Market Overview by FXCC

Forex Technical & Market Analysis FXCC Oct 09 2013

IMF lowers global growth targets as USA debt ceiling impasse drags on

The IMF now expects the global economy to expand by 2.9% in 2013 and 3.6% in 2014, down by 0.3 and 0.2 points respectively on its last predictions, made in July, despite signs of recovery in the euro area. Obama's late statement on Tuesday evening spooked the USA indices, at the start of his speech the DJIA was hovering around a 0.7% loss on the day, by the time he'd finished and the markets had closed the DJIA was down 1.07%, the SPX closed down 1.23% and the NASDAQ down a precise 2.00% on the day. Equity index futures are, at the time of writing, pointing to another negative day on both the European and USA markets. The DJIA equity index future is down 0.92%, SPX down 1.06%, NASDAQ down 1.69%. UK FTSE equity index future is down 0.91%, CAC down 0.73% and the DAX equity index future is down 0.24% The dollar increased 0.2 percent to 96.88 yen late in New York on Tuesday after gaining as much as 0.6 percent earlier in the day. The greenback was little changed at $1.3573 per euro after rising 0.2 percent earlier. The 17-nation shared common currency appreciated by 0.1 percent to 131.49 yen. The dollar rose versus 13 of its 16 most-traded peers as the U.S. political stalemate persisted and President Barack Obama warned the nation faces a “very deep recession” if Congress doesn’t raise the debt limit, fueling safe haven demand for the dollar.

Market Analysis | FXCC Blog

FOREX ECONOMIC CALENDAR :

2013-10-09 08:30 GMT | UK Industrial Production (YoY) (Aug)

2013-10-09 14:00 GMT | UK NIESR GDP Estimate (3M) (Sep)

2013-10-09 18:00 GMT | US FOMC Minutes

2013-10-09 22:00 GMT | ECB President Draghi's Speech

FOREX NEWS :

2013-10-09 03:36 GMT | GBP/USD rally fizzles early Tuesday likely on “fade the news” reaction to Yellen news

2013-10-09 03:22 GMT | EUR/USD violates support printing 1.3562 session lows

2013-10-09 02:53 GMT | AUD/USD tumbling after poor Aussie data

2013-10-09 02:26 GMT | USD/JPY spikes to 97.36 peaks on +43 pips gains

----------------------

EURUSD

HIGH 1.36046 LOW 1.35617 BID 1.35630 ASK 1.35633 CHANGE -0.08% TIME 08 : 42:32

OUTLOOK SUMMARY : Down

TREND CONDITION : Sideway

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : High

MARKET ANALYSIS - Intraday Analysis

Upwards scenario: EURUSD tested negative territory today though appreciation above the resistive structure at 1.3584 (R1) might shift short-term tendency to the bullish side and validate our intraday targets at 1.3596 (R2) and 1.3607 (R3). Downwards scenario: Market decline below the support level at 1.3557 (S1) might shift market sentiment to the bearish side. In such scenario we expect next targets to be exposed today at 1.3546 (S2) and 1.3535 (S3).

Resistance Levels: 1.3584, 1.3596, 1.3607

Support Levels: 1.3557, 1.3546, 1.3535

------------------------

GBPUSD

HIGH 1.61219 LOW 1.60612 BID 1.60664 ASK 1.60672 CHANGE -0.1% TIME 08 : 42:33

OUTLOOK SUMMARY : Down

TREND CONDITION : Downward penetration

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : High

Upwards scenario: From the technical side, medium - term tendency is bearish, however new step of recovery phase is possible above the resistance level at 1.6086 (R1). Loss here would open way towards to next targets at 1.6106 (R2) and 1.6127 (R3). Downwards scenario: Our next support level is placed at 1.6058 (S1). Possible penetration below it might initiate bearish pressure and gradually push the price towards to our intraday targets at 1.6039 (S2) and 1.6019 (S3).

Resistance Levels: 1.6086, 1.6106, 1.6127

Support Levels: 1.6058, 1.6039, 1.6019

--------------------

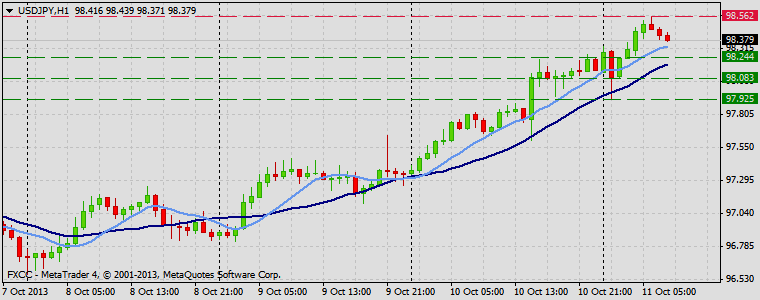

USDJPY :

HIGH 97.446 LOW 96.825 BID 97.404 ASK 97.408 CHANGE 0.56% TIME 08 : 42:34

OUTLOOK SUMMARY : Up

TREND CONDITION : Upward penetration

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : High

Upwards scenario: USDJPY trapped to the correction phase on the hourly chart frame. Break of resistive level at 97.48 (R1) is required to enable upwards action. Next visible targets are seen at 97.67 (R2) and 97.85 (R3). Downwards scenario: Though, we still keep the bearish scenario in focus. Risk of market decline is seen below the support level at 97.18 (S1). Loss here would enable initial targets at 97.00 (S2) and 96.80 (S3).

Resistance Levels: 97.48, 97.67, 97.85

Support Levels: 97.18, 97.00, 96.80

Source: FX Central Clearing Ltd,( ECN Forex Broker | ECN Forex Trading Platform | Foreign Currency Exchange | Best Currency Online Trading | FXCC )

Forex Technical & Market Analysis FXCC Oct 11 2013

ECB Agrees on swap line with PBOC as Chinese trade increases

The European Central Bank and the People’s Bank of China agreed to establish a bilateral currency swap line on Thursday, increasing access to trade finance in the euro area and strengthening the international use of the yuan. The swap line will be valid for three years and have a maximum size of 350 billion yuan ($57 billion) when Chinese currency is provided to the ECB and 45 billion euros ($61 billion) when money is given to the PBOC. The arrangement is available to all Eurosystem counter-parties via national central banks, it said. House Speaker John Boehner has proposed extending the federal debt limit until Nov. 22nd as a way to shift debate back to a government-spending bill. The bill wouldn’t end the partial shutdown of the government, which began Oct. 1st after Republicans insisted on changes to the 2010 health-care law. Boehner told reporters the House wants to “offer the president today the ability to move.”

http://blog.fxcc.com/market-analysis

FOREX ECONOMIC CALENDAR :

