Market Overview by FXCC

Forex Technical & Market Analysis FXCC Apr 01 2013

US Data, Italian Politics and Holidays

While it has been and will continue to be an exceedingly quiet morning in the foreign exchange market with most of the major markets closed for the Easter holidays, there were still have a few pieces of U.S. data released this morning. Personal income rose 1.1% in the month of February while personal spending rose 0.7%. USD/JPY barely reacted to the news because there's no one trading today but both numbers were better than expected and consistent with a continued recovery in the U.S. economy. The stronger increase in incomes versus spending is also a healthy trend that makes the light at the end of the tunnel shine slightly brighter for the Federal Reserve. The final University of Michigan Consumer Confidence numbers will be released later this morning but no revisions are expected and so the data should be a nonevent for the U.S. dollar.

Now that the situation in Cyprus has been pacified, the focus in Europe has shifted back to Italy where there were rumors that Berlusconi is open to a coalition with Bersani. He has since denied this possibility, saying instead that a grand coalition with an agreement on program reforms is the only acceptable option. Recent polls suggest that 50% of Italians are ready to vote again. - https://support.fxcc.com/email/technical/01042013/

FOREX ECONOMIC CALENDAR :

2013-04-01 14:00 GMT | USA.Construction Spending (MoM) (Feb)

2013-04-01 14:00 GMT | USA.ISM Manufacturing PMI (Mar)

2013-04-01 14:00 GMT | USA.ISM Prices Paid (Mar)

2013-04-01 22:30 GMT | AU.AiG Performance of Mfg Index (Mar)

FOREX NEWS :

2013-04-01 04:31 GMT | EUR/USD offered below 1.28; Italy and Cyprus main focus

2013-04-01 04:06 GMT | GBP/USD, premature to abandon bullish H&S pattern - BBH

2013-04-01 02:59 GMT | AUD/JPY lowest in 2 weeks, holds above 97.50

2013-04-01 01:26 GMT | USD/JPY dips further, 94.00 holds

---------------------

EURUSD :

HIGH 1.28129 LOW 1.2771 BID 1.27834 ASK 1.27842 CHANGE -0.25% TIME 08 : 02:10

OUTLOOK SUMMARY : Down

TREND CONDITION : Down trend

TRADERS SENTIMENT : Bullish

IMPLIED VOLATILITY : Medium

MARKET ANALYSIS - Intraday Analysis

Upwards scenario: The recent price acceleration on the upside suggests a possible move higher ahead. Next on tap is resistive barrier at 1.2810 (R1) on the way towards to higher targets at 1.2844 (R2) and 1.2866 (R3). Downwards scenario: Although market players may prefer to increase exposure on the short positions and push the price below the support level at 1.2768 (S1). Possible price devaluation would suggest next initial targets at 1.2742 (S2) and then 1.2701 (S3).

Resistance Levels: 1.2810, 1.2844, 1.2866

Support Levels: 1.2768, 1.2742, 1.2701

-------------------------

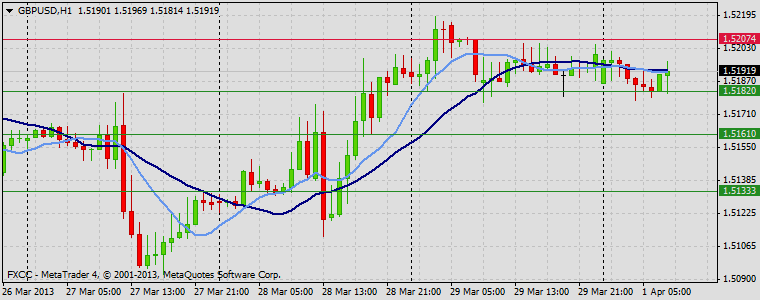

GBPUSD :

HIGH 1.52018 LOW 1.51777 BID 1.51892 ASK 1.51904 CHANGE -0.07% TIME 08 : 02:10

OUTLOOK SUMMARY : Down

TREND CONDITION : Downward penetration

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : Medium

Upwards scenario: Medium-term negative bias pressure the price lower however instrument might find buyers above the important resistance level at 1.5207 (R1). Break here might open route towards to our initial targets at 1.5231 (R2) and 1.5256 (R3). Downwards scenario: Opportunities for bearish oriented traders are seen below the important support level at 1.5182 (S1). Loss here would open door for the downtrend expansion towards to interim targets at 1.5161 (S2) and 1.5133 (S3).

Resistance Levels: 1.5207, 1.5231, 1.5256

Support Levels: 1.5182, 1.5161, 1.5133

--------------------------

USDJPY :

HIGH 94.373 LOW 93.832 BID 93.943 ASK 93.950 CHANGE -0.28% TIME 08 : 02:11

OUTLOOK SUMMARY : Down

TREND CONDITION : Sideway

TRADERS SENTIMENT : Bullish

IMPLIED VOLATILITY : Medium

Upwards scenario: USDJPY maintained a negative near-term tone though recovery action is possible above the next visible resistance at 94.34 (R1). Clearance here might initiate bullish pressure and validate our next targets at 94.59 (R2) and 94.86 (R3). Downwards scenario: Any downside fluctuations remains for now limited to the key support barrier at 93.85 (S1). Only clear break here would be a signal of possible market easing towards to our next targets at 93.60 (S2) and potentially to 93.34 (S3).

Resistance Levels: 94.34, 94.59, 94.86

Support Levels: 93.85, 93.60, 93.34

Source: FX Central Clearing Ltd,( ECN Forex Trading Accounts | Currency Converter | Forex School | FXCC )

Forex Technical & Market Analysis FXCC Apr 02 2013

Spain will revised down its 2013 GDP forecast to -1.0%; Negotiating new deficit target

Spain is discussing with the European union a new 2013 budget deficit target around 6% of the GDP, the current target is 4.5%, according to a Reuters information citing Spanish officials sources. The Spanish government needs to renegotiate a new target as they would revise down the Kingdom of Spain 2013 GDP forecast to -1.0% from the -0.5% expected before.

