Market Overview by FXCC

Forex Technical & Market Analysis FXCC Jun 26 2013

Pause Before Another Big Move?

Based on the price action over the past 48 hours in the forex market, volatility has declined as traders and investors wait for a fresh catalyst to drive the dollar higher. Better than expected U.S. economic data helped the greenback hold onto its gains against most of the major currencies but after such an extensive rally, the market is waiting for some confirmation that the Federal Reserve is on track to taper this year and won't do too much damage on the U.S. economy. The latest economic reports suggests that the economy may be able handle less stimulus but that is far from certain. As we said on Monday, the key is whether the other FOMC members are onboard with the idea. Right now, currency traders are in wait and see mode as they look forward to the next big catalyst - which could come from the speeches by Fed officials.

https://support.fxcc.com/email/technical/26062013/

FOREX ECONOMIC CALENDAR :

2013-06-26 06:00 GMT | Germany. Gfk Consumer Confidence Survey (Jul)

2013-06-26 09:30 GMT | UK. BoE's Governor King Speech

2013-06-26 12:30 GMT | USA. Gross Domestic Product. Annualized

2013-06-26 22:45 GMT | New Zeland. Trade Balance (MoM)

FOREX NEWS :

2013-06-26 04:35 GMT | The Greenback awaits next catalyst

2013-06-26 03:41 GMT | EUR/USD feeling the selling pressure; holds above 1.3050

2013-06-26 02:33 GMT | GBP/USD risk skewed to the downside - RBS

2013-06-26 01:59 GMT | USD/JPY dips below 98.00 on Yen strength

--------------------------

EURUSD :

HIGH 1.30872 LOW 1.30569 BID 1.30681 ASK 1.30687 CHANGE -0.1% TIME 08:21:14

OUTLOOK SUMMARY : Down

TREND CONDITION : Down trend

TRADERS SENTIMENT : Bullish

IMPLIED VOLATILITY : Medium

MARKET ANALYSIS - Intraday Analysis

Upwards scenario: Despite the current consolidation pattern, EURUSD remains in downtrend formation on the bigger picture. Clearance of our next resistance level at 1.3102 (R1) might trigger corrective action towards to our initial targets at 1.3129 (R2) and 1.3156 (R3). Downwards scenario: Risk of further price regress is seen below the support level at 1.3054 (S1). Clearance here is required to enable bearish pressure towards to next aims at 1.3029 (S2) and 1.3004 (S3) in potential.

Resistance Levels: 1.3102, 1.3129, 1.3156

Support Levels: 1.3054, 1.3029, 1.3004

--------------------------

GBPUSD :

HIGH 1.54273 LOW 1.54022 BID 1.54215 ASK 1.54227 CHANGE 0.01% TIME 08:21:14

OUTLOOK SUMMARY : Down

TREND CONDITION : Downward penetration

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : Medium

Upwards scenario: Market sentiment has improved for the bullish oriented traders yesterday though medium term bias remains negative. Next visible fractals level at 1.5436 (R1) offers a key resistance level. Break here would suggest higher targets at 1.5458 (R2) and 1.5479 (R3). Downwards scenario: Current price pattern suggests bearish potential if the pair manages to overcome next support level at 1.5397 (S1). Possible price regress could expose our initial targets at 1.5377 (S2) and 1.5356 (S3) later on today.

Resistance Levels: 1.5436, 1.5458, 1.5479

Support Levels: 1.5397, 1.5377, 1.5356

--------------------

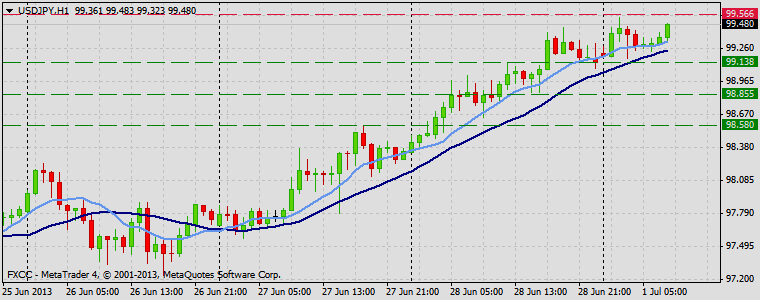

USDJPY :

HIGH 98.235 LOW 97.646 BID 97.770 ASK 97.773 CHANGE -0.06% TIME 08:21:15

OUTLOOK SUMMARY : Neutral

TREND CONDITION : Downward penetration

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : Medium

Upwards scenario: Possibility of market strengthening is seen above the immediate resistive barrier at 97.92 (R1). Rise above that level would suggest next interim target at 98.14 (R2) and then final aim locates at 98.37 (R3). Downwards scenario: On the downside our attention is shifted to the immediate support level at 97.39 (S1). Break here is required to enable bearish forces and expose our intraday targets at 97.19 (S2) and 96.99 (S3).

Resistance Levels: 97.92, 98.14, 98.37

Support Levels: 97.39, 97.19, 96.99

Source: FX Central Clearing Ltd,( http://www.fxcc.com )

Forex Technical & Market Analysis FXCC Jun 28 2013

Should the Dollar be Worried about Fed Comments?