24h | G20 Finance Ministers and Central Bank Governors Meeting

24h | IMF Meeting

2013-10-11 06:00 GMT | DE Harmonised Index of Consumer Prices (YoY) (Sep)

2013-10-11 12:30 GMT | CA Unemployment Rate (Sep)

FOREX NEWS :

2013-10-11 05:26 GMT | USD/CHF struggles to keep the 0.9100 level

2013-10-11 04:56 GMT | USD/CAD sits on the fence ahead of Canadian labor data, BoC outlook

2013-10-11 04:24 GMT | AUD/USD upwards amidst easing worries on US fiscal issues

2013-10-11 03:01 GMT | EUR/USD on steady climb to 1.3540

------------------------

EURUSD :

HIGH 1.35441 LOW 1.35178 BID 1.35347 ASK 1.35350 CHANGE 0.11% TIME 08:37:18

OUTLOOK SUMMARY : Up

TREND CONDITION : Upward penetration

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : Medium

MARKET ANALYSIS - Intraday Analysis

Upwards scenario: On the upside current structure might face next hurdle at 1.3546 (R1). Successful penetration above that mark would suggest next target zone – 1.3559 (R2) onto 1.3573 (R3) price levels. Downwards scenario: Any downside fluctuations remains for now limited to the next support barrier at 1.3517 (S1). Only clear break here would be a signal of possible market easing towards to our targets at 1.3503 (S2) and 1.3489 (S3) in potential

Resistance Levels: 1.3546, 1.3559, 1.3573

Support Levels: 1.3517, 1.3503, 1.3489

------------------

GBPUSD :

HIGH 1.59903 LOW 1.5963 BID 1.59881 ASK 1.59885 CHANGE 0.13% TIME 08:37:18

OUTLOOK SUMMARY : Up

TREND CONDITION : Upward penetration

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : Medium

Upwards scenario: Our next resistance level is placed at 1.5993 (R1). Clearance here is required to commence ascending structure towards to next target at 1.6023 (R2) and any further price appreciation would then be limited to 1.6053 (R3) mark. Downwards scenario: On the other side, a dip below the initial support level at 1.5950 (S1) is liable to trigger bearish pressure and drive market price towards to supportive means at 1.5921 (S2) and 1.5891 (S3) in potential.

Resistance Levels: 1.5993, 1.6023, 1.6053

Support Levels: 1.5950, 1.5921, 1.5891

--------------------

USDJPY :

HIGH 98.552 LOW 97.921 BID 98.370 ASK 98.373 CHANGE 0.23% TIME 08:37:19

OUTLOOK SUMMARY : Up

TREND CONDITION : Up trend

TRADERS SENTIMENT : Bullish

IMPLIED VOLATILITY : Medium

Upwards scenario: USDJPY resumed upwards penetration today and we see potential to expose our intraday targets at 98.72 (R2) and 98.88 (R3) if the price manages to overcome key resistance measure at 98.56 (R1). Downwards scenario: Possible downside pressure could be maintained if the price penetrates below the support measure at 98.24 (S1). Clearance here would open way for a price move towards to lower targets at 98.08 (S2) and 97.92 (S3).

Resistance Levels: 98.56, 98.72, 98.88

Support Levels: 98.24, 98.08, 97.92

Source: FX Central Clearing Ltd,( http://www.fxcc.com )

Forex Technical & Market Analysis FXCC Oct 14 2013

World Bank head Jim Yong Kim warns US is ‘five days away from a very dangerous moment

Jim Yong Kim has warned the United States they're just 'days away' from causing a global economic disaster unless politicians come up with a plan to raise the nation's debt limit and avoid default. 'We're now five days away from a very dangerous moment. I urge U.S. policymakers to quickly come to a resolution before they reach the debt ceiling deadline. Inaction could result in interest rates rising, confidence falling and growth slowing. If this comes to pass, it could be a disastrous event for the developing world, and that will in turn greatly hurt developed economies as well." Meanwhile the Chinese have lost very little time in making their opinion known, one of the official news outlets, Xinhua, has begun to call for a new global reserve currency to be created given the instability of the dollar; "US fiscal failure warrants a de-Americanized world and the creation of a new reserve currency to be created to replace the dominant U.S. dollar, so that the international community could permanently stay away from the spillover of the intensifying domestic political turmoil in the United States." The U.S. shouldn’t risk defaulting on its debt because doing so would wreak havoc in the world’s economy and financial markets, said the heads of JPMorgan, Deutsche Bank AG and Pacific Investment Management Co. JPMorgan Chief Executive Officer Jamie Dimon said yesterday during a panel discussion at a financial industry conference in Washington; “The United States cannot default and, in my opinion, will not default. It would ripple through the global economy in a way you couldn’t possibly understand.”

http://blog.fxcc.com/market-analysis

FOREX ECONOMIC CALENDAR :

2013-10-14 24 hours | Eurogroup meeting

2013-10-14 24 hours | US. Columbus Day

2013-10-14 09:00 GMT | EU. Industrial Production s.a. (MoM) (Aug)

2013-10-14 12:00 GMT | Poland. M3 Money Supply (YoY) (Sep)

FOREX NEWS :

2013-10-14 05:08 GMT | AUD/USD gains again uptrend momentum after solid China CPI release

2013-10-14 05:07 GMT | GBP/USD trading modestly higher on concerns over US politics

2013-10-14 04:20 GMT | USD/JPY under pressure on concerns about US debt ceiling

2013-10-14 04:20 GMT | GBP/JPY consolidating recent gains; technicians say a bit more upside likely

-----------------------

EURUSD :

HIGH 1.35668 LOW 1.35509 BID 1.35665 ASK 1.35668 CHANGE 0.18% TIME 08:25:37

OUTLOOK SUMMARY : Up

TREND CONDITION : Downward penetration

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : Low

MARKET ANALYSIS - Intraday Analysis

Upwards scenario: We are not expecting significant volatility increase today however upside risk aversion is seen above the next resistance level at 1.3581 (R1). Price evaluation above this level would suggest next targets at 1.3599 (R2) and 1.3616 (R3). Downwards scenario: If the price manages to overcome our next support barrier at 1.3551 (S1), we expect to see further market decline towards to our next target at 1.3536 (S2) and then next stop could be found at 1.3517 (S3) mark.

Resistance Levels: 1.3581, 1.3599, 1.3616

Support Levels: 1.3551, 1.3536, 1.3517

----------------------

GBPUSD :

HIGH 1.59888 LOW 1.59633 BID 1.59859 ASK 1.59867 CHANGE 0.23% TIME 08:25:43

OUTLOOK SUMMARY : Up

TREND CONDITION : Down trend

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : Low

Upwards scenario: On the upside market might get more incentives above the immediate resistive barrier at 1.6003 (R1). If the price manages to overcome it we would suggest next intraday targets at 1.6035 (R2) and 1.6061 (R3). Downwards scenario: Penetration below the support at 1.5964 (S1) is liable to put more downward pressure on the instrument in the near-term perspective. As a result our supportive means at 1.5928 (S2) and 1.5893 (S3) might be triggered.

