Market Overview by FXCC

Forex Technical & Market Analysis FXCC Nov 25 2013

Iran's real rises versus the U.S. dollar as historic agreement reached whilst oil falls circa one percent.

Hedge-fund managers and other large institutional speculators increased their net-long position in two-year note futures to the highest level since August, according to U.S. Commodity Futures Trading Commission data. Speculative long positions, or bets that prices will rise, outnumbered short positions by 34,011 contracts in the week ending Nov. 19th on the Chicago Board of Trade, this was up 19 percent, from the week previous. The benchmark 10-year yield rose four basis points last week, or 0.04 percentage point, to 2.74 percent in New York. The price of the 2.75 percent note maturing in November 2023 was 100 2/32. A gauge of U.S. company credit risk fell to its lowest level since 2007 as job openings (JOLTS) climbed to a five-year high. The Markit CDX North American Investment Grade Index, a credit-default swaps benchmark investors use to hedge against losses, or to speculate on creditworthiness, decreased 1.7 basis points to 68.8 basis points in New York trading last week. The benchmark reached the lowest closing level since November 2007. Iran’s currency strengthened more than 2 percent as the Nation won access about $7 billion in relief from sanctions after agreeing to limit its nuclear program, ending a decade-long diplomatic stalemate. The rial appreciated by 2.3 percent to 29,300 a dollar on Sunday in Tehran compared with 30,000 yesterday, according to prices provided by street traders in the Iranian currency black market. The currency had lost more than half its value in the year before President Hassan Rouhani’s election in June, partly as a consequence of sanctions denying Iran access to the global financial system. Iran’s gross domestic product declined by approx. 5.4 percent in the fiscal year ending in March. Sanctions have pushed the country’s oil output to the lowest since 1990.

http://blog.fxcc.com/market-analysis

FOREX ECONOMIC CALENDAR :

2013-11-25 15:00 GMT | USA. Pending Home Sales (YoY) (Oct)

2013-11-25 15:30 GMT | USA. Dallas Fed Manufacturing Business Index (Nov)

2013-11-25 22:00 GMT | Australia. RBA Deputy Governor Lowe Speech

2013-11-25 23:50 GMT | Japan. BoJ Monetary Policy Meeting Minutes

FOREX NEWS :

2013-11-25 06:16 GMT | Gold suffers intraday flash crash, off $12 from 1238.00 to 1,226.00

2013-11-25 05:16 GMT | AUD/USD breaks below Friday's low as bounces keep failing

2013-11-25 05:10 GMT | EUR/JPY touches Fibonacci projection at 137.90 and backs off temporarily

2013-11-25 04:41 GMT | GBP/JPY closes week above LT key level of 163.52; bears running for cover

-------------------

EURUSD :

HIGH 1.356 LOW 1.35368 BID 1.35368 ASK 1.35371 CHANGE -0.14% TIME 08:13:00

OUTLOOK SUMMARY : Down

TREND CONDITION : Sideway

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : Medium

MARKET ANALYSIS - Intraday Analysis

Upwards scenario: Next barrier on the upside lie at 1.3563 (R1). Surpassing of this level might enable our initial target at 1.3583 (R2) and any further gains would then be limited to last resistive structure at 1.3608 (R3). Downwards scenario: On the downside our attention is shifted to the immediate support level at 1.3520 (S1). Break here is required to enable bearish forces and expose our intraday targets at 1.3498 (S2) and 1.3473 (S3).

Resistance Levels: 1.3563, 1.3583, 1.3608

Support Levels: 1.3520, 1.3498, 1.3473

-------------------

GBPUSD :

HIGH 1.62401 LOW 1.62055 BID 1.62064 ASK 1.62073 CHANGE -0.1% TIME 08:13:01

OUTLOOK SUMMARY : Down

TREND CONDITION : Upward penetration

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : Medium

Upwards scenario: Immediate resistance at 1.6236 (R1) remains in near-term focus, climb above this level might open way for a stronger move towards to next interim target at 1.6276 (R2) and any further rise would then be limited to final resistive measure at 1.6309 (R3). Downwards scenario: Any downside extension is limited now to the next support level at 1.6188 (S1). Break here is required to open a route towards to next target at 1.6145 (S2) and then any further easing would be targeting final support at 1.6108 (S3).

Resistance Levels: 1.6236, 1.6276, 1.6309

Support Levels: 1.6188, 1.6145, 1.6108

--------------------------

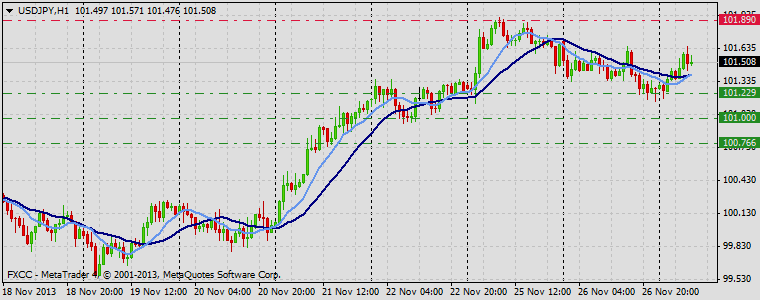

USDJPY :

HIGH 101.917 LOW 101.139 BID 101.879 ASK 101.882 CHANGE 0.63% TIME 08:13:02

OUTLOOK SUMMARY : Up

TREND CONDITION : Up trend

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : High

Upwards scenario: Any upside action is limited now to the next resistive structure at 102.02 (R1). Clearance here might shift trader’s sentiment to bullish side and open road towards to our initial targets at 102.21 (R2) and 102.50 (R3). Downwards scenario: On the other hand, risk of correction development is seen below the next support at 101.20 (S1). Possible price downgrade would suggest next initial targets at 100.99 (S2) and 100.77 (S3).

