Daily Market Analysis By FXOpen

Big Tech hit by fears of potential recession

Last year, there was a huge amount of caution around the US Big Tech stocks, many of which demonstrated considerable levels of volatility on New York's premier stock exchanges.

There were several periods in which stocks in some of the most well recognized publicly listed technology firms decreased in value tremendously.

That has all gone relatively quiet, especially in the light of the current volatility in the currency markets as the US Dollar remarkably holds its strength over a weak Pound.

Today, however, the US big tech stock debacle has come to light again, with Microsoft and Alphabet (Google) having reported that they have experienced downturns in sales, which adds further weight to the speculation that the Western economy in general is looking at further downturns.

Alphabet (Google) has been cutting its advertising budget, and the resultant 6% rise in sales in the 3 months neding September 30 this year is a damp squib. In fact, this is the slowest quarterly growth since before March 2020 for Alphabet.

Microsoft has also stated that demand for its hardware and software has weakened over the same period, with sales having increased by 11% to $50.1bn, marking its slowest revenue growth in five years.

Costs for US tech giants have been a major stumbling block recently, as the strong US Dollar against depreciating majors in Europe and Japan have resulted in a very high cost of doing business overseas.

Profits at Alphabet dropped nearly 30% to $13.9bn in the quarter, as YouTube (also owned by Alphabet alongside Google) advertising revenues declined for the first time since the firm started to report them publicly.

Interestingly, Microsoft stock has been doing well until this announcement came to light. It is currently at 1.38% over its close yesterday, and up 5.76% over the five day average, however there is a prediction by Google Finance that it may not hold that way.

It's a similar story for Alphabet (Google) stock which closed 1.9% up over yesterday's close, with a prediction of some volatility ahead.

Time will tell of course, however these figures are being considered by many news sources as a marker of weak performance and therefore have led to cautiousness in the markets.

Buy or sell shares with CFDs in some of the world's biggest publicly listed companies on FXOpen’s trading platform. Open your FXOpen account now or learn more about making your money go further with FXOpen.

VIEW FULL ANALYSIS VISIT - FXOpen Blog...

Disclaimer: CFDs are complex instruments and come with a high risk of losing your money.

ETHUSD and LTCUSD Technical Analysis – 27th OCT, 2022

ETHUSD: Inverted Hammer Pattern Above $1254

Ethereum was unable to sustain its bearish momentum and after touching a low of 1254 on 21st Oct, the prices started to correct upwards against the US dollar. The prices of Ethereum touched a high of 1593 on 26th Oct after which we can see a shift towards the consolidation phase in the markets.

We can see that the prices of Ethereum are ranging near the support of the triangle in the 15-minute time frame indicating the bullish overtone of the markets.

We can clearly see an inverted hammer pattern above the $1254 handle which is a bullish pattern and signifies the end of a bearish phase and the start of a bullish phase in the markets.

ETH is now trading just below its pivot level of 1554 and is moving into a mildly bullish channel. The price of ETHUSD is now testing its classic resistance levels of 1568 and Fibonacci resistance levels of 1583 after which the path towards 1600 will get cleared.

The relative strength index is at 75 indicating an overbought market and the shift towards the correction and consolidation phase in the markets.

We can see that the commodity channel index is giving a bullish divergence signal in the 30-minute time frame.

Both the STOCH and Williams percent range are indicating an overbought market, which means that the prices are expected to decline in the short-term range.

Some of the technical indicators are giving a STRONG BUY market signal.

Some of the moving averages are giving a BUY signal, and we are now looking at the levels of $1650 to $1700 in the short-term range.

ETH is now trading above both the 100 & 200 hourly simple and exponential moving averages.

[*] The short-term range appears to be mildly bullish

[*] ETH continues to remain above the $1500 level

[*] The average true range is indicating HIGH market volatility

Ether: Bullish Reversal Seen Above $1254

ETHUSD is now moving into a mildly bullish channel with the price trading above the $1500 handle in the European trading session today.

ETH touched an intraday high of 1583 in the Asian trading session and an intraday low of 1536 in the European trading session today.

The parabolic SAR indicator is giving a bullish reversal signal in the weekly time frame.