Resistance Levels: 1.6003, 1.6035, 1.6061

Support Levels: 1.5964, 1.5928, 1.5893

------------------

USDJPY :

HIGH 98.351 LOW 98.119 BID 98.258 ASK 98.262 CHANGE -0.31% TIME 08:25:51

OUTLOOK SUMMARY : Down

TREND CONDITION : Downward penetration

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : Low

Upwards scenario: Any upside actions looks limited to resistance level at 98.60 (R1). Surpassing of this level might enable next target at 98.81 (R2) and any further gains would then be targeting final mark at 99.03 (R3) in potential. Downwards scenario: Next support level is seen at 98.10 (S1), any penetration below it might activate downside pressure and enable lower target at 97.89 (S2). Any further market decline would then be limited to 97.62 (S3).

Resistance Levels: 98.60, 98.81, 99.03

Support Levels: 98.10, 97.89, 97.62

Source: FX Central Clearing Ltd,( http://www.fxcc.com )

Forex Technical & Market Analysis FXCC Oct 15 2013

Central Banks begin to plan for a USA default as the deadline nears

Global central banks are beginning to create contingency plans as to how they'd keep financial markets moving if the U.S. defaults. Jon Cunliffe, the Bank of England deputy governor said in testimony to U.K. Politicians on Monday; "Because in the past it’s always been sorted out is absolutely not a reason to fail to do the contingency planning. I would expect the Bank of England to be planning for it. I’d expect private-sector actors to be doing that, and in other countries as well.” Due to the Columbus Day bank holiday in the USA and Canada the main equity markets were closed and the FX markets experienced less transaction turnover on Monday. European markets mostly experienced a positive day. The STOXX index closed up 0.11%, the UK FTSE up 0.32%, the CAC closed up 0.07%, and the DAX closed down by 0.01%. The Portuguese index closed up the most in the European markets by 0.98%. Equity index futures (at the time of writing) appear to suggest that the USA main indices will tentatively open in positive territory on Tuesday; the DJIA equity index future is up 0.07%, SPX up 0.11% and the NASDAQ equity index future is up 0.15%. Commodities were mainly positive, ICE WTI oil closed the day up 0.22% at $102.24 per barrel, NYMEX natural closed up 1.17% at $3.82 per therm, COMEX gold closed the day up 0.28% at $1271.80 per ounce. Silver on COMEX was flat at the day's end at $21.27 per ounce. The dollar was little changed at 98.53 yen late in New York after weakening earlier as much as 0.5 percent to 98.08 yen. It rose 1.9 percent over the previous four days. The dollar fell 0.2 percent to $1.3565 per euro. Japan’s currency declined 0.1 percent to 133.65 per euro after weakening to 133.60 on Oct. 11th, the least since Sept. 26th. The U.S. Dollar Index, tracking the currency’s performance versus a basket of 10 leading counterparts, slid up to 0.23 percent, the biggest intraday drop since Oct. 2nd, to 1,010.07 before trading at 1,011.21, down 0.12 percent.

http://blog.fxcc.com/market-analysis

FOREX ECONOMIC CALENDAR :

2013-10-15 24 hours | EU. EcoFin Meeting

2013-10-15 09:00 GMT | EU. ZEW Survey - Economic Sentiment (Oct)

2013-10-15 21:45 GMT | New Zealand. Consumer Price Index (QoQ) (Q3)

2013-10-15 23:30 GMT | New Zealand. Westpac Leading Index (MoM) (Aug)

FOREX NEWS :

2013-10-15 04:31 GMT | GBP/USD heading north but also capped by 1.6000

2013-10-15 03:46 GMT | EUR/GBP modestly lower ahead of heavy data flow Tuesday

2013-10-15 01:01 GMT | EUR/USD falls to 1.3550 bottoms

2013-10-15 00:36 GMT | AUD/USD reaches 0.9523 peaks on neutral RBA minutes

----------------

EURUSD :

HIGH 1.35709 LOW 1.355 BID 1.35693 ASK 1.35697 CHANGE 0.07% TIME 08 : 17:32

OUTLOOK SUMMARY : Up

TREND CONDITION : Upward penetration

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : Medium

MARKET ANALYSIS - Intraday Analysis

Upwards scenario: On the upside potential is seen for a break above the resistance at 1.3599 (R1). In such case we would suggest next target at 1.3616 (R2) and any further rise would then be limited to final resistance at 1.3631 (R3). Downwards scenario: Possible pull back development is limited now to the key supportive barrier at 1.3551 (S1). Only loss here would be considered as a beginning of a retracement expansion. Our intraday targets locates at 1.3536 (S2) and 1.3517 (S3).

Resistance Levels: 1.3599, 1.3616, 1.3631

Support Levels: 1.3551, 1.3536, 1.3517

------------------

GBPUSD :

HIGH 1.59983 LOW 1.59521 BID 1.59943 ASK 1.59951 CHANGE 0.08% TIME 08 : 17:36

OUTLOOK SUMMARY : Up

TREND CONDITION : Down trend

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : Medium

Upwards scenario: Next resistance level is seen at 1.6019 (R1). Subsequently loss here might create upside momentum and drive market price towards to our initial targets at 1.6042 (R2) and 1.6061 (R3) in potential. Downwards scenario: We do expect some pull-backs development on the downside below the support level at 1.5964 (S1). Short-term momentum on the negative side might open the way towards to immediate supports at 1.5938 (S2) and 1.5914 (S3).

Resistance Levels: 1.6019, 1.6042, 1.6061

Support Levels: 1.5964, 1.5938, 1.5914

-----------------------

USDJPY :

HIGH 98.703 LOW 98.415 BID 98.442 ASK 98.447 CHANGE -0.14% TIME 08 : 17:40

OUTLOOK SUMMARY : Up

TREND CONDITION : Up trend

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : Low

Upwards scenario: Medium term bias remains positive however further market rise is limited now to the key resistive barrier at 98.69 (R1), clearance here is required to enable next resistances at 98.86 (R2) and last one at 99.03 (R3). Downwards scenario: In terms of technical levels, risk of price depreciation is seen below the next support level at 98.10 (S1). Loss here would suggest to monitor marks at 97.89 (S2) and 97.69 (S3) as possible intraday targets.

