Daily Market Analysis By FXOpen

GBP/USD Corrects Gains, EUR/GBP Remains Elevated

GBP/USD started a downside correction from the 1.2400 zone. EUR/GBP climbed higher above the 0.8750 and 0.8780 resistance levels.

Important Takeaways for GBP/USD and EUR/GBP

[*] The British Pound started a fresh decline from the 1.2400 resistance against the US Dollar.

[*] There is a key bearish trend line forming with resistance near 1.2090 on the hourly chart of GBP/USD.

[*] EUR/GBP started a decent increase above the 0.8720 and 0.8750 resistance levels.

[*] There is a connecting bullish trend line forming with support near 0.8765 on the hourly chart.

GBP/USD Technical Analysis

The British Pound faced a strong selling interest near the 1.2400 zone against the US Dollar. The GBP/USD pair formed a short-term top near 1.2400 and started a downside correction.

There was a clear move below the 1.2320 and 1.2280 support levels. The pair even declined below the 1.2120 level and the 50 hourly simple moving average. It traded as low as 1.1991 on FXOpen and is currently correcting losses.

GBP/USD Hourly Chart

Recently, there was a minor upside correction above the 1.2040 level. There was a clear move above the 1.2050 level. It is now approaching the 50% Fib retracement level of the downward move from the 1.2147 swing high to 1.1991 low.

On the upside, an initial resistance is near the 1.2080 level. There is also a key bearish trend line forming with resistance near 1.2090 on the hourly chart of GBP/USD.

The trend line is near the 61.8% Fib retracement level of the downward move from the 1.2147 swing high to 1.1991 low. The next main resistance is near the 1.2100 zone. A clear upside break above the 1.2100 and 1.2120 resistance levels could open the doors for a steady increase in the near term.

The next major resistance sits near the 1.2200 level. On the downside, an initial support is near the 1.2020 level, below which it could test the 1.2000 support.

The next major support is near the 1.1960 level. Any more losses could lead the pair towards the 1.1900 support zone.

VIEW FULL ANALYSIS VISIT - FXOpen Blog...

Disclaimer: This forecast represents FXOpen Companies opinion only, it should not be construed as an offer, invitation or recommendation in respect to FXOpen Companies products and services or as financial advice.

Big Tech stock collapse stark indicator of 2022's woes

An unwritten adage which has often been wheeled out over recent years is that regardless of any form of economic catastrophe, geopolitical strife or change in the natural environment, technology will always prosper. It has been clear that in the past, when other industry sectors have struggled, technology companies make hay - largely because the whole world's operational fabric is now so dependent on advancing technical solutions which find solutions to problems and move us all forward.

Perhaps it is fair to say that back in the 1980s, if the economy was good, everyone needed lawyers and accountants and if it was bad, everyone needed lawyers and accountants, therefore today if the economy is good everyone needs better technology, and if it is bad, everyone needs better technology. This commonly held theory has been somewhat decimated this year, and the full extent of the downturn in fortunes for some of the world's largest technology and internet giants have nosedived in syncronization with the nosedive that the European and American economies have faced.

As the final days of 2022 are now with us, it is clear to see that during the course of this year, Apple stock has declined in value by 25%, Meta (Facebook) by 65%, and Amazon by 49%. The Nasdaq Composite Index which has a large number of technology firms listed on it has lost almost twice as much as the broader S&P 500 Index, which is a clear notification that it is not just Jeff and Mark that are in dire straits, but also a range of tech firms across all areas of the software and hardware world.

During the draconian lockdowns which western governments foist upon their populations during 2020, the 'big tech' firms, most of which offer services via the internet such as Amazon, thrived as others struggled due to forced closures of all physical competition and companies in Silicon Valley posted record earnings even as much of the western economy crumpled.

Defying the gravity of the economic meltdown appears to have been the tech industry's achilles heel, and now these firms are experiencing a fall which appears to be in some cases reducing them to almost half of their 2021 value.

The economic woes that many Western nations face are of course a large contributor to these matters, because in today's global world, high levels of inflation mean that American companies have to exchange more dollars to pay staff in their European offices, especially now that US inflation is dropping and European inflation is increasing and is now over 10% in Western Europe and in some Eastern European countries as much as 25%. Logisitical problems and shortages of components such as semiconductors have blighted production and slowed down delivery dates for new products from many large companies, resulting in very high costs and missed opportunities.

