EURUSD daily Technical analysis November -29:news.fxbase

EURUSD daily Technical analysis November -29

Thursday EURUSD market Started from 1.29520. After some hours we got a bearish candle .Here we can expect some changes in uptrend side sure.

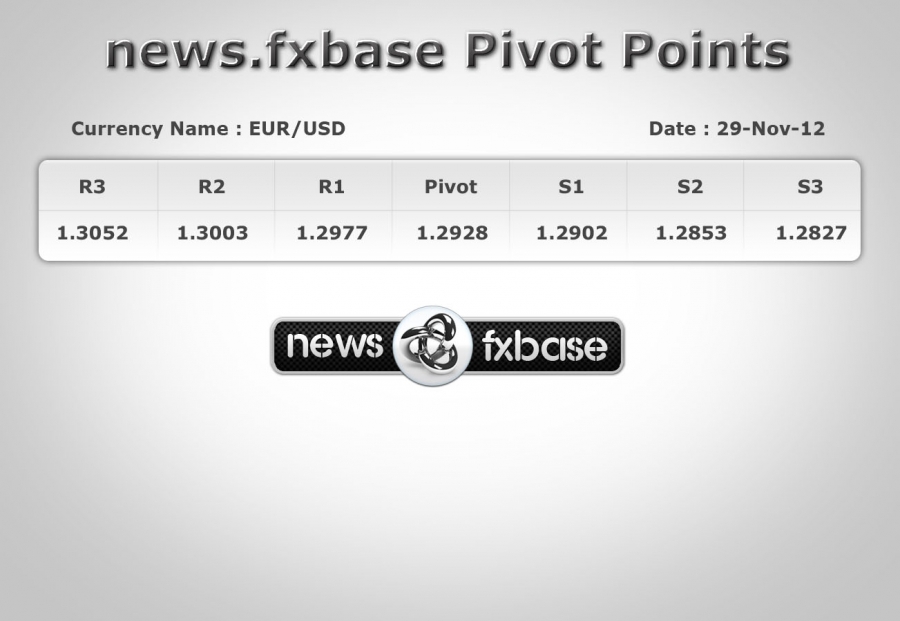

Pivot Point Details:

see attachements side Fig

This is the pivot point values for today EURUSD.Its can reach today Pivot level P-1.2928 and also we expect its touch Support level S1-1.2902.

And In uptrend side it can expect Resistance level R1-1.2977 the news announcement will give any strong fluctuations means then market also try to touch Resistance R3-1.3091 and support S2-1.2853.

see attachements side Fig

CCI Values:

Today morning market opened time CCI values was in the position of +127.325. After some hours its touched +80.00 (see Fig).so market is so good for sellers at morning time.

In CCI we can expect today sell trend.

News Details:

Our markets watch team has given the detail about Today’s news Analysis.

FXBase Market analysis team says,

”

GDP 13:30(GMT) USD High impact news

Gross Domestic Product (GDP) is the primary indicator used to estimate the country’s economy. It is used to measure the values of all goods and service changes produced by the economy it means size of the economy.

Measuring GDP is complicated so it can be calculated in two ways:

1) Income approach

2) Expenditure method

When economy is healthy you can see the low unemployment and wage increases as businesses demand labor to meet the growing economy. If there is a change in the GDP whether up or down it usually made a lot of changes to the stock market. Investors really worry about negative GDP growth, which is one of the factors economists use to determine whether an economy is in a recession.

The forecasted value is 2.8% if the actual reading is greater than the forecasted value USD can move in the uptrend, otherwise moves in downtrend.

It’s give an alert as market get ready to go sell side .

Initial Jobless Claims 13:30 (GMT) USD High Impact news

The numbers of U.S. workers filing applications for jobless benefits rebounded last week, though numbers so far this month have been distorted by technical factors. Initial jobless claims—which are a measure of layoffs—were up by 46,000 to a seasonally adjusted 388,000 in the week ended Oct. 13, the Labor Department said Thursday. Economists surveyed by Dow Jones Newswires had forecast 365,000 new applications for jobless benefits last week.

In the previous week, jobless claims dropped by 27,000 because of an unexpected shift in seasonal reporting by one state. That state--California--reported fewer claims than expected, which accounted for the large decrease. There were nearly 5,000 fewer layoffs in the service and retail industries in California for the week ended Oct. 6, according to the Labor Department report.

The Labor Department sets seasonal factors well in advance based on historical trends but that can skew numbers when state-level reporting doesn't match those established patterns.

"These types of things happen several times a year," a Labor Department official said Thursday. "It tends to be temporary."

From This details ways, today market can expect more to downtrend side.

”

So the final report is that the market will reach P - 1.2928

& R1-1.2977

in uptrend side today and also in downtrend side we can expect the market to cross Support level of S1- 1.2902 sure.