Market Overview by FXCC

Forex Technical & Market Analysis FXCC Nov 07 2013

Interest rate settings in Europe and USA GDP take centre stage on Thursday

It's a day of rate setting decisions in Europe on Thursday; the UK's BoE MPC is predicted to leave base rates at 0.5% and the quantitative easing levels at $375 bn. The ECB is also predicted to leave base rates at their current level at 0.50% the accompanying press statement may indicated when (and if) the ECB may alter that plan. In the USA the GDP figures are released, expected to come in at 2.0%, whilst unemployment claims for the week are expected to stay in the stubborn range at circa 336K. Later in the afternoon the ECB president Mario Draghi will hold court at a press gathering explaining the current economic situation in Europe and the decisions made earlier regarding the rate setting. Later in the evening the trade balance for China is expected to print at 23.5 billion up from 15.2 billion the previous month, whilst Australia's RBA delivers its monetary policy statement. Looking towards Thursday's market open the DJIA equity index future is currently up 0.86%, the SPX up 0.52%. The FTSE equity index future is up 0.16%, CAC up 0.82% and the DAX up 0.37% all indices suggesting a positive open across the majority of bourses. The euro strengthened 0.3 percent to $1.3513 late in New York on Wednesday after declining to $1.3442 on Nov. 4th, the weakest level since Sept. 18th. The common currency rose 0.4 percent to 133.31 yen. The dollar strengthened 0.2 percent to 98.66 yen.

http://blog.fxcc.com/market-analysis

FOREX ECONOMIC CALENDAR :

2013-11-07 12:00 GMT | BoE Interest Rate Decision

2013-11-07 12:45 GMT | ECB Interest Rate Decision (Nov 7)

2013-11-07 13:30 GMT | EMU ECB Monetary policy statement and press conference

2013-11-07 13:30 GMT | USA Gross Domestic Product Annualized (Q3)

FOREX NEWS :

2013-11-07 05:57 GMT | EUR/GBP off of session lows as traders position themselves ahead of BOE and ECB

2013-11-07 05:14 GMT | Is fading Euro strength the best play of the week?

2013-11-07 04:34 GMT | GBP/JPY capped by 159.00

2013-11-07 03:49 GMT | GBP/USD trading off session lows ahead of Bank of England decision and commentary

------------------

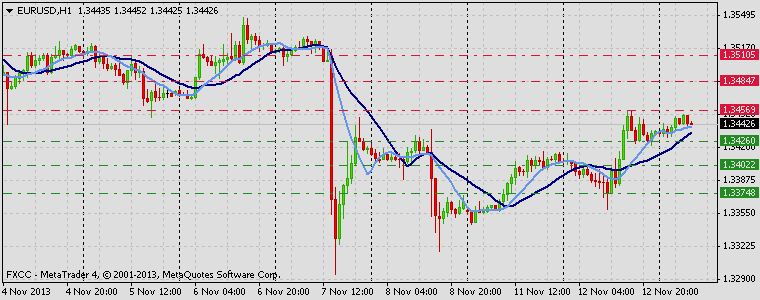

EURUSD :

HIGH 1.35288 LOW 1.35006 BID 1.35247 ASK 1.35249 CHANGE 0.08% TIME 08 : 52:53

OUTLOOK SUMMARY : Up

TREND CONDITION : Upward penetration

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : High

MARKET ANALYSIS - Intraday Analysis

Upwards scenario: Possibility of market strengthening is seen above the resistance level at 1.3548 (R1). Clearance here is required to validate next interim target at 1.3572 (R2) and any further rise would then be targeting mark at 1.3596 (R3). Downwards scenario: An important technical level at 1.3500 (S1) prevents possible market weakening. Break here is required to open road towards to interim target at 1.3476 (S2) en route to final aim at 1.3451 (S3).

Resistance Levels: 1.3548, 1.3572, 1.3596

Support Levels: 1.3500, 1.3476, 1.3451

------------------------

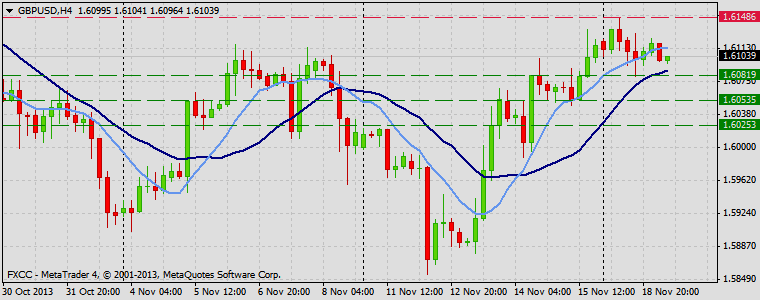

GBPUSD :

HIGH 1.60914 LOW 1.60655 BID 1.60835 ASK 1.60844 CHANGE 0.03% TIME 08 : 52:53

OUTLOOK SUMMARY : Up

TREND CONDITION : Upward penetration

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : High

Upwards scenario: Further buying interest might arise above the resistance at 1.6117 (R1). Clearance here would suggest next intraday target at 1.6138 (R2) and if the price holds its momentum we can expect an exposure of 1.6158 (R3). Downwards scenario: Our next supportive measure locates at 1.6065 (S1). Break here is required to enable correction action towards to next target at 1.6043 (S2). Final support for today locates at 1.6023 (S3).

Resistance Levels: 1.6117, 1.6138, 1.6158

Support Levels: 1.6065, 1.6043, 1.6023

---------------------

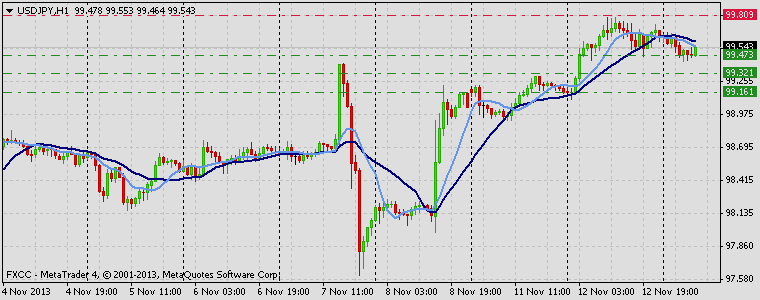

USDJPY :

HIGH 98.748 LOW 98.556 BID 98.635 ASK 98.639 CHANGE -0.02% TIME 08 : 52:54

OUTLOOK SUMMARY : Up

TREND CONDITION : Upward penetration

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : High

Upwards scenario: Possibility of upwards action is seen above the next resistance level at 98.76 (R1). Clearance here is required to let the price achieve our higher intraday targets at 1.3703 (R2) and 1.3724 (R3). Downwards scenario: On the other hand, current range pattern on the hourly chart suggest possible retest of our supportive measure at 98.52 (S1). Break here is required to open way towards to initial targets at 98.38 (S2) and 98.24 (S3).

