Market Overview by FXCC

Forex Technical & Market Analysis FXCC Jul 18 2013

Fed's Bernanke: Asset purchases not 'on a preset course'

According to the prepared text of Chairman Ben Bernanke's speech, to be delivered later today during his Semiannual Monetary Policy Report to the Congress, the pace of the Federal Reserve's bond purchases is not 'on a preset course', as it depends on the current economic and financial situation. The Fed head assured that signs of recovery are visible in the US labor market, but that “the jobs situation is far from satisfactory, as the unemployment rate remains well above its longer-run normal level.” He also pointed out that inflation is still below the Fed's 2% target. That is why “a highly accommodative monetary policy will remain appropriate for the foreseeable future.”

As far as QE is concerned, Bernanke stressed that the decision on when the tapering should begin depends on the Fed's assessment of the US economic outlook. Should economic data improve earlier than forecasted and inflation rise towards the objective, a reduction could be carried out sooner. Otherwise, “the current pace of purchases could be maintained for longer.” According to Rob Carnell from ING: ”This speech neither contradicts nor supports the notion that the taper begins in September. The taper might begin then. But as we have written elsewhere, there are quite good reasons why it may occur somewhat later. Not that it really matters all that much anyway – given that the Fed funds decision is one that will be taken independently from QE.”

https://support.fxcc.com/email/technical/18072013/

FOREX ECONOMIC CALENDAR :

2013-07-18 08:30 GMT | UK Retail Sales (YoY)

2013-07-18 12:30 GMT | US Initial Jobless Claims

2013-07-18 14:00 GMT | US Fed's Bernanke Speech

2013-07-18 23:50 GMT | Japan. Foreign bond investment

FOREX NEWS :

2013-07-18 04:52 GMT | GBP/USD breaks below 1.52 ahead of UK retail sales

2013-07-18 04:31 GMT | USD/JPY above 100 again ahead of Sunday's elections

2013-07-18 04:20 GMT | EUR/USD breaks 1.32, needs to clear 1.3180

2013-07-18 04:04 GMT | AUD/USD trips stop losses below 0.9170

EURUSD :

HIGH 1.31271 LOW 1.3091 BID 1.30962 ASK 1.30968 CHANGE -0.22% TIME 08 : 24:12

OUTLOOK SUMMARY : Down

TREND CONDITION : Downward penetration

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : Low

MARKET ANALYSIS - Intraday Analysis

Upwards scenario: EURUSD stabilized on the hourly timeframe. Potential to move higher is seen above the next resistance level at 1.3147 (R1). Loss here would suggest next intraday targets at 1.3179 (R2) and 1.3210 (R3). Downwards scenario: Possible downside extension might face next supportive barrier at 1.3081 (S1). Clearance here is required to open the way towards to interim target at 1.3050 (S2) and any further price regress would then be targeting 1.3019 (S3).

Resistance Levels: 1.3147, 1.3179, 1.3210

Support Levels: 1.3081, 1.3050, 1.3019

--------------------

GBPUSD :

HIGH 1.52232 LOW 1.51728 BID 1.51789 ASK 1.51799 CHANGE -0.21% TIME 08 : 24:12

OUTLOOK SUMMARY : Up

TREND CONDITION : Downward penetration

TRADERS SENTIMENT : Bullish

IMPLIED VOLATILITY : Medium

Upwards scenario: GBPUSD is approaching our next resistance level at 1.5223 (R1), keeping the ascending structure intact. The break here is required for the price appreciation towards to next target at 1.5252 (R2) and any further rise would then be targeting to 1.5281 (R3). Downwards scenario: On the downside next supportive bastion lies at 1.5152 (S1). Prolonged movement below it might then expose our intraday targets at 1.5124 (S2) and 1.5095 (S3).

Resistance Levels: 1.5223, 1.5252, 1.5281

Support Levels: 1.5152, 1.5124, 1.5095

------------------

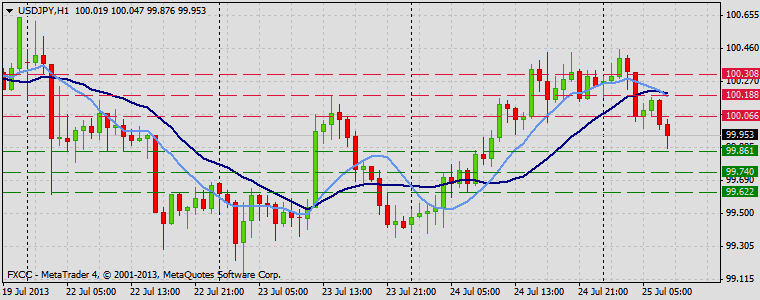

USDJPY :

HIGH 100.18 LOW 99.463 BID 100.085 ASK 100.088 CHANGE 0.53% TIME 08 : 24:13

OUTLOOK SUMMARY : Up

TREND CONDITION : Upward penetration

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : Medium

Upwards scenario: Our next resistance level is placed at 100.22 (R1). Clearance here is required to resume uptrend structure towards to next target at 100.41 (R2) and any further price appreciation would then be limited to 100.61 (R3) mark. Downwards scenario: While instrument trades above the moving averages, our short-term bias would stay positive though penetration below the support level at 99.84 (S1) might open way towards to lower targets at 99.64 (S2) and 99.44 (S3).

Resistance Levels: 100.22, 100.41, 100.61

Support Levels: 99.84, 99.64, 99.44

Source: FX Central Clearing Ltd,( http://www.fxcc.com )

Forex Technical & Market Analysis FXCC Jul 22 2013

Portugal's president backs coalition government

Portugal president Aníbal Cavaco Silva on Sunday supported the current coalition government, saying they should stay till end of the term, ending weeks of political crisis in the country, which had led international actors to even threaten the country's €78 billion international bailout. "As the national salvation compromise was impossible to achieve, I consider that the best alternative solution is for the present government to remain in its functions, with reinforced guarantees of cohesion and solidity of the coalition, until the end of its term (in 2015)" Mr. Cavaco said. Further headlines were provided by Bloomberg, with Cavaco saying he "laments talks on ‘National salvation’ agreement failed to produce results", and that "agreement will eventually be imposed by reality in future."

