Daily Market Analysis By FXOpen

Gold Price Recovers While Crude Oil Price Aims Upside Break

Gold price started an upside correction from the $1,615 zone. Crude oil price is rising and might clear the $90 resistance zone.

Important Takeaways for Gold and Oil

[*] Gold price found support near the $1,616 level and corrected higher against the US Dollar.

[*] There is a key bearish trend line forming with resistance near $1,650 on the hourly chart of gold.

[*] Crude oil price is showing positive signs above the $87.20 support zone.

[*] There was a break below a connecting bullish trend line with support near $88.30 on the hourly chart of XTI/USD.

Gold Price Technical Analysis

Gold price failed to gain strength for a move above the $1,665 resistance against the US Dollar. The price started a fresh decline and traded below the $1,650 support level.

There was a clear move below the $1,635 support zone and the 50 hourly simple moving average. The price traded as low as $1,616 on FXOpen and recently there was a recovery wave. The price was able to clear the $1,630 resistance zone.

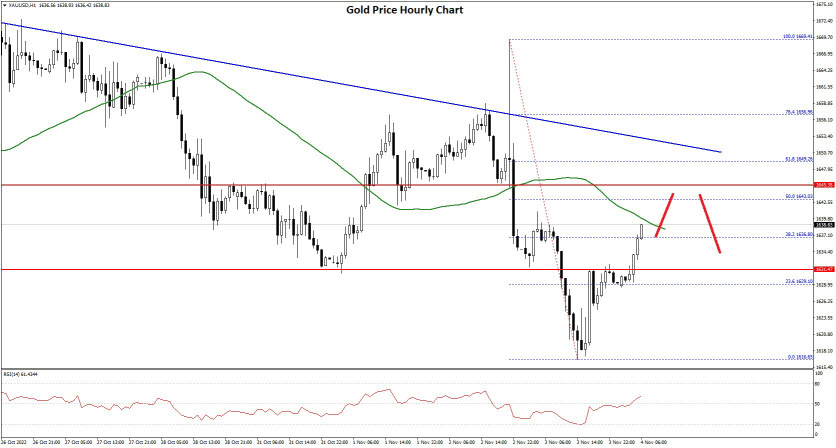

Gold Price Hourly Chart

The price even climbed above the 38.2% Fib retracement level of the downward move from the $1,669 swing high to $1,616 low. It is now facing resistance near the $1,640 level and the 50 hourly simple moving average.

The first major resistance is near the $1,644 level. It is near the 50% Fib retracement level of the downward move from the $1,669 swing high to $1,616 low.

There is also a key bearish trend line forming with resistance near $1,650 on the hourly chart of gold. The main resistance is now forming near the $1,655 level, above which it could even test $1,670. A clear upside break above the $1,670 resistance could send the price towards $1,700.

An immediate support on the downside is near the $1,630 level. The next major support is near the $1,620 level, below which there is a risk of a larger decline. In the stated case, the price could decline sharply towards the $1,600 support zone.

VIEW FULL ANALYSIS VISIT - FXOpen Blog...

Disclaimer: CFDs are complex instruments and come with a high risk of losing your money.

Watch FXOpen's October 31 - November 4 Weekly Market Wrap Video

In this video, FXOpen UK COO Gary Thomson sums up the week’s happenings and discusses the most significant news reports.

[*] FTSE 100 rockets as oil giant reaps the profits

[*] The Fed shook the market. What's next?

[*] UK Interest Rate announcement

[*] Will the Oil price rise?

Watch our short and informative video, and stay updated with FXOpen.

FXOpen YouTube

Disclaimer: CFDs are complex instruments and come with a high risk of losing your money.

Inflation in the UK hits high at 11..1% as US inflation goes down

The floundering British economy has once again been subject to a set of metrics that have marked out the severity of the current situation, this time it is yet again the announcement of an increase in inflation.

Inflation in the United Kingdom reached 11.1% in October 2022, which is higher than had originally been predicted, marking out the very bleak nature of the British economic situation especially considering that yesterday, the United States government issued official figures showing that its level of inflation had reduced significantly to 7.7%.