Technology is often considered evergreen, but in today's world, political malevolence and economic mismanagment can even adversely affect tech whereas until recently it was considered the savior in such circumstances.

VIEW FULL ANALYSIS VISIT - FXOpen Blog...

Disclaimer: This forecast represents FXOpen Companies opinion only, it should not be construed as an offer, invitation or recommendation in respect to FXOpen Companies products and services or as financial advice.

BTCUSD and XRPUSD Technical Analysis – 27th DEC 2022

BTCUSD: Three White Soldiers Pattern Above $16323

Bitcoin was unable to sustain its bearish momentum and after touching a low of $16387 on 20th Dec, the prices started to correct upwards against the US dollar and are now ranging above the $16500 handle in the European trading session.

We have seen a bullish opening of the markets this week.

We can clearly see a three white soldiers pattern above the $16323 handle which is a bullish reversal pattern because it signifies the end of a downtrend and a shift towards an uptrend.

Bitcoin touched an intraday low of 16826 and an intraday high of 16970 in the Asian trading session today.

The prices are ranging near the support of the channel in the 1-hour time frame indicating a bullish tone of the markets.

Both the STOCH and Williams percent range are indicating overbought levels which means that in the immediate short term a decline in the prices is expected.

The relative strength index is at 51 indicating a NEUTRAL level for bitcoin, and the shift towards the consolidation phase in the markets.

Bitcoin is now moving above its 100 hourly simple moving average and below its 100 hourly exponential moving average.

Some of the major technical indicators are giving a BUY signal, which means that in the immediate short term, we are expecting targets of 17000 and 18000.

The average true range is indicating LESS market volatility with a mildly bullish momentum.

[*] Bitcoin: bullish reversal seen above $16323

[*] The STOCHRSI is indicating an oversold level

[*] The price is now trading just below its pivot level of $16881

[*] The short term range is mildly bullish

Bitcoin: Bullish Reversal Seen Above $16323

We can now see that the price of bitcoin is moving in a mildly bullish momentum and we are expecting moves towards the $17000 level before any market consolidation this week.

Some of the technical indicators are also giving a neutral tone of the markets.

We are now waiting for the next upwards leg above the $17000 handle which will push the price towards the $18000 levels.

We can see the formation of the bullish trend reversal pattern with adaptive moving averages AMA20 and AMA50 in the 30-minute time frame.

The price of bitcoin is ranging near the support of the triangle in the 1-hour time frame indicating a bullish trend.

The immediate short-term outlook for bitcoin is mildly bullish, the medium-term outlook has turned neutral, and the long-term outlook remains neutral under present market conditions.

Bitcoin’s support zone is located at $16374 which is a 3-10 day MACD oscillator stalls.

The price of BTCUSD is now facing its classic resistance level of 16902 and Fibonacci resistance level of 16912 after which the path towards 17000 will get cleared.

In the last 24hrs, BTCUSD has increased by 0.08% by 14.24$ and has a 24hr trading volume of USD 12.985 billion. We can see an increase of 3.96% in the trading volume compared to yesterday, which appears to be normal.

The Week Ahead

Bitcoin’s price is expected to remain in a consolidation phase before any major moves upwards due to the start of the holiday season, and trading volumes remain thin across the major cryptocurrency exchanges.

We are now looking for an upwards rally in the markets in 2023 with major targets at $20000 and $25000 levels.

The daily RSI is printing at 47 which indicates a NEUTRAL demand for bitcoin and the possibility of a shift towards the consolidation/correction phase for a short term in the markets.

The price of BTCUSD is now facing its resistance zone at $17175 which is a 50% retracement from a 4-week high/low and at $17765 at which the price crosses the 9-day moving average stalls.

The weekly outlook is projected at $17500 with a consolidation zone of $17000.

Technical Indicators:

The MACD (12,26): is at 6.40 indicating a BUY

The commodity channel index, CCI (14): is at -29.45 indicating a NEUTRAL

The rate of price change, ROC: is at 0.077 indicating a BUY

Bull/bear power (13): is at 2.02 indicating a BUY

VIEW FULL ANALYSIS VISIT - FXOpen Blog...

