Daily Market Analysis By FXOpen

UK Government ditches high-earner tax rate cut; Pound freefall halted for the moment

The British Pound's tremendous freefall has been staggering viewing over the past few weeks. Just when it looked like it would not fall lower, a sudden further drop ensued, bringing the Pound to almost parity with the US Dollar and creating a degree of speculation that perhaps the US Dollar, given its remarkable recent strength, would overtake the Pound and replace it as the world's most valuable currency.

This has not yet happened, and today as the week's trading begins, the British Pound has made a very slight step in the upward direction, albeit still at very low values compared to its high points six months ago.

As the London market opened this morning, the Pound had risen by 0.7% to US1.2453 and 0.20% to EUR0.982.

It is being considered that new further tax cuts which are being expected to be released by Prime Minister Liz Truss in which the highest tax rate, 45%, which is applied to higher earners in the UK, presented a serious risk to the economy, and had been met with great unpopularity by the electorate.

Today, the government announced that it would not proceed with the tax cuts, and that the high rate of tax will remain at 45%, which has gone some way toward curtailing the freefall that the British economy has been in for some months now.

The new government has been criticized for potentially assisting 'the rich' whilst the majority of small businesses and private individuals in the country struggle against extremely difficult economic circumstances.

It is of course easy for those saddled with a 45% tax burden to disagree with the way that the current government has been spending their tax, however in terms of actual percentage of taxable income, it is unlikely that keeping the high rate at 45% will cause a 'brain drain' - that being a term for highly educated, high earners to consider leaving the country.

This is largely because any other Western country which provides a lifestyle as good as that in the United Kingdom will likely have similar tax rates, therefore not much advantage would be gained.

Whilst the Pound's dramatic fall in value appears to have slowed, the FTSE 100 is now in the sights of observers. It is expected to open lower today following heavy losses in the US on Friday and with ongoing nervousness about the state of the UK finances.

There is no doubt that just keeping the top tax rate at 45% is not going to resolve the serious situation that the British economy is in.

Stocks listed on the FTSE 100 are large, blue-chip companies with vast shareholder bases, and their ability to perform well on their home market is a critical measure of investor confidence and equally a measure of the overall condition of British industry.

At the moment, housebuilders and financial services firms are down, whereas raw materials miners are up.

VIEW FULL ANALYSIS VISIT - FXOpen Blog...

Disclaimer: CFDs are complex instruments and come with a high risk of losing your money.

GBP/USD Eyes Steady Recovery, EUR/GBP Faces Hurdle

GBP/USD started a recovery wave from a new low at 1.0341 and climbed above 1.1000. EUR/GBP is now facing a major resistance near 0.8870.

Important Takeaways for GBP/USD and EUR/GBP

[*] The British Pound started a fresh recovery wave above the 1.0920 resistance zone against the US Dollar.

[*] There was a break above a couple of bearish trend lines at 1.0700 and 1.0800 on the hourly chart of GBP/USD.

[*] EUR/GBP started a sharp decline and traded below the 0.8900 level.

[*] There is a major bearish trend line forming with resistance near 0.8830 on the hourly chart.

GBP/USD Technical Analysis

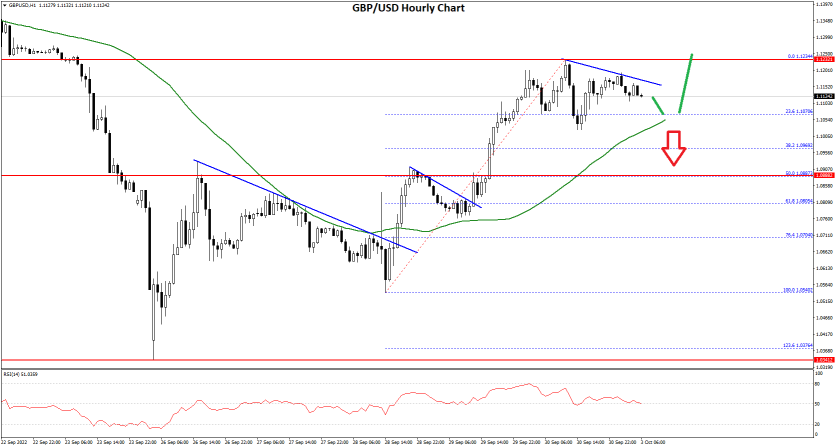

The British Pound found support near the 1.0340 zone against the US Dollar. The GBP/USD pair started a recovery wave and was able to clear the 1.0650 resistance zone.