As can perhaps be expected, low-income households suffered the biggest jump in the cost of living, while high income households were less hit during that period, because low-income households spend more of their money on energy and food where costs have soared.

Surprisingly, however, despite the very high inflation figures in the United Kingdom, the British Pound actually rose against the US Dollar to 1.19 last night and has thus far sustained that level of value, but it fell against the Euro during the early hours of the trading day this morning.

It is looking likely that the Bank of England will not pause its program of increasing interest rates given the 11.1% inflation figure for October, giving more weight to the speculation that interest rates may rise to as much as 5% by January 2023, which would put pressure on people paying mortgages and other loans.

The housing market outside London has already slowed down tremendously compared to just two months ago after 10 banks across the United Kingdom withdrew mortgage products from the market.

Many analysts are looking back to the dark days of the early 1980s when the British economy was struggling after James Callaghan's 1979 'Winter of Discontent' in which there was no public money to pay for essential services and piles of household refuse were meters high in the streets, and companies implemented a 3-day working week due to inability to afford to pay wages.

Today, the set of circumstances that has led to this level of inflation are completely different to those of the late 1970s, hence the uncertainty of what lies ahead and volatility in the currency markets.

VIEW FULL ANALYSIS VISIT - FXOpen Blog...

Disclaimer: CFDs are complex instruments and come with a high risk of losing your money.

ETHUSD and LTCUSD Technical Analysis – 17th NOV, 2022

ETHUSD: Bearish Engulfing Pattern Below $1349

Ethereum was unable to sustain its bullish momentum and after touching a high of 1349 on 10th Nov, the prices started to decline against the US dollar touching a low of 1171 on 14th Nov.

After this decline, we can see some upwards correction in the levels of Ethereum above the $1200 handle.

We have seen a bearish opening of the markets this week.

We can clearly see a bearish engulfing pattern below the $1349 handle which is a bearish pattern and signifies the end of a bullish phase and the start of a bearish phase in the markets.

ETH is now trading just below its pivot levels of 1204 and moving into a mildly bearish channel. The price of ETHUSD is now testing its classic support level of 1188 and Fibonacci resistance level of 1198 after which the path towards 1100 will get cleared.

The relative strength index is at 40 indicating a WEAK demand for Ether and the continuation of the selling pressure in the markets.

The prices are ranging near the horizontal resistance in the weekly time frame, indicating a bearish trend.

Both the STOCHRSI and Williams percent range are indicating oversold levels.

All of the technical indicators are giving a STRONG SELL market signal.

Most of the moving averages are giving a STRONG SELL signal and we are now looking at the levels of $1150 to $1100 in the short-term range.

ETH is now trading below both the 100 & 200 hourly simple and exponential moving averages.

[*] Ether: bearish reversal seen below the $1349 mark

[*] Short-term range appears to be mildly bearish

[*] ETH continues to remain below the $1300 level

[*] The average true range is indicating LESS market volatility

Ether: Bearish Reversal Seen Below $1349

ETHUSD is now moving in a mildly bearish channel with the prices trading below the $1300 handle in the European trading session today.

ETH continues to remain under pressure this month and fresh downsides are expected below the $1100 handle.

ETHUSD touched an intraday high of 1227 and an intraday low of 1193 in the Asian trading session today.

We can see a bullish price crossover pattern with moving averages MA50 and MA100 in the 1-hour time frame.

We can also see the formation of a black evening star pattern in the 15-minute time frame.

The daily RSI is printing at 38 indicating a very weak demand for Ether in the long-term range.

The key support level to watch is $1186 which is the last resistance level, and $1195 which is a 14-3 day raw stochastic at 20%

ETH has decreased by 3.15% with a price change of 38.81$ in the past 24hrs and has a trading volume of 11.524 billion USD.

We can see an increase of 1.46% in the total trading volume in the last 24 hrs which appears to be normal.

The Week Ahead

ETH price continues to remain in a bearish zone against the US dollar and bitcoin. ETHUSD is expected to move lower towards the $1100 and $11150 levels this week.

We can see the formation of a major bearish trend line in place from $1349 towards $1119 levels.

The immediate short-term outlook for Ether has turned mildly bearish, the medium-term outlook has turned neutral, and the long-term outlook for Ether is neutral in present market conditions.