Disclaimer: This forecast represents FXOpen Companies opinion only, it should not be construed as an offer, invitation or recommendation in respect to FXOpen Companies products and services or as financial advice.

EUR/USD Faces Hurdle While USD/JPY Aims Recovery

EUR/USD is stable above the 1.0600 support zone. USD/JPY could gain bullish momentum if there is a clear move above the 135.00 resistance.

Important Takeaways for EUR/USD and USD/JPY

[*] The Euro started a downside correction from the 1.0670 resistance zone.

[*] There is a key bullish trend line forming with support near 1.0635 on the hourly chart of EUR/USD.

[*] USD/JPY is attempting a recovery wave from the 130.60 support zone.

[*] Earlier, there was a break below a rising channel with support near 135.00 on the hourly chart.

EUR/USD Technical Analysis

This past week, the Euro found support near the 1.0570 zone against the US Dollar. The EUR/USD pair started a steady upward move above the 1.0600 and 1.0620 resistance levels.

There was a clear increase above the 1.0650 resistance zone and the 50 hourly simple moving average. The pair even climbed towards the 1.0670 resistance zone. A high was formed near 1.0669 on FXOpen and the pair is now correcting gains.

EUR/USD Hourly Chart

There was a move below the 1.0650 support zone, but the pair remained stable above the 50 hourly simple moving average. A low is formed near 1.0611 and the pair is now rising.

There was a move towards the 1.0640 level. It tested the 50% Fib retracement level of the downward move from the 1.0669 swing high to 1.0611 low. On the upside, an immediate resistance is near the 1.0650 level.

The next major resistance is near the 1.0670 level. An upside break above 1.0670 could set the pace for another increase. In the stated case, the pair might visit 1.0720. Any more gains might send the pair towards 1.0780.

An initial support on the downside is near the 1.0635 level. There is also a key bullish trend line forming with support near 1.0635 on the hourly chart of EUR/USD.

The first major support is near the 1.0625 level. The main support sits near the 1.0600 zone, below which the pair could start a major decline. In the stated case, the pair might dive towards the 1.0550 support zone.

VIEW FULL ANALYSIS VISIT - FXOpen Blog...

Disclaimer: This forecast represents FXOpen Companies opinion only, it should not be construed as an offer, invitation or recommendation in respect to FXOpen Companies products and services or as financial advice.

Tesla stock reaches 1-year low, loses another 11% in just one day

It has been a very rough ride for Tesla stock over recent months.

Yesterday's New York trading session was another case in point as Tesla stock declined in value to $109.1 per share, representing its lowest point in over a year, by a considerable margin.

Over the course of the past 12 months, Tesla has lost almost 70% of its value despite its vehicles remaining extremely popular worldwide.

What is very interesting about disruptors such as Tesla is that there appears to be a huge value in suspense and speculation.

Back in 2014 when Tesla began to make its first assault against the established motor industry which was already over 120 years old and extremely conservative - motor vehicles were still using internal combustion and there was no interest in moving away from it - which is the same type of motive power that the very first car used back in 1886 after Karl Benz committed his life's work to building a carriage which does not require a horse.

VIEW FULL ANALYSIS VISIT - FXOpen Blog...

Disclaimer: This forecast represents FXOpen Companies opinion only, it should not be construed as an offer, invitation or recommendation in respect to FXOpen Companies products and services or as financial advice.

A Look Back Over 2022

The trading year ends in a couple of weeks from now, and everyone is planning for the holiday season. December, traditionally, is a short month for traders as markets slow down in the second half of the month.

As such, it is the best time to review what happened throughout the year, what moved financial markets, and what might happen in the period ahead.

VIEW FULL ANALYSIS VISIT - FXOpen Blog...

Disclaimer: This forecast represents FXOpen Companies opinion only, it should not be construed as an offer, invitation or recommendation in respect to FXOpen Companies products and services or as financial advice.