There was a decent increase above the 1.0920 level and the 50 hourly simple moving average. The pair even climbed above the 1.1100 level. During the increase, there was a break above a couple of bearish trend lines at 1.0700 and 1.0800 on the hourly chart of GBP/USD.

A high was formed near 1.1234 on FXOpen and the pair is now correcting gains. On the downside, an initial support is near the 1.1070 level. It is near the 23.6% Fib retracement level of the upward move from the 1.0540 swing low to 1.1234 high.

The next major support is near the 1.0880 level. It is near the 50% Fib retracement level of the upward move from the 1.0540 swing low to 1.1234 high. Any more losses could lead the pair towards the 1.0750 support zone or even 1.0680.

On the upside, an initial resistance is near the 1.1230 level. The next main resistance is near the 1.1300 zone. A clear upside break above the 1.1300 and 1.1310 resistance levels could open the doors for a steady increase in the near term. The next major resistance sits near the 1.1500 level.

VIEW FULL ANALYSIS VISIT - FXOpen Blog...

Disclaimer: CFDs are complex instruments and come with a high risk of losing your money.

Tesla in the doldrums as Elon Musk offers political advice

Tesla stock is one of the more volatile among big-cap publicly listed corporations, and the last day's performance has demonstrated once again that there is still a lot of uncertainty with regard to its values.

Tesla stock fell over 8.6% in value during yesterday's New York trading session, adding a further downturn to the 14.6% it has lost over the five day moving average.

Opinions vary on what caused this particular collapse in value, however it did coincide with reports that the company's record delivery figures for its electric cars had shown how challenging it can be to secure vehicle transportation capacity and at a reasonable cost, but surely there must be more to it than that?

Record deliveries of a product which is manufactured by a publicly listed company with shareholders to please usually brings confidence and Tesla's revolutionization of the entire automotive industry toward electric vehicles plus its standing as a huge market contender globally should go along with these record delivery figures nicely.

But it didn't.

Some dissenters consider that the entry level Tesla models such as the Model 3 and Model Y are quite simply not premium products, and despite their pricetag, are not much more well equipped or better engineered than budget cars from established brands in Europe and Asia at less than half the cost, giving rise to a possible feeling of marketing over substance.

That still wouldn't be enough to create such a downturn in share price though, because the cars are selling in high numbers and the revenues are pouring in more than ever.

Increased operating costs are one perhaps interesting area to examine. An expert in balancing the books, rival car manufacturer Ford Motor Company, recently said that inflation-related costs would be $1 billion more than expected in the third quarter and that parts shortages had delayed deliveries.

However, it may well be Elon Musk's tendency to go down the political path in the public arena that has had some effect.

Yesterday, Elon Musk said that, in the current geopolitical conflict, UN-supervised elections in four occupied regions that Moscow has falsely annexed after what it called referendums. "Russia leaves if it is the will of the people" he said, prompting a Twitter response from Ukrainian President Volodymyr Zelensky.

Politics and business often do not mix, and the more conservative investors often take a dim view of involvement in such situations which can create commercial risk.

Elon Musk is no stranger to that, of course, and has in the past caused crashes and booms by taking to Twitter to voice his opinion!

VIEW FULL ANALYSIS VISIT - FXOpen Blog...

Disclaimer: CFDs are complex instruments and come with a high risk of losing your money.

BTCUSD and XRPUSD Technical Analysis – 04th OCT 2022

BTCUSD: Three White Soldiers Pattern Above $18527

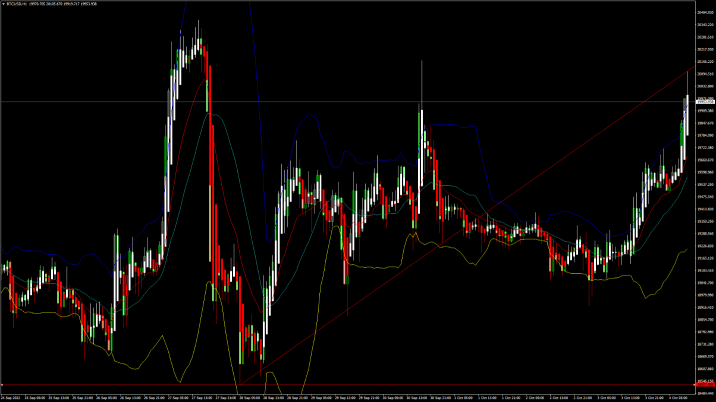

Bitcoin was unable to sustain its bullish momentum and after touching a high of 20328 on 27th Sep, it started to decline touching a low of 18525 on 28th Sep. After this decline, the prices have stabilized and we can see an uptrend in the markets.

