Market Overview by FXCC

Forex Technical & Market Analysis FXCC Dec 16 2013

All eyes on the FOMC meeting later this week, whilst Markit Economics PMIs also take centre stage

Sunday evening witnesses the publication of the Westpac consumer sentiment survey for New Zealand, the previous print came in at 115.4, the anticipation is for a similar result. The Japanese Tankan manufacturing index is published late Sunday evening, predictions are for a figure of 15, up from the previous month's figure of 12. The non-manufacturing Tankan index is also published, expected in at 16 from the previous print of 12. In the UK the Rightmove asking house price index is published, in the previous month asking prices fell by 2.4% therefore an improvement is expected. The Chinese HSBC flash manufacturing index is published late Sunday evening with the expectations that a small rise from 50.5 to 51 will be witnessed. Monday sees the publication of French flash PMI manufacturing and services data courtesy of Markit economics; both indices are expected to rise, manufacturing to 49.1, services to 48.9. Germany's twin PMI Markit gauges are also published; manufacturing predicted in at 53.1 services at 55.2. Finally Europe's are published with manufacturing predicted in at 51.9 with services at 51.5. Europe's trade balance published Monday is expected in at €15.2 bn, meanwhile the Bundesbank's tentative monthly survey is published. In the USA we witness the publication of the Empire State manufacturing survey, last month saw a surprise fall to -2.2%, a restoration of positive data is expected, with the print potentially coming in at 4.9. Flash Markit manufacturing PMI is published for the USA, expected in at 54.9, whilst industrial production is expected to rise by 0.6% from the previous month's figure of -0.1%. The ECB president Mario Draghi speaks mid-afternoon European time on Monday, the expectation is that he'll cover the subjects of: the strength of the euro, countries such as Ireland moving out of various bailout imposed austerity measures, interest rate reductions, European banking union and the potential for quantitative easing - through a bond buying programme.

http://blog.fxcc.com/market-analysis

FOREX ECONOMIC CALENDAR :

2013-12-16 13:58 GMT | USA. Markit Manufacturing PMI (Dec)Preliminar

2013-12-16 14:00 GMT | EU. ECB President Draghi's Speech

2013-12-16 14:00 GMT | USA. Net Long-Term TIC Flows (Oct)

2013-12-16 14:15 GMT | USA. US Industrial Production (MoM) (Nov)

FOREX NEWS :

2013-12-13 22:14 GMT | Session recap: Dollar extends the swing ahead FOMC

2013-12-13 21:58 GMT | AUD/USD, stay bearish?

2013-12-13 21:42 GMT | EUR/CAD a sure sell?

2013-12-13 21:25 GMT | GBP/JPY ending the week on the back foot

EURUSD :

HIGH 1.3761 LOW 1.37287 BID 1.3756 ASK 1.37564 CHANGE 0% TIME 08 : 40:51

OUTLOOK SUMMARY : Up

TREND CONDITION : Downward penetration

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : High

MARKET ANALYSIS - Intraday Analysis

Upwards scenario: Medium term bias tends to slide into the bearish side. Further market rise is limited now to the key resistive barrier at 1.3777 (R1), clearance here is required to enable next resistances at 1.3792 (R2) and last one at 1.3806 (R3). Downwards scenario: Risk of market decline is seen below the next support level at 1.3737 (S1). Loss here might downgrade currency rate towards to the next supportive means at 1.3723 (S2) and 1.3706 (S3) in potential.

Resistance Levels: 1.3777, 1.3792, 1.3806

Support Levels: 1.3737, 1.3723, 1.3706

--------------------

GBPUSD :

HIGH 1.63095 LOW 1.62871 BID 1.63069 ASK 1.63075 CHANGE 0% TIME 08 : 40:51

OUTLOOK SUMMARY : Up

TREND CONDITION : Down trend

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : High

Upwards scenario: Even though instrument trades above the moving averages, it keeps immediate downside potential. Next hurdle is seen at 1.6314 (R1), break above it might extend gains towards to next targets at 1.6333 (R2) and 1.6353 (R3). Downwards scenario: Possible downside extension might face next supportive barrier at 1.6290 (S1). Clearance here is required to open the way towards to our initial support at 1.6268 (S2) and any further price regress would then be limited to final support at 1.6246 (S3).