Fed Presidents Dudley, Powell and Lockhart spoke yesterday and with the first 2 being voting members of the FOMC this year, its no surprise that their comments triggered intraday volatility in the dollar. All 3 Fed Presidents said that it may be appropriate for the central bank to taper asset purchases in 2013 and end QE buying in mid-2014 but the markets chose to hone in on Dudley's comment that QE depends on the economic outlook and not the calendar and could be prolonged if the economy misses their forecasts. There's no question that the recent rise in U.S. yields has irritated central bankers but the fact Dudley still repeated Bernanke's timing after qualifying the conditions for QE means that this uber dove is most likely onboard with the idea of reducing asset purchases. Fed President Powell's stance was similar - while he sees the central bank scaling back purchases this year, he said it is data and not date dependent. Both Dudley and Lockhart didn't see Bernanke's press conference last week as a strong signal of Fed policy or a major shift but rather a "soft notion" of when QE could end.

https://support.fxcc.com/email/technical/28062013/

FOREX ECONOMIC CALENDAR :

2013-06-28 06:00 GMT | UK. Nationwide Housing Prices n.s.a (YoY) (Jun)

2013-06-28 12:00 GMT | Germany. Consumer Price Index (YoY) (Jun)

2013-06-28 12:30 GMT | Canada. Gross Domestic Product (MoM)

2013-06-28 13:55 GMT | USA. Reuters/Michigan Consumer Sentiment Index (Jun)

FOREX NEWS :

2013-06-28 05:27 GMT | AUD/JPY set to recover towards 94.00 - Westpac

2013-06-28 04:32 GMT | GBP/USD struggles around the 20 hourly EMA

2013-06-28 03:29 GMT | EUR/AUD easing below 1.4150

2013-06-28 02:58 GMT | USD/JPY prints fresh weekly highs shy of 99.00

---------------------------

EURUSD :

HIGH 1.30747 LOW 1.30301 BID 1.30613 ASK 1.30618 CHANGE 0.19% TIME 08 : 16:12

OUTLOOK SUMMARY : Up

TREND CONDITION : Upward penetration

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : Medium

MARKET ANALYSIS - Intraday Analysis

Upwards scenario: An element of resistive measure could be found at 1.3077 (R1). Clearance here would open way towards to higher target at 1.3101 (R2) and any further rise would then be limited to last resistance at 1.3124 (R3). Downwards scenario: Possible price depreciation is limited to next support barrier at 1.3042 (S1). Break here is required to enable further downtrend formation towards to lower targets at 1.3018 (S2) and 1.2993 (S3).

Resistance Levels: 1.3077, 1.3101, 1.3124

Support Levels: 1.3042, 1.3018, 1.2993

-------------------

GBPUSD :

HIGH 1.52745 LOW 1.52413 BID 1.52688 ASK 1.52695 CHANGE 0.07% TIME 08 : 16:13

OUTLOOK SUMMARY : Down

TREND CONDITION : Upward penetration

TRADERS SENTIMENT : Bullish

IMPLIED VOLATILITY : Medium

Upwards scenario: GBPUSD commenced its consolidation phase on the hourly chart today. Possibility of uptrend evolvement is seen above the next resistance at 1.5283 (R1). Violation here might increase bullish pressure and validate next intraday targets at 1.5311 (R2) and 1.5338 (R3). Downwards scenario: Risk of market depreciation is seen below the next support level at 1.5240 (S1). Clearance here would suggest next intraday targets at 1.5213 (S2) and 1.5186 (S3) in potential.

Resistance Levels: 1.5283, 1.5311, 1.5338

Support Levels: 1.5240, 1.5213, 1.5186

-------------------

USDJPY :

HIGH 99.022 LOW 98.335 BID 98.844 ASK 98.849 CHANGE 0.51% TIME 08 : 16:14

OUTLOOK SUMMARY : Up

TREND CONDITION : Up trend

TRADERS SENTIMENT : Bullish

IMPLIED VOLATILITY : Medium

Upwards scenario: Market sentiment is improved for the bullish oriented traders however further appreciation needs to clear barrier at 99.06 (R1) to enable our interim target at 99.36 (R2) and then any further gains would be limited to last resistance at 99.67 (R3). Downwards scenario: While instrument trades above the moving averages, our short-term bias would stay positive though penetration below the support level at 98.58 (S1) might open way towards to lower targets at 98.27 (S2) and 97.97 (S3).

Resistance Levels: 99.06, 99.36, 99.67

Support Levels: 98.58, 98.27, 97.97

Source: FX Central Clearing Ltd,( http://www.fxcc.com )

Forex Technical & Market Analysis FXCC Jul 01 2013

China top banking regulator says enough liquidity

The Chinese top banking regulatory body appeased fears over the credit crunch in the country, saying that liquidity remains ample for the interbank needs. Regulators reassured the markets by pledging to tighten risk controls over local government, real estate and shadow banking. The chairman of the China Banking Regulatory Commission, Mr. Shang, said "excess reserves more than double amount necessary", although Shanga failed to provide further details on how they intend to reduce shadow banking practices.

According to Bloomberg, citing Shang Fulin, "Banks had about 1.5 trillion yuan ($244.4 billion) of cash reserves as of June 28 that could be used for payment and settlement needs, more than double what is usually required." Mr. Shang added that “The tight liquidity condition on the interbank market has been easing in the last few days", reassuring that "This type of situation won’t affect the banking sector’s smooth operations.” The comments from Mr. Shang follow a pledge from the People’s Bank of China governor Zhou Xiaochuan, who said last June 28, that the Chinese financial marketplace will not be disrupted by the liquidity deficiencies. The calmed approached by Chinese top decision-makers aided Chinese bank stocks, one of the best performing sectors end of last week. “Some people have compared our local government debt to European debt, but there’s a big difference -- our debts are accumulated for production not for consumption -- most of them have assets as guarantees and the overall risk is controllable,” Shang said, cite by Bloomberg.

https://support.fxcc.com/email/technical/01072013/

FOREX ECONOMIC CALENDAR :

2013-07-01 07:58 GMT | EMU. Markit Manufacturing PMI

2013-07-01 08:28 GMT | UK. Markit Manufacturing PMI

2013-07-01 09:00 GMT | EMU. Consumer Price Index

2013-07-01 14:00 GMT | USA. ISM Manufacturing PMI

FOREX NEWS :

2013-07-01 04:59 GMT | GBP/USD stalls the decline above 1.5200

2013-07-01 04:50 GMT | Will the big USD rally be sustainable?