The prices have crossed the $20000 mark in the European trading session today.

We can see that the price is back over the pivot point in the weekly time frame.

The price of bitcoin is ranging near the horizontal support levels in the weekly time frame.

We can clearly see a three white soldiers pattern above the $18527 handle which is a bullish reversal pattern because it signifies the end of a downtrend and a shift towards an uptrend.

Bitcoin touched an intraday low of 19510 in the Asian trading session and an intraday high of 20099 in the European trading session today.

Both the STOCH and STOCHRSI are indicating overbought levels which means that in the immediate short term a decline in the prices is expected.

The relative strength index is at 74 indicating a STRONG demand for bitcoin, and the continuation of the buying pressure in the markets.

Bitcoin is now moving above its 100 hourly simple moving average and above its 200 hourly exponential moving averages.

Most of the major technical indicators are giving a STRONG BUY signal, which means that in the immediate short term we are expecting targets of 21000 and 22500.

The average true range is indicating LESS market volatility with a strong bullish momentum.

[*] Bitcoin: bullish reversal seen above $18527

[*] The Williams percent range is indicating an overbought level

[*] The price is now trading just above its pivot level of $19931

[*] All of the moving averages are giving a STRONG BUY market signal

Bitcoin: Bullish Reversal Seen Above $18527

The strong bullish rebound that is seen is expected to continue in the short-term range and now we are looking at $21000 and $22000 as the immediate targets.

The adaptive moving average AMA20 is giving a bullish crossover pattern in the daily timeframe.

The parabolic SAR indicator is giving a bullish reversal signal on the daily time frame.

We have also detected the ichimoku bullish crossover pattern on the 4-hour time frame.

The immediate short-term outlook for bitcoin is bullish, the medium-term outlook has turned bullish, and the long-term outlook remains neutral under present market conditions.

Bitcoin’s support zone is located at $19005 and the prices continue to remain above this level for the continuation of the bullish reversal in the markets.

The price of BTCUSD is now facing its classic resistance level of 20007 and Fibonacci resistance level of 200048 after which the path towards 21000 will get cleared.

In the last 24hrs, BTCUSD has increased by 3.80% by 730$, and has a 24hr trading volume of USD 31.762 billion. We can see an increase of 28.33% in the trading volume as compared to yesterday, due to increased demand for bitcoin globally.

The Week Ahead

The prices of bitcoin are moving in a bullish zone above the $19900 level. Further upsides are projected at $21000 and $22000 as the immediate targets.

We have seen continued buying pressure at lower levels, as we can see the formation of an ascending price channel from $18527 towards the $20214 levels.

The daily RSI is printing at 52 which indicates a neutral level and a move towards the consolidation phase in the markets.

The price of BTCUSD will need to remain above the important support level of $19000 this week.

The weekly outlook is projected at $21000 with a consolidation zone of $20500.

Technical Indicators:

The moving averages convergence divergence (12,26): is at 142.70 indicating a BUY

The ultimate oscillator: is at 60.39 indicating a BUY

The rate of price change: is at 1.75 indicating a BUY

The average directional change (14): is at 52.40 indicating a BUY

VIEW FULL ANALYSIS VISIT - FXOpen Blog...

Disclaimer: CFDs are complex instruments and come with a high risk of losing your money.

EUR/USD Recovers Ground, USD/JPY Could Resume Uptrend

EUR/USD started a decent recovery wave above the 0.9900 resistance zone. USD/JPY is rising and might soon clear the key 145.00 resistance zone.

Important Takeaways for EUR/USD and USD/JPY

[*] The Euro formed a base and started a decent recovery wave above the 0.9800 zone.

[*] There is a major bullish trend line forming with support near 0.9910 on the hourly chart of EUR/USD.

[*] USD/JPY declined sharply before it found support near the 143.50 level.

[*] There was a break below a key bullish trend line with support near 144.55 on the hourly chart.

EUR/USD Technical Analysis

This past week, the Euro found support near the 0.9550 zone against the US Dollar. The EUR/USD pair started a steady recovery wave above the 0.9600 and 0.9680 resistance levels.

There was a steady increase above the 0.9800 resistance zone and the 50 hourly simple moving average. The pair even climbed above the 0.9900 resistance zone. A high was formed near 0.9998 on FXOpen and the pair is now correcting lower.