Resistance Levels: 98.69, 98.86, 99.03

Support Levels: 98.10, 97.89, 97.69

Source: FX Central Clearing Ltd,( http://www.fxcc.com )

Forex Technical & Market Analysis FXCC Oct 21 2013

China’s central government has called for “unrelenting” implementation of its economic policies and reform measures

Monday sees the publication of Germany's PPI figure and the monthly report from Germany's Bundesbank. Inflation is expected to come in at 0.1% month on month. In the USA another member of the Fed will hold court with the focus moving from the debt ceiling issue to the other issues affecting the USA economy, such as the throttling of monetary easing by way of tapering. Existing home sales in the USA are expected to come in at 5.31 million from the previous month's 5.48 million. Canada's wholesale sales are anticipated to print at 0.6%. USA crude oil inventory figures are suggested to fall to 3.4 million barrels from 6.8 million barrels the previous month. More arrivals from China contributed to a 7 percent increase in visitors to New Zealand in September 2013, compared with September 2012, Statistics New Zealand said today. "The 21,200 visitors from China was well up from 14,000 last September," population statistics manager Andrea Blackburn said. "This continues the strong growth in visitor numbers which we have seen from the world's most populous country in recent years." In the September 2013 year, visitor arrivals rose 3 percent to reach 2.670 million.

http://blog.fxcc.com/market-analysis

FOREX ECONOMIC CALENDAR :

N/A | US CB Leading Indicator (MoM) (Sep)

2013-10-21 06:00 GMT | DE Producer Price Index (YoY) (Sep)

2013-10-21 14:00 GMT | US Existing Home Sales (MoM) (Sep)

2013-10-21 14:30 GMT | US EIA Crude Oil Stocks change (Oct 11)

FOREX NEWS :

2013-10-21 05:40 GMT | AUD/USD upwards ‘flirting’ with the 200-daily SMA at 0.9755

2013-10-21 05:04 GMT | USD/CHF moves on the upper level on greenback strengthening

2013-10-21 04:23 GMT | USD/JPY looking to test 200-day MA 97.15 - BBH

2013-10-21 03:33 GMT | EUR/USD opens week in the red as part of consolidation; upside eventually 1.3750?

----------------------

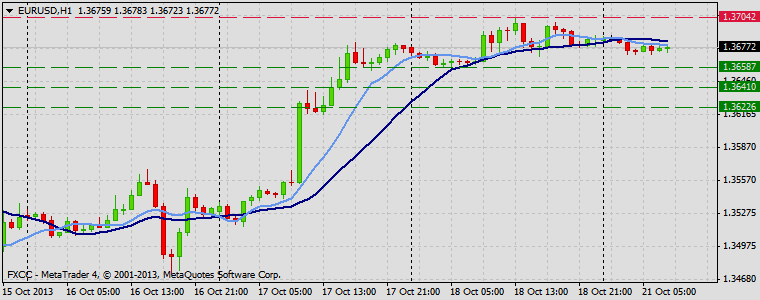

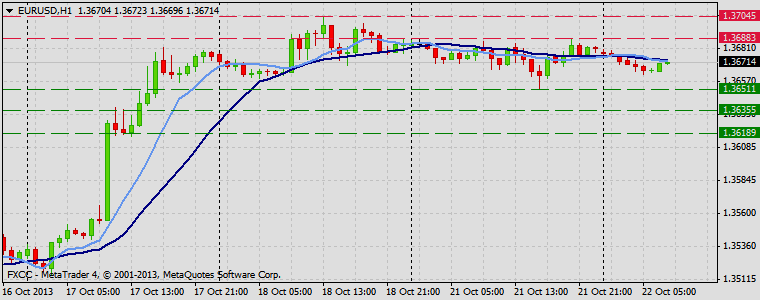

EURUSD :

HIGH 1.36879 LOW 1.36706 BID 1.36776 ASK 1.36779 CHANGE -0.06% TIME 08:53:03

OUTLOOK SUMMARY : Up

TREND CONDITION : Sideway

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : Low

MARKET ANALYSIS - Intraday Analysis

Upwards scenario: EURUSD clearly determined positive bias on the medium-term perspective. Penetration above the resistive measure at 1.3704 (R1) might encourage protective orders execution and drive market price towards to the next resistive means at 1.3721(R2) and 1.3739 (R3). Downwards scenario: Our next supportive measure locates at 1.3658 (S1). Break here is required to enable correction action towards to next target at 1.3641 (S2). Final support for today locates at 1.3622 (S3).

Resistance Levels: 1.3704, 1.3721, 1.3739

Support Levels: 1.3658, 1.3641, 1.3622

----------------

GBPUSD :

HIGH 1.61774 LOW 1.61522 BID 1.61706 ASK 1.61711 CHANGE 0.04% TIME 08:53:04

OUTLOOK SUMMARY : Up

TREND CONDITION : Sideway

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : Low

Upwards scenario: On the upside fractal level at 1.6225 (R1) prevents further gains. Successful clearance here would suggest next intraday targets at 1.6248 (R2) and 1.6269 (R3). Downwards scenario: On the other hand, current range pattern on the hourly chart suggest possible retest of our supportive measure at 1.6148 (S1). Break here is required to open way towards to initial targets at 1.6125 (S2) and 1.6102 (S3).

Resistance Levels: 1.6225, 1.6248, 1.6269

Support Levels: 1.6148, 1.6125, 1.6102

-----------------------------

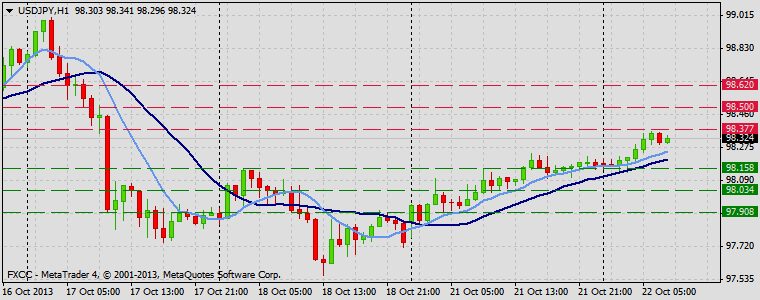

USDJPY :

HIGH 98.103 LOW 97.771 BID 98.021 ASK 98.024 CHANGE 0.29% TIME 08:53:05

OUTLOOK SUMMARY : Up

TREND CONDITION : Upward penetration

TRADERS SENTIMENT : Bullish

IMPLIED VOLATILITY : Low

Upwards scenario: Resistance at 98.16 (R1) limits possible upwards penetration. Break here is required to enable next interim target at 98.31 (R2) en route towards to final aim for today at 98.46 (R3). Downwards scenario: On the other hand, successful retest of our support level at 97.74 (S1) would clear the way for a downtrend expansion towards to our lower targets at 97.59 (S2) and 97.43 (S3) in potential

Resistance Levels: 98.16, 98.31, 98.46

Support Levels: 97.74, 97.59, 97.43

Source: FX Central Clearing Ltd,( http://www.fxcc.com )

