Market Overview by FXCC

Forex Technical & Market Analysis FXCC May 30 2013

OECD: Global economy is moving forward at multiple speeds

In its biannual Economic Outlook report, published on Wednesday, the Organization for Economic Cooperation and Development reduced the global growth outlook to 3.1% from the previous estimate of 3.4%. It expects the US and the Japanese economies to improve this year, suggesting at the same time that the Eurozone will continue to lag which might have “negative implications for the global economy."

The OECD cut the Eurozone growth forecast to -0.6% from -0.1% estimated in November 2012, warning that "activity is still falling, reflecting ongoing fiscal consolidation, weak confidence and tight credit conditions, especially in the periphery." The Eurozone economy should rebound to 1.1% in 2014. The OECD also urged the ECB to seriously consider implementing QE and introducing negative deposit rates in order to stimulate recovery in the area. China, which already saw its growth outlook reduced on Tuesday by the IMF, is expected to grow by 7.8% this year, down from a previous estimate of 8.5%. The organization was more upbeat about the US, which is projected to grow by 1.9% in 2013 and by 2.8% in 2014. Japan's growth forecast was hiked to 1.6% from 0.7%, with the prospect of a 1.4% gain next year, owing to the BoJ's implementation of fiscal and monetary stimulus programs.

http://blog.fxcc.com/forex-technical...s-may-30-2013/

FOREX ECONOMIC CALENDAR

2013-05-30 06:00 GMT UK. Nationwide Housing Prices n.s.a (YoY) (May)

2013-05-30 12:30 GMT USA. Gross Domestic Product Price Index

2013-05-30 14:30 GMT USA. Pending Home Sales (YoY) (Apr)

2013-05-30 23:30 GMT Japan. National Consumer Price Index (YoY) (Apr)

FOREX NEWS

2013-05-30 04:39 GMT USD eases to key level at 83.50 ahead of US GDP

2013-05-30 03:11 GMT GBP/USD – Bullish engulfing candle to spur further advances?

2013-05-30 02:29 GMT EUR/USD edging towards resistance at 1.3000

2013-05-30 01:50 GMT Aussie edging higher towards resistance at 0.9700

Forex Technical Analysis EURUSD

MARKET ANALYSIS – Intraday Analysis

Upwards scenario: Recent upside penetration is limited now to the key resistive barrier at 1.2977 (R1). Appreciation above this mark might likely push the pair toward to next targets at 1.2991 (R2) and 1.3006 (R3) in potential. Downwards scenario: Possible bull back on the hourly chart might face next hurdle at 1.2933 (S1). Break here is required to open road towards to our next retracement target at 1.2919 (S2) en route to final aim at 1.2902 (S3).

Resistance Levels: 1.2977, 1.2991, 1.3006

Support Levels: 1.2933, 1.2919, 1.2902

Forex Technical Analysis GBPUSD

MARKET ANALYSIS – Intraday Analysis

Upwards scenario: A bullish oriented market participant might pressures to test our next resistance level at 1.5165 (R1). Loss here could open a route towards to our interim target at 1.5188 (R2) and the main aim for today locates at 1.5211 (R3). Downwards scenario: As long as price stays below the moving averages our medium-term outlook would be negative. Though, extension lower the 1.5099 (S1) is being able to drive market price towards to our next supports at 1.5076 (S2) and 1.5053 (S3).

Resistance Levels: 1.5165, 1.5188, 1.5211

Support Levels: 1.5099, 1.5076, 1.5053

Forex Technical Analysis USDJPY

MARKET ANALYSIS – Intraday Analysis

Upwards scenario: USDJPY recently tested negative side and currently remains stable below the 20 SMA. Possible price appreciation is limited to the resistance level at 101.53 (R1). Only clear break here would suggest next intraday targets at 101.81 (R2) and 102.09 (R3). Downwards scenario: Any prolonged movement below the support at 100.60 (S1) might prolong downside pressure and drive market price towards to supportive means at 100.34 (S2) and 100.08 (S3).

Resistance Levels: 101.53, 101.81, 102.09

Support Levels: 100.60, 100.34, 100.08

Source: FX Central Clearing Ltd,( Currency Converter | Forex ECN Broker | Forex Demo Account |FXCC )

Forex Technical & Market Analysis FXCC May 31 2013

Will the Dollar Recover Too?

U.S. stocks and Treasury yields resumed their rise but the dollar failed to follow. Instead of trading higher, the greenback lost value against most of the major currencies. The EUR/USD rose above 1.30 and USD/JPY slipped below 101 after a round of weaker than expected economic data. Equity and fixed income traders shrugged off the data but FX traders refused to budge. Long dollar positions are still being cut which suggests that currency traders are still worried about the volatility in the financial markets and the eagerness of the Fed to taper asset purchases. U.S. equity and fixed income traders have completely ignored the 5% drop in the Nikkei overnight. Japanese stocks are 13% off its highs and if it continues to decline, it may have ripple effects over to U.S. markets and keep the dollar in corrective mode. However if the Nikkei stabilizes and starts to recover, then the dollar has a chance of joining the recovery.

https://support.fxcc.com/email/technical/31052013/

FOREX ECONOMIC CALENDAR

2013-05-31 08:30 GMT UK. Net Lending to Individuals (MoM)

2013-05-31 09:00 GMT EMU. Consumer Price Index - Core (YoY)

2013-05-31 12:30 GMT USA. Personal Spending (Apr)

2013-05-31 13:55 GMT USA. Reuters/Michigan Consumer Sentiment Index (May)

FOREX NEWS

2013-05-31 04:01 GMT ‘Pennant’ pattern break out on EUR/USD targets a move north of 1.3200