The prices of ETHUSD will need to remain above the important support levels of $1094 which is the 3rd support pivot point.

The weekly outlook is projected at $1150 with a consolidation zone of $1100.

Technical Indicators:

The relative strength index (14): is at 37.20 indicating a SELL

The rate of price change: is at -1.23 indicating a SELL

Bull/Bear power (13): is at -14.17 indicating a SELL

High/lows (14): is at -7.94 indicating a SELL

VIEW FULL ANALYSIS VISIT - FXOpen Blog...

Disclaimer: CFDs are complex instruments and come with a high risk of losing your money.

Gold Price Could Correct Lower, Crude Oil Price Breaks Key Support

Gold price climbed higher and traded above the $1,750 resistance. Crude oil price declined below the $86.00 and $83.80 support levels.

Important Takeaways for Gold and Oil

[*] Gold price found support near the $1,700 level and started a fresh increase against the US Dollar.

[*] There was a break below a key bullish trend line with support near $1,772 on the hourly chart of gold.

[*] Crude oil price gained bearish momentum below the $86.00 support zone.

[*] There is a major bearish trend line forming with resistance near $84.40 on the hourly chart of XTI/USD.

Gold Price Technical Analysis

Gold price formed a base above the $1,700 level against the US Dollar. The price started a fresh increase and was able to clear the $1,720 and $1,740 resistance levels.

There was a clear move above the $1,750 resistance and the 50 hourly simple moving average. The price even broke the $1,780 level and traded as high as $1,786 on FXOpen. Recently, there was a downside correction below the $1,775 level.

Gold Price Hourly Chart

The price traded below the 23.6% Fib retracement level of the upward move from the $1,702 swing low to $1,786 high. Besides, there was a break below a key bullish trend line with support near $1,772 on the hourly chart of gold.

An immediate support on the downside is near the $1,755 level. The next major support is near the $1,745 level or the 50% Fib retracement level of the upward move from the $1,702 swing low to $1,786 high, below which there is a risk of a larger decline.

In the stated case, the price could decline sharply towards the $1,722 support zone. On the upside, the first major resistance is near the $1,770 level.

The main resistance is now forming near the $1,785 level, above which it could even test $1,800. A clear upside break above the $1,800 resistance could send the price towards $1,840.

VIEW FULL ANALYSIS VISIT - FXOpen Blog...

Disclaimer: CFDs are complex instruments and come with a high risk of losing your money.

Watch FXOpen's November 14 - 18 Weekly Market Wrap Video

In this video, FXOpen UK COO Gary Thomson sums up the week’s happenings and discusses the most significant news reports.

[*] How will Rishi Sunak affect the pound?

[*] US may avoid recession whereas Europe may plunge deeper

[*] EUR/USD rallies while USD/JPY takes a major hit

[*] GBPUSD reaches 1.20, what's next?

[*] Inflation in the UK hits high at 11.1% as US inflation goes down.

Watch our short and informative video, and stay updated with FXOpen.

FXOpen YouTube

Disclaimer: CFDs are complex instruments and come with a high risk of losing your money.

GBP/USD Corrects Gains, USD/CAD Eyes Fresh Increase

GBP/USD climbed towards 1.2000 before it faced sellers. USD/CAD is rising and might gain pace above the 1.3450 resistance zone.

Important Takeaways for GBP/USD and USD/CAD

[*] The British Pound was able to move above the 1.1800 and 1.1900 resistance levels.

[*] There is a key bearish trend line forming with resistance near 1.1900 on the hourly chart of GBP/USD.

[*] USD/CAD tested the 1.3220 zone and started a recovery wave.

[*] There is a major bullish trend line forming with support at 1.3370 on the hourly chart.

GBP/USD Technical Analysis

After forming a base above the 1.1500, the British Pound started a steady increase against the US Dollar. GBP/USD gained pace for a move above the 1.1650 and 1.1800 resistance levels.

There was a move above the 1.1900 resistance and the 50 hourly simple moving average. The pair even moved above the 1.2000 level and traded as high as 1.2027 on FXOpen. It is now correcting gains and trading below the 1.1950 level.