Session in the Asia-Pacific to start the week opened with an early move higher in Yen that soon corrected to break even before Tokyo started trading, but then as soon as traders hit the floor the Yen rose again to as high as 99.57 of the USD/JPY pair. The Yen move became in broad USD weakness following Japan PM Abe's upper house win, taking EUR/USD to session highs at 1.3170, AUD/USD to 0.9228, and Cable to 1.5298. Nikkei index opened in the 14750 region but soon eased to break even shy of 14600. Gold and Silver broke higher above key $1300 resistance in case of Gold, while Oil remained above the $108 handle. Local share markets traded mixed with China mainland and Japan in the negative, while Australia and Korea still in the positive.

https://support.fxcc.com/email/technical/22072013/

FOREX ECONOMIC CALENDAR :

2013-07-22 07:00 GMT | Stitzerland. Monthly Statistical Bulletin (Jul)

2013-07-22 12:30 GMT | USA. Chicago Fed National Activity Index (Jun)

2013-07-22 14:00 GMT | USA. Existing Home Sales Change (Jun)

2013-07-22 15:30 GMT | USA. 6-Month Bill Auction

FOREX NEWS :

2013-07-22 04:53 GMT | AUD/USD, 0.93 to mark a cap in the recovery - BBH

2013-07-22 04:47 GMT | GBP/USD capped below 1.53 ahead of London

2013-07-22 04:45 GMT | AUD/JPY to peak at 94.00 in September - NAB

2013-07-22 04:33 GMT | EUR/USD holding gains above 1.3150

EURUSD :

HIGH 1.31694 LOW 1.31329 BID 1.31529 ASK 1.31534 CHANGE 0.09% TIME 08:19:28

OUTLOOK SUMMARY : Up

TREND CONDITION : Upward penetration

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : Low

MARKET ANALYSIS - Intraday Analysis

Upwards scenario: Apparently market sentiment is positive for the EURUSD as both moving averages are pointing up. Clearance of our resistance at 1.3178 (R1) would clear the way for an upside penetration towards to next visible targets at 1.3201 (R2) and 1.3224 (R3). Downwards scenario: Prolonged movement below the supportive measure at 1.3130 (S1) is required to activate downtrend expansion. Next aim on the way would be mark at 1.3105 (S2) and then final target could be met at 1.3081 (S3).

Resistance Levels: 1.3178, 1.3201, 1.3224

Support Levels: 1.3130, 1.3105, 1.3081

----------------------

GBPUSD :

HIGH 1.52971 LOW 1.52577 BID 1.52831 ASK 1.52842 CHANGE 0.13% TIME 08:19:29

OUTLOOK SUMMARY : Up

TREND CONDITION : Upward penetration

TRADERS SENTIMENT : Bullish

IMPLIED VOLATILITY : Low

Upwards scenario: Further uptrend development is limited now to the next resistive measure at 1.5311 (R1). Clearance here is required to enable our interim target at 1.5341 (R2) en route to final aim at 1.5372 (R3). Downwards scenario: On the other hand, depreciation below the technically important support level at 1.5246 (S1) might lead to the correction formation on the short-term perspective. Possible targets lies at 1.5213 (S2) and 1.5182 (S3).

Resistance Levels: 1.5311, 1.5341, 1.5372

Support Levels: 1.5246, 1.5213, 1.5182

---------------------------

USDJPY :

HIGH 100.62 LOW 99.608 BID 100.041 ASK 100.044 CHANGE -0.6% TIME 08:19:29

OUTLOOK SUMMARY : Neutral

TREND CONDITION : Sideway

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : Low

Upwards scenario: Possibility of market strengthening is seen above the resistance level at 100.18 (R1). Clearance here is required to validate next interim target at 100.36 (R2) and any further rise would then be targeting mark at 100.55 (R3). Downwards scenario: On the downside, support level at 99.80 (S1) limits possible downtrend expansion. Break here is required to enable lower target at 99.63 (S2) en route to final aim at 99.45 (S3).

Resistance Levels: 100.18, 100.36, 100.55

Support Levels: 99.80, 99.63, 99.45

Source: FX Central Clearing Ltd,( http://www.fxcc.com )

Forex Technical & Market Analysis FXCC Jul 23 2013

Bank of Japan stands ready to inject further stimulus

The Bank of Japan is prepared to provide further easing to the economy should signs fail to emerge about an economic recovery, including an inflation mandate of 2% in the short-run. According to BoJ board member Takehiro Sato, more stimulus is a real possibility if the economy's recovery is threatened, naming a few risks such as slower-than-expected growth in China. "A high degree of uncertainty remains concerning the global economy, and I see risks to the economic outlook as somewhat tilted to the downside," Sato said.