Resistance Levels: 102.02, 102.21, 102.50

Support Levels: 101.20, 100.99, 100.77

Source: FX Central Clearing Ltd,( http://www.fxcc.com )

Forex Technical & Market Analysis FXCC Nov 26 2013

USA house price index is published as the Richmond Fed Manufacturing Index is expected to rise.

Tuesday in the UK will see the publication of the UK's Nationwide Building Society's house price inflation report. As one of the more modest/reasonable indices of house price data in the UK the print is expected to come in up 0.6% month on month. The UK also holds inflation report hearings during the day. The USA publishes data on building permits and housing starts, expected in at circa 0.92K for both. The Standard & Poor's Case Shiller house price index is published with the expectations that annual house price inflation in the USA will rise to 13% year on year. The Conference Board Confidence index is published, expected in at 72.1, with the Richmond Manufacturing index expected up at 3 from the previous reading of 1.0. Late Tuesday evening New Zealand publishes its trade balance, expected down at -345 million, whilst construction data (completed) for Australia is published. The yen fell 0.4 percent to 101.67 per dollar late in New York time on Monday after reaching 101.92, the weakest since May 29th. It slid 0.1 percent to 137.43 per euro after touching 137.99, the weakest since October 2009. The dollar added 0.3 percent to $1.3517 against Europe’s shared currency. The U.S. Dollar Index, which tracks the currency against 10 major counterparts, rose 0.2 percent to 1,020.95.

http://blog.fxcc.com/market-analysis

FOREX ECONOMIC CALENDAR :

2013-11-26 10:00 GMT | UK Inflation Report Hearings

2013-11-26 13:30 GMT | US Housing Starts (MoM) (Oct)

2013-11-26 15:00 GMT | US Consumer Confidence (Nov)

2013-11-26 21:45 GMT | NZ Trade Balance (YoY) (Oct)

FOREX NEWS :

2013-11-26 05:44 GMT | EUR/USD at risk of further retracements - ANZ

2013-11-26 04:47 GMT | Gold giving its best impression of an upside attempt – something not seen in a while

2013-11-26 03:55 GMT | GBP/USD falling softly after posting a nasty bearish reversal candle on Monday

2013-11-26 02:16 GMT | USD/JPY taking a breather after closing Monday above key “correction resistance” at 101.46

-----------------------

EURUSD :

HIGH 1.35408 LOW 1.35151 BID 1.35301 ASK 1.35305 CHANGE 0.1% TIME 08 : 36:32

OUTLOOK SUMMARY : Up

TREND CONDITION : Upward penetration

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : Medium

MARKET ANALYSIS - Intraday Analysis

Upwards scenario: Risk of possible price appreciation is seen above the next resistance level at 1.3541 (R1). Clearance here would suggest next intraday target at 1.3553 (R2) and then final aim locates at 1.3566 (R3). Downwards scenario: Our technical outlook would turn into negative side below the support level at 1.3516 (S1). Possible price depreciation would then be targeting support at 1.3504 (S2) en route to final target at 1.3492 (S3).

Resistance Levels: 1.3541, 1.3553, 1.3566

Support Levels: 1.3516, 1.3504, 1.3492

--------------------------

GBPUSD :

HIGH 1.61742 LOW 1.61456 BID 1.61462 ASK 1.61469 CHANGE -0.05% TIME 08 : 36:33

OUTLOOK SUMMARY : Down

TREND CONDITION : Downward penetration

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : Medium

Upwards scenario: Immediate resistance at 1.6174 (R1) remains in near-term focus, climb above this level might open way towards to next interim target at 1.6193 (R2) and any further rise would then be limited to final resistive measure at 1.6213 (R3) Downwards scenario: Opportunity for bearish oriented traders is seen below the important support level at 1.6133 (S1). Loss here would open door for the downtrend expansion towards to interim targets at 1.6114 (S2) and 1.6096 (S3).

Resistance Levels: 1.6174, 1.6193, 1.6213

Support Levels: 1.6133, 1.6114, 1.6096

------------------

USDJPY :

HIGH 101.71 LOW 101.333 BID 101.551 ASK 101.555 CHANGE -0.12% TIME 08 : 36:34

OUTLOOK SUMMARY : Up

TREND CONDITION : Downward penetration

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : Medium

Upwards scenario: Next actual resistance level is seen at 101.91 (R1). If the market manages to surge higher, our focus will shift to the next target at 102.15 (R2) and any further price strengthening would be limited to final resistance at 102.39 (R3). Downwards scenario: Any penetration below the support level at 101.32 (S1) might create more scope for the instrument weakness in near-term perspective. We are looking to our immediate supports at 101.10 (S2) and 100.86 (S3) as next possible targets.