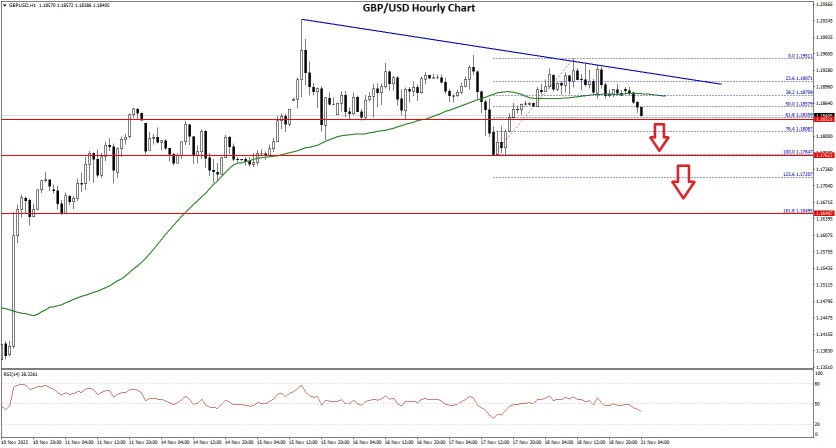

GBP/USD Hourly Chart

Recently, there was a move below the 1.1920 and 1.1880 support levels. The pair declined below the 50% Fib retracement level of the upward move from the 1.1764 swing low to 1.1951 high.

It is now trading below the 1.1880 level and the 50 hourly simple moving average. On the downside, an initial support is near the 1.1835 area. It is near the 61.8% Fib retracement level of the upward move from the 1.1764 swing low to 1.1951 high.

The next major support is near the 1.1765 level. If there is a break below 1.1765, the pair could extend its decline. The next key support is near the 1.1650 level. Any more losses might call for a test of the 1.1550 support.

An immediate resistance is near the 1.1880 level. There is also a key bearish trend line forming with resistance near 1.1900 on the hourly chart of GBP/USD.

The next resistance is near the 1.1920 level. The main resistance is near the 1.2000 level. If there is an upside break above the 1.2000 zone, the pair could rise towards 1.2120. The next key resistance could be 1.2200.

VIEW FULL ANALYSIS VISIT - FXOpen Blog...

Disclaimer: CFDs are complex instruments and come with a high risk of losing your money.

Pound's gains wiped off after tax-grab budget leads toward retail sales outlook

The monumental and sustained decline in value that blighted the British Pound over recent months in which it almost went into freefall with no sign of an end suddenly began to show signs of improvement a couple of weeks ago when Liz Truss, the British Prime Minister to hold the shortest tenure in office in British history - just 44 days - resigned.

Her resignation was considered a positive step by the markets, as along with her leaving her office, an equally short-lived stint in office for Chancellor of the Exchequer (Finance Minister) Kwasi Kwarteng also came to an end.

During Ms Truss' 44 day term as Prime Minster, she ramped up the rhetoric against Russia, presided over a disastrous mini-budget which was canceled the moment she left office, and created a sense of nervousness in the markets.

The pound began to recover after her tenure as Prime Minister ended, and although still very much in the doldrums and having not managed to reach 1.18 against the US Dollar which by contrast has been a very strong currency over recent months, the economic woes in the United Kingdom have been too grave to ignore.

Last week, new Prime Minister Rishi Sunak along with new Chancellor of the Exchequer Jeremy Hunt unveiled their new budget, which was laden with significant socialist-style tax increases, right at a time when the economy is in limp-home mode following the hundreds of billions which flowed out of the coffers during 2020 and 2021 under Mr Sunak's watch as Chancellor.

The pound crashed in value once again yesterday during the hours of the London trading session, and although it is not down to the low levels that it reached at the end of Ms Truss' tenure at Number 10 Downing Street, it did head back to the low 1.18 range.

It appears that the confidence-busting high-tax budget which now causes the average British household to be even more cash-strapped during what is being dubbed a 'cost of living crisis', and the potential that some high net worth individuals or companies with international offices may move their wealth to more tax-friendly jurisdictions, has caused investors and traders to take a conservative view once again.