Resistance Levels: 98.76, 98.92, 99.07

Support Levels: 98.52, 98.38, 98.24

Source: FX Central Clearing Ltd,( http://www.fxcc.com )

Forex Technical & Market Analysis FXCC Nov 08 2013

The markets expect a very poor NFP print of circa 121K.

European news events in the morning session mainly concern the UK's balance of payments, expected in at -9.1billion and Germany's trade balance is expected in at +17.2 billion. North American employment figures for Canada and the USA are published in the afternoon trading session. Canada's unemployment rate is expected to rise to 7.0%, whilst the NFP jobs report for the USA is predicted to show that only 121K jobs were created in October. The unemployment rate in the USA may climb to 7.3%. The preliminary University of Michigan sentiment report is published expected to show a figure of 74.6. China delivers a raft of information late on Friday evening, the high impact news items will centre on the inflation levels, CPI expected in at 3.3%, new loans at circa 800 bn, and industrial production expected in at 10.1% up year on year. NYMEX WTI oil closed down on the day by 0.63% at $94.20 per barrel, NYMEX natural gas closed up on the day 0.60%, COMEX gold closed down 0.71% at $1308.50 per ounce, COMEX silver down 0.50% at $21.66 per ounce. Equity index futures are pointing to the main European and USA markets opening in negative territory. The DJIA is down 0.64%, the SPX down 1.16%, the NASDAQ down 1.67%. STOXX future is down 0.33%, DAX future up 0.51%, CAC future down 0.14%, and the UK FTSE future is down 0.73%.

http://blog.fxcc.com/market-analysis

FOREX ECONOMIC CALENDAR :

2013-11-08 07:00 GMT | DE Trade Balance s.a. (Sep)

2013-11-08 09:30 GMT | UK Total Trade Balance (Sep)

2013-11-08 13:30 GMT | US Nonfarm Payrolls (Oct)

2013-11-08 13:30 GMT | CA Unemployment Rate (Oct)

FOREX NEWS :

2013-11-08 06:13 GMT | S&P downgrades France to AA from AA+, outlook stable

2013-11-08 05:49 GMT | AUD/USD peels back to opening levels

2013-11-08 05:00 GMT | USD/CHF well above the 0.9150 area

2013-11-08 04:56 GMT | US Non-Farm Payrolls will likely continue the volatility party that started Thursday

----------------------

EURUSD :

HIGH 1.34241 LOW 1.33885 BID 1.33984 ASK 1.33987 CHANGE -0.15% TIME 08 : 40:29

OUTLOOK SUMMARY : Down

TREND CONDITION : Downward penetration

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : High

MARKET ANALYSIS - Intraday Analysis

Upwards scenario: Appreciation above the resistance at 1.3453 (R1) might commence new step of the ascending structure. Our intraday targets today are placed at 1.3502 (R2) and 1.3551 (R3). Downwards scenario: Risk of possible price depreciation is seen below the support at 1.3296 (S1). Loss here might enable bearish pressure and drive market price towards to next targets at 1.3248 (S2) and 1.3199 (S3) later on today.

Resistance Levels: 1.3453, 1.3502, 1.3551

Support Levels: 1.3296, 1.3248, 1.3199

-----------------

GBPUSD :

HIGH 1.6102 LOW 1.60784 BID 1.60945 ASK 1.60947 CHANGE 0.01% TIME 08 : 40:29

OUTLOOK SUMMARY : Up

TREND CONDITION : Upward penetration

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : High

Upwards scenario: We see potential of market strengthening in near-term perspective. Next on tap is seen resistance level at 1.6117 (R1). Break here would suggest next intraday targets at 1.6138 (R2) and 1.6158 (R3). Downwards scenario: Break of support at 1.6065 (S1) is required to determine negative intraday bias and enable lower target at 1.6043 (S2). Clearance of this target would open a path towards to final support at 1.6023 (S3).

Resistance Levels: 1.6117, 1.6138, 1.6158

Support Levels: 1.6065, 1.6043, 1.6023

-----------------

USDJPY :

HIGH 98.255 LOW 98.039 BID 98.107 ASK 98.109 CHANGE 0.03% TIME 08 : 40:30

OUTLOOK SUMMARY : Down

TREND CONDITION : Downward penetration

TRADERS SENTIMENT : Bullish

IMPLIED VOLATILITY : High

Upwards scenario: On the upside resistive structure at 98.27 (R1) prevents possible gains. Clearance here is required to open route towards to next target at 98.41 (R2) and then final target could be triggered at 98.55 (R3). Downwards scenario: Current price pattern suggests bearish potential if the pair manages to overcome next support level at 97.89 (S1). Possible price regress could expose our initial targets at 97.75 (S2) and 97.62 (S3) later on today.

Resistance Levels: 98.27, 98.41, 98.55

Support Levels: 97.89, 97.75, 97.62

Source: FX Central Clearing Ltd,( http://www.fxcc.com )

Forex Technical & Market Analysis FXCC Nov 11 2013

China's Plenum meeting could have a profound impact for global markets

Monday sees several bank holidays that will affect the volume of trading activity during the various trading sessions. France, Canada and the USA have bank holidays. The German Bundesbank president Weidmann will hold court with a conference on Monday. Whilst the German central bank is subservient and defers to the ECB, on matters such as quantitative easing and rate setting, investors and analysts will look for 'code' in Weidmann's speech concerning the direction the singular German economy will be headed for and directed towards over coming months. Towards the end of the trading day we'll receive the consumer confidence publication from Australia's National Bank. The previous month's reading came in at 12, a print close to this figure is expected. Sterling posted its first weekly advance in three versus the dollar as reports showed British services growth unexpectedly accelerated in October to the fastest pace in 16 years. U.K. government bonds declined for a second week as the Bank of England kept its key interest rate at a record low, whilst maintaining its bond-buying stimulus target. The pound climbed versus the euro for a second week, rising the most since April, after the European Central Bank unexpectedly lowered its benchmark interest rate, boosting demand for the U.K. currency. Benchmark 10-year yields reached the highest level in seven weeks last week after payrolls grew by 204,000 in October versus the 120,000 median forecast. U.S. debt rallied after the European Central Bank cut its benchmark interest rate to a record to address prolonged price weakness. The USA Treasury will auction $70 billion of notes and bonds this week. Treasuries fell the most in two months as reports showed the economy expanded in the third quarter beyond projections, boosting speculation the Federal Reserve is moving closer to 'tapering' its $85 billion of monthly bond-buying.