Resistance Levels: 101.91, 102.15, 102.39

Support Levels: 101.32, 101.10, 100.86

Source: FX Central Clearing Ltd,( http://www.fxcc.com )

Forex Technical & Market Analysis FXCC Nov 27 2013

Unemployment claims in the USA expected to stay in their narrow range of 331K

Wednesday sees the UK's second estimate GDP figure is published, expected to come in at 0.8%. The preliminary business investment data is published, it fell by 2.7% last quarter the expectations is for a 2.3% rise in the latest figures. The GFK German consumer confidence is published expected in at 7.1, versus 7.0 in the previous month. Durable goods orders for the USA are expected to fall by 1.5%, the Chicago PMI is excepted to fall to 60.6, with unemployment claims in at 331K. Natural gas and oil storage figures for the USA need watching carefully in relation to the volatility of trading oil and gas. Retail sales in Japan are scheduled to fall to a 2.2% increase month on month. The New Zealand ANZ business confidence index is published in the evening, as is Australian data concerning new homes sales and private capital expenditure, the latter expected to fall by -1.1%. Looking towards Wednesday's market open the DJIA equity index future is flat, as is the SPX, with the NASDAQ up 0.53%. STOXX is down 0.23%, DAX down 0.03%, CAC down 0.52% and FTSE down 0.93%. NYMEX WTI oil closed down 0.44% on the Dayan Tuesday at $93.68 per barrel, NYMEX nat gas was up 0.77% at $3.82 per therm. COMEX gold was flat at $1241.50 per ounce and silver at$19.85 per ounce down 0.38%. The euro strengthened 0.4 percent to $1.3572 per dollar late in New York time Tuesday after rising to $1.3575, the highest level since Nov. 20th. The 17-nation currency was little changed at 137.46 yen. Japan’s currency appreciated 0.4 percent to 101.28 per dollar after gaining 0.5 percent, the most since Nov. 13th. Australia’s dollar fell 0.8 percent to 92.44 yen after decreasing 1 percent to 92.25, the weakest since Oct. 10th. The U.S. Dollar Index, which tracks the currency against 10 major counterparts, fell 0.2 percent to 1,018.83 after gaining 0.1 percent.

http://blog.fxcc.com/market-analysis

FOREX ECONOMIC CALENDAR :

2013-11-27 12:00 GMT | USA. MBA Mortgage Applications (Nov 22)

2013-11-27 13:30 GMT | USA. Chicago Fed National Activity Index (Oct)

2013-11-27 13:30 GMT | USA. Durable Goods Orders (Oct)

2013-11-27 13:30 GMT | USA. Initial Jobless Claims (Nov 22)

FOREX NEWS :

2013-11-27 05:49 GMT | GBP/JPY finds offers at 164.90

2013-11-27 03:44 GMT | EUR/USD spikes in Asia, approaching 1.36

2013-11-27 01:47 GMT | AUD/USD pressured; glued to 0.91

2013-11-27 01:41 GMT | USD/JPY trading a bit higher Wednesday after posting a bearish reversal candle Tuesday

-------------------

EURUSD

HIGH 1.3599 LOW 1.35576 BID 1.35876 ASK 1.35881 CHANGE 0.11% TIME 08 : 07:20

OUTLOOK SUMMARY : Up

TREND CONDITION : Upward penetration

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : High

MARKET ANALYSIS - Intraday Analysis

Upwards scenario: The next resistance level is at 1.3597 (R1). Penetration above that level might trigger upside action and expose our next resistive mean at 1.3620 (R2) en route towards to final target for today at 1.3646 (R3). Downwards scenario: Further correction development is limited now to the session low - 1.3560 (S1). If the price manages to surpass it we would suggest next intraday targets at 1.3542 (S2) and 1.3520 (S3).

Resistance Levels: 1.3597, 1.3620, 1.3646

Support Levels: 1.3560, 1.3542, 1.3520

-----------------------

GBPUSD :

HIGH 1.62305 LOW 1.61973 BID 1.62164 ASK 1.62176 CHANGE 0.01% TIME 08 : 07:21

OUTLOOK SUMMARY : Up

TREND CONDITION : Upward penetration

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : High

Upwards scenario: Possible upwards formation is limited now to resistive measure at 1.6236 (R1). A break above it would suggest next intraday target at 1.6276 (R2) and if the price holds its momentum we can expect price increase towards to final resistance at 1.6309 (R3). Downwards scenario: If the price manages to overcome our next support barrier at 1.6188 (S1), we expect to see further market decline towards to our next target at 1.6145 (S2) and then next stop could be found at 1.6108 (S3) mark.