Moving average bullish crossovers are seen: AMA20 and AMA50 in the daily timeframe.

We can also see the formation of a bullish price crossover pattern with moving average MA20 in the weekly time frame.

Ethereum’s price continues to move into a bullish zone against the US dollar and is expected to move above the $1600 level.

The daily RSI is printing at 69 indicating a very strong demand for Ether in the long-term range.

The key support levels to watch are $1392 which is a 50% retracement from a 4-week low and 1439 which is a 38.2% retracement from 4-week high.

ETH has increased by 0.74% with a price change of 11.43$ in the past 24hrs and has a trading volume of 26.649 billion USD.

We can see a decrease of 29.89% in the total trading volume in the last 24 hrs which is due to the shift towards the consolidation phase in the markets.

The Week Ahead

After the recent declines, Ethereum’s price is extending upwards correction against the US dollar and bitcoin. We are now looking for a fresh rally into the markets towards the $1800 level.

We can see the formation of a major bullish trend line in place from $1254 towards $1745 level.

The immediate short-term outlook for Ether has turned mildly bullish, the medium-term outlook has turned neutral, and the long-term outlook for Ether is neutral in present market conditions.

The price of ETHUSD will need to remain above the important support levels of $1473 — 1273 which is a pivot point 1st support point.

The weekly outlook is projected at $1700 with a consolidation zone of $1600.

Technical Indicators:

The average directional index ADX (14): is at 42.29 indicating a BUY

The ultimate oscillator: is at 61.39 indicating a BUY

The bull/bear power (13): is at 126.52 indicating a BUY

The commodity channel index (14): is at 81.21 indicating a BUY

VIEW FULL ANALYSIS VISIT - FXOpen Blog...

Disclaimer: CFDs are complex instruments and come with a high risk of losing your money.

AUD/USD and NZD/USD Aim More Upsides

AUD/USD is moving higher and showing positive signs above 0.6400. NZD/USD is also rising and might aim more upsides above 0.5850.

Important Takeaways for AUD/USD and NZD/USD

[*] The Aussie Dollar started a fresh increase above the 0.6350 and 0.6400 levels against the US Dollar.

[*] There is a key bullish trend line forming with support at 0.6460 on the hourly chart of AUD/USD.

[*] NZD/USD is showing a lot of bullish signs above the 0.5800 support zone.

[*] There is a major bullish trend line forming with support at 0.5820 on the hourly chart of NZD/USD.

AUD/USD Technical Analysis

The Aussie Dollar formed a base above the 0.6200 level and started a fresh increase against the US Dollar. The AUD/USD pair gained pace above the 0.6300 level to move into a positive zone.

There was a clear move above the 0.6350 level and the 50 hourly simple moving average. The pair even climbed above the 0.6500 level and traded as high as 0.6522. It is now correcting gains and trading below the 0.6500 level.

AUD/USD Hourly Chart

It spiked below the 23.6% Fib retracement level of the upward move from the 0.6210 swing low to 0.6522 high. On the downside, an initial support is near the 0.6460 level.

There is also a key bullish trend line forming with support at 0.6460 on the hourly chart of AUD/USD. The next support could be the 0.6400 level. If there is a downside break below the 0.6400 support, the pair could extend its decline towards the 0.6365 level.

The 50% Fib retracement level of the upward move from the 0.6210 swing low to 0.6522 high is also near 0.6365. On the upside, the AUD/USD pair is facing resistance near the 0.6500 level.

The next major resistance is near the 0.6520 level. A close above the 0.6520 level could start a steady increase in the near term. The next major resistance could be 0.6580.

VIEW FULL ANALYSIS VISIT - FXOpen Blog...

Disclaimer: CFDs are complex instruments and come with a high risk of losing your money.

Watch FXOpen's October 24-28 Weekly Market Wrap Video

In this video, FXOpen UK COO Gary Thomson sums up the week’s happenings and discusses the most significant news reports.

[*] How will Rishi Sunak affect the pound?

[*] EUR/USD gathers pace

[*] Big Tech hit by fears of potential recession

[*] META (FB) shares fall 20% after earnings report

Watch our short and informative video, and stay updated with FXOpen.

