Daily Market Analysis By FXOpen

ETHUSD and LTCUSD Technical Analysis – 18th AUG, 2022

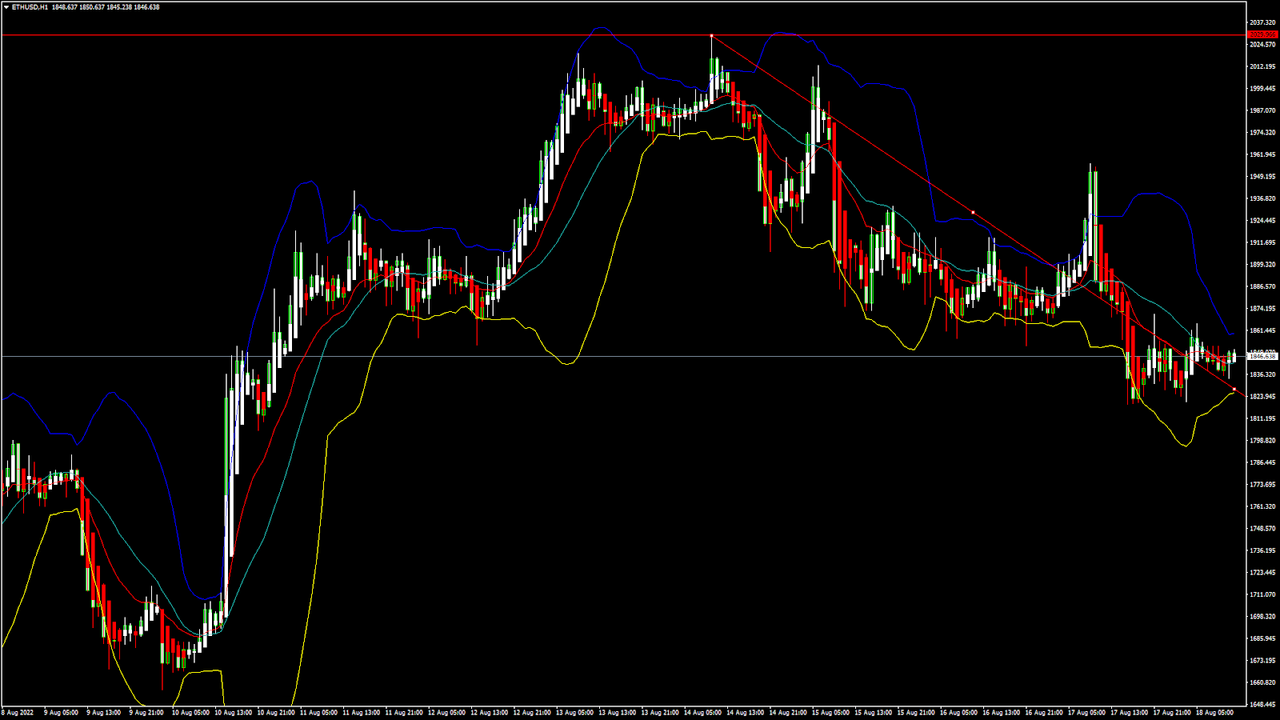

ETHUSD: Shooting Star Pattern Below $2029

Ethereum was unable to sustain its bullish momentum and after touching a high of 2029 on 14th Aug started to decline against the US dollar coming down below the $1900 handle in the European trading session today.

We can see a continuous fall in the price of Ethereum due to the heavy selling pressure amid rising global inflation levels.

We can clearly see a shooting star pattern below the $2029 handle which is a bearish pattern and signifies the end of a bullish phase and the start of a bearish phase in the markets.

ETH is now trading just above its pivot levels of 1842 and moving into a strong bearish channel. The price of ETHUSD is now testing its classic support level of 1827 and Fibonacci support level of 1838 after which the path towards 1700 will get cleared.

The relative strength index is at 43 indicating a weak market and the continuation of the downtrend in the markets.

We can see the formation of a bearish engulfing line in the 15-minute time frame indicating the underlying bearish nature of the markets.

Both the STOCH and STOCHRSI are indicating a neutral market, which means that the prices are expected to remain in a consolidation phase.