"The BOJ does not exclude the implementation of additional measures and will not hesitate to fine-tune its policies flexibly when unexpected tail risks materialise," Sato added in a speech to business leaders in Fukushima, northeastern Japan. Sato also said the 2% inflation should be seen as a flexible target, subject to change in the 2-year projections, a timeframe which had been repeatedly mentioned by BOJ governor Haruhiko Kuroda in past meetings. "If the inflation rate is projected to stabilise within a certain range, with the median being 2 per cent price growth, the main objective of the bank's policy will have been fulfilled," Sato said. Mr Sato, an economist who joined the BOJ board last year, was nonetheless more optimistic about japan’s economy from a year earlier, saying a recovery was "coming into view", presenting a "window of opportunity" to overcome deflation.

https://support.fxcc.com/email/technical/23072013/

FOREX ECONOMIC CALENDAR :

2013-07-23 08:30 GMT | UK. BBA Mortgage Approvals

2013-07-23 12:30 GMT | Canada. Retail Sales

2013-07-23 13:00 GMT | USA. Housing Price Index

2013-07-23 14:00 GMT | EMU. Consumer Confidence

FOREX NEWS :

2013-07-23 03:27 GMT | EUR/JPY back around 131.50 on Euro strength

2013-07-23 02:55 GMT | AUD/USD struggling above 0.9280 highs

2013-07-23 02:42 GMT | GBP/USD conquers 1.5304 resistance – now targeting key level at 1.5432

2013-07-23 02:16 GMT | EUR/USD faces risk for extension into 1.20/1.18 - JPMorgan

--------------------

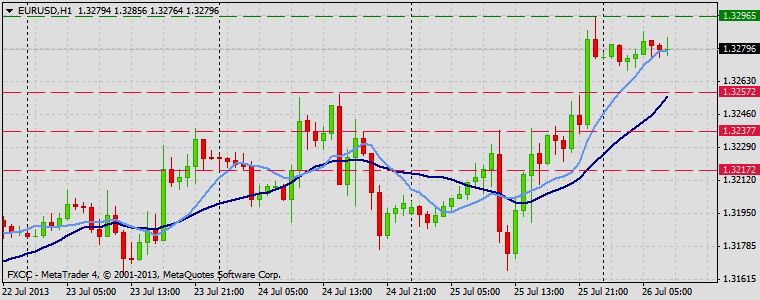

EURUSD :

HIGH 1.32072 LOW 1.31827 BID 1.31970 ASK 1.31975 CHANGE 0.09% TIME 08:37:12

OUTLOOK SUMMARY : Up

TREND CONDITION : Up trend

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : Medium

MARKET ANALYSIS - Intraday Analysis

Upwards scenario: Yesterday high at 1.3217 (R1) limits further uptrend establishment. Break here is required to enable next interim target at 1.3243 (R2) en route towards to final aim for today at 1.3268 (R3). Downwards scenario: Depreciation below the support level at 1.3177 (S1) would suggest next intraday target at 1.3152 (S2) and any further weakening would then be limited to final support level at 1.3126 (S3).

Resistance Levels: 1.3217, 1.3243, 1.3268

Support Levels: 1.3177, 1.3152, 1.3126

-----------------

GBPUSD :

HIGH 1.53767 LOW 1.53548 BID 1.53667 ASK 1.53673 CHANGE 0.05% TIME 08:37:13

OUTLOOK SUMMARY : Up

TREND CONDITION : Up trend

TRADERS SENTIMENT : Bullish

IMPLIED VOLATILITY : Medium

Upwards scenario: Fractal level at 1.5385 (R1) offers next resistive barrier. Penetration above that mark might trigger upside pressure and expose our next resistive mean at 1.5415 (R2) en route towards to final target for today at 1.5445 (R3). Downwards scenario: Though, possibility of correction is high. Price devaluation below the support at 1.5345 (S1) would initiate bearish pressure. On the way our next interim support at 1.5315 (S2) en route to final target at 1.5285 (S3).

Resistance Levels: 1.5385, 1.5415, 1.5445

Support Levels: 1.5345, 1.5315, 1.5285

--------------------

USDJPY :

HIGH 99.68 LOW 99.143 BID 99.465 ASK 99.467 CHANGE -0.2% TIME 08:37:13

OUTLOOK SUMMARY : Down

TREND CONDITION : Down trend

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : Medium

Upwards scenario: USDJPY remains under the consolidation mode after the initial uptrend formation. Strengthening above the next resistive structure at 99.70 (R1) might activate medium-term bullish pressure and expose our intraday targets at 99.86 (R2) and 100.02 (R3). Downwards scenario: Further downside expansion might face next hurdle at 99.28 (S1). Break here is liable to initiate stronger bearish pressure and validate our immediate targets at 99.13 (S2) and 98.98 (S3) in potential.

Resistance Levels: 99.70, 99.86, 100.02

Support Levels: 99.28, 99.13, 98.98

Source: FX Central Clearing Ltd,( http://www.fxcc.com )

Forex Technical & Market Analysis FXCC Jul 23 2013

Bank of Japan stands ready to inject further stimulus

The Bank of Japan is prepared to provide further easing to the economy should signs fail to emerge about an economic recovery, including an inflation mandate of 2% in the short-run. According to BoJ board member Takehiro Sato, more stimulus is a real possibility if the economy's recovery is threatened, naming a few risks such as slower-than-expected growth in China. "A high degree of uncertainty remains concerning the global economy, and I see risks to the economic outlook as somewhat tilted to the downside," Sato said.

"The BOJ does not exclude the implementation of additional measures and will not hesitate to fine-tune its policies flexibly when unexpected tail risks materialise," Sato added in a speech to business leaders in Fukushima, northeastern Japan. Sato also said the 2% inflation should be seen as a flexible target, subject to change in the 2-year projections, a timeframe which had been repeatedly mentioned by BOJ governor Haruhiko Kuroda in past meetings. "If the inflation rate is projected to stabilise within a certain range, with the median being 2 per cent price growth, the main objective of the bank's policy will have been fulfilled," Sato said. Mr Sato, an economist who joined the BOJ board last year, was nonetheless more optimistic about japan’s economy from a year earlier, saying a recovery was "coming into view", presenting a "window of opportunity" to overcome deflation.

https://support.fxcc.com/email/technical/23072013/

FOREX ECONOMIC CALENDAR :

2013-07-23 08:30 GMT | UK. BBA Mortgage Approvals

2013-07-23 12:30 GMT | Canada. Retail Sales

2013-07-23 13:00 GMT | USA. Housing Price Index

2013-07-23 14:00 GMT | EMU. Consumer Confidence

FOREX NEWS :