Resistance Levels: 1.6314, 1.6333, 1.6353

Support Levels: 1.6290, 1.6268, 1.6246

----------------------

USDJPY :

HIGH 103.291 LOW 102.643 BID 102.821 ASK 102.827 CHANGE 0% TIME 08 : 40:51

OUTLOOK SUMMARY : Down

TREND CONDITION : Upward penetration

TRADERS SENTIMENT : Bullish

IMPLIED VOLATILITY : High

Upwards scenario: Further uptrend evolvement is limited now to the local high at 102.92 (R1). Break here is required to enable higher targets at 103.08 (R2) and 103.28 (R3). Downwards scenario: Price regress below the support level at 102.65 (S1) would increase likelihood of failing towards to our key supportive barrier at 102.51 (S2) and any further market decline would then be targeting final support for today at 102.35 (S3).

Resistance Levels: 102.92, 103.08, 103.28

Support Levels: 102.65, 102.51, 102.35

Source: FX Central Clearing Ltd,( http://www.fxcc.com )

Forex Technical & Market Analysis FXCC Dec 18 2013

All eyes on the last FOMC meeting of 2013, expect taper speculation to reach fever pitch

Wednesday sees the publication of the German IFO business climate index, expected in at 109.7. The UK publishes its latest claimant count figures, predicted to be down 35.2 K month on month. The expected percentage unemployment claimant count is expected in at 7.6%. The UK's BoE MPC reveals the votes on interest rate setting and quantitative easing both expected in as unanimous votes. ECONFIN meetings continue through the week, whilst the Swiss ZEW sentiment index is published. In the afternoon session attention turns to the USA data, housing starts data is predicted in at 0.91 million year on year, whilst crude oil inventories might have the capacity to shock again with the previous week's figure coming in -10.6 m barrels. Then attention turns to the FOMC and the expected news regarding the potential taper, the Fed's base rate decision will be announced expected to remain at 0.25%, thereafter the FOMC will deliver an explanatory statement and deliver their economic projections. The DJIA closed down marginally by 0.06% at 15875 on Tuesday, SPX down 0.31%, NASDAQ by 0.14%. European indices suffered a sharp selloff over the two trading sessions on Tuesday; STOXX 50 down 1.24%, CAC down 1.24%, DAX down 0.86%, FTSE down 0.55%. The DJIA equity index future is down 0.08% at the time of writing (10:00pm UK time), the SPX future is down 0.42%, NASDAQ down 0.27%. STOXX future is down 0.97%, DAX future down 0.62%, CAC future down 1.00%, FTSE future down 0.33%. NYMEX WTI oil is down 0.38% on the day at $97.11 per barrel, NYMEX nat gas is up 0.02%, COMEX gold sold off sharply by 1.15% at $1230.10 per ounce, silver on COMEX is down 1.02% at $19.90 per ounce. The dollar slipped 0.3 percent to 102.67 yen mid-afternoon New York time Tuesday, after touching 103.92 yen on Dec. 13th, the strongest level since October 2008. It was little changed at $1.3768 per euro. The 17-nation common currency fell 0.3 percent to 141.36 yen. The dollar traded at almost a five-year high versus the yen as the Federal Reserve begins a two-day meeting that may will result in a reduction of currency-debasing stimulus. The Aussie fell 0.4 percent to NZ$1.0773 after earlier touching the weakest since October 2008. It was 0.5 percent weaker at 88.98 U.S. cents. The Aussie dollar fell to a five-year low versus New Zealand’s currency as the Reserve Bank of Australia said in minutes of its most recent meeting that it maintained the option to cut interest rates. The pound fell for a fifth day versus the dollar on Tuesday after a government report showed U.K. consumer-price inflation unexpectedly slowed in November to the lowest level in four years. Sterling declined 0.2 percent to $1.6267.