Most of the technical indicators are giving a strong sell market signal.

All of the moving averages are giving a strong sell signal, and we are now looking at the levels of $1800 to $1700 in the short-term range.

ETH is now trading below both the 100 hourly simple and exponential moving averages.

[*] Short-term range appears to be strongly BEARISH

[*] ETH continues to remain below the $1900 level

[*] The average true range is indicating LESS market volatility

Ether: Bearish Reversal Seen Below $2029

ETHUSD is now moving into a strong bearish channel with the price trading below the $1900 handle in the European trading session today.

ETH touched an intraday high of 1865 and an intraday low of 1821 in the Asian trading session today.

We can see the adaptive moving average AMA20 and AMA50 bearish crossover pattern in the 2-hour time frame.

We have also detected the formation of a bearish harami pattern in the weekly time frame.

The commodity channel index is indicating a neutral market level, and the continuation of the consolidation phase in the markets.

The key support levels to watch are $1800 and $1820, and the prices of ETHUSD need to remain above these levels for any potential bullish reversal in the markets.

ETH has decreased by 2.47% with a price change of 46$ in the past 24hrs and has a trading volume of 17.646 billion USD.

We can see an increase of 0.58% in the total trading volume in the last 24 hrs which appears to be normal.

The Week Ahead

We can see a continuous progression of a bearish trendline formation from 2029 towards the 1821 level.

The price of Ethereum is now testing its support zone located at $1800, and we are likely to see a more decline in the price once it touches these levels.

The immediate short-term outlook for Ether has turned strongly bearish; the medium-term outlook has turned bearish; and the long-term outlook for Ether is neutral in present market conditions.

The price of ETHUSD will need to remain above the important support level of $1800 this week.

The weekly outlook is projected at $1850 with a consolidation zone of $1800.

Technical Indicators:

The relative strength index (14): at 43.31 indicating a SELL

The moving averages convergence divergence (12,26): at -7.90 indicating a SELL

The rate of price change: at -0.68 indicating a SELL

The ultimate oscillator: at 37.67 indicating a SELL

VIEW FULL ANALYSIS VISIT - FXOpen Blog

Gold Price Slides While Crude Oil Price Aims Higher

Gold price started a fresh decline below the $1,780 support zone. Crude oil price is rising and might aim more gains above the $90 resistance.

Important Takeaways for Gold and Oil

[*] Gold price started a fresh decline after it failed to stay above $1,800 against the US Dollar.

[*] There is a key bearish trend line forming with resistance near $1,763 on the hourly chart of gold.

[*] Crude oil price started a fresh increase from the $85.50 support zone.

[*] There is a major bullish trend line forming with support near $89.10 on the hourly chart of XTI/USD.

Gold Price Technical Analysis

Gold price attempted to settle above the $1,800 resistance zone against the US Dollar. However, the price failed to stay above $1,800 and started a fresh decline.

There was a clear move below the $1,780 support zone and the 50 hourly simple moving average. The price declined below the $1,765 level to move into a short-term bearish zone. The decline gained pace below the $1,760 level.

Gold Price Hourly Chart

The price traded as low as $1,753 and is currently consolidating losses. On the upside, the price is facing resistance near the $1,760 level. It is near the 38.2% Fib retracement level of the downward move from the $1,772 swing high to $1,753 low.

The main resistance is now forming near the $1,765 level. There is also a key bearish trend line forming with resistance near $1,763 on the hourly chart of gold.

The trend line is near the 50% Fib retracement level of the downward move from the $1,772 swing high to $1,753 low. A close above the $1,765 level could open the doors for a steady increase towards $1,780. A clear upside break above the $1,780 resistance could send the price towards $1,800.

An immediate support on the downside is near the $1,752 level. The next major support is near the $1,750 level, below which there is a risk of a larger decline. In the stated case, the price could decline sharply towards the $1,730 support zone.

VIEW FULL ANALYSIS VISIT - FXOpen Blog

GBP/USD Nosedives, EUR/GBP Could Climb Higher

GBP/USD started a fresh decline from well above the 1.2000 zone. EUR/GBP is rising and might climb further higher above the 0.8500 resistance.