Today's Asia-Pacific session has had a common denominator in the form of a falling USD across the board, and specially against Yen, that has seen a 1-month fresh high printing a low at 92.55 in the USD/JPY pair, something not seen since early March. Strangely enough, Gold has printed fresh session highs at $1604 at the same time. The other main driver of the season has come from Australia and the RBA holding rates at 3%, with scope to ease further if market conditions are met, the statement said. Local share markets traded in a mixed way with Tokyo leading the loses at some point down more than -2%, but last at -0.83%, with Shanghai -0.38%, and Kospi -0.44%, while Australian ASX is up +0.34%, and Hang-Seng +0.10%. As the London open gets closer, after a long 4-day weekend closed for holidays, the USD finds some bids, making EUR/USD, GBP/USD and AUD/USD to ease a bit, while USD/JPY recovers some ground. European futures markets show a mixed open ahead, with small advances and declines in main equity indexes.

https://support.fxcc.com/email/technical/02042013/

FOREX ECONOMIC CALENDAR :

2013-04-02 07:43 GMT | Italy. IT Markit Manufacturing PMI (Mar)

2013-04-02 08:28 GMT | UK. Markit Manufacturing PMI (Mar)

2013-04-02 12:00 GMT | Germany. DE Consumer Price Index (YoY) (Mar)

2013-04-02 14:00 GMT | USA. Factory Orders (MoM) (Feb)

FOREX NEWS :

2013-04-02 04:51 GMT | EUR/USD adjusts value within bearish context

2013-04-02 03:58 GMT | USD/JPY enters 92.40/75 demand after 92.95 break

2013-04-02 03:46 GMT | AUD/USD higher as RBA on holds

2013-04-02 03:40 GMT | RBA holds rates at 3%; statement more neutral

EURUSD :

HIGH 1.28775 LOW 1.28399 BID 1.28616 ASK 1.28621 CHANGE 0.1% TIME 08:01:01

OUTLOOK SUMMARY : Up

TREND CONDITION : Up trend

TRADERS SENTIMENT : Bullish

IMPLIED VOLATILITY : Medium

MARKET ANALYSIS - Intraday Analysis

Upwards scenario: EURUSD gained momentum and determined medium-term positive bias. Next hurdle ahead is seen at 1.2878 (R1). Clearance here would suggest next intraday targets at 1.2892 (R2) and 1.2907 (R3) in potential. Downwards scenario: Any penetration below the support level at 1.2844 (S1) might create more scope for the instrument weakness in near-term perspective. We are looking to our immediate supports at 1.2830 (S2) and 1.2815 (S3) as next possible targets.

Resistance Levels: 1.2878, 1.2892, 1.2907

Support Levels: 1.2844, 1.2830, 1.2815

-------------------------

GBPUSD :

HIGH 1.52584 LOW 1.52183 BID 1.52374 ASK 1.52384 CHANGE 0.04% TIME 08:01:02

OUTLOOK SUMMARY : Up

TREND CONDITION : Upward penetration

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : Medium

Upwards scenario: Further uptrend evolvement is limited now to the local high at 1.5259 (R1). Break here is required to enable higher targets at 1.5269 (R2) and 1.5279 (R3). Downwards scenario: A downside pressure could be maintained if the price penetrates below the key supportive measure at 1.5225 (S1). Clearance here would open way for a price move towards to lower supports at 1.5214 (S2) and 1.5203 (S3).

Resistance Levels: 1.5259, 1.5269, 1.5279

Support Levels: 1.5225, 1.5214, 1.5203

-------------------------

USDJPY :

HIGH 93.322 LOW 92.565 BID 92.840 ASK 92.845 CHANGE -0.42% TIME 08:01:03

OUTLOOK SUMMARY : Down

TREND CONDITION : Down trend

TRADERS SENTIMENT : Bullish

IMPLIED VOLATILITY : Medium

Upwards scenario: Instrument showed excessive losses last few days and we expect some stabilization ahead. However appreciation above the next resistance at 93.03 (R1) might be a good catalyst for a recovery action towards to our next targets at 93.30 (R2) and 93.55 (R3). Downwards scenario: Fresh low at 92.56 (S1) offers a key supportive barrier on the way of downtrend development. A dip below it would suggest next intraday targets at 92.32 (S2) and potentially 92.08 (S3).

Resistance Levels: 93.03, 93.30, 93.55

Support Levels: 92.56, 92.32, 92.08

Source: FX Central Clearing Ltd,( Best ECN Trading Account | Forex Trading Education | FXCC )

Forex Technical & Market Analysis FXCC Apr 03 2013

Cyprus FinMin steps down after finalizing bailout deal

Cypriot finance minister Michael Sarris submitted his resignation on Tuesday, just after concluding bailout negotiations with Troika officials. Labor minister Haris Georgiadis has been nominated to the post shortly after. According to the Greek newspaper Kathimerini, other changes in the Cypriot government might follow today. It also suggests that Michael Sarris was replaced due to the Cyprus president Nicos Anastasiades’s dissatisfaction with the way he handled the crisis. As for the bailout deal, it was agreed that Cyprus would receive the first tranche of the aid in May. The fiscal adjustment period has been extended until 2018. The bailout loans will carry interest of 2.5% and repayment, spread over 12 years, is to begin in 10 years time. Michael Sarris also said that it was uncertain when the capital controls could be lifted completely.