FXOpen YouTube

Disclaimer: CFDs are complex instruments and come with a high risk of losing your money.

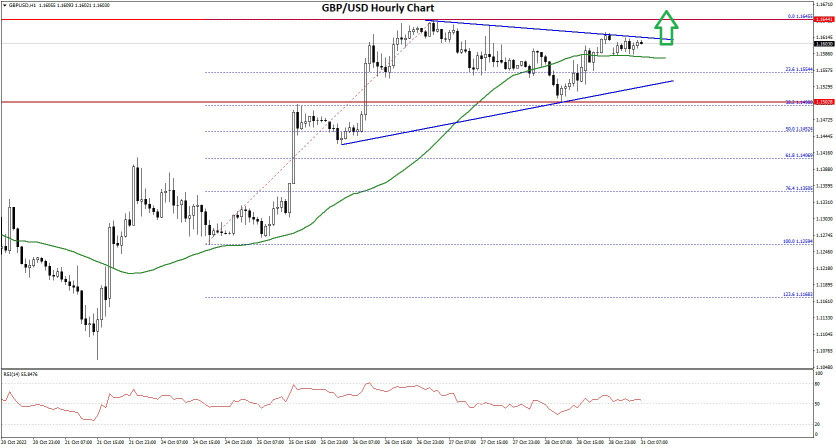

GBP/USD Eyes Additional Gains, USD/CAD Could Start Fresh Increase

GBP/USD is gaining pace above the 1.1500 resistance zone. USD/CAD is recovering and might rally if it clears the 1.3635 resistance zone.

Important Takeaways for GBP/USD and USD/CAD

[*] The British Pound was able to move above the 1.1420 and 1.1500 resistance levels.

[*] There is a key contracting triangle forming with resistance near 1.1615 on the hourly chart of GBP/USD.

[*] USD/CAD tested the 1.3500 zone and started a recovery wave.

[*] There is a major bearish trend line forming with resistance at 1.3625 on the hourly chart.

GBP/USD Technical Analysis

After forming a base above the 1.1200, the British Pound started a steady recovery wave against the US Dollar. GBP/USD gained pace for a move above the 1.1320 and 1.1420 resistance levels.

There was a move above the 1.1500 resistance and the 50 hourly simple moving average. The pair even moved above the 1.1600 level and traded as high as 1.1645 on FXOpen. It is now consolidating gains above the 1.1600 zone.

GBP/USD Hourly Chart

Recently, there was a move below the 1.1600 and 1.1580 support levels. The pair declined below the 23.6% Fib retracement level of the upward move from the 1.1259 swing low to 1.1645 high.

It is now trading above the 1.1600 level and the 50 hourly simple moving average. An immediate resistance is near the 1.1615 level. There is also a key contracting triangle forming with resistance near 1.1615 on the hourly chart of GBP/USD.

The next resistance is near the 1.1650 level. The main resistance is near the 1.1700 level. If there is an upside break above the 1.1700 zone, the pair could rise towards 1.1880. The next key resistance could be 1.2000, above which the pair could gain strength.

On the downside, an initial support is near the 1.1550 area. The next major support is near the 1.1450 level. It is near the 50% Fib retracement level of the upward move from the 1.1259 swing low to 1.1645 high.

If there is a break below 1.1450, the pair could extend its decline. The next key support is near the 1.1322 level. Any more losses might call for a test of the 1.1250 support.

VIEW FULL ANALYSIS VISIT - FXOpen Blog...

Disclaimer: CFDs are complex instruments and come with a high risk of losing your money.

Telsa stock builds steadily after long decline

Tesla stock has been on the backfoot for quite a few weeks now, and founder and CEO Elon Musk's maverick-style behavior has been one of the contributing factors.

Is he buying Twitter or is he not? Is it wise to take a publicly listed corporate tech giant - Tesla - into cryptocurrency?

These are all questions that would potentially cause polarized views among investors and traders.

This week, however, Tesla stock has been growing in value, and over the five day moving average it has increased by a strong 11%, taking its value at the close of business on Friday's New York trading session to $228.5 per share.