http://blog.fxcc.com/market-analysis

FOREX ECONOMIC CALENDAR :

2013-11-11 09:00 GMT | IT Industrial Output s.a. (MoM) (Sep)

2013-11-11 17:00 GMT | DE German Buba President Weidmann speech

2013-11-11 23:30 GMT | AU Westpac Consumer Confidence Index (Nov)

2013-11-11 23:50 GMT | JP Tertiary Industry Index (MoM) (Sep)

FOREX NEWS :

2013-11-11 04:55 GMT | EUR/JPY loses momentum in late Asian trading session

2013-11-11 04:55 GMT | GBP/USD, another 1.5900 retest on deck - 2ndSkies

2013-11-11 04:36 GMT | EUR/USD should see sell on strength circa 1.3375 - JPMorgan

2013-11-11 04:19 GMT | AUD/USD sideways after solid Australian home data

----------------------

EURUSD :

HIGH 1.33671 LOW 1.33448 BID 1.33657 ASK 1.33659 CHANGE -0.01% TIME 08 : 29:13

OUTLOOK SUMMARY : Down

TREND CONDITION : Sideway

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : Low

MARKET ANALYSIS - Intraday Analysis

Upwards scenario: While price is quoted below the moving averages our medium-term technical outlook would be negative. Though, appreciation above the resistance at 1.3438 (R1) might enable upwards penetration towards to next targets at 1.3492 (R2) and 1.3543 (R3). Downwards scenario: On the downside bearish pressure might push the price below the support at 1.3317 (S1). Further downside extension would open road towards to next target at 1.3262 (S2) and any further losses would then be limited to 1.3209 (S3) mark.

Resistance Levels: 1.3438, 1.3492, 1.3543

Support Levels: 1.3317, 1.3262, 1.3209

--------------------------

GBPUSD :

HIGH 1.60216 LOW 1.59978 BID 1.60182 ASK 1.60187 CHANGE 0.01% TIME 08 : 29:13

OUTLOOK SUMMARY : Down

TREND CONDITION : Downward penetration

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : Low

Upwards scenario: GBPUSD commenced consolidation pattern, however, price strengthening above the next resistive structure at 1.6058 (R1) might activate short-term bullish pressure and expose our intraday targets at 1.6085 (R2) and 1.6112 (R3). Downwards scenario: As long as price stays below the 20 SMA our technical outlook would be negative. Extension lower the next support level at 1.5993 (S1) is being able to drive market price towards to our next targets at 1.5968 (S2) and 1.5942 (S3).

Resistance Levels: 1.6058, 1.6085, 1.6112

Support Levels: 1.5993, 1.5968, 1.5942

------------------

USDJPY :

HIGH 99.225 LOW 98.94 BID 98.953 ASK 98.955 CHANGE -0.09% TIME 08 : 29:14

OUTLOOK SUMMARY : Up

TREND CONDITION : Upward penetration

TRADERS SENTIMENT : Bullish

IMPLIED VOLATILITY : Low

Upwards scenario: After the strong appreciation on Friday we expect to see some consolidation ahead. Though clearance of next resistance level at 99.23 (R1) might enable bullish pressure and open route towards to our next targets at 99.41 (R2) and 99.60 (R3). Downwards scenario: On the other hand, recovery phase might commence below the important support level at 98.85 (S1). Break here is required to validate our targets at 98.65 (S2) and 98.47 (S3) later on today.

Resistance Levels: 99.23, 99.41, 99.60

Support Levels: 98.85, 98.65, 98.47

Source: FX Central Clearing Ltd,( http://www.fxcc.com )

Forex Technical & Market Analysis FXCC Nov 12 2013

USA small business optimism loses ground in October.

In the overnight early morning trading session we'll receive the publication of the Australian NAB business confidence report. Japan will release its consumer confidence index, predicted to come in at 46.3. UK inflation figures are published in the London session, expected to come in at 2.5% for CPI and 3% for RPI. The USA small business index is published in the afternoon session expected in at 93.5, as is the RBNZ financial stability report for New Zealand. It provides insights into the bank's view of inflation, growth, and other economic conditions that will affect interest rates in the future. The RBNZ governor Wheeler will then hold court shortly after the financial stability report to discuss the current state of the nation's finances. The NFIB Index of Small Business Optimism in the USA has lost 2.3 points to 91.6. Two components, the outlook for business conditions and the outlook for real sales gains, accounted for 52 percent of the Index decline. A weaker outlook for business produced dissatisfaction with inventory stocks, and fewer plans to create new jobs. The average value of the Index since the recovery started is 91. Looking towards tomorrow's open the DJIA equity index future is up 0.18%, SPX up 0.09% and the NASDAQ future is currently at the time of writing down 0.15%. The DAX future is up 0.48%, STOXX up 0.69% and CAC up 0.81% with UK FTSE up 0.43%. The DJIA closed up 0.14%, the SPX up 0.07% and the NASDAQ up 0.01%. Looking at Europe's bourses the STOXX index closed up 0.59%, CAC up 0.70%, DAX up 0.33%, and the UK FTSE up 0.30%.

http://blog.fxcc.com/market-analysis

FOREX ECONOMIC CALENDAR :

2013-11-12 09:30 GMT | UK Core Consumer Price Index (YoY) (Oct)

2013-11-12 13:30 GMT | US Chicago Fed National Activity Index (Sep)

2013-11-12 20:00 GMT | RBNZ Financial Stability Report

2013-11-12 23:50 GMT | JP Machinery Orders (YoY) (Sep)

FOREX NEWS :

2013-11-12 07:16 GMT | EUR/USD dips to lows on German data

2013-11-12 06:56 GMT | GBP/USD deflates to session lows

2013-11-12 05:28 GMT | EUR/GBP on the soggy side

2013-11-12 05:07 GMT | GBP/AUD soars on solid UK home data, struggling Aussie

----------------------

EURUSD

HIGH 1.34137 LOW 1.33798 BID 1.33938 ASK 1.33941 CHANGE -0.09% TIME 09 : 51:38

OUTLOOK SUMMARY : Neutral

TREND CONDITION : Sideway

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : Medium

MARKET ANALYSIS - Intraday Analysis

Upwards scenario: Possibility of further price progress is seen above the next resistance level at 1.3438 (R1). Breakthrough here would suggest interim target at 1.3485 (R2) and then mark at 1.3532 (R3) acts as next attractive point. Downwards scenario: Risk of market weakening is seen below the support level at 1.3368 (S1). Loss here is required to enable our supportive barrier at 1.3317 (S2) en route towards to final target for today at 1.3270 (S3).