Important Takeaways for GBP/USD and EUR/GBP

[*] There is a key bearish trend line forming with resistance near 1.1850 on the hourly chart of GBP/USD.

[*] EUR/GBP climbed higher above the 0.8420 and 0.8450 resistance levels.

[*] There is a major bullish trend line forming with support near 0.8480 on the hourly chart.

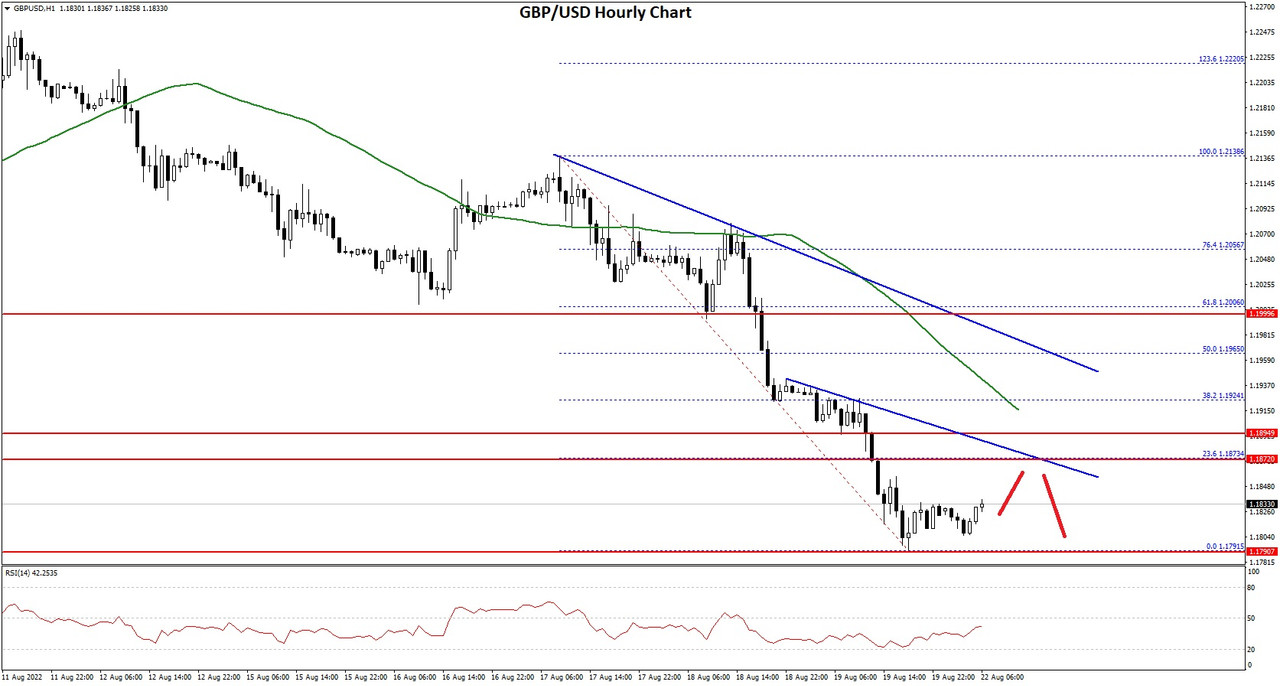

GBP/USD Technical Analysis

The British Pound struggled to clear the 1.2250 and 1.2200 resistance levels against the US Dollar. The GBP/USD pair started a decline and there was a move below the 1.2120 support zone.

There was a sharp decline below the 1.2000 support and the 50 hourly simple moving average. The bears were able to push the pair below the 1.1920 level. A low was formed near 1.1791 on FXOpen and the pair is now consolidating losses.

GBP/USD Hourly Chart

On the upside, an initial resistance is near the 1.1850 level. There is also a key bearish trend line forming with resistance near 1.1850 on the hourly chart of GBP/USD.

The trend line is near the 23.6% Fib retracement level of the downward move from the 1.2138 swing high to 1.1791 low. The next main resistance is near the 1.1910 zone and the 50 hourly simple moving average.

The key hurdle is near the 1.1950 and 1.1965 levels. It is near the 50% Fib retracement level of the downward move from the 1.2138 swing high to 1.1791 low. A clear upside break above the 1.1950 and 1.1965 resistance levels could open the doors for a steady increase in the near term. The next major resistance sits near the 1.2000 level.