This steady rise in value from its low point a week ago may still only place Tesla stock at a fraction of its value one month ago when it was trading at over $300 per share, and over a six month period it is possible to see values of $317 having been reached in early May.

An upward direction over a period of a few days is interesting, however, and coincides with Elon Musk's renewed interest in Twitter, a deal which he pulled out of earlier this year but regained interest in owning the social media platform just recently and has now dominated the media in news stories which include speculation that Mr Musk would terminate a large number of Twitter employees' contracts and restructure the platform.

Additionally, Elon Musk has once again influenced the cryptocurrency market, causing a sudden $1 Trillion Bitcoin and altcoin price surge As Ethereum and Dogecoin increased in value late last week, with one of his outrageous ideas being potential plans to integrate the meme-based cryptocurrency dogecoin into Twitter if his $44 billion bid goes through.

Whether his high profile social media exclamations are always catalysts for volatile markets or not, it is clear that Elon Musk's ideas are often taken seriously. In 2021, over $1 trillion was wiped off the value of 5 popular cryptocurrencies because of a Tweet put out by Elon Musk saying that Tesla would no longer accept Bitcoin as a method of purchasing the electric cars manufactured by the company on the grounds of environmental concerns due to the amount of power needed to mine Bitcoin.

As the values crashed, there was no panic. Instead, many people bought in and then when the prices went up again as Elon Musk then retweeted that he had worked with Bitcoin mining companies and resolved the issue, a clear pattern of market influence had been demonstrated.

Now, Tesla's prices are rising slowly, which is interesting given Elon Musk's obsession with cryptocurrency to the extent that the Tesla company controversially became the first ever publicly listed corporation to become a Bitcoin 'whale' in 2021.

VIEW FULL ANALYSIS VISIT - FXOpen Blog...

Disclaimer: CFDs are complex instruments and come with a high risk of losing your money.

FTSE 100 rockets as oil giant reaps the profits

The FTSE 100 index has been more than a little bit volatile recently, with some degree of downturn having taken place over recent weeks in the light of the continual concern over the state of the economy in the United Kingdom, and the unprecedented instability of the government which has been changing its top cabinet regularly lately.

Over the past day, however, the FTSE 100 index has suddenly rocketed, rising to 7195 points as the energy sector results begin to demonstrate their continued strength.

For the past year and a half, energy products have been under close scrutiny by governments, traders and investors alike as supply chain shortages in 2021 caused by government lockdowns were replaced by geopolitical conflict and sanctions on one of the world's largest oil producing nations.

Demand remained high whilst supply was more scarce, hence the value of the thick black stuff being on the minds of many.

Publicly listed British oil giant BP announced yesterday that it had made $8.2 billion in profits for the third quarter. Yes, the British government is talking about attributing a windfall tax to energy companies, but the numbers are there, standing proud, and therefore a measure of good performance regardless of the tax implications.

Whilst BP shares remained relatively flat, the FTSE 100 index jumped significantly as key components which perform well are often an indicator of overall strength within the top companies in the London listed markets.

Today's performance on the FTSE 100 index constitutes a five week high, and perhaps as can be expected, the raw materials miners included in the FTSE 100 index had all performed well, bolstering BP's stellar profit results.

As an interesting compliment to the mining and oil bonanza, food delivery company Ocado’s shares jumped 20% after it announced a further push into Asia with a tie-up with the retail arm of South Korean conglomerate, Lotte Group, Ocado being a FTSE 100 component.

Looking at BP's giant profits in greater detail, the company's third quarter profit figure of $8.2billion is a massive increase from $3.3bn last year, as high crude and gas prices buoyed its upstream business. The markets may have considered that a potential windfall tax may stall its progress, however any $800 million would do nothing to slow its momentum.

VIEW FULL ANALYSIS VISIT - FXOpen Blog...

Disclaimer: CFDs are complex instruments and come with a high risk of losing your money.