2013-07-01 03:36 GMT | AUD/USD breaking above 0.9180

2013-07-01 02:17 GMT | EUR/AUD hovering above 1.4200

EURUSD :

HIGH 1.30325 LOW 1.30053 BID 1.30286 ASK 1.30289 CHANGE 0.16% TIME 08:40:42

OUTLOOK SUMMARY : Neutral

TREND CONDITION : Sideway

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : Medium

MARKET ANALYSIS - Intraday Analysis

Upwards scenario: Without tier one macroeconomic news announcement neutral mode remains favored. Clearance of next resistance level at 1.3040 (R1) might enable bullish pressure and open route towards to our next targets at 1.3062 (R2) and 1.3084 (R3). Downwards scenario: Possible downside extension might face next supportive barrier at 1.2990 (S1). Clearance here is required to open the way towards to interim target at 1.2971 (S2) and any further price regress would then be targeting 1.2951 (S3).

Resistance Levels: 1.3040, 1.3062, 1.3084

Support Levels: 1.2990, 1.2971, 1.2951

----------------------

GBPUSD :

HIGH 1.52265 LOW 1.51953 BID 1.52248 ASK 1.52258 CHANGE 0.12% TIME 08:40:43

OUTLOOK SUMMARY : Down

TREND CONDITION : Upward penetration

TRADERS SENTIMENT : Bullish

IMPLIED VOLATILITY : Low

Upwards scenario: Descending structure on GBPUSD suggests possible correction ahead. Break above the resistance at 1.5240 (R1) would clear the way towards to higher target at 1.5271 (R2). Further price appreciation would face then final resistive measure at 1.5303 (R3) Downwards scenario: Next support level lies at 1.5187 (S1). Penetration below it might shift medium-term tone to the negative side. Our intraday targets locates at 1.5159 (S2) and 1.5130 (S3).

Resistance Levels: 1.5240, 1.5271, 1.5303

Support Levels: 1.5187, 1.5159, 1.5130

--------------------

USDJPY :

HIGH 99.54 LOW 99.176 BID 99.389 ASK 99.396 CHANGE 0.25% TIME 08:40:44

OUTLOOK SUMMARY : Up

TREND CONDITION : Up trend

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : Low

Upwards scenario: USDJPY clearly determined positive bias on the medium-term perspective. Penetration above the resistive structure at 99.56 (R1) might encourage protective orders execution and drive market price towards to the next resistive means at 99.84 (R2) and 100.11 (R3). Downwards scenario: Price regress below the support level at 99.13 (S1) would increase likelihood of failing towards to the next supportive barrier at 98.85 (S2) and any further correction development would then be targeting final support at 98.58 (S3).

Resistance Levels: 99.56, 99.84, 100.11

Support Levels: 99.13, 98.85, 98.58

Source: FX Central Clearing Ltd,( http://www.fxcc.com )

Forex Technical & Market Analysis FXCC Jul 05 2013

EUR and GBP Crushed by ECB and BoE

Big moves are happening in the FX market yesterday. The euro and British pound dropped to 5 week lows against the U.S. dollar, taking out key levels in the process. The absence of U.S. traders most likely compounded the volatility in currencies. The European Central Bank and the Bank of England left monetary policy unchanged but Mario Draghi and Mark Carney made it clear that both central banks have a bias to ease. The dovish comments from European central bankers were motivated by the recent volatility in interest rates and a desire to set themselves apart from the Federal Reserve who is on a path to reduce stimulus. The ECB and the BoE wants everyone to know that they are still prepared to increase stimulus if the volatility in the bond markets persist or their economies weaken. In the Eurozone in particular, the EUR/USD dropped through 1.30 and 1.29. The currency started to fall as soon as Draghi said that policy will remains accommodative as long as needed, there are downside risks to their economic outlook and rates will stay low for an extended period of time. The sell-off gained momentum when the central bank took the unprecedented step of forward guidance. The ECB said there is no exit in sight, they are keeping rates low for an extended period of time, their decision will be data dependent and they are keeping an open mind on negative deposit rates. Draghi also reminded everyone that the central bank is "technically ready" for negative rates. They had an extensive discussion about the possibility of a rate cut and unanimously decided that the guidance was needed which included saying that 50bp is not the lower bound. The central bank is screaming their bias to ease from the top of the mountain - they don't want to leave any room for ambiguity because the risk could be a further rise in yields. Having dropped below 1.29, the next support for the EUR/USD should be at 1.28.

https://support.fxcc.com/email/technical/05072013/

FOREX ECONOMIC CALENDAR :

2013-07-05 10:00 GMT | Germany. Factory Orders n.s.a. (YoY)

2013-07-05 12:30 GMT | Canada. Unemployment Rate

2013-07-05 12:30 GMT | USA. Nonfarm Payrolls

2013-07-05 12:30 GMT | USA. Unemployment Rate

FOREX NEWS :

2013-07-05 04:51 GMT | EUR/GBP limited below 0.8580 asks

2013-07-05 04:46 GMT | NFP amid low liquidity; drastic moves ahead?

2013-07-05 04:22 GMT | GBP/USD hovering around 1.5050

2013-07-05 03:39 GMT | AUD/USD extends decline below 0.9130

EURUSD

HIGH 1.29166 LOW 1.28878 BID 1.28983 ASK 1.28988 CHANGE -0.12% TIME 08 : 24:40

OUTLOOK SUMMARY : Down

TREND CONDITION : Down trend

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : High

MARKET ANALYSIS - Intraday Analysis

Upwards scenario: The possibility of an upside price progress is seen above the resistance level at 1.2931 (R1). Evaluation above this mark might initiate bullish pressure and expose medium-term interim targets at 1.2952 (R2) and 1.2974 (R3). Downwards scenario: We placed our support level right above the yesterday low at 1.2881 (S1). Clearance here is required to open way towards to our interim target at 1.2862 (S2) and then final aim locates at 1.2842 (S3).