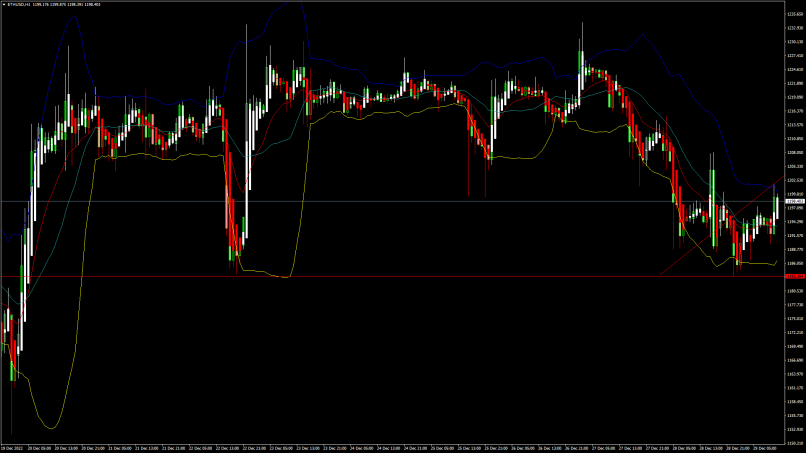

ETHUSD and LTCUSD Technical Analysis – 29th DEC, 2022

ETHUSD: Double Bottom Pattern Above $1183

Ethereum was unable to sustain its bearish momentum and after touching a low of 1185 on 22nd Dec, the price started to correct upwards against the US dollar moving into a consolidation channel above the $1200 handle on 27th Dec.

The prices are ranging near the support of the channel in the 15-minute time frame indicating a bullish trend.

We can clearly see a double bottom pattern above the $1183 handle which is a bullish pattern and signifies the end of a bearish phase and the start of a bullish phase in the markets.

ETH is now trading just above its pivot level of 1197 and moving into a consolidation channel. The price of ETHUSD is now testing its classic resistance level of 1202 and Fibonacci resistance level of 1206 after which the path towards 1300 will get cleared.

The relative strength index is at 53 indicating a NEUTRAL demand for Ether and the continuation of the consolidation phase in the markets.

Both the STOCHRSI and Williams percent range are indicating an OVERBOUGHT level, which means that the price is expected to decline in the short-term range.

Some of the technical indicators are giving a BUY market signal.

Most of the moving averages are giving a NEUTRAL signal due to the market consolidation seen below the $1250 handle.

ETH is now trading below its 100 hourly simple and 200 hourly exponential moving averages.

[*] Ether: bullish reversal seen above the $1183 mark

[*] The short-term range appears to be mildly bullish

[*] ETH continues to remain above the $1150 level

[*] The average true range is indicating LESS market volatility

Ether: Bullish Reversal Seen Above $1183

ETHUSD is now moving into a consolidation/correction channel with the price trading above the $1150 handle in the European trading session today.

We can see a range-bound movement in Ethereum from the last 15 days due to low liquidity and lower trading volumes.

The price of Ethereum has failed to clear the resistance of $1300 after touching a low of $1159 on 17th Dec.

ETHUSD touched an intraday low of 1184 in the Asian trading session and an intraday high of 1200 in the European trading session today.

We have seen a bullish opening in the markets this week.

The daily RSI is printing at 44 indicating a weak demand for Ether in the long-term range.

The key support levels to watch are $1152 which is a 1-month low, and $1183 which is a 3-10 day MACD oscillator stalls.

ETH has increased by 0.04% with a price change of 0.442$ in the past 24hrs and has a trading volume of 4.723 billion USD.

We can see an increase of 4.27% in the total trading volume in the last 24 hrs which appears to be normal.

The Week Ahead

ETH’s price started a minor correction above the $1200 handle and is now facing hurdles crossing the $1250 range on the upside.

The immediate short-term outlook for Ether has turned mildly bullish, the medium-term outlook has turned neutral, and the long-term outlook for Ether is neutral in present market conditions.

The price of ETHUSD will need to remain above the important support level of $1197 which is the pivot point.

The resistance zone is located at $1227 which is a 38.2% retracement from a 4-week low and at $1265 at which the price crosses 9-day moving average stalls.

The weekly outlook is projected at $1250 with a consolidation zone of $1200.