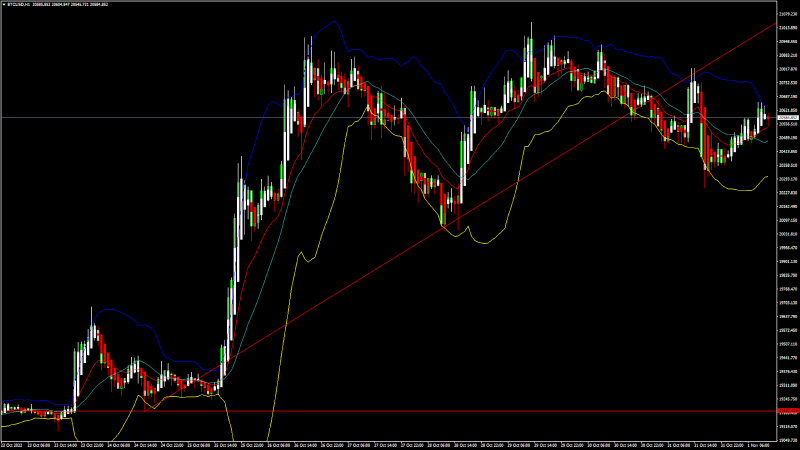

BTCUSD and XRPUSD Technical Analysis – 01st NOV 2022

BTCUSD: Inverted Hammer Pattern Above $19187

Bitcoin was unable to sustain its bearish momentum and after touching a low of 19187 on 24th Oct, the prices started to correct upwards crossing the $20500 handle.

We can see continued appreciation in the price of BTCUSD which is now trading above the 20500 in the European trading session today.

We can see the formation of a bullish harami pattern in the 30-minute time frame.

The resistance of the channel is broken in the 1-hourly time frame indicating the bullish tone of the markets.

We can clearly see an inverted hammer pattern above the $19187 handle which is a bullish reversal pattern because it signifies the end of a downtrend and a shift towards an uptrend.

Bitcoin touched an intraday low of 20379 in the Asian trading session and an intraday high of 20657 in the European trading session today.

Both the STOCH and STOCHRSI are indicating overbought levels which means that in the immediate short term, a decline in the price is expected.

The relative strength index is at 53 indicating a NEUTRAL demand for bitcoin and a shift towards the consolidation phase in the markets.

Bitcoin is now moving above its 100 hourly exponential moving average and above its 200 hourly exponential moving averages.

Most of the major technical indicators are giving a STRONG BUY signal, which means that in the immediate short term, we are expecting targets of 21000 and 21500.

The average true range is indicating LESS market volatility with a mildly bullish momentum.

[*] Bitcoin: bullish reversal seen above $19187.

[*] The Williams percent range is indicating an overbought level.

[*] The price is now trading just below its pivot level of $20607.

[*] Most of the moving averages are giving a STRONG BUY market signal.

Bitcoin: Bullish Reversal Seen Above $19187

We can now see that the price of bitcoin rocketed higher recently towards the monthly high of 20969 on 29th Oct, and we can now witness the formation of an ascending channel in the markets.

Bitcoin’s price is super bullish against the US dollar and bitcoin and now we are aiming towards crossing the $21000 and $22000 levels soon.

The adaptive moving average AMA20 and AMA50 are giving a bullish trend reversal signal.

The price of bitcoin is back over the pivot point in the daily time frame indicating the bullish overtone present in the markets.

We have also seen a bullish opening of the markets this week.

The immediate short-term outlook for bitcoin is strongly bullish, the medium-term outlook has turned bullish, and the long-term outlook remains neutral under present market conditions.

Bitcoin’s support zone is located at $19637 which is a 50% retracement from a 4-week high/low and the price needs to remain above this level for the continuation of the bullish reversal in the markets.

The price of BTCUSD is now facing its classic resistance level of 20628 and Fibonacci resistance level of 20667 after which the path towards 21500 will get cleared.

In the last 24hrs, BTCUSD has increased by 0.25% by 51$ and has a 24hr trading volume of USD 45.266 billion. We can see an increase of 39.05% in the trading volume compared to yesterday, which is due to the heavy buying pressure seen in the global markets.

The Week Ahead

The price of bitcoin is moving in a strongly bullish zone above the $20500 levels. Further upsides are projected at $21500 and $22000 as the immediate targets.