Resistance Levels: 1.3438, 1.3485, 1.3532

Support Levels: 1.3368, 1.3317, 1.3270

--------------------------

GBPUSD :

HIGH 1.59922 LOW 1.59513 BID 1.59573 ASK 1.59577 CHANGE -0.2% TIME 09 : 51:38

OUTLOOK SUMMARY : Down

TREND CONDITION : Downward penetration

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : Medium

Upwards scenario: Measures of resistance might be activating if the pair approaches 1.5978 (R1) price level. Break here would suggest next interim target at 1.6005 (R2) and If the price keeps its momentum we expect an exposure of 1.6031 (R3). Downwards scenario: On the other hand, progress below the initial support level at 1.5932 (S1) might initiate bearish pressure and expose our intraday targets at 1.5907 (S2) and 1.5880 (S3) later on today.

Resistance Levels: 1.5978, 1.6005, 1.6031

Support Levels: 1.5932, 1.5907, 1.5880

----------------------

USDJPY :

HIGH 99.731 LOW 99.104 BID 99.688 ASK 99.692 CHANGE 0.53% TIME 09 : 51:39

OUTLOOK SUMMARY : Up

TREND CONDITION : Up trend

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : Medium

Upwards scenario: Further price appreciation needs to clear the barrier at 99.86 (R1) to enable our interim target at 100.06 (R2) and then any further gains would be limited to last resistance at 100.25 (R3). Downwards scenario: On the downside, USDJPY might encounter supportive measures at 99.30 (S1). Break here would open the way for a test of our next targets at 99.10 (S2) and 98.89 (S3) later on today.

Resistance Levels: 99.86, 100.06, 100.25

Support Levels: 99.30, 99.10, 98.89

Source: FX Central Clearing Ltd,( http://www.fxcc.com )

Forex Technical & Market Analysis FXCC Nov 13 2013

Japan's preliminary GDP figures are expected in up 0.4% as Ben Bernanke gives a speech

European markets take centre stage on Wednesday, the UK's claimant count data is published, with the rate of unemployment scheduled to fall to 7.6% of the workforce. Industrial production for Europe is scheduled to fall by 0.2%. Later the BoE governor Carney delivers the bank's quarterly inflation report. Later on the German Bundesbank president Weidmann speaks and despite the German central bank not being in control of its money supply, or interest rate setting, the bank is still amongst the most respected banking institutions globally. The USA federal budget balance is scheduled to deliver what many may consider a rogue outlier number, predictions suggest a figure of -$103 billion will be published when last months' figure was a positive $73 billion. Later on in the late evening trading session we receive New Zealand's retail sales figures expected in at 0.9%. Thereafter Japan's preliminary GDP figure is expected to print at 0.4%. The Fed chairman Ben Bernanke gives a speech, whilst China reveals its percentage rise in foreign firms' investments and finally Japan delivers it's revised industrial prod ruins figures expected in at 1.5% up month on month. Looking towards the opening sessions on Wednesday the DJIA future is down 0.07%, SPX down 0.14% and the NASDAQ up 0.31%. European indices look weak; STOXX down 0.59%, DAX down 0.37%, CAC down 0.60% and UK FTSE down 0.14%. NYMEX WTI oil closed the day down 2.18% at $93.07 per barrel. NYMEX nat gas was up 2.01% on the day at $3.65 per therm. COMEX gold closed the day down 1.09% at $1267.20 per ounce with silver down 2.69% at $20.71 per ounce.

http://blog.fxcc.com/market-analysis

FOREX ECONOMIC CALENDAR :

2013-11-13 09:30 GMT | UK.ILO Unemployment Rate (3M) (Sep)

2013-11-13 10:00 GMT | EU.Industrial Production w.d.a. (YoY) (Sep)

2013-11-13 10:30 GMT | UK.Bank of England Quarterly Inflation Report

2013-11-13 12:00 GMT | US.MBA Mortgage Applications (Nov 8)

FOREX NEWS :

2013-11-13 05:50 GMT | EUR/USD edges higher; momentum bias still negative

2013-11-13 05:03 GMT | AUD/CHF slightly higher; both components under pressure

2013-11-13 04:40 GMT | GBP/JPY back down at 158 after failing to conquer 159 for days

2013-11-13 04:19 GMT | EUR/JPY in consolidation mode

-------------------

EURUSD :

HIGH 1.34525 LOW 1.34296 BID 1.34427 ASK 1.34429 CHANGE 0.05% TIME 07 : 58:31

OUTLOOK SUMMARY : Up

TREND CONDITION : Down trend

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : Medium

MARKET ANALYSIS - Intraday Analysis

Upwards scenario: Next barrier on the upside lie at 1.3456 (R1). Surpassing of this level might enable our initial target at 1.3484 (R2) and any further gains would then be limited to last resistive structure at 1.3510 (R3). Downwards scenario: On a slightly longer term we expect pullback formation. Risk of market depreciation is seen below the next support level at 1.3426 (S1). Clearance here would suggest lower targets at 1.3402 (S2) and 1.3374 (S3) in potential.

Resistance Levels: 1.3456, 1.3484, 1.3510

Support Levels: 1.3426, 1.3402, 1.3374

-------------------------

GBPUSD :

HIGH 1.59073 LOW 1.58855 BID 1.58930 ASK 1.58933 CHANGE -0.08% TIME 07:58:32

OUTLOOK SUMMARY : Down

TREND CONDITION : Down trend

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : High

Upwards scenario: Possibility of market strengthening is seen above the resistance level at 1.5919 (R1). Clearance here is required to validate next interim target at 1.5938 (R2) and any further rise would then be targeting mark at 1.5962 (R3). Downwards scenario: Risk of market decline is seen below the next support level at 1.5888 (S1). Loss here might downgrade currency rate towards to the next supportive means at 1.5866 (S2) and 1.5848 (S3) in potential.