Resistance Levels: 1.2931, 1.2952, 1.2974

Support Levels: 1.2881, 1.2862, 1.2842

-------------------------

GBPUSD :

HIGH 1.50777 LOW 1.50268 BID 1.50465 ASK 1.50478 CHANGE -0.16% TIME 08 : 24:41

OUTLOOK SUMMARY : Down

TREND CONDITION : Down trend

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : High

Upwards scenario: Nonfarm Payrolls announcement might change overall technical structure. We see potential to overcome our next resistive barrier at 1.5090 (R1). Any prolonged movement above it would suggest next intraday targets at 1.5120 (R2) and 1.5151 (R3). Downwards scenario: Risk of price depreciation is seen below the support level at 1.5024 (S1). A fall below it might prolong medium-term weakness towards to next support at 1.4992 (S2) and any further market decline would then be targeting final support at 1.4959 (S3).

Resistance Levels: 1.5090, 1.5120, 1.5151

Support Levels: 1.5024, 1.4992, 1.4959

--------------------------

USDJPY :

HIGH 100.458 LOW 99.999 BID 100.257 ASK 100.261 CHANGE 0.22% TIME 08 : 24:42

OUTLOOK SUMMARY : Up

TREND CONDITION : Upward penetration

TRADERS SENTIMENT : Bullish

IMPLIED VOLATILITY : Medium

Upwards scenario: Neutral tone dominates on the hourly chart frame. Local high offers an important resistive structure at 100.45 (R1). Any penetration above that level would suggest next targets at 100.68 (R2) and 100.90 (R3). Downwards scenario: Possible downside expansion is limited to the next support level at 100.15 (S1). Break here is required to open way towards to initial targets at 99.92 (S2) and 99.70 (S3).

Resistance Levels: 100.45, 100.68, 100.90

Support Levels: 100.15, 99.92, 99.70

Source: FX Central Clearing Ltd,( http://www.fxcc.com )

ECB members had heated clash over last rate decision

ECB Governing Council members had a confrontational approach over interest rates at their latest board meeting on Thursday, according to German weekly Der Spiegel, citing no sources, the MNI newswire reports. Der Spiegel claims to have obtained insights over the dovish views from ECB chief economist Peter Praet, who proposed to cut the benchmark interest rate by 25 bp in the last meeting, an action that ECB President Mario Draghi would have supported.

However, as MNI reports, "seven board members, mainly from northern European member states, were arguing sharply against a rate cut last week, the magazine reported." Der Spiegel reports German Bundesbank President Jens Weidmann, Dutch central bank governor Klaas Knot as well as ECB Executive Board member Joerg Asmussen, as the most notoriously opposed to it. As is well known, the final decision taken by the board was to unanimously keep the benchmark rate unchanged at 0.5% while providing forward guidance on low rates. Draghi's said that "broad-based weakness in the real economy and subdued monetary dynamics" will keep rates at present or lower levels for an extended period of time.

https://support.fxcc.com/email/technical/08072013/

FOREX ECONOMIC CALENDAR :

24h | All. Eurogroup Meeting

2013-07-08 13:30 GMT | EMU. ECB President Draghi's Speech

2013-07-08 14:30 GMT | Canada. Bank of Canada Business Outlook Survey (Q2)

2013-07-08 19:00 GMT | USA. Consumer Credit Change

FOREX NEWS :

2013-07-08 04:59 GMT | Calls to buy USD all over; time to be sellers?

2013-07-08 04:26 GMT | GBP/USD strongly capped below 1.4900

2013-07-08 03:40 GMT | Buy AUD/NZD targeting 1.2130/70 - Societe Generale

2013-07-08 03:38 GMT | AUD/CAD depressed below 0.96 round

------------------------

EURUSD :

HIGH 1.28319 LOW 1.28106 BID 1.28169 ASK 1.28173 CHANGE -0.11% TIME 08 : 30:00

OUTLOOK SUMMARY : Down

TREND CONDITION : Down trend

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : Medium

MARKET ANALYSIS - Intraday Analysis

Upwards scenario: Market players may prefer to stay neutral today during limited tier one macroeconomic data flow, though a break of our resistance at 1.2852 (R1) would suggest next targets at 1.2879 (R2) and 1.2905 (R3). Downwards scenario: Friday low offers a key support barrier at 1.2805 (S1). Only clear break here would be a signal of possible market easing towards to next targets at 1.2781 (S2) and 1.2757 (S3) in potential.

Resistance Levels: 1.2852, 1.2879, 1.2905

Support Levels: 1.2805, 1.2781, 1.2757

----------------------------

GBPUSD :

HIGH 1.48824 LOW 1.48582 BID 1.48765 ASK 1.48774 CHANGE -0.02% TIME 08 : 30:01

OUTLOOK SUMMARY : Down

TREND CONDITION : Down trend

TRADERS SENTIMENT : Bullish

IMPLIED VOLATILITY : Medium

Upwards scenario: Upside risk aversion is seen above the next resistance level at 1.4923 (R1). Appreciation above it might lead would enable corrective phase, targeting resistive measures at 1.4962 (R2) and 1.4999 (R3) in potential. Downwards scenario: On the other hand, if the pair accelerates on the downside and manage to break our next support level at 1.4853 (S1), it is likely to trigger our next support level at 1.4818 (S2) and 1.4782 (S3) later on today.

Resistance Levels: 1.4923, 1.4962, 1.4999

Support Levels: 1.4853, 1.4818, 1.4782

-----------------------

USDJPY :

HIGH 101.531 LOW 101.06 BID 101.095 ASK 101.100 CHANGE -0.08% TIME 08:30:02

OUTLOOK SUMMARY : Up

TREND CONDITION : Upward penetration

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : Medium

Upwards scenario: Uptrend evolvement remains in power. Further appreciation above the resistive barrier at 101.53 (R1) is liable to next intraday targets at 101.81 (R2) and 102.09 (R3). Downwards scenario: Possible retracement action might get more stimulus below the support level at 100.87 (S1). Loss here would suggest next intraday target at 100.58 (S2) and any weakening below it would then face final support at 100.28 (S3).