Technical Indicators:

The STOCH (9,6): is at 66.34 indicating a BUY

The commodity channel index (14): is at 162.66 indicating a BUY

High/lows (14): is at 4.04 indicating a BUY

Bull/bear power (13): is at 7.87 indicating a BUY

VIEW FULL ANALYSIS VISIT - FXOpen Blog...

Disclaimer: This forecast represents FXOpen Companies opinion only, it should not be construed as an offer, invitation or recommendation in respect to FXOpen Companies products and services or as financial advice.

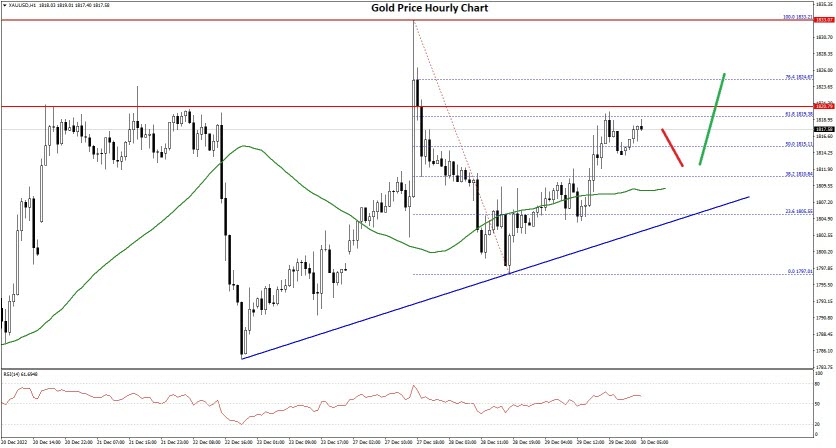

Gold Price Aims More Gains, Crude Oil Price Could Resume Decline

Gold price is showing positive signs above the $1,800 level. Crude oil price is struggling below $80 and might resume its decline.

Important Takeaways for Gold and Oil

[*] Gold price faced resistance near $1,832 and corrected lower against the US Dollar.

[*] There is a key bullish trend line forming with support near $1,808 on the hourly chart of gold.

[*] Crude oil price started a fresh decline from the $82.00 resistance zone.

[*] There was a break below a major bullish trend line with support near $79.75 on the hourly chart of XTI/USD.

Gold Price Technical Analysis

Gold price attempted an upside break above the $1,825 resistance zone against the US Dollar. The price even cleared the $1,830 level, but the bears were active near the $1,832 zone.

A high was formed near $1,833 and the price started a fresh decline. There was a clear move below the $1,810 and $1,805 support levels. The price traded as low as $1,797 and recently started a fresh increase.

Gold Price Hourly Chart

There was a clear move above the $1,805 level and the 50 hourly simple moving average. The price even surpassed the 50% Fib retracement level of the downward move from the $1,833 swing high to $1,798 swing low.

Besides, there is a key bullish trend line forming with support near $1,808 on the hourly chart of gold. On the upside, the first major resistance is near the $1,820 level. It is near the 61.8% Fib retracement level of the downward move from the $1,833 swing high to $1,798 swing low.

The next key hurdle is near the $1,832 level, above which it could even test $1,850. A clear upside break above the $1,850 resistance could send the price towards $1,880.

An immediate support on the downside is near the $1,808 level. The next major support is near the $1,800 level, below which there is a risk of a larger decline. In the stated case, the price could decline sharply towards the $1,765 support zone.

VIEW FULL ANALYSIS VISIT - FXOpen Blog...

Disclaimer: This forecast represents FXOpen Companies opinion only, it should not be construed as an offer, invitation or recommendation in respect to FXOpen Companies products and services or as financial advice.