Forex Technical & Market Analysis FXCC Oct 21 2013

China’s central government has called for “unrelenting” implementation of its economic policies and reform measures

Monday sees the publication of Germany's PPI figure and the monthly report from Germany's Bundesbank. Inflation is expected to come in at 0.1% month on month. In the USA another member of the Fed will hold court with the focus moving from the debt ceiling issue to the other issues affecting the USA economy, such as the throttling of monetary easing by way of tapering. Existing home sales in the USA are expected to come in at 5.31 million from the previous month's 5.48 million. Canada's wholesale sales are anticipated to print at 0.6%. USA crude oil inventory figures are suggested to fall to 3.4 million barrels from 6.8 million barrels the previous month. More arrivals from China contributed to a 7 percent increase in visitors to New Zealand in September 2013, compared with September 2012, Statistics New Zealand said today. "The 21,200 visitors from China was well up from 14,000 last September," population statistics manager Andrea Blackburn said. "This continues the strong growth in visitor numbers which we have seen from the world's most populous country in recent years." In the September 2013 year, visitor arrivals rose 3 percent to reach 2.670 million.

http://blog.fxcc.com/market-analysis

FOREX ECONOMIC CALENDAR :

N/A | US CB Leading Indicator (MoM) (Sep)

2013-10-21 06:00 GMT | DE Producer Price Index (YoY) (Sep)

2013-10-21 14:00 GMT | US Existing Home Sales (MoM) (Sep)

2013-10-21 14:30 GMT | US EIA Crude Oil Stocks change (Oct 11)

FOREX NEWS :

2013-10-21 05:40 GMT | AUD/USD upwards ‘flirting’ with the 200-daily SMA at 0.9755

2013-10-21 05:04 GMT | USD/CHF moves on the upper level on greenback strengthening

2013-10-21 04:23 GMT | USD/JPY looking to test 200-day MA 97.15 - BBH

2013-10-21 03:33 GMT | EUR/USD opens week in the red as part of consolidation; upside eventually 1.3750?

----------------------

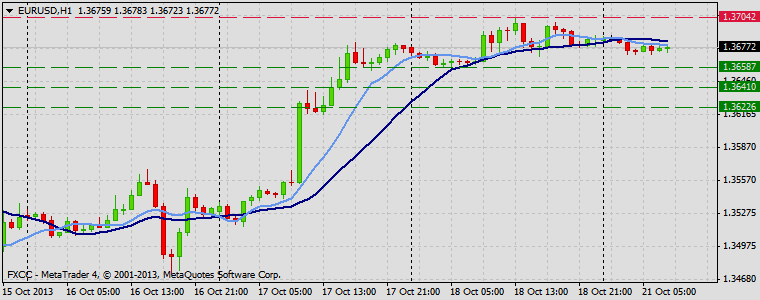

EURUSD :

HIGH 1.36879 LOW 1.36706 BID 1.36776 ASK 1.36779 CHANGE -0.06% TIME 08:53:03

OUTLOOK SUMMARY : Up

TREND CONDITION : Sideway

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : Low

MARKET ANALYSIS - Intraday Analysis

Upwards scenario: EURUSD clearly determined positive bias on the medium-term perspective. Penetration above the resistive measure at 1.3704 (R1) might encourage protective orders execution and drive market price towards to the next resistive means at 1.3721(R2) and 1.3739 (R3). Downwards scenario: Our next supportive measure locates at 1.3658 (S1). Break here is required to enable correction action towards to next target at 1.3641 (S2). Final support for today locates at 1.3622 (S3).

Resistance Levels: 1.3704, 1.3721, 1.3739

Support Levels: 1.3658, 1.3641, 1.3622

----------------

GBPUSD :

HIGH 1.61774 LOW 1.61522 BID 1.61706 ASK 1.61711 CHANGE 0.04% TIME 08:53:04

OUTLOOK SUMMARY : Up

TREND CONDITION : Sideway

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : Low

Upwards scenario: On the upside fractal level at 1.6225 (R1) prevents further gains. Successful clearance here would suggest next intraday targets at 1.6248 (R2) and 1.6269 (R3). Downwards scenario: On the other hand, current range pattern on the hourly chart suggest possible retest of our supportive measure at 1.6148 (S1). Break here is required to open way towards to initial targets at 1.6125 (S2) and 1.6102 (S3).

Resistance Levels: 1.6225, 1.6248, 1.6269

Support Levels: 1.6148, 1.6125, 1.6102

-----------------------------

USDJPY :

HIGH 98.103 LOW 97.771 BID 98.021 ASK 98.024 CHANGE 0.29% TIME 08:53:05

OUTLOOK SUMMARY : Up

TREND CONDITION : Upward penetration

TRADERS SENTIMENT : Bullish

IMPLIED VOLATILITY : Low

Upwards scenario: Resistance at 98.16 (R1) limits possible upwards penetration. Break here is required to enable next interim target at 98.31 (R2) en route towards to final aim for today at 98.46 (R3). Downwards scenario: On the other hand, successful retest of our support level at 97.74 (S1) would clear the way for a downtrend expansion towards to our lower targets at 97.59 (S2) and 97.43 (S3) in potential

Resistance Levels: 98.16, 98.31, 98.46

Support Levels: 97.74, 97.59, 97.43

Source: FX Central Clearing Ltd,( http://www.fxcc.com )

Forex Technical & Market Analysis FXCC Oct 21 2013

China’s central government has called for “unrelenting” implementation of its economic policies and reform measures

Monday sees the publication of Germany's PPI figure and the monthly report from Germany's Bundesbank. Inflation is expected to come in at 0.1% month on month. In the USA another member of the Fed will hold court with the focus moving from the debt ceiling issue to the other issues affecting the USA economy, such as the throttling of monetary easing by way of tapering. Existing home sales in the USA are expected to come in at 5.31 million from the previous month's 5.48 million. Canada's wholesale sales are anticipated to print at 0.6%. USA crude oil inventory figures are suggested to fall to 3.4 million barrels from 6.8 million barrels the previous month. More arrivals from China contributed to a 7 percent increase in visitors to New Zealand in September 2013, compared with September 2012, Statistics New Zealand said today. "The 21,200 visitors from China was well up from 14,000 last September," population statistics manager Andrea Blackburn said. "This continues the strong growth in visitor numbers which we have seen from the world's most populous country in recent years." In the September 2013 year, visitor arrivals rose 3 percent to reach 2.670 million.

http://blog.fxcc.com/market-analysis

FOREX ECONOMIC CALENDAR :

N/A | US CB Leading Indicator (MoM) (Sep)

2013-10-21 06:00 GMT | DE Producer Price Index (YoY) (Sep)

2013-10-21 14:00 GMT | US Existing Home Sales (MoM) (Sep)

2013-10-21 14:30 GMT | US EIA Crude Oil Stocks change (Oct 11)

FOREX NEWS :

2013-10-21 05:40 GMT | AUD/USD upwards ‘flirting’ with the 200-daily SMA at 0.9755

2013-10-21 05:04 GMT | USD/CHF moves on the upper level on greenback strengthening

2013-10-21 04:23 GMT | USD/JPY looking to test 200-day MA 97.15 - BBH

2013-10-21 03:33 GMT | EUR/USD opens week in the red as part of consolidation; upside eventually 1.3750?