http://blog.fxcc.com/market-analysis

FOREX ECONOMIC CALENDAR :

2013-12-18 09:30 GMT | UK. Claimant Count Change (Oct)

2013-12-18 09:30 GMT | UK. ILO Unemployment Rate (3M) (Oct)

2013-12-18 19:00 GMT | US. Fed Interest Rate Decision

2013-12-18 19:30 GMT | US. Fed's Monetary Policy Statement and press conference

FOREX NEWS :

2013-12-18 04:25 GMT | USD/JPY hits 103.00 on high-volume Nikkei 225 rally

2013-12-18 02:31 GMT | GBP/USD on the rise ahead of the Fed; 1.6317 is ST “correction resistance”

2013-12-18 01:40 GMT | AUD/USD: Rally finds resistance at 0.8930

2013-12-18 01:06 GMT | EUR/JPY surges from weekly lows

------------------

EURUSD :

HIGH 1.37748 LOW 1.37627 BID 1.37709 ASK 1.37714 CHANGE 0% TIME 08 : 36:08

OUTLOOK SUMMARY : Up

TREND CONDITION : Sideway

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : High

MARKET ANALYSIS - Intraday Analysis

Upwards scenario: Market having failed to establish directional movement yesterday. Possible price strengthening might arise above the next resistance level at 1.3792 (R1). Our interim target holds at 1.3814 (R2) en route toward to our major aim at 1.3832 (R3). Downwards scenario: On the other hand, price pattern suggests bearish potential if the instrument manages to overcome next support level at 1.3746 (S1). Possible price regress could expose our initial targets at 1.3729 (S2) and 1.3709 (S3) in potential.

Resistance Levels: 1.3792, 1.3814, 1.3832

Support Levels: 1.3746, 1.3729, 1.3709

----------------

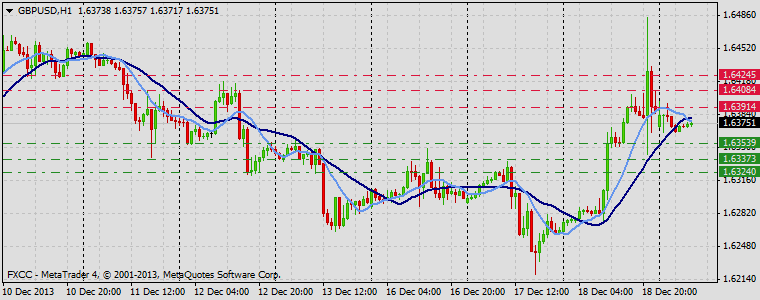

GBPUSD :

HIGH 1.62888 LOW 1.6262 BID 1.62839 ASK 1.62846 CHANGE 0% TIME 08 : 36:08

OUTLOOK SUMMARY : Down

TREND CONDITION : Down trend

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : High

Upwards scenario: Medium-term negative bias pressure the price lower however instrument might find buyers above the resistance level at 1.6309 (R1). Break here might open route towards to our initial targets at 1.6333 (R2) and 1.6353 (R3). Downwards scenario: Risk of market weakening is seen below the support level at 1.6260 (S1). Loss here is required to allow further declines and expose our supportive barrier at 1.6244 (S2) en route towards to final target for today at 1.6228 (S3).

Resistance Levels: 1.6309, 1.6333, 1.6353

Support Levels: 1.6260, 1.6244, 1.6228

------------------

USDJPY :

HIGH 103.034 LOW 102.564 BID 102.954 ASK 102.958 CHANGE 0.01% TIME 08 : 36:08

OUTLOOK SUMMARY : Up

TREND CONDITION : Downward penetration

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : High

Upwards scenario: A violation of next resistance at 103.11 (R1) might call for a run towards to next target at 103.28 (R2) and any further appreciation would then be limited to final target at 103.42 (R3). Downwards scenario: Neutral market structure might lose its power if the price manages to overcome next support level at 102.64 (S1). Any penetration below this level might determine medium-term negative bias and expose our intraday targets at 102.46 (S2) and 102.24 (S3).