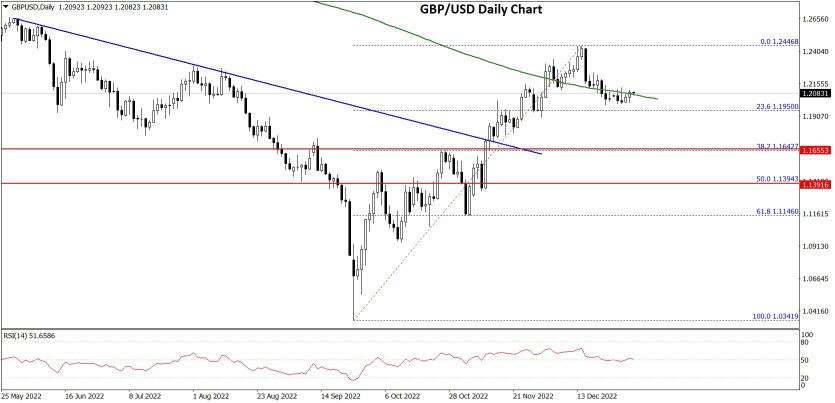

GBP/USD and USD/CAD 2023 Chart Outlook

GBP/USD started a downside correction from 1.2450. USD/CAD is signaling a fresh decline towards the 1.3300 and 1.3200 support levels.

Important Takeaways for GBP/USD and USD/CAD

[*] The British Pound struggled to clear the 1.2420 and 1.2450 resistance levels.

[*] Earlier, there was a break above a major bearish trend line with resistance near 1.1700 on the daily chart of GBP/USD.

[*] USD/CAD is facing a strong resistance near the 1.3700 zone.

[*] It traded below a key contracting triangle with support near 1.3600 on the daily chart.

GBP/USD Technical Analysis

After forming a base above the 1.0350, the British Pound started a steady increase against the US Dollar. GBP/USD gained pace for a move above the 1.1100 and 1.1500 resistance levels.

There was a move above the 1.2000 resistance and the 50-day simple moving average. During the increase, there was a break above a major bearish trend line with resistance near 1.1700 on the daily chart of GBP/USD.

GBP/USD Daily Chart

The pair even moved above the 1.2220 level and traded as high as 1.2446 on FXOpen. It is now correcting gains and trading below the 1.2350 level.

Recently, there was a move below the 1.2220 and 1.2200 support levels. On the downside, an initial support is near the 1.1950 area. It is near the 23.5% Fib retracement level of the upward move from the 1.0341 swing low to 1.2466 high.

The next major support is near the 1.1800 level. If there is a break below 1.1800, the pair could extend its decline. The next key support is near the 1.1400 level. It coincides with the 50% Fib retracement level of the upward move from the 1.0341 swing low to 1.2466 high

Any more losses might call for a test of the 1.1200 support. An immediate resistance is near the 1.2200 level. The next resistance is near the 1.2450 level. If there is an upside break above the 1.2450 zone, the pair could rise towards 1.2600. The next key resistance could be 1.3000.

VIEW FULL ANALYSIS VISIT - FXOpen Blog...

Disclaimer: This forecast represents FXOpen Companies opinion only, it should not be construed as an offer, invitation or recommendation in respect to FXOpen Companies products and services or as financial advice.

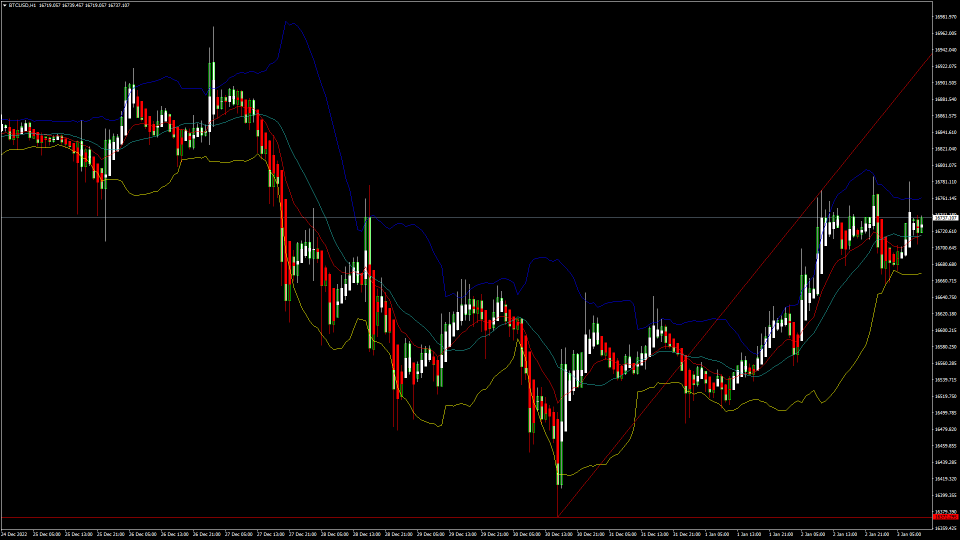

BTCUSD and XRPUSD Technical Analysis – 03rd JAN 2023

BTCUSD: Bullish Engulfing Pattern Above $16372

Bitcoin was unable to sustain its bearish momentum and after touching a low of $16372 on 30th Dec, the prices started to correct upwards against the US dollar and are now ranging above the $16600 handle in the European trading session today.