2013-05-31 03:43 GMT Aussie advances capped below 0.9700

2013-05-31 02:30 GMT EUR/AUD off fresh 1.5-year highs below 1.35

2013-05-31 01:53 GMT AUD/JPY firm bounce off 97.00 support, sets eyes on 98.30

---------------------

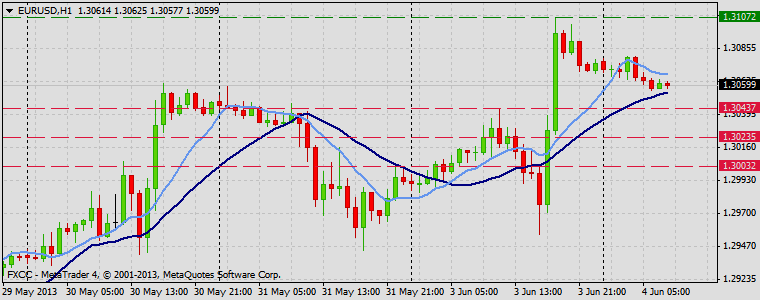

Forex Technical Analysis EURUSD

MARKET ANALYSIS – Intraday Analysis

HIGH 1.30593 LOW 1.30312 BID 1.30405 ASK 1.30410 CHANGE -0.06% TIME 08 : 39:18

OUTLOOK SUMMARY Up

TREND CONDITION Up trend

TRADERS SENTIMENT Bearish

IMPLIED VOLATILITY Medium

MARKET ANALYSIS - Intraday Analysis

Upwards scenario: Further bullish momentum might occur if the price manages to climb above the key resistance level at 1.3061 (R1). Next targets on the way could be exposed at 1.3081 (R2) and 1.3101 (R3). Downwards scenario: On the other hand, corrective action would be reasonable scenario in current price setup. Next on tap is seen support level at 1.3026 (S1), break here is required to enable our initial targets at 1.3006 (S2) and 1.2987 (S3)

Resistance Levels: 1.3061, 1.3081, 1.3101

Support Levels: 1.3026, 1.3006, 1.2987

---------------------

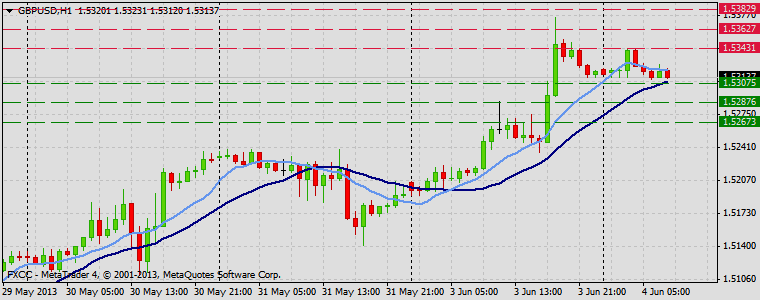

Forex Technical Analysis GBPUSD

MARKET ANALYSIS – Intraday Analysis

HIGH 1.52392 LOW 1.52151 BID 1.52260 ASK 1.52269 CHANGE -0.02% TIME 08 : 39:19

OUTLOOK SUMMARY Up

TREND CONDITION Up trend

TRADERS SENTIMENT Bullish

IMPLIED VOLATILITY Medium

Upwards scenario: An evidence of further uptrend formation could be provided if the pair manages to surpass key resistive barrier at 1.5239 (R1). Execution of protective orders above that level might enable initial targets at 1.5257 (R1) and 1.5274 (R3). Downwards scenario: Recent upside momentum likely exhausted and we expect some stabilization ahead. Next supportive bastion lies at 1.5211 (S1). Prolonged movement below it might then expose our intraday targets at 1.5193 (S2) and 1.5176 (S3).

Resistance Levels: 1.5239, 1.5257, 1.5274

Support Levels: 1.5211, 1.5193, 1.5176

--------------------------

Forex Technical Analysis USDJPY

MARKET ANALYSIS – Intraday Analysis

HIGH 101.281 LOW 100.679 BID 100.871 ASK 100.874 CHANGE 0.15% TIME 08 : 39:20

OUTLOOK SUMMARY Down

TREND CONDITION Sideway

TRADERS SENTIMENT Bullish

IMPLIED VOLATILITY Medium

Upwards scenario: Price has comfortably ranged on the hourly timeframe however we see potential to overcome our next resistance level at 101.30 (R1) later on today. Our eventual targets locates at 101.60 (R2) and 101.90 (R3). Downwards scenario: If the price failed to gain momentum on the upside we expect retest of our key support level at 100.47 (S1). Clearance here is required to keep the downside extension intact and enable our lower targets at 100.16 (S2) and 99.87 (S3).

Resistance Levels: 101.30, 101.60, 101.90

Support Levels: 100.47, 100.16, 99.87

Source: FX Central Clearing Ltd,( http://www.fxcc.com )

Forex Technical & Market Analysis FXCC Jun 04 2013

Fitch cuts Cyprus to B-, negative outlook

Fitch Ratings has downgraded Cyprus's long-term foreign currency issuer default rating by one notch to 'B-' from 'B' while keeping a negative outlook due to the country's elevated economic uncertainty. The rating agency had placed Cyprus on negative watch in March. With this decision, Fitch pushed Cyprus further into junk territory, now 6 notches. "Cyprus has no flexibility to deal with domestic or external shocks and there is a high risk of the (EU/IMF) program going off track, with financing buffers potentially insufficient to absorb material fiscal and economic slippage," Fitch said in a statement.

The EUR/USD finished the day sharply higher, at one point trading all the way up to 1.3107 before leaking lower later in the day to close up 76 pips at 1.3070. Some analysts were pointing towards weaker than expected ISM data from the US as the main catalyst for the bullish move in the pair. Economic data out of the US will slow down a bit the next few days, but volatility is certain to pick up as we approach the ECB Rate Decision on Thursday, as well as the Non-Farm Payrolls number due out of the US on Friday.

https://support.fxcc.com/email/technical/04062013/

FOREX ECONOMIC CALENDAR :

2013-06-04 08:30 GMT | UK. PMI Construction (May)

2013-06-04 09:00 GMT | EMU. Producer Price Index (YoY) (Apr)

2013-06-04 12:30 GMT | USA. Trade Balance (Apr)

2013-06-04 23:30 GMT | Australia. AiG Performance of Services Index (May)

FOREX NEWS :

2013-06-04 04:30 GMT | RBA Interest Rate Decision stays unchanged at 2.75%

2013-06-04 03:20 GMT | Will economic data later in week free EUR/USD from range bound behavior?