Resistance Levels: 101.53, 101.81, 102.09

Support Levels: 100.87, 100.58, 100.28

Source: FX Central Clearing Ltd,( http://www.fxcc.com )

roika approves next disbursment to Greece

Troika officials struck a deal with Greece this Monday, allowing the debt-laden country to receive its next tranche of funds, totalling The money, totaling 6.8bn euros ($8.7bn). The troika of the European Commission, the European Central Bank and the International Monetary Fund (IMF) will be responsible to make the funds available end of the month. Eurozone finance ministers indicated earlier today that 2.5bn euros would come from the eurozone rescue fund and 1.5bn euros, while the European Central Bank will contribute with another 1.5bn euros. It is thought that an additional 500m euros from both the EZ rescue fund and the ECB will be transferred in October. The IMF will add the remaining 1.8bn euros.

The loans are subject to Greece showing a committal approach towards the country's fiscal path, with the Troika demanding further cuts and a faster implementation of its reform programme, one that has brought the country to its knees. Despite so, the Troika continues to underline the slow progress seen so far, as the country continues to struggle through an era of depression.

https://support.fxcc.com/email/technical/09072013/

FOREX ECONOMIC CALENDAR :

24h | EcoFin Meeting

2013-07-09 08:30 GMT | UK. Manufacturing Production (YoY)

2013-07-09 12:15 GMT | Canada. Housing Starts s.a (YoY)

2013-07-09 14:00 GMT | UK. NIESR GDP Estimate (3M)

FOREX NEWS :

2013-07-09 04:52 GMT | GBP/USD stalls the recovery below 1.4950

2013-07-09 04:50 GMT | EUR/USD aiming at 2nd daily gain

2013-07-09 03:09 GMT | NZD/USD back around 0.78 post-China CPI

2013-07-09 03:02 GMT | AUD/JPY setting stage for a 92.50 breakout?

-----------------------------

EURUSD :

HIGH 1.28711 LOW 1.2846 BID 1.28677 ASK 1.28683 CHANGE -0.01% TIME 08:33:00

OUTLOOK SUMMARY : Up

TREND CONDITION : Upward penetration

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : Medium

MARKET ANALYSIS - Intraday Analysis

Upwards scenario: Instrument gained momentum on the upside recently, turning short-term bias to the positive side. Next resistive structure on the way lies at 1.2892 (R1), break here would suggest next intraday targets at 1.2909 (R2) and 1.2926 (R3). Downwards scenario: Failure to establish positive bias today would shift our focus to the next support level at 1.2844 (S1). Clearance here would open way towards to our initial targets at 1.2826 (S2) and 1.2806 (S3).

Resistance Levels: 1.2892, 1.2909, 1.2926

Support Levels: 1.2844, 1.2826, 1.2806

--------------------

GBPUSD :

HIGH 1.4953 LOW 1.49199 BID 1.49434 ASK 1.49442 CHANGE -0.05% TIME 08:33:01

OUTLOOK SUMMARY : Up

TREND CONDITION : Upward penetration

TRADERS SENTIMENT : Bullish

IMPLIED VOLATILITY : Medium

Upwards scenario: Yesterday high offers a key resistive measure at 1.4968 (R1). If the price manages to overcome it we would suggest next intraday targets at 1.4999 (R2) and 1.5029 (R3). Downwards scenario: Any downside extension is limited now to the next support level at 1.4918 (S1). Below here we see potential for the price acceleration towards to next targets at 1.4884 (S2) and 1.4851 (S3).

Resistance Levels: 1.4968, 1.4999, 1.5029

Support Levels: 1.4918, 1.4884, 1.4851

----------------------

USDJPY :

HIGH 101.243 LOW 100.768 BID 101.147 ASK 101.151 CHANGE 0.19% TIME 08:33:02

OUTLOOK SUMMARY : Up

TREND CONDITION : Upward penetration

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : Medium

Upwards scenario: Measures of resistance might be activating if the pair approaches 101.41 (R1) price level. Break here would suggest next interim target at 101.70 (R2) and If the price keeps its momentum we expect an exposure of 101.97 (R3). Downwards scenario: On the other hand, break below the support at 100.76 (S1) is required to enable further market decline. Our next supportive measures locates at 100.49 (S2) and 100.21 (S3).

Resistance Levels: 101.41, 101.70, 101.97

Support Levels: 100.76, 100.49, 100.21

Source: FX Central Clearing Ltd,( http://www.fxcc.com )

Forex Technical & Market Analysis FXCC Jul 10 2013

S&P downgrades Italy to BBB, outlook negative

Ratings Agency Standard & Poor's decided to downgrade Italy on Tuesday, cutting the rating to BBB from BBB+. According to S&P, this action reflects their view of the effects of further weakening growth on Italy's economic structure and resilience, and its impaired monetary transmission mechanism. S&P also left their outlook at negative, meaning there is at least one-in-three chance that the rating could be lowered again in 2013 or 2014.