This drop came in at exactly the time when earnings reports from many publicly-listed retail giants are about to be released, and whilst we do not know what those figures may be as yet, it is estimated by many analysts that they could be a bit lower than usual at this time of year due to people simply not having as much disposable income available as they once did, and the government's imminent interest rate rises which are estimated to reach around 5% by January 2023 as inflation soared over the 11% mark in Britain by Friday last week.

By contrast, the United States, whilst still blighted by high inflation over the past year, is not fairing so badly at all. At the end of last week, inflation in the United States actually decreased to 7.7%, and whilst that may still sound a lot compared to the levels that it stood at by the end of last decade, it is far lower than the 10% it reached by the summer of this year.

By no means is the United States economy out of the woods yet, but it is certainly showing signs of returning to some degree of fortitude.

Britain, by contrast, battles on with serious challenges ahead.

VIEW FULL ANALYSIS VISIT - FXOpen Blog...

Disclaimer: CFDs are complex instruments and come with a high risk of losing your money.

BTCUSD and XRPUSD Technical Analysis – 22nd NOV 2022

BTCUSD: Shooting Star Pattern Below $17110

Bitcoin was unable to sustain its bullish momentum and after touching a high of 17110 on 15th Nov, the prices started to decline against the US dollar touching a low of 15509 on 21st Nov.

The global demand for bitcoin continues to remain weak, and the prices are expected to break below the $15000 handle soon.

We can see the formation of bearish engulfing lines in the weekly time frame.

The RSI indicator is under 30 in the 4-hour time frame indicating the neutral signal and oversold markets.

We can clearly see a shooting star pattern below the $17110 handle which is a bearish reversal pattern because it signifies the end of an uptrend and a shift towards a downtrend.

Bitcoin touched an intraday low of 15524 and an intraday high of 15948 in the Asian trading session today.

Both the STOCH and STOCHRSI are indicating overbought levels which means that in the immediate short term, a decline in the prices is expected.

The relative strength index is at 36 indicating a WEAK demand for bitcoin, and the continuation of the selling pressure in the markets.

Bitcoin is now moving below its 100 hourly simple moving average and below its 200 hourly exponential moving averages.

Most of the major technical indicators are giving a STRONG SELL signal, which means that in the immediate short term, we are expecting targets of 15500 and 15000.

The average true range is indicating LESS market volatility with a mildly bearish momentum.

[*] Bitcoin: bearish reversal seen below $17110

[*] The Williams percent range is indicating an overbought levels

[*] The price is now trading just above its pivot level of $15718

[*] All of the moving averages are giving a STRONG SELL market signal

Bitcoin: Bearish Reversal Seen Below $17110

We can now see that the price of bitcoin is moving in a mildly bearish momentum and we are expecting more downside waves in this week.

We can see that the support of the channel is broken in the daily time frame indicating bearish trends.

The price of bitcoin is ranging near a new record low of 1 month and 1 year’s time frame.

There is a descending channel forming which is expected to break the current support levels of bitcoin at $15716.

The immediate short-term outlook for bitcoin is strongly bearish, the medium-term outlook has turned bearish, and the long-term outlook remains neutral under present market conditions.

Bitcoin’s support zone is located at $15516 which is a 1-month and 1-year’s low point.

The price of BTCUSD is now facing its classic support level of 15583 and Fibonacci support level of 15682 after which the path towards 15500 will get cleared.

In the last 24hrs BTCUSD has decreased by 2.09% by 334$ and has a 24hr trading volume of USD 33.191 billion. We can see an increase of 12.91% in the trading volume compared to yesterday, which appears to be normal.

The Week Ahead

The price of bitcoin is moving near the 1-year low and has already broken the support levels of $15980 which is the last pivot point.

We can see a bearish trend reversal signal with the moving average MA50 in the 15-minute time frame.

The daily RSI is printing at 31 which indicates a weaker demand for bitcoin and the continuation of the selling pressure in the markets.

The price of BTCUSD will need to remain above the important support level of $14688 which is a 3–10-day MACD oscillator stalls.

The weekly outlook is projected at $15500 with a consolidation zone of $15000.