Popular opinion in Brussels is that the worst outcome for the euro currency union would be if one of the member-states were forced out. On this pretext, the ECB has so far bailed out the banking systems of Portugal, Ireland, Greece, and Spain. When Cyprus faced a run on its banks two weeks ago, the eurocrats stepped in with a new proposal to shore up reserves: forfeiture of 9.9% on deposits over €100K and 6.7% below that level. This has come to be known as a "bail in." The reaction was immediate and intense. Cypriots took to the streets to protest the anticipated losses and breach of the government's deposit insurance guarantees for amounts under €100K; riot police were deployed. The Russian government was upset it was not consulted and that its citizens' deposits would face even steeper losses. The talking heads lamented the grave precedent that this move would set.

http://blog.fxcc.com/forex-technical...april-03-2013/

FOREX ECONOMIC CALENDAR

2013-04-03 08:30 GMT UK. PMI Construction (Mar)

2013-04-03 09:00 GMT EMU. Consumer Price Index (YoY) (Mar)

2013-04-03 13:15 GMT USA. US ADP Employment Change (Mar)

2013-04-03 14:00 GMT USA. ISM Non-Manufacturing PMI (Mar)

FOREX NEWS

2013-04-03 05:54 GMT EUR/USD regains 1.2800

2013-04-03 03:44 GMT Precious metals resume the selling off

2013-04-03 03:24 GMT GBP/JPY barely above 141.00 dragged on Pound weakness

2013-04-03 01:27 GMT GBP/USD breaks into 2-week low; no significant demand until 1.4950/1.50

Forex Technical Analysis EURUSD

MARKET ANALYSIS – Intraday Analysis

Upwards scenario: market sentiment is shifted to the negative side after the losses provided yesterday however market appreciation is possible above the next resistance at 1.2826 (R1). Loss here would suggest next intraday targets at 1.2844 (R2) and 1.2860 (R3). Downwards scenario: Fresh low at 1.2794 (S1) offers a key resistive measure on the downside. Break here is required to enable bearish pressure and validate next target at 1.2777 (S2). Final support for today locates at 1.2761 (S3).

Resistance Levels: 1.2826, 1.2844, 1.2860

Support Levels: 1.2794, 1.2777, 1.2761

Forex Technical Analysis GBPUSD

Upwards scenario: GBPUSD broke all supportive means yesterday and determined clear negative bias on the medium-term timeframe. Possibility of market appreciation is seen above the resistance level at 1.5109 (R1). Break here is required to validate next targets at 1.5125 (R2) and 1.5141 (R3). Downwards scenario: Risk of the further downtrend formation is seen below the support at 1.5074 (S1). With penetration here opens a route towards to our immediate support level at 1.5059 (S2) and any further price cut would then be limited to final target at 1.5043 (S3).

Resistance Levels: 1.5109, 1.5125, 1.5141

Support Levels: 1.5074, 1.5059, 1.5043

Forex Technical Analysis USDJPY

Upwards scenario: Price deviates from its initial downtrend formation on the hourly chart. Local high at 93.67 (R1) is a key technical point on the upside. Penetration above would suggest higher targets at 93.84 (R2) and 93.99 (R3). Downwards scenario: Our next support level is seen at 93.32 (S1). Any penetration below this level would increase likelihood of the downtrend development and suggest bearish priority in direction. Intraday support levels are placed at the 93.14 (S2) and 92.95 (S3) price levels.

Resistance Levels: 93.67, 93.84, 93.99

Support Levels: 93.32, 93.14, 92.95

Source: FX Central Clearing Ltd,( http://www.fxcc.com )

Forex Technical & Market Analysis FXCC Apr 05 2013

More Risk From Portugal

The euro area has had a rough few weeks: Cyprus agreed a bailout program that will decimate its economy, Italy’s Pier Luigi Bersani, the Democratic Party leader, failed to put together a government, borrowing costs for businesses in the peripheral countries continue to rise, unemployment reached record highs, and purchasing manager indices across the region greatly underperformed expectations. There may be one more piece of bad news to add to the pile before the week is out: Portugal’s budget for 2013 may fall apart, and with it the Portuguese government. During his New Year’s Day address, Portuguese President Anibal Cavaco Silva called on the constitutional court to rule whether the budget, which consists of tax increases and spending cuts worth 5.3 billion euros ($6.8 billion), is legal.

If the court rules against the budget, an estimated 2 billion euros of the austerity measures may be compromised. This would immediately derail Portugal’s progress toward hitting its fiscal targets, only weeks after the country’s international creditors relaxed them. Rejection of the budget could also cause the government to collapse if the ruling Social Democratic Party cannot find alternative austerity measures to get Portugal back on track with its bailout program. It is unclear exactly when the constitutional court will make its ruling, but it may be before the week is out. Concerns over what the court might say could account for an increase in Portuguese two-year bond yields to over 3.8 percent today, before falling back to around 3 percent again later in the day. This isn’t what a country looking to exit its bailout program and regain full market access needs. -FXstreet.com

https://support.fxcc.com/email/technical/05042013/

FOREX ECONOMIC CALENDAR :

2013-04-05 09:00 GMT | EMU. Gross Domestic Product s.a. (QoQ) (Q1)

2013-04-05 10:00 GMT | Germany. Factory Orders n.s.a. (YoY) (Feb)

2013-04-05 12:30 GMT | USA. Nonfarm Payrolls (Mar)

2013-04-05 12:30 GMT | Canada. Unemployment Rate (Mar)

FOREX NEWS :

