Should I burn my money instead of giving it to stop bots?

It's a question that I've been asking myself quite a lot.

With the infinate number of price levels that price could be traded to, why does is mostly seem that once your stop is hit, price stalls and then reverses to your now dead profit target?

I've lost over 40% of my account. Money management has slowed the losses, but they all add up. In that respect money management helps you to lose your money, but over a longer time, in mycase 3 years.

I trade with the trend, unfortunately I get a lot of break even trades, but more initial stops get hit. Price does not make my target except on the rare occasion. So, I win 144 PIPs on one trade, then lose 180 on the next 4 trades in a row, that's combined not each.

More often than not, price reaches my stop, goes a few pips past it and then reverses for unseen profits. I catch tops and bottoms, but not in the direction I'm trading.

I still think there are stop bots that take out stops that are bunched up around the same price level. Brokers and/or banks MUST know where stops are, otherwise they wouldn't be able to execute them.

I've tried breakouts, price channels, divergence, RSI/MACD crosses all in the direction of the daily trend, but the result is the same, LOSS, LOSS, LOSS, LOSS. The lowest time frame I use is the hourly.

If you need to get rid of money in a controlled way, do it in FOREX. You won't be dissapointed.

With the infinate number of price levels that price could be traded to, why does is mostly seem that once your stop is hit, price stalls and then reverses to your now dead profit target?

It is very popular question answered many times. It simply means that traders like us r trapped by Pros into fake moves. We and traders like us keep investing and the Pros keep pulling that cash. So we have to get our mind out of "obvious" moves. Same thing happens with me too.

Hello Leebut. I had a look at your account "Micro from the beginning". At very first page of ur statement there r 4 trades with 2537 pip loss. It is insanely high as compared to what u r getting as profit. You wrote that u get 144 pip gain from 1 trade and then 180 pips loss from 4 trades. But I think ur losses are also big and these 4 losses will eat up many profitable trades.

You should revise ur SL strategy. You have less profitable trades but it doesnt matter much. T0009 also had around 40% profitable trades but not a single month of loss. He used very tight SL strategy.

Stick to your rules

Hello uniquetrader,

Those four trades were on XAU/USD. The PIP cost is much smaller @ $0.01 on a micro account with a 50 pip spread, so I widened the stops. Considering that gold can move 1,000 pips in an hour, 600 pips of stop isn't that many. I wouldn't have such stops on the majors.

Nowadays, I generally trade with upto 70 pips risk now, but usually 50 or less on H1 charts.

Thanks,

Lee.

Originally posted by leebutHello uniquetrader,

Those four trades were on XAU/USD. The PIP cost is much smaller @ $0.01 on a micro account with a 50 pip spread, so I widened the stops. Considering that gold can move 1,000 pips in an hour, 600 pips of stop isn't that many. I wouldn't have such stops on the majors.

Nowadays, I generally trade with upto 70 pips risk now, but usually 50 or less on H1 charts.

Thanks,

Lee.

Yes this SL for gold is not too much. Your account went down slowly but continuously. I think you need to change ur strategy. Maybe Confluence in forex trading article can solve problem.

Leebut. Have u tried any other strategy? Do u trade on EAs or 100% manually?

The good or ill of a man lies within his own will. – Epictetus

100% manually.

I've tried several strategies: Donchian Channels, breakouts (more like fakeouts), triangle breaks, MACD/MVA crosses. Nothing really works.

I'm thinking that a coin toss would be more effective.