On the downside, an initial support is near the 1.1800 level. The next major support is near the 1.1750 level. Any more losses could lead the pair towards the 1.1680 support zone or even 1.1620.

VIEW FULL ANALYSIS VISIT - FXOpen Blog

British Pound collapses against EUR and USD, despite 'Bidenomics' data

It has been a catastrophic few days for the British Pound.

Looking at the graph this morning which shows the Pound absolutely crashing against the US Dollar makes for somewhat alarming reading, as it lost further ground on the European market open this morning having begun its downward spiral on Friday last week.

In fact, the British Pound has now arrived at a value of 1.18 against the US Dollar, which is its lowest value in over a year, and although the downturn has been gradual over the past few weeks, the sudden further drop which began on Friday and continued this morning is a clear indicator of tanking value.

It's almost the same situation when looking at the British Pound against the Euro. The Pound tanked to a low of 1.18 (same value as its standing against the Dollar today) on Friday, giving clear indication that despite the Eurozone's economic woes, confidence suddenly left the building when it comes to the Pound at the end of last week.

Yes, the United Kingdom's economy has been shattered by the current government having blown hundreds of billions of Pounds over the past two years with carefree abandon, and now expect the public to pay for it with increasing costs in energy, fuel taxation and interest rates as well as the effect of a delinquent economy crippled by government-imposed lockdowns, furlough schemes, misappropriated government-backed loans, multi-billion pound contracts handed to invested parties on the grounds of 'Covid', and subsequently Prime Minister Boris Johnson who is soon to leave office continually nailing his colors to the mast with Ukraine flags adorning his office and continually demonstrating vocal opponency toward Russia and its industry base.

This has exacerbated an already existing fiscal problem and now the piper has to be paid.

Inflation is at a 40 year high, and the cost of living crisis in the United Kingdom is not just media propaganda - it is real. Anyone walking the streets of provincial towns will see the food banks and charity dependence in full view.

Yes, the United States also pandered to the narratives of recent agendas, but its economy is not teetering despite its high inflation. Industrial production is still high and the nation appears to be fairing quite well despite tremendous challenges, hence the US Dollar's surprising strength over recent months.

After a year marked by Democrats’ internal dysfunction, Congress has over the last few weeks suddenly delivered a raft of legislation that will help form the core of President Biden’s economic record before lawmakers face voters in the 2022 midterm elections.

Beyond the economic rescue package and bipartisan infrastructure law passed last year, Congress this month alone also approved a $280 billion measure to expand veterans health care, a $280 billion law to counter China’s economic rise, and the Inflation Reduction Act centered on addressing the climate crisis, lowering health-care costs and raising taxes on large corporations.

That appears to be straight out of the socialist instruction manual, which would usually be enough to frighten investors, but the pragmatic minds in the markets have been viewing the dire situation in Europe and weighing it up against a relatively productive situation in the United States.

Yes, President Biden has garnered poor confidence from investment-savvy professionals and individuals, and his anti-Russia stance is almost as strong as Boris Johnson's (although Boris Johnson takes the accolade for being the most vocal). Biden has sent billions of Dollars to Ukraine, but still the economy is building itself up.

Right now, the British Pound's low point is a serious matter for the currency markets.

VIEW FULL ANALYSIS VISIT - FXOpen Blog

BTCUSD and XRPUSD Technical Analysis – 23rd AUG 2022

BTCUSD: Double Bottom Pattern Above $20798

Bitcoin was unable to sustain its bearish momentum and after touching a low of 20794 on 20th Aug, it has entered into a consolidation channel above the $21000 handle today in the European trading session.

We can see that bitcoin failed to clear its resistance zone located at $25500 for the fourth time this month.

After touching a high of $25195, we can see some downwards correction in the prices towards the $20798 levels.

We can clearly see a double bottom pattern above the $20798 handle which is a bullish reversal pattern because it signifies the end of a downtrend and a shift towards an uptrend.

Bitcoin touched an intraday low of 20909 in the Asian Trading session, and an intraday high of 21510 in the European trading session today.