2013-07-23 03:27 GMT | EUR/JPY back around 131.50 on Euro strength

2013-07-23 02:55 GMT | AUD/USD struggling above 0.9280 highs

2013-07-23 02:42 GMT | GBP/USD conquers 1.5304 resistance – now targeting key level at 1.5432

2013-07-23 02:16 GMT | EUR/USD faces risk for extension into 1.20/1.18 - JPMorgan

--------------------

EURUSD :

HIGH 1.32072 LOW 1.31827 BID 1.31970 ASK 1.31975 CHANGE 0.09% TIME 08:37:12

OUTLOOK SUMMARY : Up

TREND CONDITION : Up trend

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : Medium

MARKET ANALYSIS - Intraday Analysis

Upwards scenario: Yesterday high at 1.3217 (R1) limits further uptrend establishment. Break here is required to enable next interim target at 1.3243 (R2) en route towards to final aim for today at 1.3268 (R3). Downwards scenario: Depreciation below the support level at 1.3177 (S1) would suggest next intraday target at 1.3152 (S2) and any further weakening would then be limited to final support level at 1.3126 (S3).

Resistance Levels: 1.3217, 1.3243, 1.3268

Support Levels: 1.3177, 1.3152, 1.3126

-----------------

GBPUSD :

HIGH 1.53767 LOW 1.53548 BID 1.53667 ASK 1.53673 CHANGE 0.05% TIME 08:37:13

OUTLOOK SUMMARY : Up

TREND CONDITION : Up trend

TRADERS SENTIMENT : Bullish

IMPLIED VOLATILITY : Medium

Upwards scenario: Fractal level at 1.5385 (R1) offers next resistive barrier. Penetration above that mark might trigger upside pressure and expose our next resistive mean at 1.5415 (R2) en route towards to final target for today at 1.5445 (R3). Downwards scenario: Though, possibility of correction is high. Price devaluation below the support at 1.5345 (S1) would initiate bearish pressure. On the way our next interim support at 1.5315 (S2) en route to final target at 1.5285 (S3).

Resistance Levels: 1.5385, 1.5415, 1.5445

Support Levels: 1.5345, 1.5315, 1.5285

--------------------

USDJPY :

HIGH 99.68 LOW 99.143 BID 99.465 ASK 99.467 CHANGE -0.2% TIME 08:37:13

OUTLOOK SUMMARY : Down

TREND CONDITION : Down trend

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : Medium

Upwards scenario: USDJPY remains under the consolidation mode after the initial uptrend formation. Strengthening above the next resistive structure at 99.70 (R1) might activate medium-term bullish pressure and expose our intraday targets at 99.86 (R2) and 100.02 (R3). Downwards scenario: Further downside expansion might face next hurdle at 99.28 (S1). Break here is liable to initiate stronger bearish pressure and validate our immediate targets at 99.13 (S2) and 98.98 (S3) in potential.

Resistance Levels: 99.70, 99.86, 100.02

Support Levels: 99.28, 99.13, 98.98

Source: FX Central Clearing Ltd,( http://www.fxcc.com )

Forex Technical & Market Analysis FXCC Jul 24 2013

China sets 7% growth as bottom line, eyes fresh stimulus

Chinese Premier Li Keqiang provided a juicy headline during Tuesday, suggesting the country may have to rethink its 'non-stimulatory' monetary policies should the economic growth fall below 7%, according to local media reports. Mr Li said that 7% is seen as the 'bottom line', and if target not met, there will be other options on the table as the government cannot afford the growth rate to deteriorate further, Xinhua News Agency reported. According to Beijing News, Mr. Li added: "As long as the economic growth rate, employment and other indicators don't slip below our lower limit and inflation doesn't exceed our upper limit we'll focus on restructuring and pushing reforms." As Ambrose Evans-Pritchard from the Telegraph notes: "Mr Li's comments suggest a major shift in policy by Beijing, which has deliberately engineered a slow-down over recent months by squeezing credit. The government has been rattled by upheavals in the interbank market and has begun to heed warnings that the crackdown has gone too far."

https://support.fxcc.com/email/technical/24072013/

FOREX ECONOMIC CALENDAR :

2013-07-24 07:58 GMT | EMU. Markit Manufacturing PMI

2013-07-24 12:58 GMT | USA. Markit Manufacturing PMI

2013-07-24 14:00 GMT | USA. New Home Sales

2013-07-24 21:00 GMT | New Zeland. RBNZ Interest Rate Decision

FOREX NEWS :

2013-07-24 05:02 GMT | EUR/GBP shuffling sideways after Tuesday’s bounce ahead of Euro-data

2013-07-24 04:25 GMT | AUD/USD, 0.8870/0.8770 next important target - JPMorgan

2013-07-24 04:11 GMT | GBP/USD slips after Chinese data. Overbought correction starting?

2013-07-24 03:07 GMT | USD/JPY proving 99.50 as strong support

EURUSD :

HIGH 1.32267 LOW 1.31986 BID 1.32055 ASK 1.32060 CHANGE -0.14% TIME 08:39:11

OUTLOOK SUMMARY : Up

TREND CONDITION : Up trend

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : Medium

MARKET ANALYSIS - Intraday Analysis

Upwards scenario: Despite the price is tested negative territory today further market strengthening is possible. Clearance of our next resistance level at 1.3230 (R1) would suggest next initial targets at 1.3248 (R2) and 1.3264 (R3). Downwards scenario: On the downside we put our attention to the next support level at 1.3197 (S1). Loss here is required to push the price towards to our next interim targets at 1.3180 (S2) en route towards to final support at 1.3162 (S3)

Resistance Levels: 1.3230, 1.3248, 1.3264

Support Levels: 1.3197, 1.3180, 1.3162

---------------------

GBPUSD :

HIGH 1.53782 LOW 1.5352 BID 1.53581 ASK 1.53585 CHANGE -0.07% TIME 08:39:11

OUTLOOK SUMMARY : Up

TREND CONDITION : Sideway

TRADERS SENTIMENT : Bullish

IMPLIED VOLATILITY : Medium

Upwards scenario: Volatility increase on the upside is required to push the price through key resistive measure at 1.5385 (R1). In such scenario we would suggest next targets at 1.5406 (R2) and 1.5427 (R3). Downwards scenario: Negative developments might be settled below the important support level at 1.5345 (S1). Any price action below it would then be targeting support level at 1.5326 (S2) and then final target could be exposed at 1.5305 (S3).