An initial support on the downside is near the 0.9940 level. It is near the 23.6% Fib retracement level of the upward move from the 0.9754 swing low to 0.9998 high.

The first major support is near the 0.9920 level. There is also a major bullish trend line forming with support near 0.9910 on the hourly chart of EUR/USD. The main support sits near the 0.9880 zone. It is near the 50% Fib retracement level of the upward move from the 0.9754 swing low to 0.9998 high.

An immediate resistance on the upside is near the 1.0000 level. The next major resistance is near the 1.0050 level. An upside break above 1.0050 could set the pace for another increase. In the stated case, the pair might revisit 1.0150. Any more gains might send the pair towards 1.0200.

VIEW FULL ANALYSIS VISIT - FXOpen Blog...

Disclaimer: CFDs are complex instruments and come with a high risk of losing your money.

Twitter and Tesla volatility as Elon Musk dumps stock to fund his purchase

In today's age of influencers, there is one figure who can possibly lay claim to being the influencer of all influencers, and that is Elon Musk.

Known for making extremely forthright decisions and taking a leading position in, well, pretty much everything he does, what often appear to be vanity projects for self-promotion end up being sound business moves which disrupt entire industry sectors and lead to massive returns.

A case in point is last year's almost unbelievable scenario in which a tweet put out by Elon Musk crashed the value of five popular cryptocurrencies by almost $1 trillion, and instead of scaring people off in their droves, a large number of conservative, analytical investors bought in, and then a few weeks later a subsequent tweet by Elon Musk caused the values to rise again.

This fascinating working of the media by one man has become one of his trademarks, so much so that Elon Musk has been attempting to acquire Twitter for a few months now.

Just as he appeared to have given up, his interest in buying Twitter has resurfaced, and once again he is dumping shares in Tesla to be able to fund the purchase of it.

Back in April 14 this year, Elon Musk made his initial offer to purchase Twitter for $43 billion, after previously acquiring 9.1% of the company's stock for $2.64 billion. To do this, he leveraged some of his positions at Tesla and made loans, however the deal fell through.

Now it appears that the deal is back on the table and Elon Musk is back in the business of offloading Twitter stock in order to buy Twitter on the open market, a move that has been criticized by many traditional investors and wealth managers.

One comment, coming from Wedbush Securities' Dan Ives yesteday was particularly harsh. "Selling Tesla stocks to fund his Twitter takeover is like giving away caviar to buy $2 pizza" said Mr. Ives.

Tesla stock has been declining in value for a number of weeks, and yesterday's move was no exception. The market reacted to Elon Musk's renewed interest in Twitter with a downward move for Twitter of a further 3.4% on the US market yesterday.

Twitter stock, however, jumped up in value from 50.85 USD at the beginning of the trading session to 51.81 by lunchtime yesterday, showing that investors welcomed the news.

In keeping with Elon Musk's gung-ho approach, there is much volatility now in both stocks and it sometimes appears as though he enjoys this sort of market pandemoneum, hence his continued appetite for causing it!

VIEW FULL ANALYSIS VISIT - FXOpen Blog...

Disclaimer: CFDs are complex instruments and come with a high risk of losing your money.

Watch FXOpen's October 3-7 Weekly Digest Video

In this video, FXOpen UK COO Gary Thomson sums up the week’s happenings and discusses the most significant news reports.

[*] GBP/USD eyes steady recovery, EUR/GBP faces hurdle

[*] Dollar bounces back after record fall

[*] Oil is getting more expensive. What's next?

[*] Twitter and Tesla volatility as Elon Musk dumps stock to fund his purchase

Watch our short and informative video, and stay updated with FXOpen.

FXOpen YouTube

Disclaimer: CFDs are complex instruments and come with a high risk of losing your money.

GBP/USD Faces Key Hurdle, USD/CAD Could Rise Further

GBP/USD struggled to clear 1.1500 and corrected lower. USD/CAD is rising and might climb further above the 1.3800 resistance.

Important Takeaways for GBP/USD and USD/CAD

[*] The British Pound failed to gain strength for a move above the 1.1500 resistance.

[*] There is a key bearish trend line forming with resistance near 1.1130 on the hourly chart of GBP/USD.

[*] USD/CAD started a fresh increase above the 1.3600 resistance zone.

[*] There was a clear move above a major bearish trend line with resistance at 1.3650 on the hourly chart.