Both the STOCH and STOCHRSI are indicating overbought levels which means that in the immediate short term, a decline in the prices is expected.

The relative strength index is at 57 indicating a strong demand for bitcoin at the current market levels and the continuation of the buying pressure in the markets.

Bitcoin is now moving above its 100 hourly simple moving average and below the 200 hourly simple moving average.

All of the major technical indicators are giving a strong buy signal, which means that in the immediate short term, we are expecting targets of 22500 and 22000.

The average true range is indicating less market volatility with a strong bullish momentum.

[*] Bitcoin: bullish reversal seen above $20798

[*] The Williams percent range is indicating an overbought level

[*] The price is now trading just below its pivot level of $21430

[*] Most of the moving averages are giving a BUY market signal

Bitcoin: Bullish Reversal seen Above $20798

The price of bitcoin dipped to a low of 20909 after which we can see some buying support and a move towards the consolidation phase in the markets above the $21000 handle.

The BTCUSD is attempting an upside break as the moving averages convergence divergence (MACD) has crossed its moving average in the 1-hourly time-frame.

The parabolic SAR Indicator is giving a bullish reversal signal in the 1-hourly time-frame.

We can see that the aroon indicator is giving a bullish trend signal in the 1-hourly time-frame indicating the underlying bullish nature of the markets.

The immediate short-term outlook for bitcoin is bullish, the medium-term outlook has turned neutral, and the long-term outlook remains neutral under present market conditions.

Bitcoin’s support zone is located at $20000, and the prices continue to remain above these levels for the continuation of the bullish reversal in the markets.

The price of BTCUSD is now facing its classic resistance level of 21549 and Fibonacci resistance level of 21642 after which the path towards 22000 will get cleared.

In the last 24hrs, BTCUSD has increased by 0.90% by 190$ and has a 24hr trading volume of USD 32.135 billion. We can see an increase of 27.24% in the trading volume compared to yesterday, which appears to be normal.

The Week Ahead

The price of bitcoin is moving in a consolidation zone above the $21000 level. The US Fed monetary policy and its effects on the strength of the US dollar continues to weigh on the prices of bitcoin which is being sold out by the medium-term investors.

The daily RSI is printing at 38 which indicates a weak demand from the long-term investors.

This continued downfall in the prices of bitcoin is being referred to as the start of crypto winter by some analysts.

The long-term trendline in hold is indicating that the next target for bitcoin is $28000 in the coming weeks, which is also confirmed by the super trend indicator.

The price of BTCUSD will need to remain above the important support levels of $20000 this week.

The weekly outlook is projected at $23000 with a consolidation zone of $22500.

Technical Indicators:

The average directional change (14): at 32.84 indicating a BUY

The ultimate oscillator: at 52.16 indicating a BUY

The rate of price change: at 1.52 indicating a BUY

The commodity channel index (14 days): at 100.44 indicating a BUY

VIEW FULL ANALYSIS VISIT - FXOpen Blog

EUR/USD Nosedives, USD/JPY Aims More Upsides

EUR/USD started another decline from the 1.0200 resistance. USD/JPY is rising and might gain pace above the 138.00 resistance zone.

Important Takeaways for EUR/USD and USD/JPY

[*] The Euro started a fresh decline and even traded below the 1.0000 support.

[*] There was a break above a key bearish trend line with resistance near 0.9955 on the hourly chart of EUR/USD.

[*] USD/JPY started a fresh increase after it broke the 133.50 resistance zone.

[*] There was a break above a major bearish trend line with resistance near 134.00 on the hourly chart.