Resistance Levels: 1.6236, 1.6276, 1.6309

Support Levels: 1.6188, 1.6145, 1.6108

---------------------

USDJPY :

HIGH 101.652 LOW 101.184 BID 101.496 ASK 101.501 CHANGE 0.22% TIME 08 : 07:22

OUTLOOK SUMMARY : Down

TREND CONDITION : Downward penetration

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : High

Upwards scenario: A violation of next resistance at 101.89 (R1) might call for a run towards to next target at 102.13 (R2) and any further appreciation would then be limited to final target at 102.35 (R3). Downwards scenario: On the other hand, a break of the support at 101.22 (S1) is required to determine negative intraday bias and enable lower target at 101.00 (S2). Clearance of this target would open a path towards to final support for today at 100.76 (S3).

Resistance Levels: 101.89, 102.13, 102.35

Support Levels: 101.22, 101.00, 100.76

Source: FX Central Clearing Ltd,( http://www.fxcc.com )

Forex Technical & Market Analysis FXCC Dec 02 2013

Australian Manufacturing Slips in November, U.S. Retail Holiday Sales Up 2.3%, Whilst Foot Traffic Declines.

The latest Australian Industry Group Australian Performance of Manufacturing Index (Australian PMI) fell by 5.4 points in November, to 47.7 points (seasonally adjusted). This fall interrupted the promising run of mild expansion in the Australian PMI over the past two months (50 points marks the separation between expansion and contraction in the Australian PMI) and took the index back to its pre-election levels. The Australian PMI is again indicating varying degrees of contraction across the manufacturing sectors. U.S. retailers enjoyed a 2.3 percent sales gain over the critical Thanksgiving and Black Friday holiday time, in line with a prediction for the weakest holiday results since 2009. Sales at brick-and-mortar stores on Thanksgiving and Black Friday rose to $12.3 billion, according to a report yesterday from ShopperTrak a Chicago-based researcher who reiterated its prediction that sales for the entire holiday season will gain 2.4 percent, representing the smallest increase since the last recession. Sunday-Monday morning is a relatively quite opening for high impact news events, capital spending in Japan is predicted to rise by 3.1%. The HSBC final manufacturing PMI for China is expected to come in at 50.5. There is a raft of Australian data published overnight/early morning, with building approvals being the standout piece of data which is expected to fall to -4.3% from a positive 14.4% the previous month. Company operating profits are published for Australian companies. New Zealand's overseas trade index is expected in at 3.0%.

http://blog.fxcc.com/market-analysis

FOREX ECONOMIC CALENDAR :

2013-12-02 08:58 GMT | EMU Markit Manufacturing PMI (Nov)

2013-12-02 09:28 GMT | UK Markit Manufacturing PMI (Nov)

2013-12-02 13:30 GMT | US Fed's Bernanke Speech

2013-12-02 15:00 GMT | US ISM Manufacturing PMI (Nov)

FOREX NEWS :

2013-12-02 07:52 GMT | AUD/USD firmer, eyes on 0.9170

2013-12-02 06:53 GMT | EUR/USD stabilizing around 1.3600

2013-12-02 04:10 GMT | USD/JPY, second topside failure at 102.60

2013-12-02 03:06 GMT | GBP/USD, if 1.64/6425 absorbed, potential into 1.70/1.73 - BBH

-----------------------

EURUSD :

HIGH 1.36157 LOW 1.35812 BID 1.36032 ASK 1.36036 CHANGE 0% TIME 10 : 01:18

OUTLOOK SUMMARY : Up

TREND CONDITION : Sideway

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : Low

MARKET ANALYSIS - Intraday Analysis

Upwards scenario: Possibility of price appreciation is seen above the key resistance at 1.3622 (R1). Break here would open a route towards to our intraday targets at 1.3643 (R2) and 1.3664 (R3). Downwards scenario: An important technical level at 1.3580 (S1) prevents possible market weakening. Break here is required to open road towards to interim target at 1.3558 (S2) en route to final aim at 1.3537 (S3).

Resistance Levels: 1.3622, 1.3643, 1.3664

Support Levels: 1.3580, 1.3558, 1.3537

--------------------

GBPUSD :

HIGH 1.64422 LOW 1.63684 BID 1.64126 ASK 1.64128 CHANGE 0% TIME 10 : 01:18

OUTLOOK SUMMARY : Up

TREND CONDITION : Up trend

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : Low

Upwards scenario: Fractal level at 1.6442 (R1) offers next resistive structure on the upside. If the price manages to overcome it, we would expect further appreciation towards to our initial targets at 1.6471 (R2) and 1.6499 (R3). Downwards scenario: On the hourly chart GBPUSD looks overbought and possibility of correction is high. Friday’s high offers key support level at 1.6385 (S1). Break here is required to enable our next targets at 1.6356 (S2) and 1.6327 (S3).