----------------------

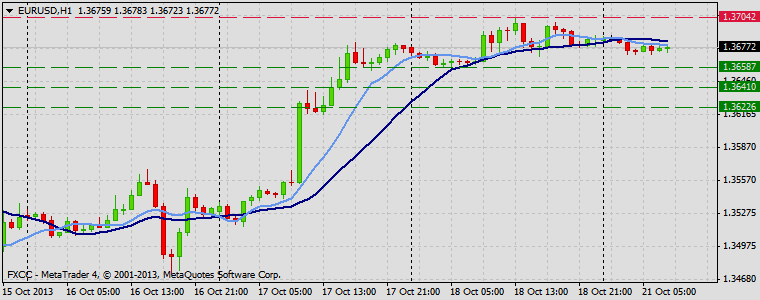

EURUSD :

HIGH 1.36879 LOW 1.36706 BID 1.36776 ASK 1.36779 CHANGE -0.06% TIME 08:53:03

OUTLOOK SUMMARY : Up

TREND CONDITION : Sideway

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : Low

MARKET ANALYSIS - Intraday Analysis

Upwards scenario: EURUSD clearly determined positive bias on the medium-term perspective. Penetration above the resistive measure at 1.3704 (R1) might encourage protective orders execution and drive market price towards to the next resistive means at 1.3721(R2) and 1.3739 (R3). Downwards scenario: Our next supportive measure locates at 1.3658 (S1). Break here is required to enable correction action towards to next target at 1.3641 (S2). Final support for today locates at 1.3622 (S3).

Resistance Levels: 1.3704, 1.3721, 1.3739

Support Levels: 1.3658, 1.3641, 1.3622

----------------

GBPUSD :

HIGH 1.61774 LOW 1.61522 BID 1.61706 ASK 1.61711 CHANGE 0.04% TIME 08:53:04

OUTLOOK SUMMARY : Up

TREND CONDITION : Sideway

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : Low

Upwards scenario: On the upside fractal level at 1.6225 (R1) prevents further gains. Successful clearance here would suggest next intraday targets at 1.6248 (R2) and 1.6269 (R3). Downwards scenario: On the other hand, current range pattern on the hourly chart suggest possible retest of our supportive measure at 1.6148 (S1). Break here is required to open way towards to initial targets at 1.6125 (S2) and 1.6102 (S3).

Resistance Levels: 1.6225, 1.6248, 1.6269

Support Levels: 1.6148, 1.6125, 1.6102

-----------------------------

USDJPY :

HIGH 98.103 LOW 97.771 BID 98.021 ASK 98.024 CHANGE 0.29% TIME 08:53:05

OUTLOOK SUMMARY : Up

TREND CONDITION : Upward penetration

TRADERS SENTIMENT : Bullish

IMPLIED VOLATILITY : Low

Upwards scenario: Resistance at 98.16 (R1) limits possible upwards penetration. Break here is required to enable next interim target at 98.31 (R2) en route towards to final aim for today at 98.46 (R3). Downwards scenario: On the other hand, successful retest of our support level at 97.74 (S1) would clear the way for a downtrend expansion towards to our lower targets at 97.59 (S2) and 97.43 (S3) in potential

Resistance Levels: 98.16, 98.31, 98.46

Support Levels: 97.74, 97.59, 97.43

Source: FX Central Clearing Ltd,( http://www.fxcc.com )

Forex Technical & Market Analysis FXCC Oct 22 2013

Tuesday's NFP day, let's be careful out there

The big event of the day is the 18 day late publication of the NFP figures. Traders need to exercise caution as the figure might come in far better than predicted, but be subject to significant revisions due to the temporary govt. shutdown. The anticipation is for a print of 182K jobs created with the unemployment rate remaining steady at 7.3%. The benchmark 10-year yield rose two basis points, or 0.02 percentage point, to 2.60 percent as of 5 p.m in New York. The price of the 2.5 percent note due in August 2023 fell 6/32, or $1.88 per $1,000 face amount, to 99 1/8. The yield declined to 2.54 percent on Oct. 18th, the lowest since July 24th, down from a 2013 high of 3 percent on Sept. 6th.Treasury 10-year notes snapped a three-day advance before the NFP government report on Tuesday.

The yen fell 0.5 percent to 98.19 per dollar after gaining 1.1 percent during the previous two days. Japan’s currency declined 0.4 percent to 134.32 per euro and touched 134.38, the weakest level since Sept. 23rd. The dollar was little changed at $1.3681 per euro after gaining 0.3 percent earlier. The U.S. Dollar Index, which monitors the greenback versus a basket of 10 other major currencies, rose 0.2 percent to 1,004.55 late in New York. The gauge fell to 1,000.70 on Oct. 18th, the lowest intraday level since Feb. 13th, extending a weekly loss to 1 percent, the most in a month. The price of crude oil fell below $100 a barrel Monday after the U.S. government reported an increase in supplies. Metals prices were broadly higher and crop prices were mixed. Crude oil for November delivery fell $1.59, or 1.6 percent, to $99.22 a barrel in New York. That's the first close below $100 a barrel since July.

http://blog.fxcc.com/market-analysis

FOREX ECONOMIC CALENDAR :

2013-10-22 08:30 GMT | UK Public Sector Net Borrowing (Sep)

2013-10-22 12:30 GMT | US Nonfarm Payrolls (Sep)

2013-10-22 12:30 GMT | CA Retail Sales (MoM) (Aug)

2013-10-22 23:00 GMT | AU CB Leading Indicator (Aug)

FOREX NEWS :

2013-10-22 05:15 GMT | Good Chinese data leads to little movement in the markets; traders await US data

2013-10-22 05:09 GMT | Oil sits below $100, gold consolidates

2013-10-22 04:35 GMT | GBP/USD grinds slowly lower ahead of NFP data

2013-10-22 04:12 GMT | NFP likely no to have two-way directionality as usual - Rabobank

---------------------

EURUSD :

HIGH 1.36806 LOW 1.36622 BID 1.36711 ASK 1.36713 CHANGE -0.07% TIME 08:43:23

OUTLOOK SUMMARY : Up

TREND CONDITION : Sideway

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : Medium

MARKET ANALYSIS - Intraday Analysis

Upwards scenario: Possibility of further price progress is seen above the next resistance level at 1.3688 (R1). Breakthrough here would suggest interim target at 1.3704 (R2) and then mark at 1.3721 (R3) acts as next attractive point. Downwards scenario: As long as price stays below the 20 SMA our technical outlook would be negative. Extension lower the key support level at 1.3651 (S1) is being able to drive market price towards to our next targets at 1.3635 (S2) and 1.3618 (S3).