The highlights today will be the FOMC Minutes and Bernanke’s Speech and until then I don’t see an awful lot to move things around. The 4 hour charts are showing some minor bullish divergence and we could see the odd bounce but the dailies continue to point lower and I suspect that the low 1.2700 area will soon be tested. In the meantime leave room for bounces as the 4 hour charts unwind. We will be adding to our shorts if we see a bounce into the 1.2850/1.2900 in the coming session. German CPI, US FOMC Minutes, Wholesale Inventories, Bernanke Speech Economic data highlights will include: German CPI, US FOMC Minutes, Wholesale Inventories, Bernanke Speech

https://support.fxcc.com/email/technical/10072013/

FOREX ECONOMIC CALENDAR :

2013-07-10 17:00 GMT | USA. 10-Year Note Auction

2013-07-10 18:00 GMT | USA. FOMC Minutes

2013-07-10 20:10 GMT | USA. Fed's Bernanke Speech

N/A | Japan. Monetary Policy Statement

FOREX NEWS :

2013-07-10 05:05 GMT | USD/JPY cracks 101.80 support

2013-07-10 04:28 GMT | GBP/USD finds buyers above 1.4850

2013-07-10 03:56 GMT | EUR/USD unable to regain the 1.28 handle

2013-07-10 03:09 GMT | Gold eases below $1250; Oil below $104

EURUSD :

HIGH 1.27868 LOW 1.27648 BID 1.27823 ASK 1.27828 CHANGE 0.01% TIME 08 : 13:47

OUTLOOK SUMMARY : Down

TREND CONDITION : Sideway

TRADERS SENTIMENT : Bullish

IMPLIED VOLATILITY : Medium

MARKET ANALYSIS - Intraday Analysis

Upwards scenario: EURUSD stabilized on the hourly chart however appreciation above the next resistance at 1.2805 (R1) might be a good catalyst for a recovery action towards to next targets at 1.2833 (R2) and 1.2862 (R3). Downwards scenario: Any downside fluctuations remains for now limited to the next support level at 1.2754 (S1), only clear break here would be a signal of possible market easing towards to next targets at 1.2727 (S2) and 1.2699 (S3) in potential.

Resistance Levels: 1.2805, 1.2833, 1.2862

Support Levels: 1.2754, 1.2727, 1.2699

---------------------

GBPUSD :

HIGH 1.48973 LOW 1.48451 BID 1.48948 ASK 1.48958 CHANGE 0.2% TIME 08 : 13:48

OUTLOOK SUMMARY : Up

TREND CONDITION : Upward penetration

TRADERS SENTIMENT : Bullish

IMPLIED VOLATILITY : Medium

Upwards scenario: Current price setup might suggest volatility increase in near term perspective. If the price get acceleration on the upside and manages to surpass our resistive measure at 1.4926 (R1), we would suggest next targets at 1.4972 (R2) and 1.5018 (R3). Downwards scenario: Yesterday session low provides an important supportive mark at 1.4813 (S1). Any penetration below this level would suggest next targets at 1.4767 (S2) and 1.4722 (S3) in potential.

Resistance Levels: 1.4926, 1.4972, 1.5018

Support Levels: 1.4813, 1.4767, 1.4722

---------------------

USDJPY :

HIGH 101.216 LOW 100.374 BID 100.405 ASK 100.410 CHANGE -0.74% TIME 08 : 13:49

OUTLOOK SUMMARY : Down

TREND CONDITION : Downward penetration

TRADERS SENTIMENT : Bullish

IMPLIED VOLATILITY : High

Upwards scenario: Upside formation is limited now to the next resistive barrier at 100.76 (R1). Clearance here is required to provide a space for a move towards to next target at 101.02 (R2) and then final aim could be found at 101.29 (R3). Downwards scenario: Further downtrend formation might get acceleration below the support level at 100.15 (S1). Loss here would suggest next intraday target at 99.87 (S2) and any weakening below it would then be limited to final support at 99.63 (S3).

Resistance Levels: 100.76, 101.02, 101.29

Support Levels: 100.15, 99.87, 99.63

Source: FX Central Clearing Ltd,( http://www.fxcc.com )

Forex Technical & Market Analysis FXCC Jul 12 2013

ECB Monthly Report: Interest rates could be reduced further

The ECB signalized in its July Monthly Report that interest rates could be reduced further, should the price stability outlook warrant it. The recently introduced forward guidance was also included: “The Governing Council expects the key ECB interest rates to remain at present or lower levels for an extended period of time.” There was also some clarification of its time horizon: “The extended period of time over which the Governing Council currently expects the key ECB interest rates to remain at present or lower levels is a flexible horizon which does not pre-specify an end-date but is conditional on the Governing Council’s assessment of the economic fundamentals that determine underlying inflation."

Furthermore, the Council pointed to recent improvements in Eurozone sentiment indicators which suggest a gradual recovery of the economy later this year and in 2014. To support it, the ECB is prepared to maintain the accomodative monetary policy for as long as necessary. The accomodative policy should prop up domestic demand while the recovery in global demand should boost export growth in the area. Additionally, the Governing Council suggested that “the overall improvements in financial markets seen since last summer should work their way through to the real economy, as should the progress made in fiscal consolidation.”

https://support.fxcc.com/email/technical/12072013/

FOREX ECONOMIC CALENDAR :

2013-07-12 09:00 GMT | EMU. Industrial Production w.d.a. (YoY)

2013-07-12 12:30 GMT | USA. Producer Price Index (YoY)

2013-07-12 13:55 GMT | USA. Reuters/Michigan Consumer Sentiment

2013-07-12 17:00 GMT | USA. Fed's Bullard speech

FOREX NEWS :

2013-07-12 04:44 GMT | GBP/USD eases below 1.5200

2013-07-12 03:27 GMT | Gold below $1290, Oil above $104

2013-07-12 02:41 GMT | AUD/USD defending 0.9130 support

2013-07-12 01:42 GMT | USD/JPY breaks through stops at 99.10

-----------------

EURUSD :

HIGH 1.31002 LOW 1.30728 BID 1.30752 ASK 1.30756 CHANGE -0.16% TIME 08:26:43

OUTLOOK SUMMARY : Up

TREND CONDITION : Upward penetration

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : Medium

MARKET ANALYSIS - Intraday Analysis

Upwards scenario: Fractals level at 1.3124 (R1) offers a key resistive measure on the downside. Break here is required to enable bearish pressure and validate next target at 1.3167 (R2). Final support for today locates at 1.3208 (R3). Downwards scenario: As long as price stays above the moving averages our medium-term outlook would be positive. Though extension lower the 1.3028 (S1) is being able to drive market price towards to initial supports at 1.2988 (S2) and 1.2945 (S3).