2013-06-04 02:13 GMT | EUR/AUD finds some ground in the 1.34 round area

2013-06-04 02:00 GMT | AUD/JPY advances capped below 97.50

------------------------

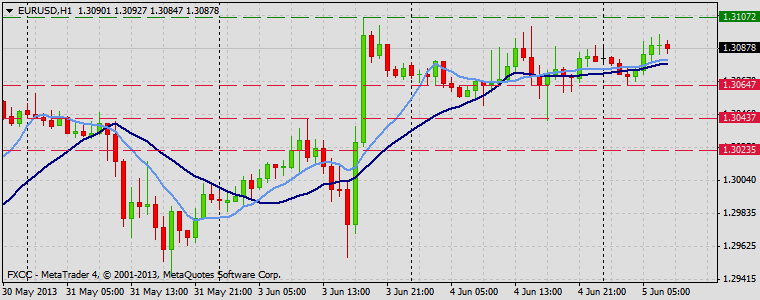

EURUSD :

HIGH 1.30804 LOW 1.30566 BID 1.30572 ASK 1.30575 CHANGE -0.14% TIME 08:22:51

OUTLOOK SUMMARY Up

TREND CONDITION Upward penetration

TRADERS SENTIMENT Bearish

IMPLIED VOLATILITY Medium

MARKET ANALYSIS - Intraday Analysis

Upwards scenario: While price is quoted above the 20 SMA, our technical outlook would be positive. Yesterday high offers next resistance level at 1.3107 (R1). Any price action above it would suggest next targets at 1.3127 (R2) and 1.3147(S3). Downwards scenario: On the other hand, price pattern suggests bearish potential if the instrument manages to overcome next support level at 1.3043 (S1). Possible price regress could expose our initial targets at 1.3023 (S2) and 1.3003 (S3) in potential.

Resistance Levels: 1.3107, 1.3127, 1.3147

Support Levels: 1.3043, 1.3023, 1.3003

-----------------------

GBPUSD :

HIGH 1.53427 LOW 1.53101 BID 1.53115 ASK 1.53119 CHANGE -0.05% TIME 08:22:52

OUTLOOK SUMMARY Up

TREND CONDITION Up trend

TRADERS SENTIMENT Bearish

IMPLIED VOLATILITY Medium

Upwards scenario: Next barrier on the upside lie at 1.5343 (R1). Surpassing of this level might enable our initial target at 1.5362 (R2) and any further gains would then be limited to last resistive structure at 1.5382 (R3). Downwards scenario: On the downside our attention is shifted to the immediate support level at 1.5307 (S1). Break here is required to enable bearish forces and expose our intraday targets at 1.5287 (S2) and 1.5267 (S3).

Resistance Levels: 1.5343, 1.5362, 1.5382

Support Levels: 1.5307, 1.5287, 1.5267

----------------------

USDJPY :

HIGH 99.88 LOW 99.333 BID 99.838 ASK 99.839 CHANGE 0.31% TIME 08:22:52

OUTLOOK SUMMARY Down

TREND CONDITION Upward penetration

TRADERS SENTIMENT Bullish

IMPLIED VOLATILITY Medium

Upwards scenario: Possible bullish penetration might face next challenge at 100.02 (R1). Break here is required to establish retracement action, targeting 100.32 (R2) en route towards to last resistance for today at 100.65 (R3). Downwards scenario: Penetration below the support at 99.31 (S1) is liable to put more downward pressure on the instrument in the near-term perspective. As a result our supportive means at 99.04 (S2) and 98.75 (S3) might be triggered.

Resistance Levels: 100.02, 100.32, 100.65

Support Levels: 99.31, 99.04, 98.75

Source: FX Central Clearing Ltd,( Forex Training | Best Automatic Forex Trading Platforms | FXCC )

Forex Technical & Market Analysis FXCC Jun 05 2013

IMF's Lagarde urges Greece not to relax bailout efforts

MF head Christine Lagarde said in an interview for the Greek state TV on Tuesday that the country was making progress on its bailout program but that it nevertheless should increase efforts to combat tax evasion and implement reforms to attract foreign investors. 'Now is not the time to relax the effort,' Lagarde said, adding that "There are some really positive developments but obviously more needs to be done.” She listed tax evasion and reforms to spur foreign investment as the most important issues which need to be dealt with. This week EU, ECB and IMG inspectors return to Athens for another revision of the Greek bailout program, during which they are expected to focus on the Greek government's progress in reducing state employee numbers.

The EUR/USD traded in a narrow range today but still managed to finish the day in positive territory, closing up 11 pips at 1.3081. Economic data out of the both the EU and US was light, but will pick up as we approach the end of the week with the ECB Interest Rate Decision on Thursday, as well as US Non Farm Payrolls on Friday. However, before the real fireworks begin, some analysts are pointing to tomorrow’s ADP data out of the US as a possible catalyst for tomorrow’s price action. According to Sean Callow at Westpac, “we have the ADP report plus non manufacturing ISM jobs components tonight. There is a great deal of focus on jobs data in the US given recent speculation about Fed tapering its asset purchase programs. ADP disappointed in April but has not had much directional success in picking payrolls outcomes. The ISM report on Monday casts a long shadow over tonight's non manufacturing report. Arguably, markets will be set up for a softer outcome given the weaker US$ in recent sessions. Tonight's data could prove to be important for FX markets.”

https://support.fxcc.com/email/technical/05062013/

FOREX ECONOMIC CALENDAR :

2013-06-05 08:28 GMT | UK. Markit Services PMI (May)

2013-06-05 09:00 GMT | EMU. Gross Domestic Product

2013-06-05 14:00 GMT | USA. ISM Non-Manufacturing PMI (May)

2013-06-05 18:00 GMT | USA. Fed's Beige Book

FOREX NEWS :

2013-06-05 05:11 GMT | USD/JPY back below 100; Australia GDP disappoints

2013-06-05 04:39 GMT | AUD/JPY searching for bids near 96.00

2013-06-05 03:26 GMT | EUR/USD technical indicators beginning to look more constructive

2013-06-05 01:46 GMT | AUD/USD breaking lower towards 0.9600 after Aussie GDP data

---------------------------

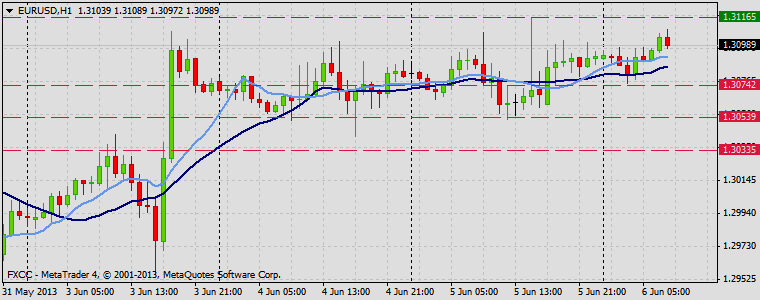

EURUSD :