2013-04-05 04:35 GMT | USD/JPY dives below 96.30 on massive taking profit

2013-04-05 04:19 GMT | EUR/USD negates market sentiment climbing above 1.29

2013-04-05 03:41 GMT | AUD/USD dips to 1.0400 lows

2013-04-05 02:09 GMT | EUR/JPY biggest single day rally on record above 125.30

----------------------

EURUSD :

HIGH 1.29379 LOW 1.29186 BID 1.29188 ASK 1.29196 CHANGE -0.12% TIME 08:49:51

OUTLOOK SUMMARY : Up

TREND CONDITION : Up trend

TRADERS SENTIMENT : Bullish

IMPLIED VOLATILITY : Medium

MARKET ANALYSIS - Intraday Analysis

Upwards scenario: EURUSD trapped to the consolidation phase after the upside development. Yesterday high at 1.2950 (R1) offers a good resistance level. Break here is required to take the pair towards to initial targets at 1.2977 (R2) and 1.3003 (R3). Downwards scenario: Hourly chart technical indicators readings are positive though Immediate focus comes on the next support level at 1.2915 (S1). Any penetration below it would suggest next intraday targets at 1.2889 (S2) and 1.2860 (S3).

Resistance Levels: 1.2950, 1.2977, 1.3003

Support Levels: 1.2915, 1.2889, 1.2860

------------------------

GBPUSD :

HIGH 1.52428 LOW 1.5214 BID 1.52279 ASK 1.52290 CHANGE -0.03% TIME 08:49:52

OUTLOOK SUMMARY : Up

TREND CONDITION : Up trend

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : Medium

Upwards scenario: GBPUSD lost momentum after the gains provided yesterday. In terms of technical levels next resistance level could be exposed at 1.5259 (R1). Further appreciation above it would enable intraday targets at 1.5284 (R2) and 1.5309 (R3). Downwards scenario: Possible pull back formation might get acceleration below the support level at 1.5208 (S1). Loss here would suggest next intraday target at 1.5182 (S2) and any weakening below it would then be limited to final support at 1.5158 (S3).

Resistance Levels: 1.5259, 1.5284, 1.5309

Support Levels: 1.5208, 1.5182, 1.5158

---------------------

USDJPY :

HIGH 97.195 LOW 96.134 BID 96.314 ASK 96.321 CHANGE -0.01% TIME 08:49:52

OUTLOOK SUMMARY : Up

TREND CONDITION : Downward penetration

TRADERS SENTIMENT : Bullish

IMPLIED VOLATILITY : Medium

Upwards scenario: We are not expecting significant volatility increase today however clearance of our next resistive barrier at 97.23 (R1) is required to push the price towards to our next visible targets at 97.63 (R2) and 98.04 (R3). Downwards scenario: Penetration below the support level at 95.94 (S1) might maintain a negative tone and prolong corrective action. Price devaluation would then be targeting our supportive measures at 95.54 (S2) and 95.08 (S3) in potential.

Resistance Levels: 97.23, 97.63, 98.04

Support Levels: 95.94, 95.54, 95.08

Source: FX Central Clearing Ltd,( Forex School | Currency Converter | Best Forex Trading Software | FXCC )

Forex Technical & Market Analysis FXCC Apr 08 2013

Portugal to slash spending after court ruling setback

Following the Portuguese constitutional court decision last Friday, in which certain austerity measures from the 2013 budget were rejected, Portugal's Prime Minister Pedro Passos Coelho said on Sunday the government will implement further cuts to compensate the unexpected budgetary setback, so that it can meet targets set by the Troika. Passos Coelho said in a televised address to the country that the court ruling was, cited by Reuters, "a serious obstacle for and risk" this year and next, but showed commitment to comply with the EU/IMF rescue program.

The Prime Minister ruled out an increase in taxes but one of the measures being explored was to cut on more spending, as mentioned above. The government is also seeking more flexible conditions from international lenders, so that they can successfully complete the bailout programme in 2014. According to Reuters: "Analysts expect Portugal to be able to agree replacement measures with the European Union and International Monetary Fund to make up for the court ruling, which could cost it between 900 million and 1.3 billion euros." http://blog.fxcc.com/forex-technical...april-08-2013/

FOREX ECONOMIC CALENDAR

2013-04-08 10:00 GMT | Germany. Industrial Production s.a. w.d.a. (YoY)

2013-04-08 14:30 GMT | Canada. Bank of Canada Business Outlook Survey

2013-04-08 23:15 GMT | USA. US Fed's Bernanke Speech

2013-04-08 23:50 GMT | Japan. BoJ Monetary Policy Meeting Minutes

FOREX NEWS

2013-04-08 04:26 GMT | GBP/JPY moves above 151 first time in 3 years

2013-04-08 03:41 GMT | EUR/USD next upside target near 1.3115 – BBH

2013-04-08 03:22 GMT | USD/JPY to remain bid; 100.00/101.50 eyed – RBS

2013-04-08 02:47 GMT | AUD/USD to stay above parity for the remainder of 2013 – NAB

---------------------

Forex Technical Analysis EURUSD :

MARKET ANALYSIS – Intraday Analysis

Upwards scenario: Upside formation is limited now to the next resistive barrier at 1.3040 (R1). Clearance here is required to provide a space for a move towards to next target at 1.3063 (R2) and then final aim would be 1.3087 (R3). Downwards scenario: Our key support level locates below the session low at 1.2972 (S1) mark. Break here is required to prolong bearish extension and validate our intraday targets at 1.2949 (S2) and 1.2926 (S3).

Resistance Levels: 1.3040, 1.3063, 1.3087

Support Levels: 1.2972, 1.2949, 1.2926

-----------------

Forex Technical Analysis GBPUSD :

Upwards scenario: Measures of resistance might be activating when the pair approaches the 1.5363 (R1) mark. Break here would suggest next interim target at 1.5388 (R2) and If the price keeps its momentum we expect an exposure of 1.5413 (R3). Downwards scenario: Any downside extension is limited now to the next support level at 1.5301 (S1). Below here we see potential for the price acceleration towards to next initial targets at 1.5276 (S2) and 1.5251 (S3).