Resistance Levels: 1.3688, 1.3704, 1.3721

Support Levels: 1.3651, 1.3635, 1.3618

-------------------

GBPUSD

HIGH 1.61475 LOW 1.61154 BID 1.61274 ASK 1.61277 CHANGE -0.11% TIME 08:43:24

OUTLOOK SUMMARY : Down

TREND CONDITION : Downward penetration

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : Medium

Upwards scenario: Retracement formation remains in power. Our next resistive measure lies at 1.6148 (R1), break here is required to achieve higher targets at 1.6173 (R2) and 1.6199 (R3). Downwards scenario: Our bearish expectations remain intact below the key support level at 1.6115 (S1). Price penetration below it would allow further declines towards to lower targets at 1.6090 (S2) and 1.6065 (S3).

Resistance Levels: 1.6148, 1.6173, 1.6199

Support Levels: 1.6115, 1.6090, 1.6065

--------------------

USDJPY :

HIGH 98.364 LOW 98.136 BID 98.311 ASK 98.313 CHANGE 0.14% TIME 08:43:25

OUTLOOK SUMMARY : Up

TREND CONDITION : Upward penetration

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : Medium

Upwards scenario: Instrument gained momentum on the upside recently, turning short-term bias to the positive side. Next resistive structure on the way lies at 98.37 (R1), break here would suggest next intraday targets at 98.50 (R2) and 98.62 (R3). Downwards scenario: On the other hand, loss of our support level at 98.15 (S1) would open road for a market decline towards to our next target at 98.03 (S2). Any further price weakening would then be limited to final support at 97.90 (S3).

Resistance Levels: 98.37, 98.50, 98.62

Support Levels: 98.15, 98.03, 97.90

Source: FX Central Clearing Ltd,( http://www.fxcc.com )

Forex Technical & Market Analysis FXCC Oct 23 2013

Markets rally as poor NFP print equals delayed monetary stimulus taper

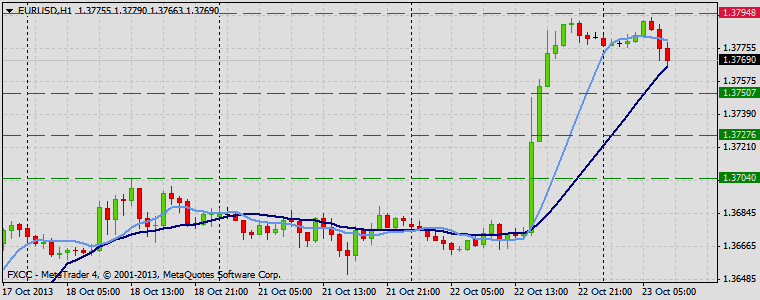

The DJIA closed up 0.49% on Tuesday with the SPX up 0.57% and the NASDAQ up 0.24%. European markets joined in the late afternoon rally; STOXX closing up 0.57%, UK FTSE up 0.62%, CAC up 0.43% and the DAX up 0.90%. The ASE closed up 0.45%. The leader on the board in Europe was the Swiss market index, closing up 1.12% on the day, the Swiss trade balance exceeding expectations helping the index rise, the balance was up to 2.49 bn. Equity index futures are currently flat or down marginally at the time of writing, the DJIA down 0.06%, SPX down 0.09% and the NASDAQ down 0.09%. European equity index futures are up; FTSE up 0.63%, CAC up 0.45% and the DAX up 0.84% Commodities experienced mixed fortunes on Tuesday, with WTI oil finally breaching the critical psyche level of $100 a barrel by some distance. ICE WTI oil was down 1.38% on the day to finish at $98.30 per barrel. NYMEX natural was up 0.34% on the day. COMEX gold was down 0.18% on the day at $1340.30 per ounce, with silver at $22.71 down 0.35% on the day. The dollar depreciated by 0.7 percent to $1.3781 per euro late in New York time, and touched $1.3792, the weakest level since November 2011. The greenback was little changed at 98.14 yen, while the Japanese currency lost 0.7 percent to 135.25 per euro and reached 135.51, the weakest since November 2009. The Swiss franc climbed as much as 0.9 percent to 89.40 centimes per dollar before trading at 89.47. The dollar slid to its weakest level in almost two years versus the euro after lower-than-forecast U.S. employment gains added to speculation the Federal Reserve will delay reducing stimulus.

http://blog.fxcc.com/market-analysis

FOREX ECONOMIC CALENDAR :

2013-10-23 08:30 GMT | Bank of England Minutes

2013-10-23 14:00 GMT | BoC Interest Rate Decision (Oct 23)

2013-10-23 14:30 GMT | Bank of Canada Monetary Policy Report

2013-10-23 15:15 GMT | BoC Press Conference

FOREX NEWS :

2013-10-23 05:36 GMT | USD/JPY tumbles on sharp Nikkei falls, China banks “jitters”

2013-10-23 04:48 GMT | AUD/USD retraced all of its post Australian CPI gains

2013-10-23 04:08 GMT | EUR/JPY tumbles on a corrective pullback

2013-10-23 03:42 GMT | EUR/USD rips past ‘13 peak of 1.3710 on “no tapering” hopes – continues higher Wednesday

-------------------------

EURUSD :

HIGH 1.37928 LOW 1.37663 BID 1.37732 ASK 1.37735 CHANGE -0.06% TIME 08 : 44:43

OUTLOOK SUMMARY : Up

TREND CONDITION : Upward penetration

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : High

MARKET ANALYSIS - Intraday Analysis

Upwards scenario: EURUSD gained momentum on the upside recently and likely resume its uptrend formation. Clearance of our next resistive structure at 1.3794 (R1) would open way towards to our initial target at 1.3821 (R2) and any further market rise would then be targeting 1.3846 (R3). Downwards scenario: On the downside bearish pressure might push the price below the support at 1.3750 (S1). Further downside extension would open road towards to next target at 1.3727 (S2) and any further losses would then be limited to 1.3704 (S3) mark.