Resistance Levels: 1.5385, 1.5406, 1.5427

Support Levels: 1.5345, 1.5326, 1.5305

----------------

USDJPY :

HIGH 99.8 LOW 99.384 BID 99.711 ASK 99.713 CHANGE 0.3% TIME 08:39:12

OUTLOOK SUMMARY : Down

TREND CONDITION : Upward penetration

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : Medium

Upwards scenario: Immediate resistance at 99.81 (R1) remains in near-term focus, climb above this level might open way for a recovery action towards to next interim target at 99.93 (R2) and any further rise would then be limited to final resistive measure at 100.06 (R3) Downwards scenario: Clearance of our next support level at 99.59 (S1) is required to enable further trend evolvement on a slightly longer term perspective. Our support levels locates today at 99.46 (S2) and 99.33 (S3).

Resistance Levels: 99.81, 99.93, 100.06

Support Levels: 99.59, 99.46, 99.33

Source: FX Central Clearing Ltd,( http://www.fxcc.com )

Forex Technical & Market Analysis FXCC Jul 25 2013

Greece one step away from bailout payment

According to the German finance ministry, Greece has completed 21 out of the 22 measures required by the international lenders in exchange for the next bailout payment. The country still has to implement the “mobility scheme” which involves a transfer or dismissal of 12,500 public workers within a year. The measure is expected to be fulfilled until tomorrow. Ryan Littlestone from ForexLive believes that the Troika will finally approve the next bailout payment for Greece, despite the impediments: “Seeing as they've never backed down from hand over cash to Greece there's little chance of this episode failing.”

https://support.fxcc.com/email/technical/25072013/

FOREX ECONOMIC CALENDAR :

2013-07-25 08:30 GMT | UK. Gross Domestic Product (YoY)

2013-07-25 12:30 GMT | USA. Durable Goods Orders (Jun)

2013-07-25 12:30 GMT | USA. Initial Jobless Claims

2013-07-25 23:30 GMT | Japan. National Consumer Price Index (YoY)

FOREX NEWS :

2013-07-25 04:53 GMT | EUR/USD rally paused for a day. More upside to come or is correction just starting?

2013-07-25 04:45 GMT | USD/CAD eyes 1.0660 as next target - JPMorgan

2013-07-25 04:30 GMT | GBP/USD holds above 1.53 ahead of UK GDP

2013-07-25 02:57 GMT | USD/JPY slipping Thursday after a bounce on Wednesday; major resistance looms

-----------------

EURUSD :

HIGH 1.3221 LOW 1.31877 BID 1.32137 ASK 1.32140 CHANGE 0.1% TIME 08 : 32:34

OUTLOOK SUMMARY : Up

TREND CONDITION : Upward penetration

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : Medium

MARKET ANALYSIS - Intraday Analysis

Upwards scenario: Recent price acceleration on the upside suggests short-term positive bias. Possible penetration above the resistance level at 1.3230 (R1) is liable to open way towards to our initial targets at 1.3248 (R2) and 1.3264 (R3). Downwards scenario: Risk of price depreciation is seen below the support level at 1.3197 (S1). A fall below it might prolong medium-term weakness towards to next support at 1.3180 (S2) and any further market decline would then be targeting final support at 1.3162 (S3).

Resistance Levels: 1.3230, 1.3248, 1.3264

Support Levels: 1.3197, 1.3180, 1.3162

----------------------

GBPUSD :

HIGH 1.53442 LOW 1.5305 BID 1.53378 ASK 1.53387 CHANGE 0.17% TIME 08 : 32:35

OUTLOOK SUMMARY : Up

TREND CONDITION : Upward penetration

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : High

Upwards scenario: A violation of next resistance at 1.5352 (R1) might call for a run towards to next target at 1.5375 (R2) and any further appreciation would then be limited to final target at 1.5397 (R3). Downwards scenario: Possible downside expansion is limited to the next support level at 1.5324 (S1). Break here is required to open way towards to initial targets at 1.5301 (S2) and 1.5278 (S3).

Resistance Levels: 1.5352, 1.5375, 1.5397

Support Levels: 1.5324, 1.5301, 1.5278

----------------------

USDJPY :

HIGH 100.456 LOW 99.876 BID 99.972 ASK 99.974 CHANGE -0.27% TIME 08 : 32:36

OUTLOOK SUMMARY : Down

TREND CONDITION : Downward penetration

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : High

Upwards scenario: Possible upwards formation is limited to resistive measure at 100.06 (R1). A break above it would suggest next intraday target at 100.18 (R2) and if the price holds its momentum we can expect price increase towards to final resistance at 100.30 (R3). Downwards scenario: In order to prolong downside extension, USDJPY should successfully retest our support level at 99.86 (S1). Below it locates our intraday targets at 99.74 (S2) and 99.62 (S3).

Resistance Levels: 100.06, 100.18, 100.30

Support Levels: 99.86, 99.74, 99.62

Source: FX Central Clearing Ltd,( http://www.fxcc.com )

Forex Technical & Market Analysis FXCC Jul 26 2013

What does Japan CPI rise mean for the BoJ?