Resistance Levels: 1.5363, 1.5388, 1.5413

Support Levels: 1.5301, 1.5276, 1.5251

------------------

Forex Technical Analysis USDJPY :

Upwards scenario: We are not expecting significant volatility increase today however appreciation above the resistive structure at 98.85 (R1) might trigger bullish pressure and drive market price towards to next targets at 99.23 (R2) and 99.60 (R3). Downwards scenario: Possible bull back on the hourly chart might face next hurdle at 98.07 (S1). Break here is required to open road towards to our next retracement target at 97.66 (S2) en route to final aim at 97.25 (S3).

Resistance Levels: 98.85, 99.23, 99.60

Support Levels: 98.07, 97.66, 97.25

Source: FX Central Clearing Ltd,( Forex Blog | Currency Converter | Forex Trading Platform | FXCC )

Forex Technical & Market Analysis FXCC Apr 09 2013

German Fin Min urges Portugal to find new austerity measures

German Finance Minister Wolfgang Schaeuble said in a radio interview on Monday that Portugal should come up with a new set of austerity measures, after the country’s high court rejected parts of the plan put forward by the Portuguese government, deeming them illegal. “Portugal has made lots of progress in the last year to gain access to financial markets,” the German finance minister said. “But after this (constitutional court) decision it will have to find new measures.” Portuguese Prime Minister Pedro Passos Coelho has already announced plans of carrying out cuts in health and education spending, in order to meet the targets set by the Troika and avoid asking for a second rescue package. He assured however that no new tax hikes would be introduced in 2013.

https://support.fxcc.com/email/technical/09042013/

FOREX ECONOMIC CALENDAR :

2013-04-09 06:00 GMT | Germany. Trade Balance s.a. (Feb)

2013-04-09 08:30 GMT | UK. Manufacturing Production (YoY) (Feb)

2013-04-09 12:15 GMT | Canada. Housing Starts s.a (YoY) (Mar)

2013-04-09 14:00 GMT | UK. NIESR GDP Estimate (3M) (Mar)

FOREX NEWS :

2013-04-09 04:43 GMT | EUR/USD hits 3 ½ week high; fresh upside potential

2013-04-09 03:11 GMT | NZD/USD testing long term resistance below 0.85

2013-04-09 02:14 GMT | USD/CAD finds 1.0160 double bottom; upside risks - TDS

2013-04-09 01:48 GMT | AUD/USD higher on China CPI

-------------------------

EURUSD :

HIGH 1.30679 LOW 1.3009 BID 1.30454 ASK 1.30461 CHANGE 0.28% TIME 08:39:23

OUTLOOK SUMMARY : Up

TREND CONDITION : Up trend

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : Medium

MARKET ANALYSIS - Intraday Analysis

Upwards scenario: Price stabilized near it local high’s however we see potential to overcome our next resistance level at 1.3069 (R1). Clearance here might pull the pair towards to eventual targets at 1.3095 (R2) and 1.3120 (R3). Downwards scenario: On the other side, price depreciation below the support barrier at 1.3037 (S1) might provide sufficient space for the recovery action. In such case e we would suggest next intraday targets at 1.3012 (R2) and then 1.2987 (R3)

Resistance Levels: 1.3069, 1.3095, 1.3120

Support Levels: 1.3037, 1.3012, 1.2987

------------------------

GBPUSD :

HIGH 1.52781 LOW 1.52508 BID 1.52717 ASK 1.52722 CHANGE 0.12% TIME 08:39:24

OUTLOOK SUMMARY : Down

TREND CONDITION : Downward penetration

TRADERS SENTIMENT : Bullish

IMPLIED VOLATILITY : Medium

Upwards scenario: Our technical outlook on the medium-term perspective remains positive. Further market appreciation is possible above the key resistance at 1.5293 (R1). Next targets could be found at 1.5318 (R2) and 1.5341 (R3). Downwards scenario: On the other hand, loss of our support level at 1.5237 (S1) would open road for a market decline towards to our next target at 1.5214 (S2). Any further price weakening would then be limited to final support for today at 1.5190 (S3).

Resistance Levels: 1.5293, 1.5318, 1.5341

Support Levels: 1.5237, 1.5214, 1.5190

---------------------

USDJPY :

HIGH 99.663 LOW 99.091 BID 99.207 ASK 99.213 CHANGE -0.15% TIME 08:39:24

OUTLOOK SUMMARY : Up

TREND CONDITION : Down trend

TRADERS SENTIMENT : Bullish

IMPLIED VOLATILITY : Medium

Upwards scenario: Upwards penetration is limited tow to the next resistance level at 99.65 (R1). Clearance here might open a route towards to our initial target at 100.12 (R2) and then further price appreciation would be targeting resistance at 100.57 (R3). Downwards scenario: On the other hand, our bearish expectations remain intact below the key support level at 98.86 (S1). Price penetration below it would allow further declines towards to our initial targets at 98.37 (S2) and 97.89 (S3).