Now we are aiming for $21710 which is a 50% retracement from 13 week high/low.

The daily RSI is printing at 59 which indicates a strong demand for bitcoin and the continuation of the buying pressure in the markets.

The price of BTCUSD will need to remain above the important support level of $20000 this week.

The weekly outlook is projected at $21500 with a consolidation zone of $22000.

Technical Indicators:

The moving averages convergence divergence MACD (12,26): is at 6.20 indicating a BUY.

The commodity channel index CCI (14): is at 138.28 indicating a BUY.

The rate of price change ROC: is at 1.22 indicating a BUY.

Bull/bear power (13): is at 128.67 indicating a BUY.

VIEW FULL ANALYSIS VISIT - FXOpen Blog...

Disclaimer: CFDs are complex instruments and come with a high risk of losing your money.

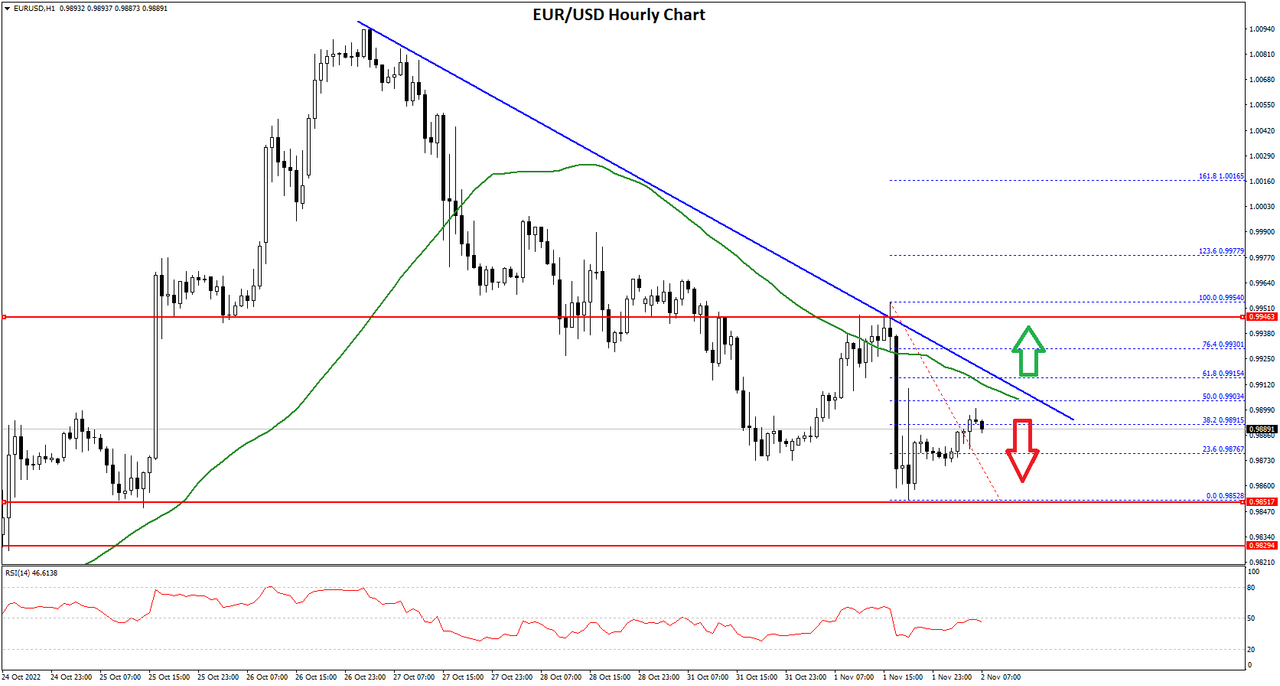

EUR/USD Eyes Upside Break While USD/CHF Consolidates Gains

EUR/USD is struggling to climb above the 0.9920 resistance zone. USD/CHF is consolidating gains above the 0.9950 support zone.

Important Takeaways for EUR/USD and USD/CHF

[*] The Euro started a fresh decline and traded below the 0.9950 zone against the US Dollar.