Resistance Levels: 1.6442, 1.6471, 1.6499

Support Levels: 1.6385, 1.6356, 1.6327

--------------------

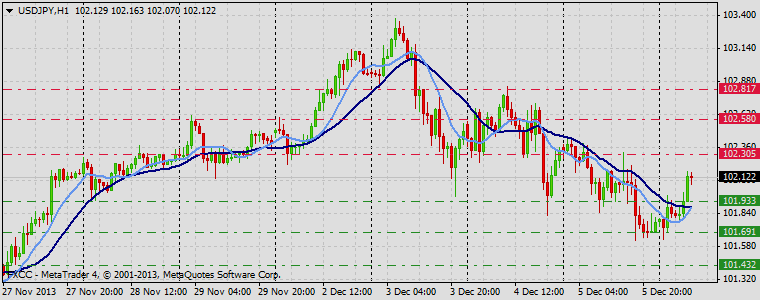

USDJPY :

HIGH 102.594 LOW 102.226 BID 102.559 ASK 102.562 CHANGE 0% TIME 10 : 01:18

OUTLOOK SUMMARY : Up

TREND CONDITION : Sideway

TRADERS SENTIMENT : Bullish

IMPLIED VOLATILITY : Medium

Upwards scenario: Price comfortably ranging on the hourly chart, however we see potential to overcome our next resistive barrier at 102.61 (R1) later on today. Any prolonged movement above it would suggest next intraday targets at 102.82 (R2) and 103.05 (R3). Downwards scenario: On the other hand, successful retest of our support level at 102.21 (S1) would clear the way for a recovery action towards to our lower targets at 102.00 (S2) and 101.78 (S3) in potential.

Resistance Levels: 102.61, 102.82, 103.05

Support Levels: 102.21, 102.00, 101.78

Source: FX Central Clearing Ltd,( http://www.fxcc.com )

Forex Technical & Market Analysis FXCC Dec 05 2013

UK BoE and ECB publish their rate and monetary easing decisions whilst UK chancellor will deliver his 'Autumn statement'.

Thursday witnesses the UK's BoE MPC publish its interest rate policy decision and the details of its monetary easing policy decision which is expected to remain the same at £375bn. The statement covering the decisions will be of keen interest to investors. The UK's chancellor will give his autumn finance statement. Europe's ECB will publish its rate decision, expected to stay at 0.25%. Canada reports its building permits and the IVEY PMI expected in at 60.2, whilst the USA publishes its preliminary GDP figures expected in at 3.1%, with unemployment claim numbers at circa 322K for the week. The USA publishes its factory orders, predicted down by 0.7%. The yen rallied 0.2 percent to 102.36 versus the dollar late in New York Wednesday, after touching 103.38 Tuesday, the weakest level since May 23rd. The U.S. currency was little changed at $1.3593 per euro. The yen gained 0.1 percent to 139.13 per euro. The U.S. Dollar Index, which tracks the U.S. currency versus its 10 major counterparts, was little changed at 1,020.94, after rising to 1,025.36 yesterday, the highest level since Sept. 13th. The yen rallied for a second day against the dollar as stronger-than-forecast U.S. economic data spurred speculation the Federal Reserve will reduce stimulus that has driven up stocks globally. Bank of Canada policy makers kept their benchmark rate on overnight loans between commercial banks at 1 percent, where it’s been for more than three years, as forecast by all 22 economists in a Bloomberg survey. The Canadian dollar fell 0.3 percent to C$1.0684 versus the greenback, reaching the lowest level since May 2010.

http://blog.fxcc.com/market-analysis

FOREX ECONOMIC CALENDAR :

2013-12-05 09:05 GMT | Bank of Japan Governor Kuroda Speech

2013-12-05 12:00 GMT | BoE Interest Rate Decision (Dec 5)

2013-12-05 12:45 GMT | ECB Interest Rate Decision (Dec 5)

2013-12-05 13:30 GMT | US Gross Domestic Product Annualized (Q3)

FOREX NEWS :

2013-12-05 03:50 GMT | NZD/USD in no man's land; capped below 0.8240/50

2013-12-05 02:53 GMT | AUD/USD short squeeze pressing against 0.9050

2013-12-05 02:08 GMT | GBP/USD: If upside clears, next target 1.65/66 - 2ndSkies

2013-12-05 01:46 GMT | EUR/AUD dropping from monthly highs

--------------------------

EURUSD

HIGH 1.36394 LOW 1.358 BID 1.36243 ASK 1.36246 CHANGE 0% TIME 08 : 50:26

OUTLOOK SUMMARY : Up

TREND CONDITION : Up trend

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : High

MARKET ANALYSIS - Intraday Analysis

Upwards scenario: Instrument gained momentum on the upside recently, turning short-term bias to the positive side. Next resistive structure on the way lies at 1.3641 (R1), break here would suggest next intraday targets at 1.3658 (R2) and 1.3674 (R3). Downwards scenario: On the other side, depreciation below the support barrier at 1.3606 (S1) might provide sufficient space for the recovery action. In such case we would suggest next intraday targets at 1.3588 (S2) and then 1.3571 (S3).

Resistance Levels: 1.3641, 1.3658, 1.3674

Support Levels: 1.3606, 1.3588, 1.3571

----------------------

GBPUSD :

HIGH 1.63971 LOW 1.637 BID 1.63842 ASK 1.63845 CHANGE 0% TIME 08 : 50:26

OUTLOOK SUMMARY : Neutral

TREND CONDITION : Sideway

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : High

Upwards scenario: Possibility of ascending structure is seen above the fractal level at 1.6404 (R1). Break here is required to clear the way towards to higher targets at 1.6426 (R2) and 1.6447 (R3). Downwards scenario: On the other hand, progress below the initial support level at 1.6364 (S1) might initiate bearish pressure and expose our intraday targets at 1.6342 (S2) and 1.6321 (S3) later on today.