HIGH 1.30964 LOW 1.30653 BID 1.30899 ASK 1.30903 CHANGE 0.08% TIME 08 : 56:44

OUTLOOK SUMMARY : Up

TREND CONDITION : Up trend

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : Medium

MARKET ANALYSIS - Intraday Analysis

Upwards scenario: We are not expecting significant volatility increase today however upside risk aversion is seen above the next resistance level at 1.3107 (R1). Price evaluation above this level would suggest next targets at 1.3127 (R2) and 1.3147 (R3). Downwards scenario: While instrument trades above the moving averages, our short-term bias would stay positive though penetration below the support level at 1.3064 (S1) might open way towards to lower targets at 1.3043 (S2) and 1.3023 (S3).

Resistance Levels: 1.3107, 1.3127, 1.3147

Support Levels: 1.3064, 1.3043, 1.3023

----------------------

GBPUSD :

HIGH 1.53379 LOW 1.52912 BID 1.53331 ASK 1.53336 CHANGE 0.14% TIME 08 : 56:45

OUTLOOK SUMMARY : Up

TREND CONDITION : Upward penetration

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : Medium

Upwards scenario: Medium- term tendency remains bullish as both moving averages are pointing up. Further progress above the resistance level at 1.5343 (R1) would open way towards to next targets at 1.5362 (R2) and 1.5382 (R3). Downwards scenario: Measures of support might be activating when the pair approaches the 1.5307 (S1). If it continues to extend its weakening below it we expect next targets to be exposed at 1.5287 (S2) and 1.5267 (S3) later on.

Resistance Levels: 1.5343, 1.5362, 1.5382

Support Levels: 1.5307, 1.5287, 1.5267

--------------------

USDJPY :

HIGH 100.462 LOW 99.385 BID 99.592 ASK 99.597 CHANGE -0.48% TIME 08 : 56:46

OUTLOOK SUMMARY : Down

TREND CONDITION : Downward penetration

TRADERS SENTIMENT : Bullish

IMPLIED VOLATILITY : Medium

Upwards scenario: We see potential to test our resistive barrier at 99.75 (R1). Successful penetration above this mark might shift traders sentiment to the bullish side and validate our intraday targets at 100.02 (R2) and 100.32 (R3). Downwards scenario: Further downtrend development is limited now to the key supportive barrier at 99.31 (S1). Only loss here would enable our intraday targets at 99.04 (S2) and 98.75 (S3) on the downside.

Resistance Levels: 99.75, 100.02, 100.32

Support Levels: 99.31, 99.04, 98.75

Source: FX Central Clearing Ltd,( Forex ECN Brokers List | Auto Forex Trading Account | FXCC )

Forex Technical & Market Analysis FXCC Jun 06 2013

EUR Prime for a Breakout on ECB

The euro is prime for a breakout. Unlike other major currency pairs, EUR/USD traded in a relatively tight range throughout the European and North American sessions. On a technical basis, the currency pair stayed between the 100 and 200-day SMAs for the past 48 hours, which reflects the hesitation of investors who are waiting for a catalyst to take the currency pair out of its range. Tomorrow could be the perfect opportunity for a breakout in the pair with the European Central Bank scheduled to deliver its monetary policy decision. The ECB is widely expected to leave interest rates unchanged leaving Mario Draghi's press conference as the primary focus for FX traders.

https://support.fxcc.com/email/technical/06062013/

FOREX ECONOMIC CALENDAR :

2013-06-06 11:00 GMT | BoE Interest Rate Decision

2013-06-06 11:45 GMT | ECB Interest Rate Decision

2013-06-06 12:30 GMT | ECB Monetary policy statement and press conference

2013-06-06 12:30 GMT | USA. Initial Jobless Claims

FOREX NEWS :

2013-06-06 05:16 GMT | GBP/USD dealing around 1.54 ahead of BoE

2013-06-06 04:59 GMT | USD lower but holding above 82.50 DXY; Aussie smacked

2013-06-06 04:24 GMT | Economic data set to heighten volatility in EUR/USD

2013-06-06 00:24 GMT | AUD/USD cracks the big 0.95 figure down

----------------------

EURUSD :

HIGH 1.31089 LOW 1.30751 BID 1.31005 ASK 1.31009 CHANGE 0.07% TIME 08:35:19

OUTLOOK SUMMARY : Up

TREND CONDITION : Sideway

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : High

MARKET ANALYSIS - Intraday Analysis

Upwards scenario: EURUSD stabilized after the initial uptrend formation. Potential to move higher is seen above the next resistance level at 1.3116 (R1). Loss here would suggest next intraday targets at 1.3135 (R2) and 1.3155 (R3). Downwards scenario: We would shift our intraday technical outlook to the negative side if the price manage to penetrate below the key support at 1.3074 (S1). Clearance here is required to enable intraday targets at 1.3053 (S2) and 1.3033 (S3).

Resistance Levels: 1.3116, 1.3135, 1.3155

Support Levels: 1.3074, 1.3053, 1.3033

----------------------

GBPUSD :

HIGH 1.54157 LOW 1.5381 BID 1.54005 ASK 1.54011 CHANGE -0.03% TIME 08:35:20

OUTLOOK SUMMARY : Up

TREND CONDITION : Up trend

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : High

Upwards scenario: Ascending structure on GBPUSD suggest possible correction ahead though break above the resistance at 1.5418 (R1) is liable to stimulate bullish pressure and validate interim target at 1.5443 (R2) en route final aim at 1.5469 (R3). Downwards scenario: Retracement action is possible if the price manages to overcome our initial support level at 1.5359 (S1). In such case we would suggest intraday targets at 1.5353 (S2) and 1.5327 (S3).