Resistance Levels: 1.3124, 1.3167, 1.3208

Support Levels: 1.3028, 1.2988, 1.2945

------------------------

GBPUSD :

HIGH 1.5189 LOW 1.51666 BID 1.51702 ASK 1.51710 CHANGE -0.09% TIME 08:26:44

OUTLOOK SUMMARY : Up

TREND CONDITION : Up trend

TRADERS SENTIMENT : Bullish

IMPLIED VOLATILITY : Medium

Upwards scenario: We are not expecting significant volatility increase today however appreciation above the resistive structure at 1.5222 (R1) might trigger bullish pressure and drive market price towards to next targets at 1.5250 (R2) and 1.5278 (R3). Downwards scenario: Next supportive mark locates at 1.5145 (S1). Depreciation below it might shift short-term tendency to the bearish side and validate our next targets at 1.5117 (S2) and 1.5088 (S3).

Resistance Levels: 1.5222, 1.5250, 1.5278

Support Levels: 1.5145, 1.5117, 1.5088

-------------------

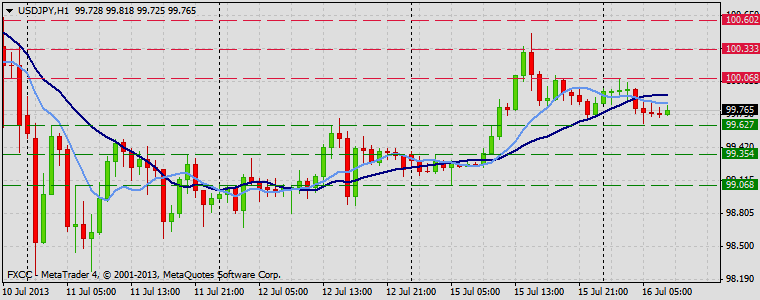

USDJPY :

HIGH 99.321 LOW 98.675 BID 99.048 ASK 99.048 CHANGE 0.11% TIME 08:26:45

OUTLOOK SUMMARY : Down

TREND CONDITION : Sideway

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : Medium

Upwards scenario: USDJPY trapped to the consolidation phase after the initial downtrend formation. Break of resistive level at 99.36 (R1) is required to enable recovery action. Our intraday targets are placed at 99.68 (R2) and 99.98 (R3). Downwards scenario: Though medium-term perspective remains negative for US Dollar. Next on tap is seen support level at 98.67 (S1), clearance here is required to enable lower targets at 98.36 (S2) and 98.06 (S3)

Resistance Levels: 99.36, 99.68, 99.98

Support Levels: 98.67, 98.36, 98.06

Source: FX Central Clearing Ltd,( http://www.fxcc.com )

Forex Technical & Market Analysis FXCC Jul 15 2013

Fitch downgrades France to AA+ from AAA

Fitch Ratings has downgraded France to AA+ from AAA on Friday, keeping a stable outlook on the country's debt. Fitch, which joins S&P and Moody's in removing the country's AAA rating, cited the high level of the French government indebtedness as one of the main reasons of the downgrade. Fitch expects France's general government debt to peak at 96% of GDP in 2014 and decline only gradually over the long term, remaining at 92% in 2017. "The only 'AAA' country with a higher debt ratio is the U.S. (AAA/negative), which has exceptional financing flexibility and debt tolerance afforded by the preeminent global reserve currency status of the U.S. dollar," Fitch said in a statement.

Standard & Poor's has affirmed on Friday Germany's top triple-A sovereign credit rating, with a stable outlook. The rating agency justified its decision saying that “Germany has a highly diversified and competitive economy with a demonstrated ability to absorb large economic and financial shocks.” As far as the outlook on the long-term rating is concerned, S&P's decision to keep it 'stable' reflects their view that: “Germany's public finances and strong external balance sheet will continue to withstand potential financial and economic shocks.”

https://support.fxcc.com/email/technical/15072013/

FOREX ECONOMIC CALENDAR :

2013-07-15 07:15 GMT | Switzerland. Producer and Import Prices (YoY)

2013-07-15 12:00 GMT | USA. Fed's Tarullo speech

2013-07-15 12:30 GMT | USA. Retail Sales (MoM)

2013-07-15 22:45 GMT | New Zeland. Consumer Price Index (YoY)

FOREX NEWS :

2013-07-15 04:56 GMT | GBP/USD treading water above 1.5100

2013-07-15 03:49 GMT | AUD/USD exposed to 0.80/0.85 fall - RBS

2013-07-15 03:35 GMT | EUR/USD, 1.2930-80 key to technical outlook - BBH

2013-07-15 02:39 GMT | USD/JPY flat above 99.00 with Tokyo closed

---------------

EURUSD :

HIGH 1.3079 LOW 1.30513 BID 1.30773 ASK 1.30773 CHANGE 0.08% TIME 08:00:33

OUTLOOK SUMMARY : Up

TREND CONDITION : Sideway

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : Low

MARKET ANALYSIS - Intraday Analysis

Upwards scenario: With limited economic data flow today we expect further neutral tone development. However, price strengthening is possible above the next resistance level at 1.3092 (R1). Our interim target holds at 1.3124 (R2) en route to our final aim for today at 1.3157 (R3). Downwards scenario: Current price pattern suggests bearish potential if the pair manages to overcome next support level at 1.3044 (S1). Possible price regress could expose our initial targets at 1.3008 (S2) and 1.2974 (S3) later on today.

Resistance Levels: 1.3092, 1.3124, 1.3157

Support Levels: 1.3044, 1.3008, 1.2974

----------------------

GBPUSD :

HIGH 1.51287 LOW 1.5098 BID 1.51257 ASK 1.51268 CHANGE 0.13% TIME 08:00:33

OUTLOOK SUMMARY : Up

TREND CONDITION : Upward penetration

TRADERS SENTIMENT : Bullish

IMPLIED VOLATILITY : Low

Upwards scenario: GBPUSD is approaching our next resistive barrier at 1.5141 (R1). Break here is required to prolong upside pressure and trigger our intraday targets at 1.5173(R2) and 1.5203 (R3) later on today. Downwards scenario: As long as price stays below the next resistance level our technical outlook would be negative. Next on tap is support level at 1.5088 (S1). Penetration below this mark would suggest next targets at 1.5059 (S2) and 1.5028 (S3).