Resistance Levels: 1.5919, 1.5938, 1.5962

Support Levels: 1.5888, 1.5866, 1.5848

--------------------------

USDJPY :

HIGH 99.673 LOW 99.428 BID 99.519 ASK 99.521 CHANGE -0.11% TIME 07 : 58:32

OUTLOOK SUMMARY : Down

TREND CONDITION : Up trend

TRADERS SENTIMENT : Bullish

IMPLIED VOLATILITY : Medium

Upwards scenario: Next hurdle on the upside is seen at important technical level – 99.80 (R1). If the price manages to overcome it we expect further acceleration towards to our initial targets at 99.97 (R2) and 100.09 (R3). Downwards scenario: Any downside extension is limited now to the next support level at 99.47 (S1). Break here is required to open a route towards to next target at 99.32 (S2) and then any further easing would be targeting final support at 99.16 (S3).

Resistance Levels: 99.80, 99.97, 100.09

Support Levels: 99.47, 99.32, 99.16

Source: FX Central Clearing Ltd,( http://www.fxcc.com )

Forex Technical & Market Analysis FXCC Nov 14 2013

Fed chairperson delegate Janet Yellen states USA far from being able to taper asset purchase programme.

French and German preliminary GDP figures are published on Thursday, Germany's is expected in at 0.3% with France's at 0.1%. Italy's is expected in at -0.3%. Europe's flash GDP number is expected in at 0.2%. The ECB will publish its monthly bulletin on Thursday, whilst the UK's retail sales are expected to be flat, but could register a fall if consumers keep their hands in their pockets with Xmas being so close. Canada's trade balance is expected in at $1.2 bn for the month, whilst the USA trade balance for the month is expected in at -$34 billion, a near mirror opposite of Germany's positive €34 billion figure. Unemployment claims in the USA for the week are predicted in at 331K. The weekly oil and gas storage inventory data is published with oil expected in at a low print of 0.7. The DJIA closed up 0.45% on Wednesday, the SPX up 0.81% and the NASDAQ up 1.16%. European markets were mainly in the red; STOXX down 0.45%, CAC down 0.56%, DAX down 0.24% and UK FTSE down a substantial 1.44% after a negative reaction to the UK's BoE inflation report. Looking towards the market opening on Thursday November 14th the DJIA future is up 0.44%, SPX up 0.82% and the NASDAQ up 1.1%. The STOXX index is down 0.53%, DAX doe 0.36% and CAC down 0.55%. NYMEX WTI oil is up 0.60% at $93.60 per barrel, NYMEX nat gas is down 1.58% $3.56 per therm, COMEX gold is up 0.87% at $1282 per ounce, COMEX silver down 0.78% at $20.62 per ounce.

http://blog.fxcc.com/market-analysis

FOREX ECONOMIC CALENDAR :

2013-11-14 09:00 GMT | EMU ECB Monthly Report

2013-11-14 09:30 GMT | UK Retail Sales (YoY) (Oct)

2013-11-14 10:00 GMT | EMU Gross Domestic Product s.a. (YoY) (Q3)

2013-11-14 15:00 GMT | FOMC Member Yellen Speech

FOREX NEWS :

2013-11-14 06:38 GMT | GBP/USD had “abc” correction in first few hours of Asian session; now working higher

2013-11-14 05:48 GMT | BoE's Fisher: we won't raise rates any time soon

2013-11-14 05:06 GMT | Nikkei surges above 2% in sympathy with Wall Street

2013-11-14 05:00 GMT | USD/CHF continues expected pullback – with extra “oomph” from Fed’s dovish comments

-------------------

EURUSD

HIGH 1.34976 LOW 1.34631 BID 1.34675 ASK 1.34678 CHANGE -0.13% TIME 08 : 44:13

OUTLOOK SUMMARY Up

TREND CONDITION Upward penetration

TRADERS SENTIMENT Bearish

IMPLIED VOLATILITY High

MARKET ANALYSIS - Intraday Analysis

Upwards scenario: Instrument gained momentum on the upside recently, turning short-term bias to the positive side. Next resistive structure on the way lies at 1.3495 (R1), break here would suggest next intraday targets at 1.3519 (R2) and 1.3542 (R3). Downwards scenario: Possible downside extension is limited now to the support level at 1.3456 (S1). Break here is required to open a route towards to next target at 1.3433 (S2) and then any further easing would be targeting final support at 1.3410 (S3).

Resistance Levels: 1.3495, 1.3519, 1.3542

Support Levels: 1.3456, 1.3433, 1.3410

----------------------

GBPUSD :

HIGH 1.60651 LOW 1.60272 BID 1.60390 ASK 1.60396 CHANGE -0.1% TIME 08 : 44:15

OUTLOOK SUMMARY : Up

TREND CONDITION : Upward penetration

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : High

Upwards scenario: GBPUSD is approaching our next resistive measure at 1.6079 (R1). Break here is required to initiate upside pressure towards to next target at 1.6109 (R2) and then resistance at 1.6139 (R3) acts as last attractive point for today. Downwards scenario: Possible price depreciation is limited to support level at 1.6010 (S1). Break here is required to enable possible retracement action towards to our next targets at 1.5980 (S2) and 1.5949 (S3) in potential.

Resistance Levels: 1.6079, 1.6109, 1.6139

Support Levels: 1.6010, 1.5980, 1.5949

---------------------

USDJPY :

HIGH 99.727 LOW 99.135 BID 99.612 ASK 99.616 CHANGE 0.39% TIME 08 : 44:16

OUTLOOK SUMMARY : Up

TREND CONDITION : Upward penetration

TRADERS SENTIMENT : Bullish

IMPLIED VOLATILITY : Neutral

Upwards scenario: We see potential of further instrument appreciation in near term perspective. Clearance of our next resistive structure at 99.79 (R1) would open way towards to next target at 100.00 (R2) and any further rise would then be targeting 100.21 (R3). Downwards scenario: Possible retracement formation is limited now to support level at 99.42 (S1). If the price manages to surpass it, we would suggest next intraday targets at 99.22 (S2) and 99.01 (S3).