Resistance Levels: 1.5418, 1.5443, 1.5469

Support Levels: 1.5359, 1.5353, 1.5327

------------------------

USDJPY :

HIGH 99.466 LOW 98.862 BID 99.348 ASK 99.352 CHANGE 0.29% TIME 08:35:21

OUTLOOK SUMMARY : Down

TREND CONDITION : Downward penetration

TRADERS SENTIMENT : Bullish

IMPLIED VOLATILITY : Medium

Upwards scenario: Next hurdle on the upside is seen at important technical level – 99.55 (R1). If the price manages to overcome it we expect further acceleration towards to our initial targets at 99.83 (R2) and 100.12 (R3). Downwards scenario: On the downside next challenge is seen at 98.86 (S1). Breakthrough of this mark would open way for a downside expansion and could possibly trigger our initial targets at 98.58 (S2) and 98.30 (R3) later on today.

Resistance Levels: 99.55, 99.83, 100.12

Support Levels: 98.86, 98.58, 98.30

Source: FX Central Clearing Ltd,( FX Central Clearing Ltd )

Forex Technical & Market Analysis FXCC Jun 07 2013

Will Non-Farm Payrolls Save or Kill the Dollar?

The big story today in the financial markets was the sell-off in the U.S. dollar. The greenback fell quickly and aggressively against all of the major currencies right around the European close and held onto its losses to end the day down 2% against the Japanese Yen and more than 1% against the euro, British pound and Swiss Franc. There were a few different factors behind the sell-off in the greenback. The dollar initially traded lower on the optimistic comments from ECB President Draghi but those losses were contained to the EUR/USD. USD/JPY did not see any losses until 90 minutes before the European close at 12pm NY Time and only when it started to break down did the dollar collapse against all of the major currencies.

https://support.fxcc.com/email/technical/07062013/

FOREX ECONOMIC CALENDAR :

2013-06-07 06:00 GMT | Germany. Trade Balance s.a. (Apr)

2013-06-07 08:30 GMT | UK. Total Trade Balance (Apr)

2013-06-07 12:30 GMT | USA. Nonfarm Payrolls (May)

2013-06-07 19:00 GMT | USA. Consumer Credit Change (Apr)

FOREX NEWS :

2013-06-07 04:46 GMT | USD/JPY attempts to fight back above 96.00 in Asia trade

2013-06-07 03:36 GMT | EUR/USD technical picture looks set for further advances ahead of NFP

2013-06-07 02:43 GMT | Aussie breaks 0.9550 as selling resumes in Asia

2013-06-07 01:40 GMT | USD/JPY breaks momentarily below 97 figure

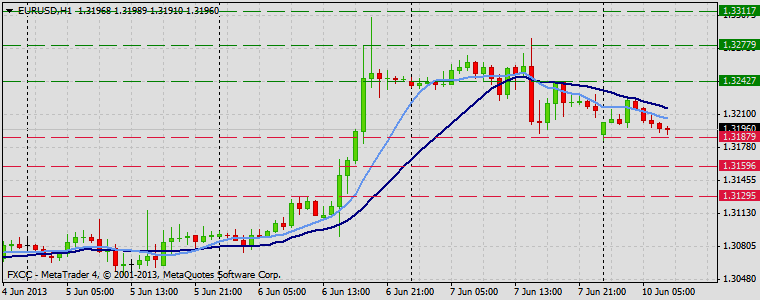

EURUSD :

HIGH 1.32688 LOW 1.32355 BID 1.32534 ASK 1.32540 CHANGE 0.06% TIME 08 : 24:35

OUTLOOK SUMMARY : Up

TREND CONDITION : Up trend

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : High

MARKET ANALYSIS - Intraday Analysis

Upwards scenario: Apparently market sentiment is clearly positive for the EURUSD as both moving averages are pointing up. Clearance of our resistance level at 1.3305 (R1) would open the way for an upside penetration towards to next targets at 1.3337 (R2) and 1.3370 (R3). Downwards scenario: Possible price depreciation is limited to the key support barrier at 1.3223 (S1). Break here is required to enable corrective action towards to lower targets at 1.3190 (S2) and 1.3157 (S3).

Resistance Levels: 1.3305, 1.3337, 1.3370

Support Levels: 1.3223, 1.3190, 1.3157

---------------------

GBPUSD :

HIGH 1.56178 LOW 1.55808 BID 1.55949 ASK 1.55963 CHANGE -0.02% TIME 08 : 24:36

OUTLOOK SUMMARY : Up

TREND CONDITION : Up trend

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : High

Upwards scenario: Yesterday high offers a key resistive barrier at 1.5684 (R1). Subsequently loss here might create upside momentum and drive market price towards to our initial targets at 1.5732 (R2) and 1.5781 (R3) in potential. Downwards scenario: Possible downside extension might face next supportive barrier at 1.5564 (S1). Clearance here is required to open the way towards to interim target at 1.5517 (S2) and any further price regress would then be targeting 1.5467 (S3).

Resistance Levels: 1.5684, 1.5732, 1.5781

Support Levels: 1.5564, 1.5517, 1.5467

-------------------------

USDJPY :

HIGH 97.517 LOW 95.549 BID 96.696 ASK 96.701 CHANGE -0.27% TIME 08 : 24:37

OUTLOOK SUMMARY : Down

TREND CONDITION : Down trend

TRADERS SENTIMENT : Bullish

IMPLIED VOLATILITY : High

Upwards scenario: After dipping lower today we see potential of market strengthening in near-term perspective. Next on tap is seen resistance level at 97.57 (R1). Break here would suggest next intraday targets at 98.07 (R2) and 98.58 (R3). Downwards scenario: Price regress below the support level at 95.53 (S1) would increase likelihood of failing towards to our key supportive barrier at 95.07 (S2) and any further market decline would then be targeting final support for today at 94.58 (S3).

Resistance Levels: 97.57, 98.07, 98.58

Support Levels: 95.53, 95.07, 94.58

Source: FX Central Clearing Ltd,( Free Forex Demo Accounts | Top ECN Forex Broker | Forex Blog | FXCC )

Forex Technical & Market Analysis FXCC Jun 07 2013

Will Non-Farm Payrolls Save or Kill the Dollar?