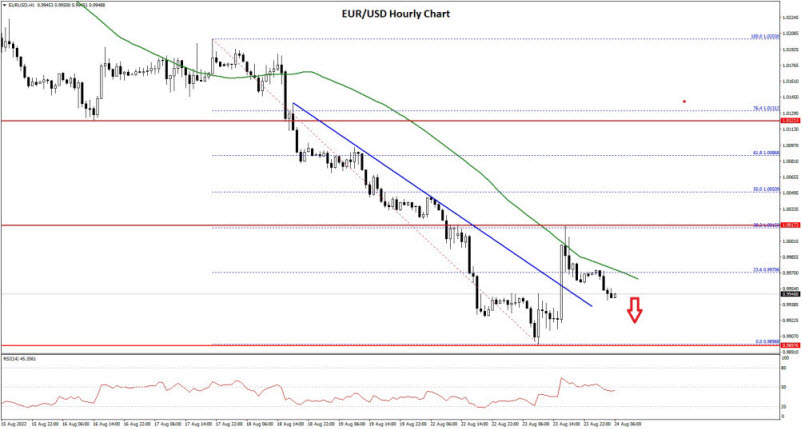

EUR/USD Technical Analysis

This past week, the Euro started a fresh decline from well above the 1.0180 level against the US Dollar. The EUR/USD pair declined below the 1.0150 and 1.0120 support levels.

The bears even pushed the pair below the 1.0050 level. There was a close below 1.0000 and the 50 hourly simple moving average. The pair traded as low as 0.9898 and recently started a minor upside correction.

EUR/USD Hourly Chart

There was a move above the 23.6% Fib retracement level of the downward move from the 1.0203 swing high to 0.9898 low. Besides, there was a break above a key bearish trend line with resistance near 0.9955 on the hourly chart of EUR/USD.

However, the pair struggled to clear the 1.0000 resistance zone and the 50 hourly simple moving average. An immediate resistance on the upside is near the 0.9970 level.

The next major resistance is near the 1.0000 level. An upside break above 1.0000 could set the pace for a steady increase. In the stated case, the pair might revisit 1.0050. It is near the 50% Fib retracement level of the downward move from the 1.0203 swing high to 0.9898 low.

If not, the pair might drop and test the 0.9920 support. The next major support is near 0.9900, below which the pair could drop to 0.9850 in the near term.

VIEW FULL ANALYSIS VISIT - FXOpen Blog

ETHUSD and LTCUSD Technical Analysis – 25th AUG, 2022

ETHUSD: Bullish Harami Pattern Above $1523

Ethereum was unable to sustain its bearish momentum and after touching a low of 1529 on 20th Aug started to correct upwards, crossing the $1700 handle in the European trading session today.

We can see a continuous appreciation in the prices of Ethereum due to the buying seen at lower levels by the medium-term investors.

We can clearly see a bullish harami pattern above the $1523 handle which is a bullish pattern and signifies the end of a bearish phase and the start of a bullish phase in the markets.

ETH is now trading just below its pivot level of 1709 and moving into a strongly bullish channel. The price of ETHUSD is now testing its classic resistance level of 1713 and Fibonacci resistance level of 1718 after which the path towards 1800 will get cleared.

The relative strength index is at 63 indicating a STRONG demand for Ether and the continuation of the uptrend in the markets.

We can see that the adaptive moving average, AMA100, is indicating a bullish trend reversal in both the 2-hour and 4-hour timeframes.

The Williams percent range is indicating an OVERBOUGHT market, which means that the prices are expected to correct downwards in the short-term range.

Most of the technical indicators are giving a STRONG BUY market signal.

All of the moving averages are giving a STRONG BUY signal and we are now looking at the levels of $1800 to $1900 in the short-term range.

ETH is now trading Above its 100 hourly simple and exponential moving averages.

[*] Ether: bullish reversal seen above the $1523 mark

[*] Short-term range appears to be strongly BULLISH

[*] ETH continues to remain above the $1600 level

[*] The average true range is indicating LESS market volatility

Ether: Bullish Reversal Seen Above $1523

ETHUSD is now moving into a strong bullish channel with the prices trading above the $1600 handle in the European trading session today.

ETH touched an intraday low of 1652 in the Asian trading session and an intraday high of 1715 in the European trading session today.

We have seen a bullish opening with a gap in the markets which indicates that now we are heading towards the $1800 mark.

The daily RSI is printing at 50 indicating a neutral demand in the long-term range.

Ethereum continues to move in a rising trend channel which is expected to continue in the medium-term range.

The key support levels to watch are $1600 and $1660, and the price of ETHUSD need to remain above these levels for the continuation of the bullish reversal in the markets.

ETH has increased by 3.91% with a price change of 64$ in the past 24hrs and has a trading volume of 16.144 billion USD.