[*] There is a major bearish trend line forming with resistance near 0.9905 on the hourly chart of EUR/USD.

[*] USD/CHF started a fresh increase after it was able to clear the 0.9920 resistance.

[*] There is a key bullish trend line forming with support near 0.9950 on the hourly chart.

EUR/USD Technical Analysis

This past week, the Euro saw a major decline below the 0.9980 support against the US Dollar. The EUR/USD pair declined below the 0.9920 support level to move into a bearish zone.

The pair even tested the 0.9850 support zone. It is now forming a base above the 0.9850 level and is currently consolidating losses from the 0.9852 low formed on FXOpen. There was a minor recovery wave above the 0.9880 level.

EUR/USD Hourly Chart

The pair climbed above the 23.6% Fib retracement level of the downward move from the 0.9954 swing high to 0.9852 low. An immediate resistance is near the 0.9900 level and the 50 hourly simple moving average.

There is also a major bearish trend line forming with resistance near 0.9905 on the hourly chart of EUR/USD. It is near the 50% Fib retracement level of the downward move from the 0.9954 swing high to 0.9852 low.

The next major resistance is near the 0.9920 level. A clear move above the 0.9920 resistance zone could set the pace for a larger increase towards 1.0000. The next major resistance is near the 1.0050 zone.

On the downside, an immediate support is near the 0.9865 level. The next major support is near the 0.9850 level. A downside break below the 0.9850 support could start another decline.

VIEW FULL ANALYSIS VISIT - FXOpen Blog...

Disclaimer: CFDs are complex instruments and come with a high risk of losing your money.