In a clear sign of temporary victory by 'Abenomics' radical policies, Japan printed the sharpest rise in core inflation in almost 5 years, with the read out at +0.4% y/y vs 0.3% exp. The rest of indicators were also encouraging. ne of the top priorities by Japan is to end a 15-year deflation cycle, so that the country can start to develop a self-sustaining recovery. In large part, this is the main reason behind the radical ultra-loose monetary policy being currently deployed by the BoJ, which has committed to double the amount the central bank purchases in Japanese government debt. The country will continue to actively assess how these increases in price pressure - still minimal - are having an impact on the mindset of the population, potentially leading to support more credit, spending and rise in salaries. However, as IFR Markets Editor Amanda Tan notes, "a planned sales tax hike in April next year - from 5% to 8% - poses a downside risk to spending & sentiment, particularly if wages don't start to rise."

https://support.fxcc.com/email/technical/26072013/

FOREX ECONOMIC CALENDAR :

2013-07-26 06:00 GMT | Germany. Import Price Index

2013-07-26 06:00 GMT | UK. Nationwide Housing Prices n.s.a

2013-07-26 13:55 GMT | USA. Reuters/Michigan Consumer Sentiment Index

FOREX NEWS :

2013-07-26 04:58 GMT | EUR/GBP lurking below Fibonacci resistance at 0.8631 and 0.8646 ahead of data

2013-07-26 04:28 GMT | GBP/USD pares all loses post-UK GDP dump

2013-07-26 02:46 GMT | EUR/USD higher on the back of broad USD weakness

2013-07-26 02:43 GMT | USD/JPY breaking lower, lowest at 98.70

----------------------------

EURUSD :

HIGH 1.32889 LOW 1.32687 BID 1.32787 ASK 1.32790 CHANGE 0.02% TIME 08:36:57

OUTLOOK SUMMARY : Up

TREND CONDITION : Upward penetration

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : Low

MARKET ANALYSIS - Intraday Analysis

Upwards scenario: EURUSD commenced new step of uptrend formation. Possibility of further market appreciation is seen above the resistance level at 1.3296 (R1). Break here is required to validate next targets at 1.3316 (R2) and 1.3336 (R3). Downwards scenario: Any downside extension is limited now to the next support level at 1.3257 (S1). Below here we see potential for the price acceleration towards to next targets at 1.3237 (S2) and 1.3217 (S3).

Resistance Levels: 1.3296, 1.3316, 1.3336

Support Levels: 1.3257, 1.3237, 1.3217

----------------------

GBPUSD :

HIGH 1.54058 LOW 1.53732 BID 1.53913 ASK 1.53920 CHANGE 0.03% TIME 08:36:57

OUTLOOK SUMMARY : Up

TREND CONDITION : Upward penetration

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : Low

Upwards scenario: While price is traded above the moving averages short-term bias would be considered as bullish. Next on tap is resistive barrier at 1.5419 (R1) on the way towards to higher targets at 1.5445 (R2) and 1.5470 (R3). Downwards scenario: On the other hand, break below the support at 1.5370 (S1) is required to enable further market decline. Our next supportive measures locates at 1.5343 (S2) and 1.5316 (S3).

Resistance Levels: 1.5419, 1.5445, 1.5470

Support Levels: 1.5370, 1.5343, 1.5316

-------------------------

USDJPY :

HIGH 99.402 LOW 98.626 BID 98.766 ASK 98.771 CHANGE -0.52% TIME 08:36:58

OUTLOOK SUMMARY : Down

TREND CONDITION : Up trend

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : Low

Upwards scenario: USDJPY gained momentum on the downside and likely will close on the negative territory today. However clearance of our next resistive structure at 98.94 (R1) would open way towards to our initial target at 99.11 (R2) and any further market rise would then be targeting 99.29 (R3). Downwards scenario: On the other side, a dip below the initial support level at 98.53 (S1) is liable to trigger protective orders execution and drive market price towards to supportive means at 98.38 (S2) and 98.21 (S3).

Resistance Levels: 98.94, 99.11, 99.29

Support Levels: 98.53, 98.38, 98.21

Source: FX Central Clearing Ltd,( http://www.fxcc.com )

Forex Technical & Market Analysis FXCC Jul 29 2013

Japan's PM Abe rethinks sales tax hike; inflation case strengthens?

Japan's most significant fiscal reform in years, that is, a planned hike from 5% to 8% in sales tax by April 2014, faces the prospects of being delayed or watered down as concerns mount the tax increase may do more harm than good to the delicate economic recovery in the country. According to a report from Reuters earlier on Monday: "PM Abe says he will decide in the autumn whether to proceed with the first part of the two-stage plan after gauging the state of the economic recovery, especially GDP data that is due on Sept 9."

https://support.fxcc.com/email/technical/29072013/

FOREX ECONOMIC CALENDAR :

N/A | Bank of Japan Governor Kuroda Speech

2013-07-29 08:30 GMT | UK. Mortgage Approvals

2013-07-29 14:00 GMT | US. Pending Home Sales (YoY)

2013-07-29 23:50 GMT | Japan. Industrial Production (YoY)

FOREX NEWS :

2013-07-29 05:20 GMT | USD/JPY pulling back after Kuroda headlines make the rounds

2013-07-29 04:50 GMT | GBP/USD capped below big 1.54 figure

2013-07-29 04:44 GMT | EUR/USD approaching flat line for the session after initial upside

2013-07-29 04:09 GMT | AUD/JPY hovering above Friday’s lows of 90.56. Target 89.39, but will it bounce first?