Resistance Levels: 103.11, 103.28, 103.42

Support Levels: 102.64, 102.46, 102.24

Source: FX Central Clearing Ltd,( http://www.fxcc.com )

Forex Technical & Market Analysis FXCC Dec 19 2013

After the USA FOMC taper tantrum focus now shifts back to key fundamentals such as the USA claimant count

Thursday we receive data on Europe's balance of payments which is predicted to print at €14.2 billion positive. Retail sales in the UK are predicted to come in at 0.3% up on the month. USA unemployment claims are predicted in at 336K, down from 368K, existing home sales are predicted in at 5.04 million annual rate, a slight seasonal fall from the previous month. The Philly Fed manufacturing index is predicted to come in at 10.3, significantly up from 6.5 the previous month. Natural gas storage data is printed for the USA. Last week was down -81bn. Late evening Japan publishes its monetary policy statement and the Bank of Japan holds a press conference. The U.S. Dollar Index, which monitors the greenback versus its 10 major counterparts, gained 0.5 percent to 1.021.53 late in New York Wednesday. The greenback added 1.4 percent to 104.12 yen, the highest level since Oct. 6, 2008. The U.S. currency advanced 0.6 percent to $1.3685 versus Europe’s 17-nation euro. The dollar rose to a five-year high versus the yen after the Federal Reserve officials voted to reduce monthly asset purchases that are seen as debasing the U.S. currency amidst signs that economic growth is strengthening. The DJIA closed up 1.84% on Wednesday, a new record high at 16167, the SPX closed up 1.66% and the NASDAQ up 1.15%. In Europe STOXX closed up 1.13%, CAC up 1.00%, DAX up 1.06% and the FTSE up 0.09%. Looking towards Thursday the equity index future for the DJIA is up 1.89%, SPX up 1.79%, NASDAQ future up 1.38%. Euro STOXX equity index future is up 0.88%, DAX up 0.88%, CAC up 0.97%, FTSE up 0.02%. NYMEX WTI oil closed the day up 0.60% at $97.80 per barrel, NASDAQ nat gas down 0.30% at $4.27 per therm, COMEX gold up 0.40% at $1235.00 per ounce with silver on COMEX down 0.66% at $19.71 per ounce.

http://blog.fxcc.com/market-analysis

FOREX ECONOMIC CALENDAR :

2013-12-19 09:30 GMT | UK. Retail Sales (YoY) (Nov)

2013-12-19 13:30 GMT | US. Initial Jobless Claims (Dec 13)

2013-12-19 14:00 GMT | Switzerland. SNB Quarterly Bulletin (Q3)

2013-12-19 15:00 GMT | US. Existing Home Sales Change (MoM) (Nov)

FOREX NEWS :

2013-12-19 05:34 GMT | GBP/AUD remains at multi-year highs just above 1.8500; next long-term target is 1.9670

2013-12-19 05:17 GMT | EUR/USD extends bearish bias, 1.3615 support eyed

2013-12-19 04:47 GMT | EUR/JPY pulling back early Thursday after big up day Wednesday; next upside target 145.76

2013-12-19 03:11 GMT | GBP/USD may have completed 5th wave higher Wednesday at 1.6483; 1st pullback target 1.6089

EURUSD :

HIGH 1.36939 LOW 1.36493 BID 1.36744 ASK 1.36747 CHANGE 0.01% TIME 08 : 37:24

OUTLOOK SUMMARY : Down

TREND CONDITION : Downward penetration

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : High

MARKET ANALYSIS - Intraday Analysis

Upwards scenario: EUR extended its decline versus the USD and determined negative short-term technical outlook. However above the resistance at 1.3697 (R1) opens a route towards to next resistive measures at 1.3715 (R2) and 1.3731 (R3). Downwards scenario: Next support level is seen at 1.3656 (S1), any penetration below it might activate downside pressure and enable lower target at 1.3634 (S2). Any further market decline would then be limited to 1.3615 (S3).