Resistance Levels: 99.65, 100.12, 100.57

Support Levels: 98.86, 98.37, 97.89

Source: FX Central Clearing Ltd,( FX Central Clearing Ltd )

Forex Technical & Market Analysis FXCC Apr 10 2013

Moody’s maintains a negative outlook on Spanish rating

Moody’s rating agency announced today that it maintains a negative outlook on Spain’s Baa3 credit rating. One of the main reasons for this decision was the agency’s conviction that the country will fail to reach the 4.5% deficit target fixed by the EU. In Moody’s opinion, Spain will only manage to bring down its deficit to 6% this year, failing thus to reach the 4.5% target required by Brussels. In the report, which was released in the European morning, the agency assures that the continuous deviations from the deficit objectives and the recurring revisions of the estimates carried out by the Spanish government undermine its credibility. Even though the agency acknowledges the country’s fiscal consolidation efforts and highlights the good results obtained in 2012, it also warns against the multiple threats to the Spanish economy.

https://support.fxcc.com/email/technical/10042013/

N/A | China. New Loans (Mar)

2013-04-10 17:00 GMT | USA. 10-Year Note Auction

2013-04-10 18:00 GMT | USA. US FOMC Minutes

2013-04-10 22:30 GMT | New Zeland. Business NZ PMI (Mar)

2013-04-10 04:29 GMT | EUR/USD, above 1.31 where true strength test begins

2013-04-10 03:31 GMT | NZD/JPY at 95 not outside the bounds of possibility - BNZ

2013-04-10 02:26 GMT | AUD/JPY pushes again above 104 highs post China trade deficit

2013-04-10 02:22 GMT | AUD/USD strengthens bullish case; 1.0516 new high post China trade

--------------------------------

EURUSD :

HIGH 1.30907 LOW 1.30731 BID 1.30754 ASK 1.30763 CHANGE -0.05% TIME 08:35:48

OUTLOOK SUMMARY : Up

TREND CONDITION : Up trend

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : Medium

MARKET ANALYSIS - Intraday Analysis

Upwards scenario: While price is quoted above the moving averages out technical outlook would be positive. Yesterday high offers next resistance level at 1.3103 (R1). Any price action above it would suggest next targets at 1.3128 (R2) and 1.3154 (S3). Downwards scenario: Penetration below the support at 1.3068 (S1) is liable to put more downward pressure on the instrument in the near-term perspective. As a result our supportive means at 1.3042 (S2) and 1.3015 (S3) might be triggered.

Resistance Levels: 1.3103, 1.3128, 1.3154

Support Levels: 1.3068, 1.3042, 1.3015

-------------------------

GBPUSD :

HIGH 1.53389 LOW 1.53125 BID 1.53201 ASK 1.53205 CHANGE 0.02% TIME 08:35:49

OUTLOOK SUMMARY : Up

TREND CONDITION : Upward penetration

TRADERS SENTIMENT : Bullish

IMPLIED VOLATILITY : Medium

Upwards scenario: On the upside potential is seen for a break above the resistance at 1.5341 (R1). In such case we would suggest next target at 1.5361 (R2) and any further rise would then be limited to final resistance at 1.5382 (R3). Downwards scenario: On the other hand, successful retest of our next support level at 1.5311 (S1) might provide sufficient momentum for the price acceleration towards to interim target at 1.5292 (S2). Final aim for today locates at 1.5271 (S3).

Resistance Levels: 1.5341, 1.5361, 1.5382

Support Levels: 1.5311, 1.5292, 1.5271

---------------------------

USDJPY :

HIGH 99.314 LOW 98.914 BID 99.129 ASK 99.135 CHANGE 0.11% TIME 08:35:50

OUTLOOK SUMMARY : Up

TREND CONDITION : Sideway

TRADERS SENTIMENT : Bullish

IMPLIED VOLATILITY : Medium

Upwards scenario: We are not expecting busy session ahead however upwards extension above the resistance at 99.65 (R1) level would keep the bullish structure intact and validate our next intraday targets at 100.12 (R2) and 100.57 (R3). Downwards scenario: On the short-term perspective the pair might encounter supportive measures at 98.74 (S1). Loss here might change intraday technical structure and opens the way for a test of 98.32 (S2) and 97.89 (S3) later on today.

Resistance Levels: 99.65, 100.12, 100.57

Support Levels: 98.74, 98.32, 97.89

Source: FX Central Clearing Ltd,( Currency Trading Blog | Forex Account | Auto Forex Trading Account | FXCC )

Forex Technical & Market Analysis FXCC Apr 12 2013

CORRECTION - BOJ Kuroda: Easing to last until sustainable prices achieved

BoJ Kuroda speech was just published, with the governor saying that the objetive of achieving the inflation target with 2 years in mind, adding that the BoJ easing will not necessarily be limited to just 2 years. He said that the easing is actually planned to last as long as needed to achieve sustainable prices. He pointed out on his speech that capital spending is the key element to monitor and improve to end the vicious deflation cycle.

Mr. Kuroda will make prompt policy adjustment as required on varies areas, prior examination of indicators such as the capex as mentioned, consumption, exports, conducting regular examinations every single month. Finally, he said to be confident BoJ can meet its bond buying target with purchases across the yield curve, adding that monetary policies do not have as a result the depreciation of the local currency but policies are aimed to end deflation, not to affect the Yen rate.

https://support.fxcc.com/email/technical/12042013/

FOREX ECONOMIC CALENDAR :

24h EMU. Eurogroup meeting

2013-04-12 12:30 GMT | US Retail Sales (MoM) (Mar)

2013-04-12 13:55 GMT | US Reuters/Michigan Consumer Sentiment Index

2013-04-12 16:30 GMT | US Fed's Bernanke Speech

FOREX NEWS :

2013-04-12 04:37 GMT | EUR/USD having a hard time at key supply 1.3140/60

2013-04-12 04:07 GMT | AUD/USD edges higher during Asia session, 1.0553 last

2013-04-12 02:40 GMT | USD/JPY holds 99.38/45 demand for now

2013-04-11 22:48 GMT | EURJPY advances for 6th day in a row, prints new highs above 131.00

EURUSD :

HIGH 1.31261 LOW 1.30994 BID 1.31129 ASK 1.31135 CHANGE 0.09% TIME 08:52:50

OUTLOOK SUMMARY : Up

TREND CONDITION : Upward penetration

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : Medium

MARKET ANALYSIS - Intraday Analysis

Upwards scenario: Yesterday high offers key resistance level at 1.3140 (R1). Clearance here is required to resume uptrend structure towards to next target at 1.3176 (R2) and any further price appreciation would then be limited to last resistance for today at 1.3212 (R3). Downwards scenario: Next challenge on the downside is seen at 1.3083 (S1). Breakthrough of this mark would open way for a downside expansion and could possibly trigger our initial targets at 1.3046 (S2) and 1.3008 (R3) later on today.