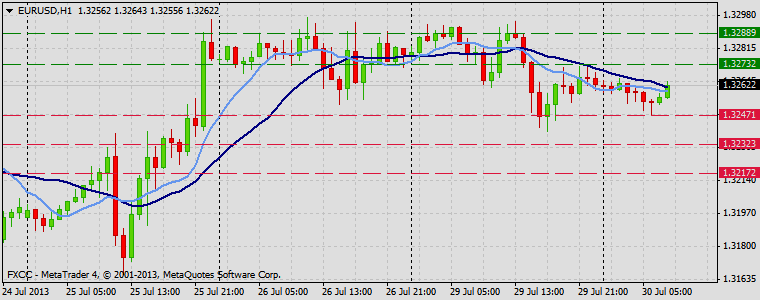

EURUSD

HIGH 1.32936 LOW 1.32735 BID 1.32770 ASK 1.32775 CHANGE -0.01% TIME 08:34:38

OUTLOOK SUMMARY : Up

TREND CONDITION : Sideway

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : Low

MARKET ANALYSIS - Intraday Analysis

Upwards scenario: Market took a breath after last days gains. Though possible clearance of our next resistive barrier at 1.3297 (R1) would suggest next intraday targets at 1.3316 (R2) and 1.3333 (R3) in potential. Downwards scenario: Fractal level, formed on the 24-07-2013 provides an important supportive mark at 1.3256 (S1). Any penetration below this level would suggest next targets at 1.3237 (S2) and 1.3217 (S3) in potential.

Resistance Levels: 1.3297, 1.3316, 1.3333

Support Levels: 1.3256, 1.3237, 1.3217

--------------------------

GBPUSD :

HIGH 1.54043 LOW 1.53747 BID 1.53816 ASK 1.53823 CHANGE 0.08% TIME 08:34:39

OUTLOOK SUMMARY : Neutral

TREND CONDITION : Sideway

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : Low

Upwards scenario: Further positive bias development would face next resistive measure at 1.5419 (R1). If the price manages to overcome it we would suggest next intraday targets at 1.5445 (R2) and 1.5470 (R3). Downwards scenario: Possible recovery action might get acceleration below the support level at 1.5370 (S1). Loss here would suggest next intraday target at 1.5343 (S2) and any weakening below it would then be limited to final support at 1.5316 (S3).

Resistance Levels: 1.5419, 1.5445, 1.5470

Support Levels: 1.5370, 1.5343, 1.5316

-------------------------

USDJPY :

HIGH 98.34 LOW 97.633 BID 97.880 ASK 97.880 CHANGE -0.37% TIME 08:34:40

OUTLOOK SUMMARY : Down

TREND CONDITION : Down trend

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : Medium

Upwards scenario: Medium term bias remains negative and possible price appreciation is limited to resistive barrier at 98.21 (R1). Prolonged movement above that level would suggest next intraday targets at 98.46 (R2) and 98.71 (R3). Downwards scenario: Further market weakening is protected by important technical level at 97.63 (S1). Break here is required to open road towards to interim target at 97.39 (S2) en route to final aim at 97.14 (S3).

Resistance Levels: 98.21, 98.46, 98.71

Support Levels: 97.63, 97.39, 97.14

Source: FX Central Clearing Ltd,( http://www.fxcc.com )

Forex Technical & Market Analysis FXCC Jul 30 2013

RBA Stevens speech recap: Still some scope to ease after last CPI

Governor of the RBA, Glenn Stevens, is giving his annual speech to The Anika Foundation Luncheon in Sydney, and some explosive comments are now crossing the wires. The topic of the speech is current issues in economic policy. According to RBA's Stevens, long rise in mining investment is now over, saying that coming fall could be "quite big". Stevens said that easing is working to shift investors to taking some more risk, adding that shift in risk taking not yet a serious impediment to further policy easing. Stevens remained dovish on his tone, saying that "still has some scope to ease after inflation data." On the Aussie value, Stevens wouldn't be surprised if it falls further, as "the fall makes economic sense."

https://support.fxcc.com/email/technical/30072013/

FOREX ECONOMIC CALENDAR :

2013-07-30 09:00 GMT | EMU. Consumer Confidence (Jul)

2013-07-30 12:00 GMT | Germany. Consumer Price Index (YoY)

2013-07-30 14:00 GMT | US. Consumer Confidence (Jul)

2013-07-30 23:13 GMT | Japan. Nomura/ JMMA Manufacturing Purchasing Manager Index (Jul)

FOREX NEWS :

2013-07-30 05:38 GMT | AUD/JPY slashes below key support at 89.39 on Stevens comments

2013-07-30 05:05 GMT | AUD/USD craters below recent trading range on Stevens’ speech

2013-07-30 05:03 GMT | NZD/USD breaks below 0.80 following RBA Stevens

2013-07-30 03:51 GMT | USD/JPY explodes towards 98.40/50 stops

EURUSD :

HIGH 1.32661 LOW 1.32474 BID 1.32587 ASK 1.32590 CHANGE -0.03% TIME 08:40:16

OUTLOOK SUMMARY : Up

TREND CONDITION : Downward penetration

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : Medium

MARKET ANALYSIS - Intraday Analysis

Upwards scenario: Market trapped to the consolidation phase after initial uptrend development. Further buying interest might occur above the resistance at 1.3273 (R1). Our initial targets locates at 1.3288 (R2) and 1.3304 (R3) Downwards scenario: If the price manages to clear an important technical level at 1.3247 (S1), recovery action might get more stimulus. Our next support levels locates at 1.3232 (S2) and 1.3217 (S3).

Resistance Levels: 1.3273, 1.3288, 1.3304

Support Levels: 1.3247, 1.3232, 1.3217

---------------------------

GBPUSD :

HIGH 1.53438 LOW 1.53152 BID 1.53391 ASK 1.53398 CHANGE 0% TIME 08:40:17

OUTLOOK SUMMARY : Down

TREND CONDITION : Downward penetration

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : Medium

Upwards scenario: GBPUSD is approaching our next resistive barrier at 1.5345 (R1). Break here is required to prolong upside pressure and trigger our intraday targets at 1.5360 (R2) and 1.5376 (R3) later on today. Downwards scenario: Further downtrend expansion might face next hurdle at the local low- 1.5314 (S1). Break here is required to open road towards to our next interim target at 1.5299 (S2) en route to final aim at 1.5283 (S3).