Resistance Levels: 1.3697, 1.3715, 1.3731

Support Levels: 1.3656, 1.3634, 1.3615

-----------------

GBPUSD :

HIGH 1.63972 LOW 1.63656 BID 1.63763 ASK 1.63768 CHANGE 0% TIME 08 : 37:24

OUTLOOK SUMMARY : Down

TREND CONDITION : Upward penetration

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : High

Upwards scenario: The possibility of an upside price progress is seen above the resistance level at 1.6391 (R1). Evaluation above this mark might initiate bullish pressure and expose medium-term interim targets at 1.6408 (R2) and 1.6424 (R3). Downwards scenario: On the short-term perspective the pair might encounter supportive measures at 1.6353 (S1). Loss here might change intraday technical structure and opens the way for a test of 1.6337 (S2) and 1.6324 (S3) later on today.

Resistance Levels: 1.6391, 1.6408, 1.6424

Support Levels: 1.6353, 1.6337, 1.6324

------------------

USDJPY :

HIGH 104.363 LOW 103.782 BID 104.006 ASK 104.009 CHANGE 0.01% TIME 08 : 37:24

OUTLOOK SUMMARY : Up

TREND CONDITION : Up trend

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : Medium

Upwards scenario: Upside risk aversion is seen above the next resistance level at 104.36 (R1). Appreciation above it might lead to the positive intraday bias formation towards to our next targets at 104.60 (R2) and 104.83 (R3). Downwards scenario: On a slightly longer term we expect pullback formation. Risk of market depreciation is seen below the next support level at 103.83 (S1). Clearance here would suggest lower targets at 103.54 (S2) and 103.24 (S3) in potential.

Resistance Levels: 104.36, 104.60, 104.83

Support Levels: 103.83, 103.54, 103.24

Source: FX Central Clearing Ltd,( ECN Forex Broker | ECN Forex Trading Platform | Foreign Currency Exchange | Best Currency Online Trading | FXCC )

Forex Technical & Market Analysis FXCC Dec 20 2013

USA final GDP data for 2013 published expectation at 3.6% annually, as UK current account data is expected to worsen

Friday sees the publication of German PPI for the month, predicted to come in flat with the German GfK business climate expected in at 7.4. The UK's current account data is expected to worsen at -13.8 bn, with public sector borrowing predicted to remain steady at £6.6 bn and final GDP expected in at 0.8%. Core data for Canada includes CPI predicted to come in at 0.1% with retail sales expected to be flat and CPI expected in up 0.2%. The USA final GDP data is predicted to show growth of 3.6% annually. Europe's consumer confidence is predicted to come on at -15 whilst the last high impact news event of the week sees the nomination vote for Fed chairman. The DJIA closed up marginally by 0.07% on Thursday, the SPX closed down 0.06% and NASDAQ down 0.29%. European markets played catch up with the bullish momentum move post the Fed's taper decision on Wednesday; STOXX closed up 1.88%, CAC up 1.64%, DAX up 1.68%, FTSE up 1.43%. Looking towards Friday's open; the DJIA equity index future is up 0.02%, SPX future down 0.17%, NASDAQ future down 0.45%. Euro STOXX equity index future is up 1.78%, DAX future up 1.56%, CAC future up 1.66%, FTSE up 1.52%. NYMEX WTI oil rose 0.99% to $98.77 per barrel on Thursday, NYMEX nat gas rose a significant 4.52% to $4.44 per therm due to storage capacity concerns. COMEX gold experienced a significant sell off, down 3.69% on the day to $1189.40 per ounce. COMEX silver closed down on the day 4.11% at $19.24 per ounce. The dollar rose 0.2 percent to $1.3655 per euro mid-afternoon Thursday New York time after advancing to $1.3650, the strongest level since Dec. 6th. The U.S. currency dropped 0.1 percent to 104.21 yen. The yen gained 0.3 percent to 142.29 per euro after sliding to 142.90 yesterday, the weakest level since October 2008. The dollar climbed to the strongest level in almost two weeks against the euro as investors assess Federal Reserve plans to wind down bond-buying next year amid signs that economic growth is gaining momentum. The U.S. currency advanced versus most of its 16 major counterparts after the Federal Open Market Committee said yesterday it would slow monetary stimulus to $75 billion a month from $85 billion.

