Eurozone data that reduces the chance of additional easing by the European Central Bank. German labor market numbers are scheduled for release tomorrow and an upside surprise will keep the EUR above 1.28.

The main driver of EUR/USD weakness has been the divergence between U.S. and Eurozone data – one was improving as the other was deteriorating. If we start to see improvements in the Eurozone economy, then the dynamics affecting the euro will start to change to benefit of the currency. Unfortunately based on the latest PMI numbers, there’s a risk of a downside surprise. According to the report, staffing levels fell for the first time since January with job shedding seen in both the manufacturing and service sectors. If unemployment rolls climb in the month of May, the EUR/USD could extend its losses but even then, the losses could be contained to 1.28, a level that has held for the past month. We probably need to see back to back weakness in Eurozone data (German unemployment and retail sales) for 1.28 to be broken.

http://blog.fxcc.com/forex-technical...s-may-29-2013/

FOREX ECONOMIC CALENDAR

2013-05-29 07:55 GMT Germany. Unemployment Change (May)

2013-05-29 12:00 GMT Germany. Consumer Price Index (YoY) (May)

2013-05-29 14:00 GMT Canada. BoC Interest Rate Decision

2013-05-29 23:50 GMT Japan. Foreign bond investment

FOREX NEWS

2013-05-29 04:41 GMT Sterling hovering above critical support at 1.5000

2013-05-29 04:41 GMT USD unchanged; IMF lowers China GDP forecast

2013-05-29 04:16 GMT EUR/USD technical picture continues to sour, more declines to come?

2013-05-29 03:37 GMT AUD/JPY continues to find firm bids near 97.00

Forex Technical Analysis EURUSD

MARKET ANALYSIS – Intraday Analysis

Upwards scenario: Our medium-term outlook is shifted to the negative side after the losses provided yesterday, however market appreciation is possible above the next resistance at 1.2880 (R1). Loss here would suggest next intraday targets at 1.2899 (R2) and 1.2917 (R3). Downwards scenario: Fresh low at 1.2840 (S1) offers a key resistive measure on the downside. Break here is required to enable bearish pressure and validate next target at 1.2822 (S2). Final support for today locates at 1.2803 (S3).

Resistance Levels: 1.2880, 1.2899, 1.2917

Support Levels: 1.2840, 1.2822, 1.2803

Forex Technical Analysis GBPUSD

MARKET ANALYSIS – Intraday Analysis

Upwards scenario: Our attention on the upside is put to the next resistive barrier at 1.5052 (R1). Break here is required to stimulate bullish forces to expose initial targets at 1.5078 (R2) and 1.5104 (R3) later on today. Downwards scenario: On the other hand, break below the support at 1.5014 (S1) is required to enable further market decline. Our next supportive measures locates at 1.4990 (S2) and 1.4967 (S3).

Resistance Levels: 1.5052, 1.5078, 1.5104

Support Levels: 1.5014, 1.4990, 1.4967

Forex Technical Analysis USDJPY

MARKET ANALYSIS – Intraday Analysis

Upwards scenario: Instrument gained momentum on the upside recently, turning short-term bias to the positive side. Further upwards penetration above the resistance at 102.53 (R1) would enable bullish forces and might drive market price towards to our initial targets at 102.70 (R2) and 102.89 (R3). Downwards scenario: On the other hand, prolonged movement below the initial support level at 102.01 (S1) might trigger protective orders execution and drive market price towards to supportive means at 101.82 (S2) and 101.61 (S3).

Resistance Levels: 102.53, 102.70, 102.89

Support Levels: 102.01, 101.82, 101.61

Source: FX Central Clearing Ltd,( Forex Trading Education | ECN Trading Forex Account | FXCC )