The big story today in the financial markets was the sell-off in the U.S. dollar. The greenback fell quickly and aggressively against all of the major currencies right around the European close and held onto its losses to end the day down 2% against the Japanese Yen and more than 1% against the euro, British pound and Swiss Franc. There were a few different factors behind the sell-off in the greenback. The dollar initially traded lower on the optimistic comments from ECB President Draghi but those losses were contained to the EUR/USD. USD/JPY did not see any losses until 90 minutes before the European close at 12pm NY Time and only when it started to break down did the dollar collapse against all of the major currencies.

https://support.fxcc.com/email/technical/07062013/

FOREX ECONOMIC CALENDAR :

2013-06-07 06:00 GMT | Germany. Trade Balance s.a. (Apr)

2013-06-07 08:30 GMT | UK. Total Trade Balance (Apr)

2013-06-07 12:30 GMT | USA. Nonfarm Payrolls (May)

2013-06-07 19:00 GMT | USA. Consumer Credit Change (Apr)

FOREX NEWS :

2013-06-07 04:46 GMT | USD/JPY attempts to fight back above 96.00 in Asia trade

2013-06-07 03:36 GMT | EUR/USD technical picture looks set for further advances ahead of NFP

2013-06-07 02:43 GMT | Aussie breaks 0.9550 as selling resumes in Asia

2013-06-07 01:40 GMT | USD/JPY breaks momentarily below 97 figure

EURUSD :

HIGH 1.32688 LOW 1.32355 BID 1.32534 ASK 1.32540 CHANGE 0.06% TIME 08 : 24:35

OUTLOOK SUMMARY : Up

TREND CONDITION : Up trend

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : High

MARKET ANALYSIS - Intraday Analysis

Upwards scenario: Apparently market sentiment is clearly positive for the EURUSD as both moving averages are pointing up. Clearance of our resistance level at 1.3305 (R1) would open the way for an upside penetration towards to next targets at 1.3337 (R2) and 1.3370 (R3). Downwards scenario: Possible price depreciation is limited to the key support barrier at 1.3223 (S1). Break here is required to enable corrective action towards to lower targets at 1.3190 (S2) and 1.3157 (S3).

Resistance Levels: 1.3305, 1.3337, 1.3370

Support Levels: 1.3223, 1.3190, 1.3157

---------------------

GBPUSD :

HIGH 1.56178 LOW 1.55808 BID 1.55949 ASK 1.55963 CHANGE -0.02% TIME 08 : 24:36

OUTLOOK SUMMARY : Up

TREND CONDITION : Up trend

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : High

Upwards scenario: Yesterday high offers a key resistive barrier at 1.5684 (R1). Subsequently loss here might create upside momentum and drive market price towards to our initial targets at 1.5732 (R2) and 1.5781 (R3) in potential. Downwards scenario: Possible downside extension might face next supportive barrier at 1.5564 (S1). Clearance here is required to open the way towards to interim target at 1.5517 (S2) and any further price regress would then be targeting 1.5467 (S3).

Resistance Levels: 1.5684, 1.5732, 1.5781

Support Levels: 1.5564, 1.5517, 1.5467

-------------------------

USDJPY :

HIGH 97.517 LOW 95.549 BID 96.696 ASK 96.701 CHANGE -0.27% TIME 08 : 24:37

OUTLOOK SUMMARY : Down

TREND CONDITION : Down trend

TRADERS SENTIMENT : Bullish

IMPLIED VOLATILITY : High

Upwards scenario: After dipping lower today we see potential of market strengthening in near-term perspective. Next on tap is seen resistance level at 97.57 (R1). Break here would suggest next intraday targets at 98.07 (R2) and 98.58 (R3). Downwards scenario: Price regress below the support level at 95.53 (S1) would increase likelihood of failing towards to our key supportive barrier at 95.07 (S2) and any further market decline would then be targeting final support for today at 94.58 (S3).

Resistance Levels: 97.57, 98.07, 98.58

Support Levels: 95.53, 95.07, 94.58

Source: FX Central Clearing Ltd,( Free Forex Demo Accounts | Top ECN Forex Broker | Forex Blog | FXCC )

Forex Technical & Market Analysis FXCC Jun 10 2013

EUR/USD still searching for direction after NFP Data

After trading as high as 1.3284 ahead of the US Non Farm Payroll data, the EUR/USD was unable to hold onto early gains and ended the session 68 pips lower 1.3216. The lack of follow through after the sharp gains early in the week is somewhat concerning, but thus far the pair has been able to hold onto the critical support level located in the 1.3200 area. Some analysts are pointing towards a combination between the Non Farm Payroll data, as well as comments from ECB President Draghi at the most recent ECB meeting as reasons to expect limited upside for the EUR/USD in coming days. According to Marc Chandler, Head of Currency Strategy at BBH, “We warned that although the technical factors looked constructive for the dollar, the fundamentals, in the form of the ECB not delivering on the negative deposit rate (that Draghi said he had an open mind about) and additional aid for small and medium size businesses, were less supportive.”

Although he believes the jobs number was not strong enough to warrant any QE tapering in the near future, Chandler noted downside potential in the USD is limited at current levels. “We anticipated that the jobs data would not support notions from some Fed officials (and market participants) that tapering of the purchases of long-term assets could being as early as this month. Now we suspect the dollar's down move has been largely exhausted and we anticipate a recovery in the dollar into a new trading range,” Chandler concluded.

https://support.fxcc.com/email/technical/10062013/

FOREX ECONOMIC CALENDAR :

2013-06-10 07:15 GMT | Switzerland. Real Retail Sales (YoY) (Apr)

2013-06-10 08:30 GMT | EMU. Sentix Investor Confidence (Jun)

2013-06-10 12:15 GMT | Canada. Housing Starts s.a (YoY) (May)

2013-06-10 23:01 GMT | UK. RICS Housing Price Balance (May)

FOREX NEWS :

2013-06-10 04:37 GMT | EUR/USD still searching for direction after NFP Data

2013-06-10 03:35 GMT | Kiwi attempting bounce towards 0.7900

2013-06-10 02:51 GMT | AUD/JPY consolidating below 92.50

2013-06-10 02:20 GMT | USD/JPY advances capped below 98.50

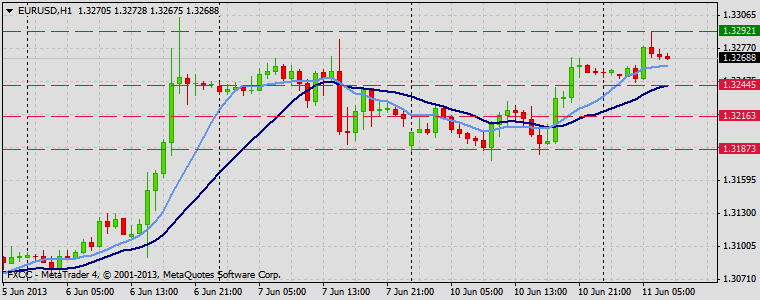

EURUSD :