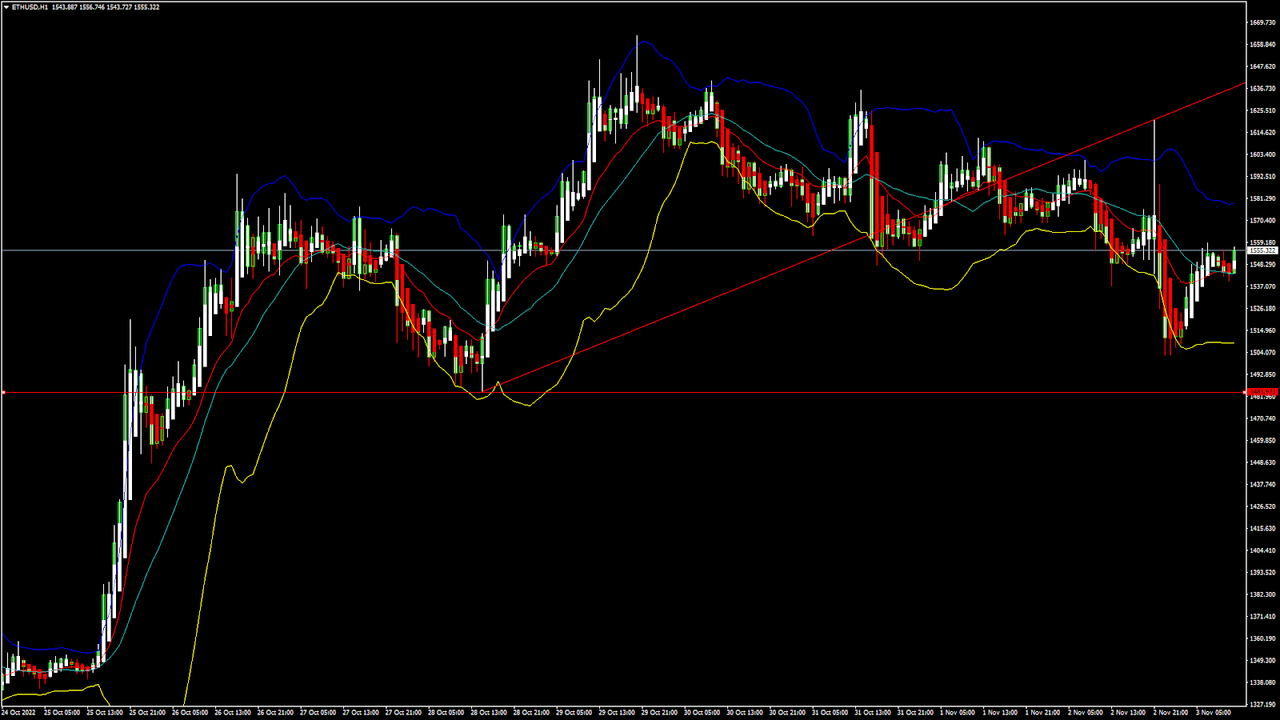

ETHUSD and LTCUSD Technical Analysis – 03rd NOV, 2022

ETHUSD: Bullish Engulfing Pattern Above $1483

Ethereum was unable to sustain its bearish momentum and after touching a low of 1488 on 28th Oct, the prices started to correct upwards against the US dollar. The prices of Ethereum touched a high of 1642 on 29th Oct after which we can see a shift towards the consolidation phase in the markets.

We can see that the MACD indicator is giving a bullish divergence signal in the 4-hour time frame

We can clearly see a bullish engulfing pattern above the $1483 handle which is a bullish pattern and signifies the end of a bearish phase and the start of a bullish phase in the markets.

ETH is now trading just above its pivot level of 1544 and is moving into a mildly bullish channel. The price of ETHUSD is now testing its classic resistance levels of 1548 and Fibonacci resistance level of 1552 after which the path towards 1600 will get cleared.

The relative strength index is at 48 indicating a neutral market and the shift towards a correction and consolidation phase in the markets.

We can see that the commodity channel index is giving a neutral signal which indicates a range bound movement for some time in the markets.

The STOCHRSI is indicating an overbought market, which means that the prices are expected to decline in the short-term range.

Some of the technical indicators are giving a BUY market signal.

Some of the moving averages are giving a BUY signal and we are now looking at the levels of $1650 to $1700 in the short-term range.

ETH is now trading below both its 100 & 200 hourly simple and exponential moving averages.

[*] Ether: bullish reversal seen above the $1483 mark

[*] The short-term range appears to be mildly bullish

[*] ETH continues to remain above the $1500 levels

[*] The average true range is indicating LESS market volatility

Ether: Bullish Reversal Seen Above $1254

ETHUSD is now moving into a mildly bullish channel with the prices trading above the $1500 handle in the European trading session today.

ETH touched an intraday low of 1502 in the Asian trading session and an intraday low of 1558 in the European trading session today.

The RSI indicator is back over 50 indicating a bullish scenario.

We can see a bullish price crossover pattern with moving averages MA20 and MA100.

We can also see the formation of a bullish harami pattern in both the 2-hour and 4-hour time frames.

The MA20 is also indicating a bullish trend reversal signal in the weekly timeframe.

The daily RSI is printing at 60 indicating a strong demand for Ether in the long-term range.

The key support level to watch is $1427 which is a 50% retracement from a 4-week high/low and 1482 which is a 38.2% retracement from 4 week high/low.

ETH has decreased by 0.70% with a price change of 11.14$ in the past 24hrs and has a trading volume of 22.835 billion USD.

We can see an increase of 53.42% in the total trading volume in the last 24 hrs which is due to the continued buying seen at lower levels.

The Week Ahead

ETH price continues to remain in a bullish zone against the US dollar and bitcoin. ETHUSD is expected to move higher towards the $1600 and $1700 levels this week.

We can see the formation of a major bullish trendline in place from $1483 towards $1640 level.

The immediate short-term outlook for Ether has turned mildly bullish, the medium-term outlook has turned neutral, and the long-term outlook for Ether is neutral at present market conditions.

The prices of ETHUSD will need to remain above the important support level of $1513 which is a 38.2% retracement from 13-week low.

Weekly outlook is projected at $1750 with a consolidation zone of $1650.

Technical Indicators:

The STOCH (9,6): is at 77.85 indicating a BUY.

The rate of price change: is at 0.983 indicating a BUY.

The bull/bear power (13): is at 4.55 indicating a BUY.

High/lows(14): is at 9.01 indicating a BUY.

VIEW FULL ANALYSIS VISIT - FXOpen Blog...

Disclaimer: CFDs are complex instruments and come with a high risk of losing your money.