Resistance Levels: 1.5141, 1.5173, 1.5203

Support Levels: 1.5088, 1.5059, 1.5028

----------------------

USDJPY :

HIGH 99.383 LOW 99.074 BID 99.271 ASK 99.272 CHANGE 0.06% TIME 08:00:34

OUTLOOK SUMMARY : Neutral

TREND CONDITION : Sideway

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : Low

Upwards scenario: On the upside potential is seen for a break above the resistance at 99.46 (R1). In such case we would suggest next target at 99.68 (R2) and any further rise would then be limited to final resistance at 99.90 (R3). Downwards scenario: On the other hand, loss of our support level at 99.03 (S1) would open road for a market decline towards to our next target at 98.83 (S2). Any further price weakening would then be limited to final support for today at 98.61 (S3).

Resistance Levels: 99.46, 99.68, 99.90

Support Levels: 99.03, 98.83, 98.61

Source: FX Central Clearing Ltd,( http://www.fxcc.com )

Forex Technical & Market Analysis FXCC Jul 16 2013

Dovish ECB, soft US retail sales balance each other out. Waiting on Bernanke – again!

Dovish talk from the ECB undermined the Euro before the softer than expected US Retail Sales turned things around, sending the US dollar slightly lower. Markets are likely to be on hold ahead of Bernanke’s testimony to Congress although equities and commodities both looks solid in the short term. A mix of data out of the EU and the US could make it a bit choppy later in the day. Before then, the RBA Minutes will be Asia’s focus.

The Euro has had a choppy but mostly uninteresting session, hanging close to 1.3000 as the northern hemisphere summer doldrums look to be well upon us. Early dovish comments from the ECB’s Hansson, indicating that there is room to cut rates further and that negative interest rates should not be ruled out helped push the Euro lower early in the session, before a bit of a turnaround following the softer than expected US retail Sales, that saw the dollar come under some pressure of its own. Fitch downgraded the EFSF – European Financial Stability Facility- to AA+ from AAA, which, following on from the recent France downgrade, had precisely no effect on the Euro at all.

https://support.fxcc.com/email/technical/16072013/

FOREX ECONOMIC CALENDAR :

N/A | UK. BOE Inflation Letter

2013-07-16 08:30 GMT | UK. Consumer Price Index (YoY)

2013-07-16 09:00 GMT | EMU. Consumer Price Index (YoY

2013-07-16 12:30 GMT | USA. Consumer Price Index (YoY)

FOREX NEWS :

2013-07-16 04:46 GMT | GBP/USD stable above 1.51 ahead of UK&US CPI's

2013-07-16 04:25 GMT | EUR/USD pressing against 1.3080

2013-07-16 03:10 GMT | NZD/USD seen at 0.78 year end - BNZ

2013-07-16 02:07 GMT | AUD/USD targets 0.9188, dip buyers on the rise

-------------------------

EURUSD :

HIGH 1.30758 LOW 1.30527 BID 1.30716 ASK 1.30722 CHANGE 0.07% TIME 08:21:26

OUTLOOK SUMMARY : Up

TREND CONDITION : Upward penetration

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : High

MARKET ANALYSIS - Intraday Analysis

Upwards scenario: Next barrier on the upside lie at 1.3092 (R1). Surpassing of this level might enable our initial target at 1.3132 (R2) and any further gains would then be limited to last resistive structure at 1.3171 (R3). Downwards scenario: On the other hand, clearance of our support at 1.3049 (S1) is required to determine negative intraday bias and enable lower target at 1.3010 (S2) and then any further market depreciation would suggest final support at 1.2969 (S3).

Resistance Levels: 1.3092, 1.3132, 1.3171

Support Levels: 1.3049, 1.3010, 1.2969

--------------------

GBPUSD :

HIGH 1.51167 LOW 1.50909 BID 1.51066 ASK 1.51078 CHANGE 0.06% TIME 08:21:27

OUTLOOK SUMMARY : Up

TREND CONDITION : Upward penetration

TRADERS SENTIMENT : Bullish

IMPLIED VOLATILITY : High

Upwards scenario: Neutral channel formation remains favored pattern on the hourly chart frame. Possible clearance of our next resistive barrier at 1.5132 (R1) would suggest next intraday targets at 1.5173 (R2) and 1.5216 (R3) in potential. Downwards scenario: Possible downside expansion is protected by support level at 1.5086 (S1), break here would put bullish oriented traders on hold. Marks at 1.5046 (S2) and 1.5004 (S3) acts as our initial targets today.

Resistance Levels: 1.5132, 1.5173, 1.5216

Support Levels: 1.5086, 1.5046, 1.5004

-------------------

USDJPY :

HIGH 100.068 LOW 99.647 BID 99.805 ASK 99.807 CHANGE -0.03% TIME 08:21:27

OUTLOOK SUMMARY : Down

TREND CONDITION : Downward penetration

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : High

Upwards scenario: USDJPY resumed its consolidation phase yesterday and we see potential for further appreciation towards to our targets at 100.33 (R2) and 100.60 (R3) if the price manages to overcome key resistance measure at 100.06 (R1). Downwards scenario: On the downside our attention is shifted to the immediate support level at 99.62 (S1). Break here is required to enable bearish forces and expose our intraday targets at 99.35 (S2) and 99.06 (S3).

Resistance Levels: 100.06, 100.33, 100.60

Support Levels: 99.62, 99.35, 99.06

Source: FX Central Clearing Ltd,( http://www.fxcc.com )