Resistance Levels: 1.5345, 1.5360, 1.5376

Support Levels: 1.5314, 1.5299, 1.5283

----------------------

USDJPY :

HIGH 98.463 LOW 97.849 BID 98.372 ASK 98.376 CHANGE 0.43% TIME 08:40:17

OUTLOOK SUMMARY : Down

TREND CONDITION : Upward penetration

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : Medium

Upwards scenario: Medium term bias is clearly negative however we expect resuming of the recovery action if the price manages to overcome key resistive bastion at 98.46 (R1). In such case we would suggest next intraday targets at 98.71 (R2) and 98.96 (R3). Downwards scenario: Our next support level locates at 97.99 (S1) mark. Possible penetration below this mark would open way towards to next target at 97.73 (S2) and then final aim lie at 97.47 (S3) price level.

Resistance Levels: 98.46, 98.71, 98.96

Support Levels: 97.99, 97.73, 97.47

Source: FX Central Clearing Ltd,( http://www.fxcc.com )

Forex Technical & Market Analysis FXCC Jul 31 2013

The world awaits the FOMC decision and statements

Unlike many of the recent Fed meetings, Today’s meeting will feature only the FOMC’s decision and accompanying statement – but still the world is watching. Today’s interest rate decision will only be accompanied by their official statement regarding their decision. Traders and analysts are hoping for more guidance on the Fed’s plans regarding their bond buying program.

https://support.fxcc.com/email/technical/31072013/

FOREX ECONOMIC CALENDAR :

2013-07-31 09:00 GMT | EMU. Consumer Price Index - Core (YoY)

2013-07-31 12:30 GMT | USA. Gross Domestic Product Annualized (Q2)

2013-07-31 18:00 GMT | USA. Fed Interest Rate Decision

2013-07-31 18:00 GMT | USA. Fed's Monetary Policy Statement and press conference

FOREX NEWS :

2013-07-31 04:43 GMT | Today is the big day, USD to be pressured - SocGen

2013-07-31 04:29 GMT | FOMC client survey results; most hold USD longs - Nomura

2013-07-31 04:25 GMT | NZD/USD holding above 0.7950 while capped below 0.80

2013-07-31 04:04 GMT | USD to strengthen as 'dovish' Fed priced in - RBS

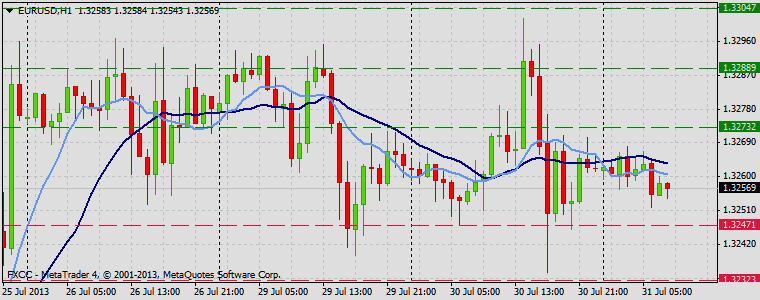

EURUSD :

HIGH 1.3268 LOW 1.32517 BID 1.32572 ASK 1.32577 CHANGE -0.04% TIME 08:46:29

OUTLOOK SUMMARY : Neutral

TREND CONDITION : Sideway

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : High

MARKET ANALYSIS - Intraday Analysis

Upwards scenario: All supports and resistances remains the same today. Mark at 1.3273 (R1) acts as next resistive barrier on the way if the pair keeps it upside potential. Break here is required to achieve higher targets at 1.3288 (R2) and 1.3304 (R3) later on today. Downwards scenario: On the other side, depreciation below the support at 1.3247 (S1) might shift short-term tendency to the bearish side and validate our intraday targets at 1.3232 (S2) and 1.3217(S3).

Resistance Levels: 1.3273, 1.3288, 1.3304

Support Levels: 1.3247, 1.3232, 1.3217

--------------------------

GBPUSD :

HIGH 1.52434 LOW 1.52185 BID 1.52244 ASK 1.52250 CHANGE -0.09% TIME 08:46:30

OUTLOOK SUMMARY : Down

TREND CONDITION : Down trend

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : High

Upwards scenario: Instrument gained momentum on the downside recently, turning short-term bias to the negative side. Though, upwards penetration above the resistance at 1.5252 (R1) might enable bullish forces and expose our initial targets at 1.5267 (R2) and 1.5282 (R3). Downwards scenario: On the other side, depreciation below the support barrier at 1.5215 (S1) might provide sufficient space for the recovery action. In such case we would suggest next intraday targets at 1.5205 (S2) and then 1.5186 (S3).

Resistance Levels: 1.5252, 1.5267, 1.5282

Support Levels: 1.5215, 1.5205, 1.5186

--------------------

USDJPY :

HIGH 98.162 LOW 97.847 BID 98.019 ASK 98.020 CHANGE -0.01% TIME 08:46:31

OUTLOOK SUMMARY : Down

TREND CONDITION : Sideway

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : High

Upwards scenario: Possible volatility increase might commence new phase of downtrend extension either prolong retracement formation on the hourly chart frame. Price appreciation above the resistance at 98.23 (R1) would suggest intraday targets at 98.44 (R2) and 98.65 (R3). Downwards scenario: On the downside, next on tap is seen support level at 97.74 (S1). Clearance here is required to enable lower targets at 97.49 (S2) and 97.25 (S3)

Resistance Levels: 98.23, 98.44, 98.65

Support Levels: 97.74, 97.49, 97.25

Source: FX Central Clearing Ltd,( http://www.fxcc.com )