Resistance Levels: 1.3794, 1.3821, 1.3846

Support Levels: 1.3750, 1.3727, 1.3704

----------------------

GBPUSD :

HIGH 1.62567 LOW 1.62101 BID 1.62164 ASK 1.62173 CHANGE -0.11% TIME 08 : 44:44

OUTLOOK SUMMARY : Down

TREND CONDITION : Downward penetration

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : High

Upwards scenario: Possibility of ascending structure is seen above the fractal level at 1.6259 (R1). Break here is required to clear the way towards to higher targets at 1.6286 (R2) and 1.6315 (R3). Downwards scenario: On the other hand, recovery phase might commence below the important support level at 1.6194 (S1). Break here is required to validate our targets at 1.6167 (S2) and 1.6139 (S3) later on today.

Resistance Levels: 1.6259, 1.6286, 1.6315

Support Levels: 1.6194, 1.6167, 1.6139

----------------------

USDJPY :

HIGH 98.195 LOW 97.264 BID 97.440 ASK 97.443 CHANGE -0.71% TIME 08 : 44:45

OUTLOOK SUMMARY : Down

TREND CONDITION : Down trend

TRADERS SENTIMENT : Bullish

IMPLIED VOLATILITY : High

Upwards scenario: Possible upwards formation is limited to resistive measure at 97.56 (R1). A break above it would suggest next intraday target 97.73 (R2) and if the price holds its momentum we can expect price increase towards to final resistance at 97.89 (R3). Downwards scenario: Clearance of our support at 97.25 (S1) is required to determine negative intraday bias and enable lower target at 97.09 (S2) and then any further market depreciation would suggest final aim at 96.92 (S3).

Resistance Levels: 97.56, 97.73, 97.89

Support Levels: 97.25, 97.09, 96.92

Source: FX Central Clearing Ltd,( http://www.fxcc.com )

Forex Technical & Market Analysis FXCC Oct 24 2013

Flash PMIs will dictate the market mood on Thursday

The DJIA closed down 0.35% on Wednesday, the recent rally, due to a temporary solution regarding the debt ceiling issue being agreed, may have now faded. The SPX closed down 0.47% and the NASDAQ down 0.57%. In Europe the STOXX index closed down 0.94%, reacting badly to the coming bank tests, the FTSE closed down 0.32%, CAC down 0.81%, DAX down 0.31%. The IBEX reacted badly to the bank test news despite crawling out of a deep recession, down 1.84% on the day. The MIB closed down 2.38%, with the Athens exchange hurting the most, down 3.82% on the day. Commodities once again endured a sell off on Wednesday, improved crude oil reserve numbers for the USA, up to 5.2 million barrels, caused WTI oil to fall by 1.22% to end at $97.10 per barrel on the day. The critical psyche level of $100 per barrel now being breached substantially with new medium term support levels being established. NYMEX natural rose by 1.06% to $3.62 per therm. COMEX gold was down 0.72% at $1333.00, with silver on COMEX down 1.01%. Equity index futures are pointing to a negative open in Europe followed by New York opening down. The DJIA equity index future is currently down 0.38%, NASDAQ down 0.42%, STOXX down 0.96%, FTSE down 0.40%, DAX down 0.35% The yen gained 0.8 percent to 134.12 per euro late in New York, after climbing as much as 1.2 percent, the biggest intraday advance since Aug. 27th. It depreciated to 135.51 Wednesday, the weakest level since November 2009. Japan’s currency strengthened 0.8 percent to 97.34 per dollar and touched 97.16, breaching its 200-day moving average at 97.28. The yen strengthened the most in eight weeks versus the euro as borrowing costs for Chinese banks jumped by the most since July affecting demand for safer assets.

http://blog.fxcc.com/market-analysis

FOREX ECONOMIC CALENDAR :

2013-10-24 07:58 GMT | EMU Markit Services PMI (Oct)

2013-10-24 14:00 GMT | US New Home Sales (MoM) (Sep)

2013-10-24 16:45 GMT | UK BOE's Governor Carney speech

2013-10-24 23:30 GMT | JP National Consumer Price Index (YoY) (Sep)

FOREX NEWS :

2013-10-24 05:07 GMT | EUR/USD continues to consolidate around 1.3780 area

2013-10-24 04:47 GMT | NZD/USD rejected off 0.8440 resistance, NZ Treasury report weighs

2013-10-24 04:20 GMT | USD/CHF breaks 2012 lows despite upbeat Chinese PMI

2013-10-24 03:06 GMT | GBP/JPY on EMA20 at 157.60

---------------------

EURUSD :

HIGH 1.37931 LOW 1.37733 BID 1.37921 ASK 1.37924 CHANGE 0.12% TIME 08:51:48

OUTLOOK SUMMARY : Up

TREND CONDITION : Sideway

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : Medium

MARKET ANALYSIS - Intraday Analysis

Upwards scenario: Possibility of further market appreciation is seen above the resistance level at 1.3794 (R1). Break here is required to validate next targets at 1.3821 (R2) and 1.3846 (R3) Downwards scenario: On the other hand, progress below the initial support level at 1.3761 (S1) might initiate bearish pressure and expose our intraday targets at 1.3735 (S2) and 1.3710 (S3) later on today.

Resistance Levels: 1.3794, 1.3821, 1.3846

Support Levels: 1.3761, 1.3735, 1.3710

-----------------

GBPUSD :

HIGH 1.62025 LOW 1.61623 BID 1.61914 ASK 1.61917 CHANGE 0.18% TIME 08:51:49

OUTLOOK SUMMARY : Up

TREND CONDITION : Upward penetration

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : Medium

Upwards scenario: Measures of resistance might be activating if the pair approaches 1.6225 (R1) price level. Break here would suggest next interim target at 1.6257 (R2) and If the price keeps its momentum we expect an exposure of 1.6287 (R3). Downwards scenario: Possible downward penetration is limited now to support level at 1.6157 (S1). If the price manages to surpass it, we would suggest next intraday targets at 1.6128 (S2) and 1.6099 (S3).

Resistance Levels: 1.6225, 1.6257, 1.6287

Support Levels: 1.6157, 1.6128, 1.6099

-------------------

USDJPY :

HIGH 97.617 LOW 97.175 BID 97.597 ASK 97.599 CHANGE 0.24% TIME 08:51:50

OUTLOOK SUMMARY : Down

TREND CONDITION : Sideway

TRADERS SENTIMENT : Bullish

IMPLIED VOLATILITY : Medium

Upwards scenario: Corrective action is possible today. Clearance of next resistance level at 97.56 (R1) would suggest next intraday targets at 97.75 (R2) and 97.96 (R3) later on today. Downwards scenario: On the other side, current price pattern suggests bearish potential if the instrument manages to overcome key support level at 97.15 (S1). Further price regress is liable to expose our initial targets at 96.96 (S2) and 96.77 (S3).

Resistance Levels: 97.56, 97.75, 97.96

Support Levels: 97.15, 96.96, 96.77

Source: FX Central Clearing Ltd,( http://www.fxcc.com )