GBP/USD Technical Analysis

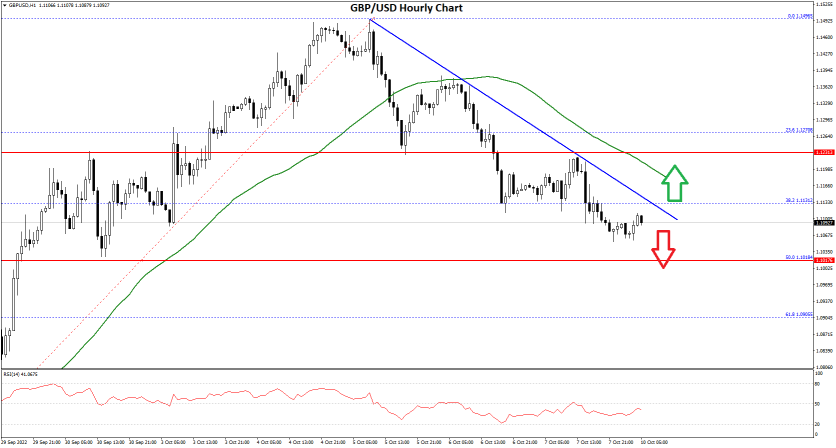

After forming a base above the 1.0850, the British Pound started a steady recovery wave against the US Dollar. GBP/USD gained pace for a move above the 1.1000 and 1.1200 resistance levels.

There was a move above the 1.1350 resistance and the 50 hourly simple moving average. However, the pair faced a strong resistance near the 1.1500 zone. A high was formed near 1.1496 on FXOpen and recently there was a downside correction.

There was a move below the 1.1350 and 1.1320 support levels. The pair declined below the 38.2% Fib retracement level of the upward move from the 1.0765 swing low to 1.1496 high.

It is now trading below the 1.1200 level and the 50 hourly simple moving average. On the downside, an initial support is near the 1.1020 area. It is near the 50% Fib retracement level of the upward move from the 1.0765 swing low to 1.1496 high.

The next major support is near the 1.0950 level. If there is a break below 1.0950, the pair could extend its decline. The next key support is near the 1.0850 level. Any more losses might call for a test of the 1.0750 support.

An immediate resistance is near the 1.1120 level. There is also a key bearish trend line forming with resistance near 1.1130 on the hourly chart of GBP/USD.

The next resistance is near the 1.1180 level. The main resistance is near the 1.1200 level. If there is an upside break above the 1.1200 zone, the pair could rise towards 1.1280. The next key resistance could be 1.1300, above which the pair could gain strength.

VIEW FULL ANALYSIS VISIT - FXOpen Blog...

Disclaimer: CFDs are complex instruments and come with a high risk of losing your money.

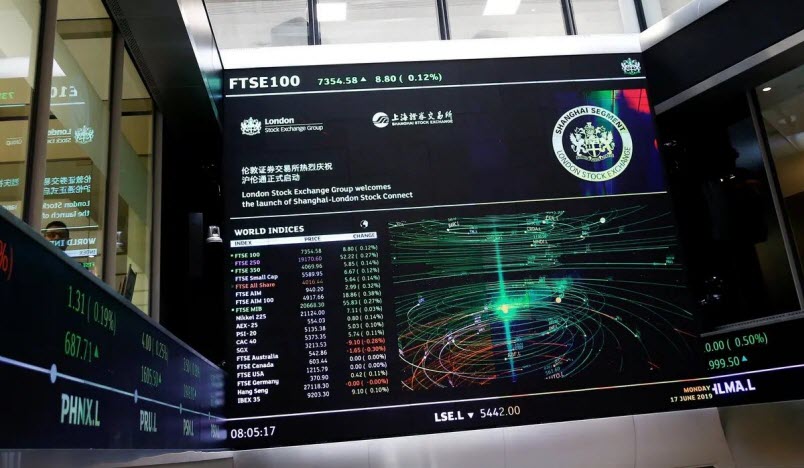

FTSE 100 approaches lowest point in 12 months

The seemingly continual focus on the ever-decreasing value of the British Pound by analysts and traders has been such a central point across the global markets during the past few months that very little attention has been paid to the dichotomy that has been taking place on the stock market.

The London Stock Exchange is home to some of the world's most long-established blue-chip companies and its performance is a definitive measure of the health of the domestic economy from a corporate and industrial perspective.

As the pound made its way down to rock bottom, an interesting pattern emerged within the FTSE 100 index, which is the index that tracks the 100 most prestigious companies listed on the London Stock Exchange's main market.