Resistance Levels: 99.79, 100.00, 100.21

Support Levels: 99.42, 99.22, 99.01

Source: FX Central Clearing Ltd,( http://www.fxcc.com )

Forex Technical & Market Analysis FXCC Nov 19 2013

Dow Jones Index breaks 16000 as SPX and NASDAQ sell off at key levels, as Troika talks will resume in Athens this week

Tuesday sees the publication of the ZEW German sentiment index and the ZEW Europe sentiment index. Both indices are expected to rise, Germany's up to 54.6 and Europe's up to 63.1. Two more FOMC members are due to speak, Dudley and Evans, whilst treasury secretary Lew is due to speak, the man who 'knocked heads' together over the debt impasse. Later in the evening Ben Bernanke holds court. New Zealand's PPI is published with the expectation of a number similar to the 0.6% of the previous month. Japan's trade balance is expected in at -0.88 trillion, with the all industries activity expected in at 0.5% up 0.2%. Greece's finance minister Yannis Stournaras will hold another session of talks with the country's various lenders this week. Relations between the Athens government and officials from the IMF/EC and ECB are tense, with little in the way of an agreement over how to address the fiscal gap in Greece's 2014 financial projections. That shortfall is estimated at €1.5bn and there's no roadmap in place as to how it will be fixed, although bond holders taking another haircut seems the most obvious solution. Looking towards equity index futures the DJIA is up 0.16%, SPX down 0.27%. European equity indices are up; STOXX up 0.88%, DAX up 0.65%, CAC up 0.64%, fits equity index future up 0.49%. On Monday NYMEX WTI oil closed the day down 0.88% at $93.01 per barrel, NYMEX nat gas down 1.17% at $3.62 per therm. COMEX gold closed the day down 0.95% at $1275.20 per ounce, silver on COMEX down 1.79% at $20.36 per ounce.

http://blog.fxcc.com/market-analysis

FOREX ECONOMIC CALENDAR :

2013-11-19 10:00 GMT | DE ZEW Survey - Economic Sentiment (Nov)

2013-11-19 13:45 GMT | US Treasury Sec Lew Speech

2013-11-19 23:30 GMT | AU Westpac Leading Index (MoM) (Sep)

2013-11-19 23:50 GMT | JP Merchandise Trade Balance Total (Oct)

FOREX NEWS :

2013-11-19 06:50 GMT | EUR/USD parked around 1.3500

2013-11-19 06:02 GMT | AUD bids expected on largest Australian bond deal issuance

2013-11-19 04:04 GMT | Dovish Yellen may limit further USD longs by specs - Rabobank

2013-11-19 02:28 GMT | EUR/JPY wants to consolidate 134.70 front

----------------------

EURUSD :

HIGH 1.35231 LOW 1.34989 BID 1.35143 ASK 1.35148 CHANGE 0.07% TIME 08:52:00

OUTLOOK SUMMARY : Up

TREND CONDITION : Upward penetration

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : Medium

MARKET ANALYSIS - Intraday Analysis

Upwards scenario: Fresh portion of the economic data releases might increase volatility later on today. Clearance of our next resistive barrier at 1.3530 (R1) is required to push the price towards to our next visible targets at 1.3549 (R2) and 1.3567 (R3). Downwards scenario: On the downside we see potential to positively retest our supportive measure at 1.3494 (S1). Clearance here is required to open route towards to our initial targets at 1.3474 (S2) and 1.3454 (S3) in potential.

Resistance Levels: 1.3530, 1.3549, 1.3567

Support Levels: 1.3494, 1.3474, 1.3454

---------------------

GBPUSD :

HIGH 1.61242 LOW 1.60964 BID 1.61032 ASK 1.61041 CHANGE -0.04% TIME 08:52:01

OUTLOOK SUMMARY : Up

TREND CONDITION : Upward penetration

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : Medium

Upwards scenario: Instrument gained momentum on the upside recently, turning short-term bias to the positive side. Further upwards penetration above the resistance at 1.6148 (R1) would enable intraday targets at 1.6177 (R2) and 1.6206 (R3). Downwards scenario: Risk of possible price depreciation is seen below the support level at 1.6081 (S1). Break here is required to open the way towards to immediate supports at 1.6053 (S2) and 1.6025 (S3).

Resistance Levels: 1.6148, 1.6177, 1.6206

Support Levels: 1.6081, 1.6053, 1.6025

----------------

USDJPY :

HIGH 100.001 LOW 99.571 BID 99.821 ASK 99.825 CHANGE -0.17% TIME 08:52:02

OUTLOOK SUMMARY : Down

TREND CONDITION : Downward penetration

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : Medium

Upwards scenario: On the upside potential is seen for a break above the resistance at 100.20 (R1). In such case we would suggest next target at 100.41 (R2) and any further rise would then be limited to final resistance at 100.62 (R3). Downwards scenario: We expect further correction evolvement if the price manages to overcome key supportive bastion at 99.56 (S1). In such case we would suggest next intraday targets at 99.35 (S2) and 99.13 (S3).

Resistance Levels: 100.20, 100.41, 100.62

Support Levels: 99.56, 99.35, 99.13

Source: FX Central Clearing Ltd,( http://www.fxcc.com )

Forex Technical & Market Analysis FXCC Nov 21 2013

European manufacturing PMIs published Thursday could indicate the ECB's next move on interest rates

Thursday sees the publication of Germany's and France's flash manufacturing and service PMIs together with Europe's which is expected to print at 51.6 for manufacturing and 51.9 for services. The RBA governor of Australia holds court on Thursday, whilst the UK's public net sector borrowing is published expected slightly up in at £10.1 bn. USA PPI is expected in at -0.1% whilst unemployment numbers are expected in at 333K, slightly up from the previous week. Flash manufacturing data is expected to print at 52.6. Europe's consumer confidence is expected in at -14.1 with the Philly manufacturing index for the USA expected in at 15.1, down from 19.8 the previous month. Perhaps the most illuminating comment in the latest FOMC meeting minutes, published late Wednesday evening, was the commitment that; "the Committee today reaffirmed its view that a highly accommodative stance of monetary policy will remain appropriate for a considerable time after the asset purchase program ends". The U.S. Dollar Index, which monitors the greenback against 10 major peers, increased for the first time in four days, adding 0.4 percent to 1,019.10 yen late in New York. The euro declined 0.9 percent to 134.34 yen after earlier touching 135.95, the strongest level since October 2009. The shared currency fell 0.8 percent to $1.3435. The dollar slid 0.1 percent to 99.99 yen. The dollar rose versus most major peers as Federal Reserve officials said they might reduce their $85 billion in monthly bond purchases “in coming months” as the economy improves, minutes of their last meeting show.