We can see a decrease of 10.39% in the total trading volume in the last 24 hrs which appears to be normal.

The Week Ahead

We can see a continuous progression of a bullish trendline formation from 1523 towards the 1762 levels.

The price of Ethereum is now testing its resistance zone located at $1800 and we are likely to witness a rally in the price once it touches these levels.

The immediate short-term outlook for Ether has turned strongly BULLISH, the medium-term outlook has turned NEUTRAL, and the long-term outlook for Ether is NEUTRAL in present market conditions.

The prices of ETHUSD will need to remain above the important support level of $1600 this week.

The weekly outlook is projected at $1950 with a consolidation zone of $1800.

Technical Indicators:

The relative strength index (14): at 62.26 indicating a BUY

The moving averages convergence divergence (12,26): at 15.03 indicating a BUY

The rate of price change: at 1.03 indicating a BUY

The ultimate oscillator: at 60.70 indicating a BUY

VIEW FULL ANALYSIS VISIT - FXOpen Blog

AUD/USD Aims Higher While NZD/USD Faces Resistance

AUD/USD is gaining pace above the 0.6950 resistance. NZD/USD is struggling to clear a key barrier near the 0.6250 resistance.

Important Takeaways for AUD/USD and NZD/USD

[*] The Aussie Dollar started a fresh increase above the 0.6950 resistance zone against the US Dollar.

[*] There is a short-term contracting triangle forming with support near 0.6955 on the hourly chart of AUD/USD.

[*] NZD/USD started an upside correction from the 0.6160 support zone.

[*] There is a connecting bearish trend line forming with resistance near 0.6230 on the hourly chart of NZD/USD.

AUD/USD Technical Analysis

The Aussie Dollar formed a base above the 0.6850 and 0.6860 levels against the US Dollar. The AUD/USD pair started a steady increase after it cleared the 0.6900 resistance zone.

There was a clear move above the 0.6920 resistance and the 50 hourly simple moving average. The pair even broke the 0.6950 hurdle and traded as high as 0.6991 on FXOpen. Recently, there was a minor downside correction below the 0.6980 level.

AUD/USD Hourly Chart

The pair dipped below the 23.6% Fib retracement level of the upward move from the 0.6879 swing low to 0.6991 high. However, the pair stayed above the 0.6950 level and the 50 hourly simple moving average.

There is also a short-term contracting triangle forming with support near 0.6955 on the hourly chart of AUD/USD. On the downside, an initial support is near the 0.6955 level.

The next support could be the 0.6935 level. It is near the 50% Fib retracement level of the upward move from the 0.6879 swing low to 0.6991 high. If there is a downside break below the 0.6935 support, the pair could extend its decline towards the 0.6850 level.

On the upside, the AUD/USD pair is facing resistance near the 0.6975 level. The next major resistance is near the 0.7000 level. A close above the 0.7000 level could start a steady increase in the near term. The next major resistance could be 0.7080.

VIEW FULL ANALYSIS VISIT - FXOpen Blog

GBP/USD Nosedives While USD/CAD Gains Strength

GBP/USD accelerated lower below the 1.1850 and 1.1750 support levels. USD/CAD is surging and could continue to rise above the 1.3075 resistance zone.

Important Takeaways for GBP/USD and USD/CAD

[*] The British Pound started a major decline below the 1.1850 support zone.

[*] There is a key bearish trend line forming with resistance near 1.1830 on the hourly chart of GBP/USD.

[*] USD/CAD started a fresh increase above the 1.3000 resistance zone.

[*] There was a break above a major bearish trend line with resistance near the 1.2970 on the hourly chart.