Resistance Levels: 1.3140, 1.3176, 1.3212

Support Levels: 1.3083, 1.3046, 1.3008

---------------------

GBPUSD :

HIGH 1.54096 LOW 1.53814 BID 1.53932 ASK 1.53938 CHANGE 0.05% TIME 08:52:51

OUTLOOK SUMMARY : Up

TREND CONDITION : Up trend

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : Medium

Upwards scenario: Instrument stabilized after the gains provided yesterday. Penetration above the resistive structure at 1.5413 (R1) might encourage protective orders execution and drive market price towards to the next resistive means at 1.5444 (R2) and 1.5477 (R3). Downwards scenario: Market decline below the support level at 1.5363 (S1) might change short-term technical picture and shift market sentiment to the bearish side. In such scenario we expect next targets to be exposed at 1.5330 (S2) and 1.5297 (S3)

Resistance Levels: 1.5413, 1.5444, 1.5477

Support Levels: 1.5363, 1.5330, 1.5297

-----------------------

USDJPY :

HIGH 99.803 LOW 99.358 BID 99.515 ASK 99.520 CHANGE -0.16% TIME 08:52:52

OUTLOOK SUMMARY : Up

TREND CONDITION : Sideway

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : Medium

Upwards scenario: Medium term bias remains positive however further market rise is limited now to the key resistive barrier at 99.95 (R1), clearance here is required to enable next resistances at 100.48 (R2) and last one at 101.04 (R3). Downwards scenario: Yesterday session low offers key supportive barrier at 99.09 (S1). Break here might provide sufficient momentum on the downside and expose our intraday targets at 98.62 (S2) and 98.12 (S3)

Resistance Levels: 99.95, 100.48, 101.04

Support Levels: 99.09, 98.62, 98.12

Source: FX Central Clearing Ltd,( Forex ECN Trading Account | Forex ECN Brokers List | FXCC )

Forex Technical & Market Analysis FXCC Apr 15 2013

Eurogroup releases statement on Cyprus

Eurozone finance ministers, who are holding talks in Dublin today, have released a statement on Cyprus in which they assure that the country has met all the requirements, allowing for the bailout deal to be completed. According to the document: The Eurogroup notes with satisfaction that the Cypriot authorities have implemented decisive bank resolution, restructuring and recapitalisation measures to address the fragile and unique situation of Cyprus' financial sector. The Eurogroup commends the authorities for their demonstrated resolve in implementing these important measures in a tight timeframe and reiterates its appreciation for the efforts made by the Cypriot citizens over the last weeks.” Eurozone finance ministers expect the bailout fund ESM board to give the green light to the proposal of granting Cyprus a 10 billion euro bailout on April 24. The first tranche of the aid could then be released by mid-may.

Following the release of the statement on the Cypriot bailout, Eurozone finance ministers, who hold talks today in Dublin, announced that the loan repayment for Ireland and Portugal would be extended. Eurogroup chief Jeroen Dijsselbloem confirmed that the Eurozone finance ministers agreed to give seven more years to Portugal and Ireland to repay their bailout loans amounting to 78 billion euros and 85 billion euros, respectively. He also informed that the maturity extension will most probably be approved at the upcoming Ecofin meeting, which kicks off later today. EU Commissioner Olli Rehn expressed hope that Ecofin would give the green light to the measure, which in his opinion is an important step on the road to exiting the rescue program.

http://blog.fxcc.com/13536/

FOREX ECONOMIC CALENDAR :

2013-04-15 09:00 GMT | EMU. Trade Balance s.a. (Feb)

2013-04-15 12:30 GMT | USA. NY Empire State Manufacturing Index (Apr)

2013-04-15 13:00 GMT | USA. Total Net TIC Flows (Feb)

2013-04-15 14:00 GMT | USA. NAHB Housing Market Index (Apr)

FOREX NEWS :

2013-04-15 04:34 GMT | Draghi testimony key in the week ahead for euro – UBS

2013-04-15 04:08 GMT | EUR/JPY, stops below 127.70 tripped

2013-04-15 03:45 GMT | USD/CAD catching a firm bid, trading up 43 pips at 1.0184

2013-04-15 03:08 GMT | NZD/USD again below 0.85

-----------------------------------------------------------------

Forex Technical Analysis EURUSD

MARKET ANALYSIS – Intraday Analysis

Upwards scenario: Possibility of market strengthening is seen above the immediate resistive barrier at 1.3103 (R1). Price extension above it is required to validate our next intraday targets at 1.3128 (R2) and 1.3154 (R3) Downwards scenario: Further correction development is limited now to the session low – 1.3043 (S1). If the price manages to surpass it we would suggest next intraday targets at 1.3015 (S2) and 1.2988 (S3).

