Our How Much Homeowners Insurance Do You Need? - Forbes PDFs

They may also check their plan to ensure it covers anything they might have added, such as a new or rebuilt deck, a garage development, or a new restroom. Property owners don't intend to be underinsured. It is essential to pick a policy that covers the substitute price of the house, which does not consider devaluation. a home owners insurance.

To ensure a policy covers exactly how a lot the

Little Known Facts About Renters Insurance: Get A Free Quote Online - Progressive.

If you assume all tenants insurer are alike, take a close check out Homesite. We was just one of the initial companies to allow customers to acquire home insurance policy directly on-line throughout a solitary go to, as well as we continue to make it quick and simple to obtain a policy from us (rental insurance).

Trick Takeaways Prior to getting a tenants insurance coverage plan, you should take a

Demo Trades: 0

Demo: 0

Followers: 0

Subscribed to user page: 0

Articles: 0

Forum: 0

They may also check their plan to ensure it covers anything they might have added, such as a new or rebuilt deck, a garage development, or a new restroom. Property owners don't intend to be underinsured. It is essential to pick a policy that covers the substitute price of the house, which does not consider devaluation. a home owners insurance.

To ensure a policy covers exactly how a lot the home is worth and the expense of restoring, it could make feeling to speak with an insurance coverage agent or an evaluator to see what the price of restoring the residence would be. Someone may likewise utilize a house protection calculator - condo insurance. Also, maintain in mind that several lenders require property owners to have homeowners insurance that covers the amount of the mortgage. credit.

cheaper homeowners insurance low cost homeowners insurance homeowners a home homeowner insurance cheaper

cheaper homeowners insurance low cost homeowners insurance homeowners a home homeowner insurance cheaper

Furthermore, building prices can alter, so every couple of years or so, make sure to review what the costs would certainly be to restore your house and ensure you have enough coverage. A property owner might likewise check out an inflation guard stipulation that resets their insurance coverage amounts to reflect local structure prices, which they could need to acquire as an additional recommendation.

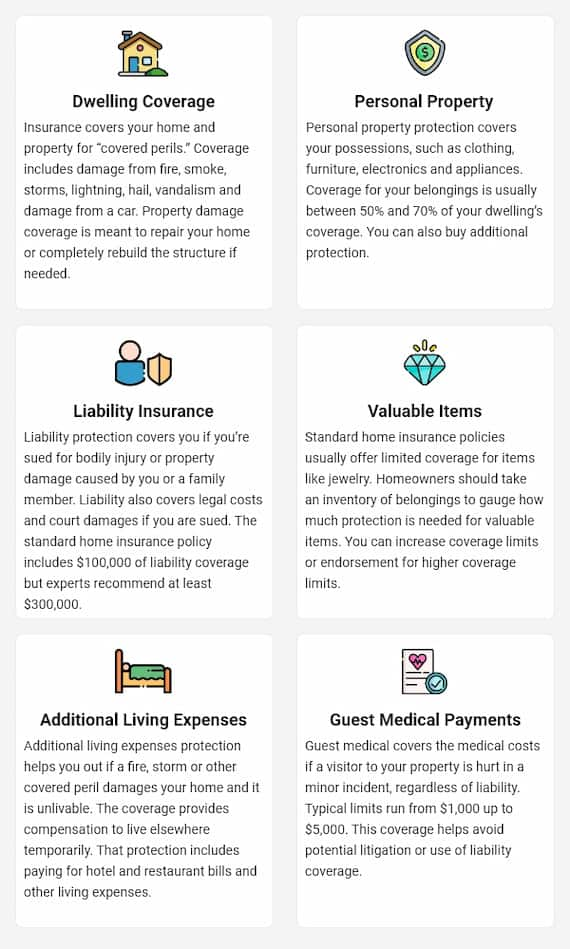

Just like the house coverage, home owners could choose a policy that covers the replacement expense of belongings. credit. If they select a real cash money worth policy, they'll be compensated only wherefore the things are worth after devaluation, not what they would certainly cost to replace them today. This kind of policy won't totally make up property owners that require to get brand-new items to replace the ones that were harmed or lost - insurance discount.

Homeowners can include the properties in their house and anything out in the garage, shed, or other structures on their home - insurer. The checklist ideally can be as outlined as they can possibly make it, so they could consist of everything from devices to computers to clothes to jewelry to furnishings (lowest homeowners insurance). They might include the day the products were purchased, where they were acquired, and a summary of each item - condo insurance.

See This Report on How Much Is Homeowners Insurance On A $150000 House?

insurance claims condo insurance cheap homeowners insurance affordable homeowners insurance cheapest homeowners insurance

insurance claims condo insurance cheap homeowners insurance affordable homeowners insurance cheapest homeowners insurance

If a house owner locates they require extra coverage than the common limitations and also covered hazards, they can talk with their insurance policy agent to locate the ideal property owners insurance for them - homeowners. These experts can assist them analyze fully what they need to have covered. Coverage requires can vary considerably based on way of living, and also they could require to cover whatever from additional financial investment properties to specific things that might need additional protection, such as fashion jewelry or costly collectibles.

landlord affordable homeowners insurance homeowners cheaper homeowners insurance insurance claims

landlord affordable homeowners insurance homeowners cheaper homeowners insurance insurance claims

Older homes may have been built under various building codes, so reconstructing or fixing them will call for even more expenditure as these homes are brought up to code. You need sufficient residence insurance coverage to totally reconstruct your residence in the event of an overall loss. Your home insurance ought to also consist of protection for your personal residential or commercial property, added frameworks, obligation protection as well as loss of usage.

Cash money value policies are sometimes pressed on individuals with older residences or ones with an insufficient water (a fire threat). You'll get your house's substitute expense minus any devaluation or wear and tear that it's suffered because being builtfor instance, they may deduct for a roof that needed to be replacedwhich methods you are virtually ensured not to have enough with which to reconstruct (liability insurance).

The Only Guide to Consumer's Guide To Homeowners Insurance - Aldoi

insurance cheap insurance discount liability insurance landlord inexpensive

insurance cheap insurance discount liability insurance landlord inexpensive

This uncommon as well as terrific creature is called a "guaranteed replacement price" plan. If your house Visit this website has historic attributes that are hard to recreate, locating such a policy will certainly be particularly tough - insurance discount. Examine Insurance Coverage for Living Prices and also Individual Ownerships Protection Along with examining your policy for just how much you'll obtain to reconstruct your residence with, inspect the small print for these things: (cheapest homeowners insurance).

One year is a conventional stipulation, yet if you can get coverage for two, that would be better. Some policies position a buck limitation (as opposed to a time frame) on your living expenditures, typically 20% of the overall insurance policy on your residence. Just like the various amounts of cash you can get for the home itself, there are different levels of insurance coverage for right stuff inside.

In other words, if a major court judgment forced you to sell your residence, watercraft, art collection and/or trip home, how a lot would you stand to lose? Examine Your Insurance deductible Amount A deductible is the quantity you have to pay after a loss prior to your insurance coverage firm steps in. homeowners insurance.

Most insurance policy representatives have household stock brochures, prepared by their companies as well as cost-free for the asking. If a loss must ever take place, the inventory will certainly aid you and your insurance coverage firm to identify your loss as precisely and swiftly as possible - low cost homeowners insurance.

Biography

Not specified

Trading Style

Not specified