Resistance Levels: 1.6404, 1.6426, 1.6447

Support Levels: 1.6364, 1.6342, 1.6321

-----------------------

USDJPY :

HIGH 102.442 LOW 101.99 BID 102.114 ASK 102.116 CHANGE 0% TIME 08 : 50:26

OUTLOOK SUMMARY : Down

TREND CONDITION : Downward penetration

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : High

Upwards scenario: We see potential of market strengthening in near-term perspective. Next on tap is seen resistance level at 102.47 (R1). Break here would suggest next intraday targets at 102.67 (R2) and 102.90 (R3). Downwards scenario: On the downside, USDJPY might encounter supportive measures at 101.82 (S1). Break here would open the way for a test of our next targets at 101.60 (S2) and 101.39 (S3) later on today.

Resistance Levels: 102.47, 102.67, 102.90

Support Levels: 101.82, 101.60, 101.39

Source: FX Central Clearing Ltd,( http://www.fxcc.com )

Forex Technical & Market Analysis FXCC Dec 06 2013

NFP day could witness a surprise 'jobs' number

Friday sees Japan's leading indicators published, France's trade balance is expected in at €-5.1bn, Germany's factory orders are expected to fall by -0.4%. Canada's unemployment number is expected to rise to 7.0%. Non-farm jobs created are expected in at circa 184K, with the USA unemployment expected in at 7.2%. Personal spending in the USA is expected in up 0.4%, whilst the preliminary university of Michigan survey of consumer sentiment expected in at 76.2. Later on Friday sees FOMC member Evans hold court, with the BOJ governor Kuroda holding court later in the evening. Late Friday evening-early Saturday morning China's trade balance is published. The euro advanced 0.6 percent to $1.3671 late in New York on Thursday after rising to $1.3677, the strongest level since Oct. 31st. The single currency was little changed at 139.10 yen after weakening as much as 0.5 percent. The dollar fell 0.6 percent to 101.74 yen. The euro rose to a five-week high versus the dollar as European Central Bank President Mario Draghi refrained from introducing further monetary stimulus. Sterling slumped 0.9 percent to 83.74 pence per euro late London time Thursday, the biggest decline since March 7th. The pound dropped 0.4 percent to $1.6315 after climbing to $1.6443 on Dec. 2nd, the highest since August 2011. The DJIA equity index future is at the time of writing down 0.43%, SPX future down 0.44%, NASDAQ down 0.11%. STOXX future is down 1.24%, DAX down 0.50%, CAC down 1.21%, FTSE future down 0.34%.

http://blog.fxcc.com/market-analysis

FOREX ECONOMIC CALENDAR :

2013-12-06 13:30 GMT | USA. Nonfarm Payrolls (Nov)

2013-12-06 13:30 GMT | USA. Unemployment Rate (Nov)

2013-12-06 13:30 GMT | Canada. Unemployment Rate (Nov)

2013-12-06 13:30 GMT | Canada. Net Change in Employment (Nov)

FOREX NEWS :

2013-12-06 04:45 GMT | Yen slides on GPIF headlines

2013-12-06 04:45 GMT | EUR/USD not relenting on upside – which shows just how strong Europe is perceived to be

2013-12-06 03:38 GMT | USD/JPY continues downside correction despite good US numbers from Thursday

2013-12-06 00:12 GMT | GBP/USD pulling back after touching upside projected target at 1.6425 this week

----------------------

EURUSD :

HIGH 1.36742 LOW 1.36566 BID 1.36608 ASK 1.36611 CHANGE 0.01% TIME 08 : 37:57

OUTLOOK SUMMARY : Down

TREND CONDITION : Upward penetration

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : High

MARKET ANALYSIS - Intraday Analysis

Upwards scenario: Market sentiment has improved for the bullish oriented traders. Fresh high formed yesterday offers key resistance level at 1.3676 (R1). In case of price appreciation above it our focus would be shifted to the higher targets at 1.3692 (R2) and 1.3709 (R3). Downwards scenario: On the other hand, successful retest of our next support level at 1.3640 (S1) might provide sufficient momentum for the price acceleration towards to interim target at 1.3621 (S2). Final aim for today locates at 1.3599 (S3).

Resistance Levels: 1.3676, 1.3692, 1.3709

Support Levels: 1.3640, 1.3621, 1.3599

------------------

GBPUSD :

HIGH 1.63414 LOW 1.6319 BID 1.63243 ASK 1.63249 CHANGE 0% TIME 08 : 37:57

OUTLOOK SUMMARY : Down

TREND CONDITION : Downward penetration

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : High

Upwards scenario: Measures of resistance might be activating when the pair approaches the 1.6340 (R1) mark. Break here would suggest next interim target at 1.6369 (R2) and If the price keeps its momentum we expect an exposure of 1.6392 (R3). Downwards scenario: On the downside our attention is shifted to the immediate support level at 1.6310 (S1). Break here is required to enable bearish forces and expose our intraday targets at 1.6289 (S2) and 1.6266 (S3).