HIGH 1.32285 LOW 1.31852 BID 1.31975 ASK 1.31978 CHANGE -0.13% TIME 08:26:07

OUTLOOK SUMMARY : Up

TREND CONDITION : Downward penetration

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : Low

MARKET ANALYSIS - Intraday Analysis

Upwards scenario: Market sentiment is neutral according to the technical indicators. Though any prolonged movement above the resistive measure at 1.3242 (R1) would suggest next intraday targets at 1.3277 (R2) and 1.3311 (R3). Downwards scenario: Medium-term ascending structure might lose its power if the price manages to overcome next support level at 1.3187 (S1). Clearance here might determine intraday negative bias and expose our initial targets at 1.3159 (S2) and 1.3129 (S3).

Resistance Levels: 1.3242, 1.3277, 1.3311

Support Levels: 1.3187, 1.3159, 1.3129

--------------------------

GBPUSD :

HIGH 1.55627 LOW 1.55179 BID 1.55262 ASK 1.55274 CHANGE -0.17% TIME 08:26:08

OUTLOOK SUMMARY : Up

TREND CONDITION : Downward penetration

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : Low

Upwards scenario: GBPUSD remains under correction mode after initial uptrend formation. However strengthening above the next resistive structure at 1.5565 (R1) might activate bullish pressure and expose our intraday targets at 1.5602 (R2) and 1.5641 (R3). Downwards scenario: Key support level lies at 1.5486 (S1). Penetration below it might shift medium-term tone to the negative side. Our intraday targets locates at 1.5449 (S2) and 1.5411 (S3).

Resistance Levels: 1.5565, 1.5602, 1.5641

Support Levels: 1.5486, 1.5449, 1.5411

-----------------------

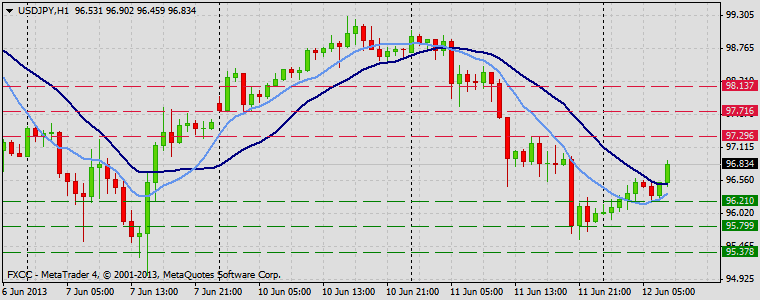

USDJPY :

HIGH 98.427 LOW 97.71 BID 98.235 ASK 98.240 CHANGE 0.73% TIME 08:26:09

OUTLOOK SUMMARY : Up

TREND CONDITION : Upward penetration

TRADERS SENTIMENT : Bullish

IMPLIED VOLATILITY : Low

Upwards scenario: Market gradually recovers previous week losses. If pair gains momentum on the upside and overcome our next resistance at 98.58 (R1), we would suggest next resistances at 98.95 (R2) and 99.33 (R3) as possible targets. Downwards scenario: On the other hand, depreciation below the technically important support level at 97.77 (S1) would allow further market decline on the medium-term perspective. Possible targets lies at 97.36 (S2) and 96.92 (S3).

Resistance Levels: 98.58, 98.95, 99.33

Support Levels: 97.77, 97.36, 96.92

Source: FX Central Clearing Ltd,( Forex Software | Forex Basics | Forex ECN Trading Account | FXCC )

Forex Technical & Market Analysis FXCC Jun 11 2013

USD/JPY searching for direction after BoJ Meeting

The USD/JPY has experienced a fairly volatile Asia session, at one point declining all the way down to 97.78 before finding support and currently consolidating near the 98.30 level. The main catalyst for the sharp drop appeared to come right after the Bank of Japan announced they wouldn’t be making any changes to current monetary policy.

Analysts on the FXStreet.com team noted although many had expected the policy to remain unchanged, there were rumors circling of possible adjustments to help control the recent government bond market volatility which may have helped spark the initial declines when market participants saw the adjustments to current policy were not made. “The Bank of Japan monetary policy meeting offered no particular response to the latest episodes of market volatility in JGB, which includes the failure to change maturities of fixed rate operations in order to ease bond market volatility. Also, there had been some rumors about a proposal to extend the loans to 2 years, something that was not accepted, leading to a strong selling in both the Nikkei and USD/JPY,” FXstreet.com team concluded.

https://support.fxcc.com/email/technical/11062013/

FOREX ECONOMIC CALENDAR :

N/A | Japan. BoJ Monetary Policy Statement

N/A | Germany. Germany Constitutional court ruling on OTM bond buying

2013-06-11 08:30 GMT | UK. Manufacturing Production

2013-06-11 14:00 GMT | UK. NIESR GDP Estimate

2013-06-11 05:00 GMT | USD/JPY searching for direction after BoJ Meeting

2013-06-11 04:43 GMT | 10% appreciation by the USD in 12-18 months - Societe Generale

2013-06-11 04:34 GMT | AUD/USD faces deeper falls on clean 0.94 breakout - JPMorgan

2013-06-11 04:01 GMT | GBP/USD possibly gunning for 1.5800 - 2ndSkies

EURUSD :

HIGH 1.32917 LOW 1.32474 BID 1.32702 ASK 1.32705 CHANGE 0.11% TIME 08:27:25

OUTLOOK SUMMARY : Up

TREND CONDITION : Upward penetration

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : Medium

MARKET ANALYSIS - Intraday Analysis

Upwards scenario: Market remains relatively stable, though clearance of next resistance level at 1.3292 (R1) might initiates bullish pressure. Above the local high locates our resistive means at 1.3321 (R2) and 1.3350 (R3). Downwards scenario: Activation of bearish forces is possible below the support level at 1.3244 (S1). Clearance here would suggest next interim target at 1.3216 (S2) and if the price holds its momentum we would suggest final aim at 1.3187 (S3).