The price of bitcoin is ranging near the support of the channel in the weekly time frame indicating a bullish trend.

We can clearly see a bullish engulfing pattern above the $16372 handle which is a bullish reversal pattern because it signifies the end of a downtrend and a shift towards an uptrend.

Bitcoin touched an intraday low of 16655 and an intraday high of 16781 in the Asian trading session today.

The price is forming an ascending channel with the current support of $16690 at which the price crosses the 9-day moving average.

Both the STOCH and Williams percent range are indicating overbought levels which means that in the immediate short term, a decline in the prices is expected.

The relative strength index is at 58.47 indicating a STRONG demand for bitcoin, and the continuation of the buying pressure in the markets.

Bitcoin is now moving above its 100 hourly simple moving average and above its 100 hourly exponential moving averages.

Some of the major technical Indicators are giving a BUY signal, which means that in the immediate short term, we are expecting targets of 17500 and 18500.

The average true range is indicating HIGH market volatility with a mild bullish momentum.

[*] Bitcoin: bullish reversal seen above $16372

[*] The average directional index is indicating a NEUTRAL level

[*] The price is now trading just below its pivot level of $16752

[*] The short term range is mildly bullish

Bitcoin: Bullish Reversal Seen Above $16372

We can now see that the price of bitcoin is moving in the correction phase after the recent decline below the $16500 level. The immediate targets are $17500 and $18500 in the short-term range.

Once the price of bitcoin will touch $18000, we are expecting a rally into the markets towards the $20000 level.

We can see the formation of the bullish trend reversal pattern with the adaptive moving average AMA50 and AMA100 in the 1-hour time frame.

Any dips from the current levels remain well supported above the $16500 handle as the bitcoin price continues to gain traction against the US dollar.

The immediate short-term outlook for bitcoin is mildly bullish, the medium-term outlook has turned neutral, and the long-term outlook remains neutral under present market conditions.

Bitcoin’s support zone is located at $16662 which is a pivot point, and at $16723 which is a 3-10 day MACD oscillator stalls.

The price of BTCUSD is now facing its classic resistance level of 16765 and Fibonacci resistance level of 16773 after which the path towards 17000 will get cleared.

In the last 24hrs, BTCUSD has increased by 0.08% by 13.10$ and has a 24hr trading volume of USD 11.564 billion. We can see an increase of 5.89% in the trading volume compared to yesterday, which appears to be normal.

The Week Ahead

Bitcoin’s price is expected to enter into a consolidation phase below the $17000 level. As the market liquidity increases, we will see the price upticking towards the $18000 handle.

As of now, the moves are expected to be in a narrow range between the $16000 and $17500 levels.

The daily RSI is printing at 47 which indicates a NEUTRAL demand for bitcoin and the possibility of a shift towards the consolidation/correction phase for a short term in the markets.

The price of BTCUSD is now facing its resistance zone at $17096 which is a 38.2% retracement from a 4-week low, and at $17333 which is a 14-3 day raw stochastic at 50%.

The weekly outlook is projected at $17500 with a consolidation zone of $17000.

Technical Indicators:

The MACD (12,26): is at 20.50 indicating a BUY

The commodity channel index, CCI (14): is at 73.18 indicating a BUY

The rate of price change, ROC: is at 0.048 indicating a BUY

The Bull/bear power (13): is at 31.92 indicating a BUY

VIEW FULL ANALYSIS VISIT - FXOpen Blog...

Disclaimer: This forecast represents FXOpen Companies opinion only, it should not be construed as an offer, invitation or recommendation in respect to FXOpen Companies products and services or as financial advice.