Resistance Levels: 1.6340, 1.6369, 1.6392

Support Levels: 1.6310, 1.6289, 1.6266

----------------------

USDJPY :

HIGH 102.167 LOW 101.631 BID 102.114 ASK 102.117 CHANGE 0% TIME 08 : 37:57

OUTLOOK SUMMARY : Up

TREND CONDITION : Down trend

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : High

Upwards scenario: Currently price deviates from its initial downside extension. Clearance of our next resistance level at 102.30 (R1) might trigger corrective action towards to our initial targets at 102.58 (R2) and 102.81 (R3). Downwards scenario: We do expect some pull-backs development on the downside below the support level at 101.93 (S1). Short-term momentum on the negative side might open the way towards to immediate supports at 101.69 (S2) and 101.43 (S3).

Resistance Levels: 102.30, 102.58, 102.81

Support Levels: 101.93, 101.69, 101.43

Source: FX Central Clearing Ltd,( http://www.fxcc.com )

Forex Technical & Market Analysis FXCC Dec 09 2013

China's trade surplus reaches a four year high as exports rise signalling strength returning to the world’s second largest economy

Sunday evening's trading session sees a raft of information published from Japan, the final GDP figure is predicted to come in at 0.4%, with the final GDP price predicted to come in at -0.3%, bank lending should come in at 2% improvement. There is important inflation data published on Sunday regarding China's economy; the CPI is predicted to come in at 3.0% with PPI expected to be in at -1.5%. Monday sees Germany's trade balance published; expected in at €17.4bn positive, Germany's month on month industrial prediction is expected in at 0.8%. The Swiss unemployment rate is predicted to come in at 3.2%, with retail sales up 1.7%. Europe's Sentix index is published with the expectation of a print of 10.5. There are also various Eurogroup meetings held. Monday also sees the UK BoE governor Mark Carney deliver a speech as does a significant person from the FOMC, Mr Bullard. The UK RICS house price balance is expected in at 59% suggesting that 59% of surveyors questioned are witnessing higher house prices in the UK. Japan publishes data on manufacturing index activity, predicted to come in at 17.2, with tertiary activity expected to print at 0.3%. Later that evening Australia's leading confidence index, from the National Australia Bank, is published, the expectation is for a print of circa 5, which is similar to the previous month's print. Australia's home loans figure is expected to come in at 1.3%. The consumer confidence index for Japan is published, expected in at 44.2, up from 42.1 the previous month.

http://blog.fxcc.com/market-analysis

FOREX ECONOMIC CALENDAR :

2013-12-09 24h | EU. Eurogroup meeting

2013-12-09 11:00 GMT | EU. Industrial Production n.s.a. w.d.a. (YoY) (Oct)

2013-12-09 13:15 GMT | Canada. Housing Starts s.a (YoY) (Nov)

2013-12-09 21:45 GMT | New Zealand. Electronic Card Retail Sales (YoY) (Nov)

FOREX NEWS :

2013-12-09 06:16 GMT | EUR/USD back in the red and below breakout point of 1.3708 ahead of European session

2013-12-09 04:29 GMT | Gold opens the week on a flat note; 1172 technical target looms

2013-12-09 03:45 GMT | GBP/USD pulling back after touching upside projected target at 1.6425 last week

2013-12-09 01:53 GMT | EUR/JPY off highs but nicely higher for session on “risk on” mood and sluggish Japanese data

---------------------

EURUSD :

HIGH 1.37212 LOW 1.36997 BID 1.37 ASK 1.37002 CHANGE 0% TIME 08 : 44:58

OUTLOOK SUMMARY : Down

TREND CONDITION : Upward penetration

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : High

MARKET ANALYSIS - Intraday Analysis

Upwards scenario: EUR/USD is entering the retracement stage on the hourly chart however we see potential for further appreciation towards to our targets at 1.3730 (R2) and 1.3748 (R3) if the price manages to overcome key resistance measure at 1.3712 (R1). Downwards scenario: In terms of technical levels, risk of price depreciation is seen below the next support level at 1.3658 (S1). Loss here would suggest to monitor marks at 1.3640 (S2) and 1.3621 (S3) as possible intraday targets.

Resistance Levels: 1.3712, 1.3730, 1.3748

Support Levels: 1.3658, 1.3640, 1.3621

------------------------

GBPUSD :

HIGH 1.63535 LOW 1.63227 BID 1.63504 ASK 1.63507 CHANGE 0% TIME 08 : 44:58

OUTLOOK SUMMARY : Up

TREND CONDITION : Down trend

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : Medium

Upwards scenario: Possible upwards formation is limited now to resistive measure at 1.6360 (R1). A break above it would suggest next intraday target at 1.6392 (R2) and if the price holds its momentum we can expect price increase towards to final resistance at 1.6423 (R3). Downwards scenario: Next challenge on the downside is seen at 1.6318 (S1). Breakthrough of this mark would open way for a downside expansion and could possibly trigger our initial targets at 1.6290 (S2) and 1.6266 (R3) later on today.