Resistance Levels: 1.3292, 1.3321, 1.3350

Support Levels: 1.3244, 1.3216, 1.3187

----------------------

GBPUSD :

HIGH 1.5602 LOW 1.55563 BID 1.55820 ASK 1.55825 CHANGE 0.06% TIME 08:27:25

OUTLOOK SUMMARY : Up

TREND CONDITION : Upward penetration

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : Medium

Upwards scenario: Resistance level at 1.5602 (R1) acts as reference point for further market strengthening. Break here is required to enable next interim target at 1.5635 (R2) en route towards to final aim for today at 1.5667 (R3). Downwards scenario: Though, possibility of correction is high. Devaluation below the support at 1.5552 (S1) would initiate bearish pressure. On the way our next interim support at 1.5521 (S2) en route to final target at 1.5488 (S3).

Resistance Levels: 1.5602, 1.5635, 1.5667

Support Levels: 1.5552, 1.5521, 1.5488

--------------------

USDJPY :

HIGH 99.056 LOW 97.791 BID 98.226 ASK 98.231 CHANGE -0.52% TIME 08:27:26

OUTLOOK SUMMARY : Down

TREND CONDITION : Downward penetration

TRADERS SENTIMENT : Bullish

IMPLIED VOLATILITY : Medium

Upwards scenario: USDJPY commence correction phase and currently any upside action is limited to the next resistive structure at 98.58 (R1). Break here is required to enable upside pressure towards to intraday targets at 98.95 (R2) and 99.33 (R3). Downwards scenario: Prolonged movement below the supportive measure at 97.77 (S1) is required to activate downtrend expansion. Next aim on the way would be mark at 97.36 (S2) and then final target could be met at 96.97 (S3).

Resistance Levels: 98.58, 98.95, 99.33

Support Levels: 97.77, 97.36, 96.97

Source: FX Central Clearing Ltd,( http://www.fxcc.com )

Forex Technical & Market Analysis FXCC Jun 12 2013

Strong technical set up helps EUR/USD post highest close since mid February

The EUR/USD finished the session sharply higher, surpassing the critical resistance level near 1.3300 and closing up 57 pips at 1.3312 (highest daily close since Feb 19th). In what was a quiet day of economic releases from both the EU and US, analysts were searching for catalyst to help explain the impressive strength. Derek Halpenny, European Head of Global Markets Research at Bank of Tokyo Mitsubishi UFJ, was pointing towards recent hawkish comments from ECB President Draghi as an initial catalyst for the sharp move higher. “The euro remains incredibly solid and has advanced further versus the dollar. ECB President Draghi did speak yesterday and stated that rates would rise once the euro-zone economy improved – a statement of the obvious.”

In further discussing his views, Halpenny went on to comment, “We suspect that the current euro demand is probably emanating from the unwinding of long high yielding currency positions. Both the dollar and the euro were likely used as funding currencies for these positions and hence the euro is modestly out-performing the dollar.” To conclude his view, Halpenny went on to say he expects the EUR/USD will start to decline once the position unwind is completed.

https://support.fxcc.com/email/technical/12062013/

FOREX ECONOMIC CALENDAR :

N/A | Germany. Constitutional court ruling on OMT bond buying

2013-06-12 06:00 GMT | Germany. Consumer Price Index (YoY) (May)

2013-06-12 08:30 GMT | UK. Claimant Count Change (May)

2013-06-12 21:00 GMT | New Zeland. Monetary Policy Statement

FOREX NEWS :

2013-06-12 04:10 GMT | German CPI next: Impact on EUR/USD

2013-06-12 03:43 GMT | USD/CAD has found a short term base - TDS

2013-06-12 03:36 GMT | AUD/JPY advances capped near 91.50

2013-06-12 02:40 GMT | AUD/USD inching higher towards 0.9500

-------------------------

EURUSD :

HIGH 1.33172 LOW 1.32972 BID 1.33003 ASK 1.33004 CHANGE -0.1% TIME 08 : 24:49

OUTLOOK SUMMARY : Up

TREND CONDITION : Downward penetration

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : Medium

MARKET ANALYSIS - Intraday Analysis

Upwards scenario: Upwards penetration is limited now to next resistive structure at 1.3321 (R1). Break here is required to enable higher targets at 1.3350 (R2) and 1.3378 (R3). Downwards scenario: On the other hand, depreciation below the support level at 1.3271 (S1) would suggest next intraday target at 1.3244 (S2) and any further weakening would then be limited to final support level at 1.3216 (S3).

Resistance Levels: 1.3321, 1.3350, 1.3378

Support Levels: 1.3271, 1.3244, 1.3216

--------------------

GBPUSD :

HIGH 1.56519 LOW 1.56337 BID 1.56362 ASK 1.56370 CHANGE -0.06% TIME 08 : 24:50

OUTLOOK SUMMARY : Up

TREND CONDITION : Downward penetration

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : Medium

Upwards scenario: Possible upwards formation is limited now to resistive measure at 1.5654 (R1). A break above it would suggest next intraday target at 1.5686 (R2) and if the price holds its momentum we can expect price increase towards to final resistance at 1.5717 (R3). Downwards scenario: On the downside our focus is shifted to the next support level at 1.5618 (S1). Loss here is required to push the price towards to our next interim targets at 1.5584 (S2) en route towards to final support at 1.5550 (S3)

Resistance Levels: 1.5654, 1.5686, 1.5717

Support Levels: 1.5618, 1.5584, 1.5550

------------------

USDJPY :

HIGH 96.778 LOW 95.918 BID 96.738 ASK 96.743 CHANGE 0.76% TIME 08 : 24:51

OUTLOOK SUMMARY : Down

TREND CONDITION : Upward penetration

TRADERS SENTIMENT : Bullish

IMPLIED VOLATILITY : Medium

Upwards scenario: A violation of next resistance at 97.29 (R1) might call for a run towards to next target at 97.71 (R2) and any further appreciation would then be limited to final target at 98.13 (R3). Downwards scenario: Negative developments might be settled below the important support level at 96.21 (S1). Any price action below it would then be targeting support at 95.79 (S2) and final target could be exposed at 95.37 (S3) mark.

Resistance Levels: 97.29, 97.71, 98.13

Support Levels: 96.21, 95.79, 95.37

Source: FX Central Clearing Ltd,( ECN Currency Trading Blog | Forex Training and Tips | FXCC )