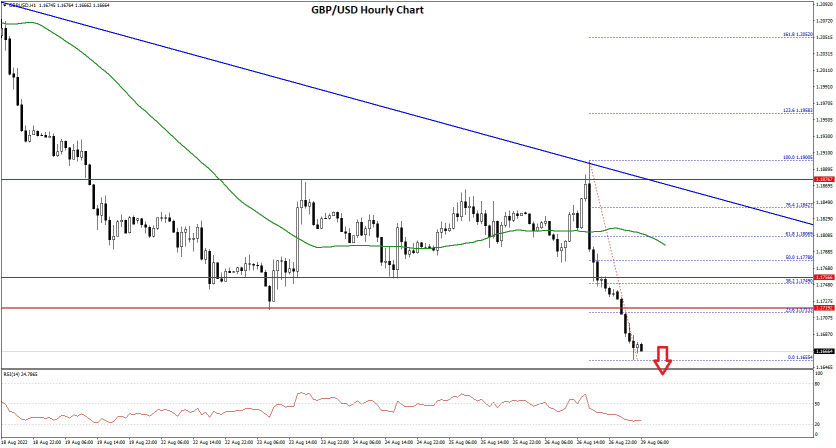

GBP/USD Technical Analysis

After a strong rejection near 1.2000, the British Pound started a fresh decline against the US Dollar. GBP/USD declined heavily below the 1.1920 support zone.

There was a move below the 1.1850 support zone and the 50 hourly simple moving average. The pair even traded below the 1.1750 support zone and formed a low near 1.1655. It is now consolidating losses above the 1.1650 level.

GBP/USD Hourly Chart

An immediate resistance is near the 1.1710 level. It is near the 23.6% Fib retracement level of the downward move from the 1.1900 swing high to 1.1655 low.

The next key resistance is near the 1.1780 level. It is near the 50% Fib retracement level of the downward move from the 1.1900 swing high to 1.1655 low. The main resistance is now forming near the 1.1820 zone.

Besides, there is a key bearish trend line forming with resistance near 1.1830 on the hourly chart of GBP/USD. If there is an upside break above the 1.1820 zone, the pair could rise towards 1.1900. The next key resistance could be 1.1950, above which the pair could gain strength.

On the downside, an initial support is near the 1.1650 area. The first major support is near the 1.1620 level. If there is a break below 1.1620, the pair could extend its decline. The next key support is near the 1.1550 level. Any more losses might call for a test of the 1.1500 support.

VIEW FULL ANALYSIS VISIT - FXOpen Blog

It's not as gloomy as it looks! FTSE 100 down, but not as low as 6 months ago

The stock market news over the past few days has been awash with coverage of the perceived low point to which the FTSE 100 index in the United Kingdom has fallen recently.

At the close of trading on the London session on Friday last week, the FTSE 100, which is the index consisting of the 100 most prestigious blue-chip stocks of publicly listed companies on the London Stock Exchange, sat at 7,427.31 points.

The overall view is that this close places it 'firmly in the red', which is certainly the case when looking at the past week in which, aside from a very sudden dip to 7,412 on Wednesday before a quick rebound, this close represents a 123 point downturn over the five day moving average.

Commentary on the FTSE 100's current situation is generally centered around reports on the continual increase in inflation across many Western markets, and some conclusions are being drawn that activity across the Atlantic in the United States has had some negative effect as markets digest the Fed's response to rising inflation at the Jackson Hole central bank meet.

However, the whilst there is certainly a current dip over the short term in the buoyancy of the FTSE 100 index, when looking over a six month period, a different picture emerges.

At the beginning of August, just three weeks ago, the FTSE 100 index was trading at 7,409 which is considerably lower than the close on Friday last week which has drawn so much attention.

Back in March, it was down to 6,959 which is a transgression of the 7,000 mark which the FTSE 100 index has been trading above since the middle of 2021 when it rallied and all eyes were focused on the 7,000 point value which was a milestone.

In the middle of 2021, there were schools of thought which considered that thee FTSE 100 could sustain a move higher than the 7,000 mark due to the inflows from foreign investors. Ever since Brexit in 2016, there has been a reluctance of foreign investors (private and institutional) to allocate money towards the FTSE 100 and other UK assets. The reduction in uncertainty had been helped by the Brexit deal in late 2020.

Therefore, when considering the overall situation which surrounds the value of the FTSE 100 index, there is certainly a fair amount of volatility, and certain industry sectors which have a number of companies listed on the FTSE 100 index such as the airline industry, have been experiencing a significant amount of disruption recently, however the overall picture over a longer term does not look anywhere near as gloomy as the current mood suggests.

What it does show is that volatility has been sustained in the usually steady index and has been present for quite some time now.

VIEW FULL ANALYSIS VISIT - FXOpen Blog