http://blog.fxcc.com/market-analysis

FOREX ECONOMIC CALENDAR :

2013-12-20 09:30 GMT | UK. Gross Domestic Product (YoY) (Q3)

2013-12-20 13:30 GMT | Canada. Bank of Canada Consumer Price Index Core (YoY) (Nov)

2013-12-20 13:30 GMT | US. Gross Domestic Product Annualized (Q3)

2013-12-20 n/a | US. Fed Chairman Nomination Vote

FOREX NEWS :

2013-12-20 06:16 GMT | EUR/USD extends decline to 2 week low

2013-12-20 05:45 GMT | EUR/GBP continues to slide Friday ahead of data; 0.8299 is next support

2013-12-20 04:11 GMT | USD/JPY holds at 5-year highs after BoJ

2013-12-20 03:46 GMT | AUD/NZD back on the downside after Thursday bounce; downtrend intact with target of 1.0560

EURUSD :

HIGH 1.3667 LOW 1.36253 BID 1.36362 ASK 1.36365 CHANGE 0% TIME 08 : 43:59

OUTLOOK SUMMARY : Down

TREND CONDITION : Downward penetration

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : Medium

MARKET ANALYSIS - Intraday Analysis

Upwards scenario: EUR/USD maintained a negative near-term tone though recovery action is possible above the next visible resistance at 1.3663 (R1). Clearance here might initiate bullish pressure and validate our next targets at 1.3678 (R2) and 1.3691 (R3). Downwards scenario: Yesterday session low offers key supportive barrier at 1.3631 (S1). Break here might provide sufficient momentum on the downside and expose our intraday targets at 1.3615 (S2) and 1.3600 (S3).

Resistance Levels: 1.3663, 1.3678, 1.3691

Support Levels: 1.3631, 1.3615, 1.3600

----------------

GBPUSD :

HIGH 1.63722 LOW 1.63502 BID 1.63527 ASK 1.63529 CHANGE 0.01% TIME 08 : 43:59

OUTLOOK SUMMARY : Down

TREND CONDITION : Sideway

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : High

Upwards scenario: Possible upwards formation is limited now to resistive measure at 1.6391 (R1). A break above it would suggest next intraday target at 1.6408 (R2) and if the price holds its momentum we can expect price increase towards to final resistance at 1.6424 (R3). Downwards scenario: Next support level is seen at 1.6351 (S1), any penetration below it might activate downside pressure and enable lower target at 1.6337 (S2). Any further market decline would then be limited to 1.6324 (S3).

Resistance Levels: 1.6391, 1.6408, 1.6424

Support Levels: 1.6351, 1.6337, 1.6324

------------------

USDJPY :

HIGH 104.591 LOW 104.213 BID 104.44 ASK 104.442 CHANGE 0% TIME 08 : 43:59

OUTLOOK SUMMARY : Up

TREND CONDITION : Up trend

TRADERS SENTIMENT : Bullish

IMPLIED VOLATILITY : Medium

Upwards scenario: Market sentiment has improved for the bullish oriented traders. Fresh high formed today offers key resistance level at 104.60 (R1). In case of price appreciation above it our focus would be shifted to the higher targets at 104.83 (R2) and 105.05 (R3). Downwards scenario: Medium-term bias is clearly positive however possible progress below the initial support level at 104.09 (S1) might expose our intraday targets at 103.83 (S2) and then 103.54 (S3) in perspective.

Resistance Levels: 104.60, 104.83, 105.05

Support Levels: 104.09, 103.83, 103.54

Source: FX Central Clearing Ltd,( http://www.fxcc.com )