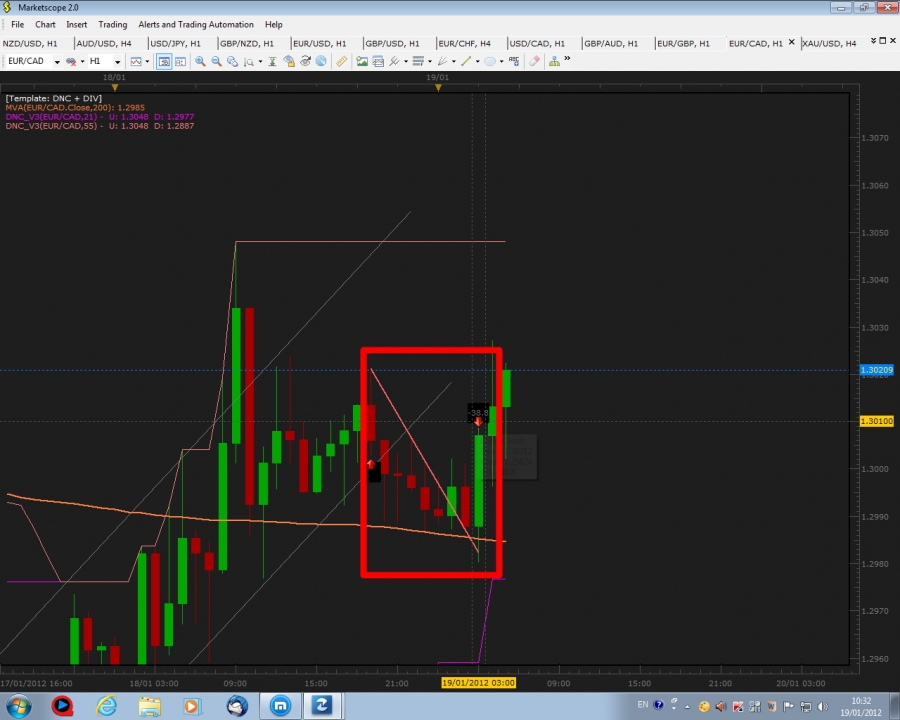

What I don't understand, is that many people on here are getting it right, while I still catch a bottom on a sell or a top on a buy. Late yesterday I had an entry to buy EUR/CAD. I got wicked in and then wicked out. Both my entry and exit were market turning points. It really is crazy! It's not like the markert went 50 PIPs past my entry and stop either.

hmm.. Indicators r not working for u or in other words u r not getting indicators. Why dont u try some automated strategy?

The good or ill of a man lies within his own will. – Epictetus

Originally posted by ironicalhmm.. Indicators r not working for u or in other words u r not getting indicators. Why dont u try some automated strategy?

I do get indicators. I understand crossovers, divergence, hidden divergence and Fib levels, etc. I also use trendlines.

I got a good run on CAD/JPY last week. Was up 112 PIPs on the trade, but price retraced for 68 PIPs profit at my manually trailed stop.

More times than not, I get wicked itno a trade, then price does an about turn.

Originally posted by leebut

Originally posted by ironical

hmm.. Indicators r not working for u or in other words u r not getting indicators. Why dont u try some automated strategy?

I do get indicators. I understand crossovers, divergence, hidden divergence and Fib levels, etc. I also use trendlines.

I got a good run on CAD/JPY last week. Was up 112 PIPs on the trade, but price retraced for 68 PIPs profit at my manually trailed stop.

More times than not, I get wicked itno a trade, then price does an about turn.

By looking at ur statement, we cannot say it badluck. Bad luck can be for 1 month or 2 months but not for all the months. Your account size continue its declining trend and we cannot see any significant upward trend.

As u said that u have good understanding of indicators then u need to change other things. For example shortening ur currency pair list, tightening SL and usage of some semi-automated strategy.

Actually it is sometimes harder to trade on technical indicators with accuracy when u r doing it manually. Have u used any such tool before?

Hello Champ,

Thank you for your comments.

I still can't get the FTP upoloader to run after installation.

I've traded 190 PIPs back into the account since last Monday, which goes to prove that I am capable.

I think the biggest problem may have been emotional, which of course, EAs don't have, as well as perhaps using an indicator's signals at the wrong time. The biggest problem is making less on winners and losing more on losers. Price makes a good run, so I move the stop to just beyond break even, price retraces and stops me out for 5-10 PIPs or so. The next trade is a loss of 3-40 PIPs. I am getting it right more often than I used to, but it's these damn retracements to B/E that are causing the problem.

I've been trading single lots most of the time, so perhaps I'm not giving myself the chance to bag some profit on half of a position and letting the rest run.

As for luck, I don't believe in that anyway, good or bad. We, and others, make decisions and perform actions, the results of which are either positive or negative. When peole say 'I'm unlucky' it's an excuse, when other people say 'You're so lucky!' it's a put down.

No, I haven't used an EA before. I'm considering creating one using FXCM's Trading Station strategy and backtest tools.