Market Analysis | FXCC Blog

FOREX ECONOMIC CALENDAR :

2013-11-21 08:58 GMT | EMU Markit Manufacturing PMI (Nov)

2013-11-21 09:05 GMT | RBA's Governor Glenn Stevens Speech

2013-11-21 10:05 GMT | ECB President Draghi's Speech

2013-11-21 13:30 GMT | US Producer Price Index (YoY) (Oct)

FOREX NEWS :

2013-11-21 06:15 GMT | USD/JPY cracks 100.60, new 6-month high

2013-11-21 05:05 GMT | EUR/USD maintains bearish pressure, 1.3390 is critical support Thursday

2013-11-21 04:31 GMT | AUD/USD bearish march pauses at 0.93 ahead of RBA Stevens

2013-11-21 03:24 GMT | BoJ keeps policy unchanged, retains 60T-70T easing plan

EURUSD :

HIGH 1.3442 LOW 1.34136 BID 1.34286 ASK 1.34289 CHANGE -0.07% TIME 08 : 37:15

OUTLOOK SUMMARY : Down

TREND CONDITION : Downward penetration

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : Medium

MARKET ANALYSIS - Intraday Analysis

Upwards scenario: EURUSD tested negative side recently, however we see potential to test resistive barrier at 1.3462 (R1) later on today. Successful penetration above that level would suggest next intraday targets at 1.3492 (R2) and 1.3525 (R3) later on today. Downwards scenario: Fresh low offers a key supportive measure at 1.3412 (S1) on a downside. A violation here is liable to commence correction pattern on the bigger picture and expose our initial targets at 1.3380 (S2) and 1.3348 (S3).

Resistance Levels: 1.3462, 1.3492, 1.3525

Support Levels: 1.3412, 1.3380, 1.3348

----------------------

GBPUSD :

HIGH 1.61082 LOW 1.60721 BID 1.60860 ASK 1.60869 CHANGE -0.11% TIME 08 : 37:16

OUTLOOK SUMMARY : Neutral

TREND CONDITION : Upward penetration

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : Medium

Upwards scenario: GBPUSD trapped to the consolidation phase on the hourly chart frame. Break of resistive level at 1.6177 (R1) is required to enable upwards action. Next visible targets are seen at 1.6220 (R2) and 1.6260 (R3). Downwards scenario: However, if the price manages to break our key support level at 1.6057 (S1) bearish market participants might take the initiative. Our intraday support level locates at 1.6018 (S2) and 1.5978 (S3).

Resistance Levels: 1.6177, 1.6220, 1.6260

Support Levels: 1.6057, 1.6018, 1.5978

--------------------

USDJPY :

HIGH 100.812 LOW 100.006 BID 100.690 ASK 100.694 CHANGE 0.66% TIME 08 : 37:17

OUTLOOK SUMMARY : Up

TREND CONDITION : Up trend

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : High

Upwards scenario: Market gained momentum on the upside recently and turned short-term tendency to the positive side. Further appreciation above the resistance at 100.88 (R1) might push the price towards to our targets at 101.12 (R2) and 101.36 (R3) later on today. Downwards scenario: Our next support level is placed at 100.44 (S1). Possible penetration below it might initiate bearish pressure and push the price towards to our intraday targets at 100.19 (S2) and 99.95 (S3).

Resistance Levels: 100.88, 101.12, 101.36

Support Levels: 100.44, 100.19, 99.95

Source: FX Central Clearing Ltd,( http://www.fxcc.com )

Forex Technical & Market Analysis FXCC Nov 22 2013

DJIA closes above 16,000 for the first time as dollar yen rises above 101

Today we receive the data concerning Germany's final GDP figure expected in at 0.3% up, with the German IFO index expected in at 107.9. Friday also sees a raft of info. regarding Canada; core CPI data is published expected in flat, with CPI up 0.2%. Retail sales is predicted in up 0.5% for the month. Jolts job openings are published in the USA, it measures the number of job openings during the reported month, excluding the farming industry. The DJIA rose more than 100 points and finally closed above 16,000 for the first time in history on Thursday. The index crossed that psychological milestone earlier this week, but then sold off for three days as the index closed in the red. The S&P 500 also closed up, while the Nasdaq rose more than 1%. The yen fell 1.1 percent to 101.16 per dollar late in New York time Thursday, the weakest level seen since July 10th. Japan’s currency slid 1.4 percent to 136.37 per euro after declining to 136.40, the lowest since October 2009. The euro rose 0.3 percent to $1.3482. The U.S. Dollar Index, which tracks the currency versus 10 major counterparts, rose 0.2 percent to 1,020.97 after advancing 0.4 percent Wednesday. The dollar gauge breached its 100- and 200-day moving averages as it approached a two-month high.

http://blog.fxcc.com/market-analysis

FOREX ECONOMIC CALENDAR :

2013-11-22 07:00 GMT | DE Gross Domestic Product w.d.a (YoY)

2013-11-22 09:30 GMT | ECB President Draghi's Speech

2013-11-22 13:30 GMT | CA Consumer Price Index (YoY) (Oct)

2013-11-22 13:30 GMT | CA Retail Sales (MoM) (Sep)

FOREX NEWS :

2013-11-22 06:47 GMT | EUR/USD tests highs ahead of German data

2013-11-22 06:34 GMT | GBP/USD nearing upper edge of two-month trading range

2013-11-22 05:39 GMT | USD/JPY retests 101.00 bids, 101.30+ double topside failure

2013-11-22 03:41 GMT | AUD/USD bearish party goes on, 0.92 gives up

EURUSD :

HIGH 1.34895 LOW 1.34624 BID 1.34837 ASK 1.34840 CHANGE 0.02% TIME 08 : 57:07

OUTLOOK SUMMARY : Up

TREND CONDITION : Upward penetration

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : Medium

MARKET ANALYSIS - Intraday Analysis

Upwards scenario: Further upwards penetration might face next challenge at 1.3495 (R1). Break here would suggest next target at 1.3513 (R2) en route towards to last resistance for today at 1.3530 (R3). Downwards scenario: On the downside, support level at 1.3462 (S1) limits possible downtrend expansion. Break here is required to enable lower target at 1.3444 (S2) en route to final aim at 1.3426 (S3).