During these recent weeks, raw materials and mining companies have been doing well, whereas banks and homebuilders have been doing less well.

That demonstrates the current situation in which the British economy is being viewed by not only investors but also banks themselves, many which have removed mortgage products from the market and are taking preventative measures relating to such lending related products in case the interest rate approaches 5% which is anticipated for January 2023.

Today, the FTSE 100 index begins the morning trading session at an almost 12-month low, with factors including high inflation which is driving up costs causing consumer spending to drop, increasing interest rates which are making access to external capital more expensive, continued supply chain disruptions causing global manufacturing delays, and the tanking Pound damaging earnings reported by listed firms being massive contributors.

It is perhaps not surprising that the overall direction of the FTSE 100 index has been a downward one, however some analysts are taking an optimistic view on some of the pharmaceutical stocks, whereas others are looking at the entire British market through a pessimistic lens.

On September 29, the FTSE 100 went down to 6880 points, its lowest point by far in 12 months, and after a slight rebound it is now declining toward that figure again.

The index opened this morning at 6959 points, still below 7000, and 7000 points has been a yardstick measure since mid-2021 when the market was in full upward swing and the news channels were going overboard on the FTSE 100 index having broken the 7000 points barrier, upwards of which it has remained until now.

VIEW FULL ANALYSIS VISIT - FXOpen Blog...

Disclaimer: CFDs are complex instruments and come with a high risk of losing your money.

Professional traders go all out for FX market volatility as volumes soar

The apparent economic disarray which has been unfolding across many Western nations for the past two years may well have resulted in a sustained devaluation of key major currencies such as the British Pound and Euro, but it has brought back something that was utterly lacking for more than two decades: volatility.

Ever since the last decade of the Cold War in which much of Eastern Europe was a non-participant in the global free-market economy and much of Western Europe was struggling under austerity and labor union chaos, the emphasis has been on steady growth and a pragmatic rise to prosperity for most members of the European and American public.

Over the past 30 years, we have seen many European nations unite and accept a common currency, we have seen Britain shake off the shackles of post-World War 2 austerity after the boom years of the 1980s transformed it from a tough climate of trade unions and beige attire into a property-owning nation of entrepreneurs and international trade, punctuated only by some high interest rates in the early 1990s and the financial crisis of 2008/2009 which only affected some banks and was swiftly recovered from.

Today, the citizens of Europe and much of North America are in a very different place. Over two years of economically catastrophic government-enforced lockdowns, taxpayer-funded furlough schemes, travel restrictions, the exit from the European Union of Great Britain, supply chain curtailments and geopolitical tensions have created rapidly depreciating currencies and massive holes in national balance sheets.

We hear endless reports about the cost of living crisis, and rocketing inflation, energy bills quadrupling and interest rates set to rise to such worrying levels that British banks have been removing mortgage products from the market.

This cocktail of woes has caused the Pound to tank over recent weeks, and although the Euro held up well, as soon as the European Central Bank began raising interest rates, it too began to sink in value.

The anomaly has been the strength of the US Dollar, which is proving its mettle as the world's most reliable reserve currency as it has held up very well against the Euro and British Pound despite the United States being subject to similar fiscal and political challenges as mainland Europe and the United Kingdom.

Interestingly, reports have focused on all of the doom and gloom, but have not been necessarily quick to note the upside of this, that being the increased interest in FX trading due to such levels of volatility which have not been present for almost 3 decades.

As an example, Euronext, which is a European electronic trading venue which operates exchange-traded funds, warrants and certificates, bonds, derivatives, commodities, foreign exchange as well as indices, has been experiencing a boom in volumes on its specialist FX trading platform Euronext FX to the extent that over 30% more trades took place on Euronext in September this year compared to the same period last year, resulting in an aggregated monthly turnover of $533 billion, which is up 18 percent from $452 billion that changed hands in the previous month.

Additionally, interbank FX trading is at multi-year highs in terms of volume, demonstrating that the Tier 1 banks are attempting to capitalize on the increased levels of volatility.

Today the US Dollar remains strong, as the Pound has begun to decline once again against the greenback, and the EURUSD pair languishes at 0.97, which is almost parity.

Yes, the economic outlook remains bleak across Europe and Britain, but the currency markets are alive with volatility.

VIEW FULL ANALYSIS VISIT - FXOpen Blog...

Disclaimer: CFDs are complex instruments and come with a high risk of losing your money.