The Collapse of FTX

The cryptocurrency exchange FTX, valued at $26.5 billion last year, collapsed, which sent ripples through the crypto market and became the primary driving force for Bitcoin which is near the record lows of its 1 year.

FTX faced a liquidity crisis, and in the hours following, experienced a possible hack in which hundreds of millions worth of tokens were stolen.

FTX filed for bankruptcy on Nov. 11, 2022. The future of FTX as a cryptocurrency exchange is in serious jeopardy. As of mid-November 2022, withdrawals are disabled and a notice on the FTX website says the company “strongly advises against depositing.”

Technical Indicators:

The moving averages convergence divergence, MACD (12,26): is at -116.00 indicating a SELL

The commodity channel index, CCI (14): is at -75.95 indicating a SELL

The rate of price change, ROC: is at -0.140 indicating a SELL

Bull/Bear power (13): is at -141.77 indicating a SELL

VIEW FULL ANALYSIS VISIT - FXOpen Blog...

Disclaimer: CFDs are complex instruments and come with a high risk of losing your money.

EUR/USD Eyes Fresh Increase While USD/CHF Corrects Lower

EUR/USD is eyeing a fresh increase above the 1.0320 resistance zone. USD/CHF is correcting gains and might test the 0.9475 support zone.

Important Takeaways for EUR/USD and USD/CHF

[*] The Euro started a fresh decline and tested the 1.0220 support against the US Dollar.

[*] There is a major bearish trend line forming with resistance near 1.0315 on the hourly chart of EUR/USD.

[*] USD/CHF started a fresh increase after it was able to clear the 0.9500 resistance.

[*] There was a break below a key bullish trend line with support near 0.9540 on the hourly chart.

EUR/USD Technical Analysis

This week, the Euro started a downside correction from the 1.0400 zone against the US Dollar. The EUR/USD pair declined below the 1.0320 support level to move into a short-term bearish zone.

The pair even tested the 1.0220 support zone. It traded as low as 1.0222 on FXOpen and recently started a decent increase. There was a move above the 1.0275 level and the 50 hourly simple moving average. The pair even cleared the 50% Fib retracement level of the downward move from the 1.0395 swing high to 1.0222 low.

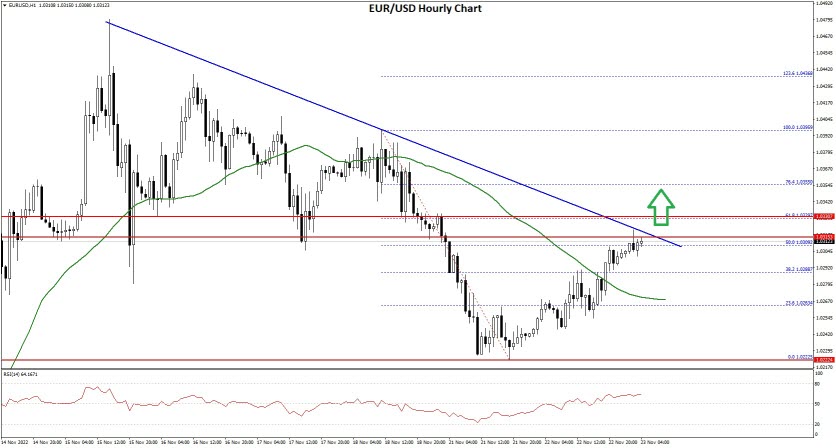

EUR/USD Hourly Chart

An immediate resistance is near the 1.0320 level. There is also a major bearish trend line forming with resistance near 1.0315 on the hourly chart of EUR/USD.

The 61.8% Fib retracement level of the downward move from the 1.0395 swing high to 1.0222 low is also near 1.0329 to act as resistance. The next major resistance is near the 1.0350 level. A clear move above the 1.0350 resistance zone could set the pace for a larger increase towards 1.0400.

The next major resistance is near the 1.0500 zone. On the downside, an immediate support is near the 1.0280 level. The next major support is near the 1.0265 level. A downside break below the 1.0265 support could start another decline.

VIEW FULL ANALYSIS VISIT - FXOpen Blog...

Disclaimer: CFDs are complex instruments and come with a high risk of losing your money.