Resistance Levels: 1.3103, 1.3128, 1.3154

Support Levels: 1.3043, 1.3015, 1.2988

--------------------------------------------------------------

Forex Technical Analysis GBPUSD

Upwards scenario: Next resistance level is seen at 1.5355 (R1). Subsequently loss here might create upside momentum and drive market price towards to our initial targets at 1.5384 (R2) and 1.5415 (R3) in potential. Downwards scenario: An important technical level is seen at 1.5306 (S1). Market decline below this level might initiate bearish pressure and drive market price towards to our next targets at 1.5282 (S2) and 1.5257 (S3).

Resistance Levels: 1.5355, 1.5384, 1.5415

Support Levels: 1.5306, 1.5282, 1.5257

--------------------------------------------------------------

Forex Technical Analysis USDJPY

Upwards scenario: Next hurdle on the upside is seen at important technical level – 98.62 (R1). If the price manages to overcome it we expect further acceleration towards to our initial targets at 99.17 (R2) and 99.71 (R3). Downwards scenario: Price regress below the support level at 97.55 (S1) would increase likelihood of failing towards to our key supportive barrier at 97.08 (S2) and any further market decline would then be targeting final support for today at 96.57 (S3).

Resistance Levels: 98.62, 99.17, 99.71

Support Levels: 97.55, 97.08, 96.57

Source: FX Central Clearing Ltd,( http://www.fxcc.com )

Forex Technical & Market Analysis FXCC Apr 16 2013

Portugal unveils new austerity measures to appease the Troika

Troika inspectors arrived in Lisbon on Monday in order to carry out the seventh review of the country’s bailout program, since it had received 78 billion euros of aid in 2011. Portugal had to come up with new austerity measures to meet the budget gap of about 1.3 billion euros, which emerged after the Portuguese Constitutional court ruled that four of the measures proposed by the PM Pedro Passos Coelho’s government were illegal.

Currently the 2 billion euro bailout tranche is blocked. If the Troika’s review has a positive conclusion, the money will be released and Portugal will also have a better chance of obtaining the 7 year loan repayment extension, approved on Friday by Ecofin. Passos Coelho said today that the additional 600 million euros would come from cuts in healthcare, education , social security and public services and another 600 million euros from reductions of administrative costs. These new austerity measures have been heavily criticized by the left-wing opposition and labor unions.

https://support.fxcc.com/email/technical/16042013/

FOREX ECONOMIC CALENDAR :

2013-04-16 09:00 GMT | Germany. ZEW Survey - Economic Sentiment (Apr)

2013-04-16 12:30 GMT | USA. Consumer Price Index (YoY) (Mar)

2013-04-16 13:00 GMT | EMU. ECB President Draghi's Speech

2013-04-16 22:45 GMT | New Zeland. Consumer Price Index (YoY)

FOREX NEWS :

2013-04-16 03:38 GMT | Kiwi retreats as macro risks weigh on sentiment

2013-04-16 03:32 GMT | EUR/USD holds above 1.3035

2013-04-16 02:13 GMT | Gold has peaked, beginnings of a new chapter - RBS

2013-04-16 01:57 GMT | EUR/AUD rockets higher as China Data spurs Aussie weakness

---------------------

EURUSD :

HIGH 1.30815 LOW 1.30305 BID 1.30747 ASK 1.30753 CHANGE 0.3% TIME 08:33:21

OUTLOOK SUMMARY : Neutral

TREND CONDITION : Sideway

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : High

MARKET ANALYSIS - Intraday Analysis

Upwards scenario: A bullish tone dominates during the Asian session and further buying interest might arise above the next resistance at 1.3108 (R1). Clearance here would suggest next intraday target at 1.3143 (R2) and if the price holds its momentum we can expect an increase towards to 1.3179 (R3). Downwards scenario: Key support level lies at 1.3043 (S1). Penetration below it might change near-term tone to the negative side and expose our initial targets at 1.3008 (S2) and 1.2969 (S3) later on today.

Resistance Levels: 1.3108, 1.3143, 1.3179

Support Levels: 1.3043, 1.3008, 1.2969

-----------------------------

GBPUSD :

HIGH 1.53097 LOW 1.52729 BID 1.53043 ASK 1.53049 CHANGE 0.14% TIME 08:33:22

OUTLOOK SUMMARY : Down

TREND CONDITION : Upward penetration

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : High

Upwards scenario: Next hurdle that limit uptrend development lies above the fractal level at 1.5345 (R1). If the break occurs here, next attractive level could be exposed at 1.5374 (R2) and any further rise would then be limited to 1.5403 (R3). Downwards scenario: However our both moving averages are pointing down and if the price manages to break our key support level at 1.5271 (S1) we would expect further depreciation towards to our next targets, located at 1.5242 (S2) and 1.5212 (S3).

Resistance Levels: 1.5345, 1.5374, 1.5403

Support Levels: 1.5271, 1.5242, 1.5212

--------------------------

USDJPY :

HIGH 97.71 LOW 95.79 BID 97.438 ASK 97.439 CHANGE 0.69% TIME 08:33:23

OUTLOOK SUMMARY : Down

TREND CONDITION : Upward penetration

TRADERS SENTIMENT : Bullish

IMPLIED VOLATILITY : Medium

Upwards scenario: Possibility of market strengthening is seen above the resistance level at 98.27 (R1). Clearance here is required to validate next interim target at 98.83 (R2) and any further rise would then be targeting mark at 99.39 (R3). Downwards scenario: Possible depreciation below the technically important support level at 97.08 (S1) would allow further market decline on the medium-term perspective. Possible targets lies at 96.53 (S2) and 95.99 (S3).

Resistance Levels: 98.27, 98.83, 99.39

Support Levels: 97.08, 96.53, 95.99

Source: FX Central Clearing Ltd,( Forex Traders Blog | Forex Trading Systems | Forex Account | FXCC )