Resistance Levels: 1.3495, 1.3513, 1.3530

Support Levels: 1.3462, 1.3444, 1.3426

--------------------

GBPUSD :

HIGH 1.62046 LOW 1.61764 BID 1.61945 ASK 1.61952 CHANGE -0.02% TIME 08 : 57:08

OUTLOOK SUMMARY : Up

TREND CONDITION : Upward penetration

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : Medium

Upwards scenario: An element of resistive measure could be found at 1.6213 (R1). Clearance here would open way towards to higher target at 1.6242 (R2) and any further rise would then be limited to last resistance at 1.6271 (R3). Downwards scenario: Any downside fluctuations remains for now limited to the next support barrier at 1.6178 (S1). Only clear break here would be a signal of possible market easing towards to our targets at 1.6150 (S2) and 1.6122 (S3) in potential

Resistance Levels: 1.6213, 1.6242, 1.6271

Support Levels: 1.6178, 1.6150, 1.6122

--------------------------

USDJPY :

HIGH 101.353 LOW 100.956 BID 100.997 ASK 100.999 CHANGE -0.15% TIME 08 : 57:10

OUTLOOK SUMMARY : Up

TREND CONDITION : Sideway

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : Medium

Upwards scenario: Market players may prefer to stay neutral today during limited tier one macroeconomic data flow, though a break of our resistance at 101.36 (R1) would suggest next targets at 101.58 (R2) and 101.81 (R3). Downwards scenario: On the other side, a dip below the initial support level at 100.84 (S1) is liable to trigger bearish pressure and drive market price towards to supportive means at 100.62 (S2) and 100.39 (S3) in potential.

Resistance Levels: 101.36, 101.58, 101.81

Support Levels: 100.84, 100.62, 100.39

Source: FX Central Clearing Ltd,( http://www.fxcc.com )

Forex Technical & Market Analysis FXCC Nov 25 2013

Iran's real rises versus the U.S. dollar as historic agreement reached whilst oil falls circa one percent.

Hedge-fund managers and other large institutional speculators increased their net-long position in two-year note futures to the highest level since August, according to U.S. Commodity Futures Trading Commission data. Speculative long positions, or bets that prices will rise, outnumbered short positions by 34,011 contracts in the week ending Nov. 19th on the Chicago Board of Trade, this was up 19 percent, from the week previous. The benchmark 10-year yield rose four basis points last week, or 0.04 percentage point, to 2.74 percent in New York. The price of the 2.75 percent note maturing in November 2023 was 100 2/32. A gauge of U.S. company credit risk fell to its lowest level since 2007 as job openings (JOLTS) climbed to a five-year high. The Markit CDX North American Investment Grade Index, a credit-default swaps benchmark investors use to hedge against losses, or to speculate on creditworthiness, decreased 1.7 basis points to 68.8 basis points in New York trading last week. The benchmark reached the lowest closing level since November 2007. Iran’s currency strengthened more than 2 percent as the Nation won access about $7 billion in relief from sanctions after agreeing to limit its nuclear program, ending a decade-long diplomatic stalemate. The rial appreciated by 2.3 percent to 29,300 a dollar on Sunday in Tehran compared with 30,000 yesterday, according to prices provided by street traders in the Iranian currency black market. The currency had lost more than half its value in the year before President Hassan Rouhani’s election in June, partly as a consequence of sanctions denying Iran access to the global financial system. Iran’s gross domestic product declined by approx. 5.4 percent in the fiscal year ending in March. Sanctions have pushed the country’s oil output to the lowest since 1990.

http://blog.fxcc.com/market-analysis

FOREX ECONOMIC CALENDAR :

2013-11-25 15:00 GMT | USA. Pending Home Sales (YoY) (Oct)

2013-11-25 15:30 GMT | USA. Dallas Fed Manufacturing Business Index (Nov)

2013-11-25 22:00 GMT | Australia. RBA Deputy Governor Lowe Speech

2013-11-25 23:50 GMT | Japan. BoJ Monetary Policy Meeting Minutes

FOREX NEWS :

2013-11-25 06:16 GMT | Gold suffers intraday flash crash, off $12 from 1238.00 to 1,226.00

2013-11-25 05:16 GMT | AUD/USD breaks below Friday's low as bounces keep failing

2013-11-25 05:10 GMT | EUR/JPY touches Fibonacci projection at 137.90 and backs off temporarily

2013-11-25 04:41 GMT | GBP/JPY closes week above LT key level of 163.52; bears running for cover

-------------------

EURUSD :

HIGH 1.356 LOW 1.35368 BID 1.35368 ASK 1.35371 CHANGE -0.14% TIME 08:13:00

OUTLOOK SUMMARY : Down

TREND CONDITION : Sideway

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : Medium

MARKET ANALYSIS - Intraday Analysis

Upwards scenario: Next barrier on the upside lie at 1.3563 (R1). Surpassing of this level might enable our initial target at 1.3583 (R2) and any further gains would then be limited to last resistive structure at 1.3608 (R3). Downwards scenario: On the downside our attention is shifted to the immediate support level at 1.3520 (S1). Break here is required to enable bearish forces and expose our intraday targets at 1.3498 (S2) and 1.3473 (S3).

Resistance Levels: 1.3563, 1.3583, 1.3608

Support Levels: 1.3520, 1.3498, 1.3473

-------------------

GBPUSD :

HIGH 1.62401 LOW 1.62055 BID 1.62064 ASK 1.62073 CHANGE -0.1% TIME 08:13:01

OUTLOOK SUMMARY : Down

TREND CONDITION : Upward penetration

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : Medium

Upwards scenario: Immediate resistance at 1.6236 (R1) remains in near-term focus, climb above this level might open way for a stronger move towards to next interim target at 1.6276 (R2) and any further rise would then be limited to final resistive measure at 1.6309 (R3). Downwards scenario: Any downside extension is limited now to the next support level at 1.6188 (S1). Break here is required to open a route towards to next target at 1.6145 (S2) and then any further easing would be targeting final support at 1.6108 (S3).

Resistance Levels: 1.6236, 1.6276, 1.6309

Support Levels: 1.6188, 1.6145, 1.6108

--------------------------

USDJPY :

HIGH 101.917 LOW 101.139 BID 101.879 ASK 101.882 CHANGE 0.63% TIME 08:13:02

OUTLOOK SUMMARY : Up

TREND CONDITION : Up trend

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : High

Upwards scenario: Any upside action is limited now to the next resistive structure at 102.02 (R1). Clearance here might shift trader’s sentiment to bullish side and open road towards to our initial targets at 102.21 (R2) and 102.50 (R3). Downwards scenario: On the other hand, risk of correction development is seen below the next support at 101.20 (S1). Possible price downgrade would suggest next initial targets at 100.99 (S2) and 100.77 (S3).

Resistance Levels: 102.02, 102.21, 102.50

Support Levels: 101.20, 100.99, 100.77

Source: FX Central Clearing Ltd,( http://www.fxcc.com )