Resistance Levels: 1.6360, 1.6392, 1.6423

Support Levels: 1.6318, 1.6290, 1.6266

------------------------

USDJPY :

HIGH 103.22 LOW 102.89 BID 103.037 ASK 103.039 CHANGE 0% TIME 08 : 44:58

OUTLOOK SUMMARY : Up

TREND CONDITION : Sideway

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : Medium

Upwards scenario: Immediate resistance at 103.13 (R1) remains in near-term focus, climb above this level might open way for a stronger move towards to next interim target at 103.29 (R2) and any further rise would then be limited to final resistive measure at 103.46 (R3) . Downwards scenario: Risk of market weakening is seen below the support level at 102.77 (S1). Loss here is required to allow further declines and expose our supportive barrier at 102.62 (S2) en route towards to final target for today at 102.46 (S3).

Resistance Levels: 103.13, 103.29, 103.46

Support Levels: 102.77, 102.62, 102.46

Source: FX Central Clearing Ltd,( http://www.fxcc.com )

Forex Technical & Market Analysis FXCC Dec 10 2013

ECOFIN meetings might affect Euro direction, whilst important USA economic data is published in the New York session

Tuesday sees the publication of China's industrial production figures, expected in at 10.2%, retail sales in China are predicted to rise by 13.2%, with fixed asset investment predicted to rise by 20.1% - year on year. In Europe both French and Italian Industrial production figures are published, both expected in at circa 0.2-0.3%. The UK's manufacturing production is expected to fall to 0.4% from the previous month's 1.1%. The UK's trade balance is expected to stay at circa £9.1 bn for the month. The UK's NIESR also publishes its latest data, suggesting that economic activity will be stable at circa 0.7%. In Europe the ECOFIN meetings will take place with Mario Draghi then holding court with a speech discussing the outcomes of the meetings in relation to any policy change, or additions. In the USA there is a raft of information published in the afternoon trading session; the NFIB small business index is published expected in at 92.7. JOLTS job openings are expected in at 3.96 million, with wholesale inventories in the USA expected to shrink to 0.3%. Later in the evening on Tuesday Australia's Westpac consumer confidence index is published, the expectation is for a figure similar to the previous month of 1.9%. Japan publishes its core machinery orders, expected in at 0.9%, up from the previous month's negative print. The corporation inflation number is also printed, expected in at 2.7% year on year. Equity index futures are looking insipid with regards to tomorrow's trading opportunities, the DJIA equity index future is up 0.05%, SPX future up 0.07%, NASDAQ up 0.07%. Looking towards the European open the STOXX future is up 0.34%, DAX up 0.35%, CAC up 0.08% and the FTSE future is up 0.22%. NYMEX WTI oil closed flat on the day on Monday at $97.34 per barrel, NYMEX nat gas closed the day up a significant 2.87% at $4.23 per therm. COMEX gold closed the day up 0.42% at $1234.20 per ounce with silver up 0.91% at $19.70 per ounce. The loonie, as the Canadian dollar is known, rose 0.1 percent to C$1.0627 per U.S. dollar at 5 p.m. in Toronto after falling as much as 0.3 percent. It touched C$1.0708 on Dec. 6th, the weakest since May 2010. One loonie buys 94.10 U.S. cents.

http://blog.fxcc.com/market-analysis

FOREX ECONOMIC CALENDAR :

2013-12-10 12:00 GMT | EU. ECB President Draghi's Speech

2013-12-10 15:00 GMT | UK. NIESR GDP Estimate (3M) (Nov)

2013-12-10 23:30 GMT | Australia. Westpac Consumer Confidence (Dec)

2013-12-10 23:50 GMT | Japan. Machinery Orders (YoY) (Oct)

FOREX NEWS :

2013-12-10 05:41 GMT | AUD/USD capped by 0.91/9120 offers cluster

2013-12-10 02:44 GMT | USD/JPY rolling over short-term as traders sell greenback; 103.54 remains key resistance

2013-12-10 02:16 GMT | EUR/USD bursts through 1.3750 barrier

2013-12-10 01:51 GMT | NZD/USD tilting towards 0.83 handle

---------------------

EURUSD :

HIGH 1.37676 LOW 1.37341 BID 1.37498 ASK 1.37501 CHANGE 0% TIME 08 : 52:41

OUTLOOK SUMMARY : Up

TREND CONDITION : Up trend

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : High

MARKET ANALYSIS - Intraday Analysis

Upwards scenario: Next barrier on the upside lie at 1.3768 (R1). Surpassing of this level might enable our initial target at 1.3788 (R2) and any further gains would then be limited to last resistive structure at 1.3806 (R3). Downwards scenario: On the other hand, price pattern suggests bearish potential if the instrument manages to overcome next support level at 1.3728 (S1). Possible price regress could expose our initial targets at 1.3706 (S2) and 1.3684 (S3) in potential.

Resistance Levels: 1.3768, 1.3788, 1.3806

Support Levels: 1.3728, 1.3706, 1.3684

-------------------

GBPUSD :

HIGH 1.64657 LOW 1.64186 BID 1.64491 ASK 1.64497 CHANGE 0% TIME 08 : 52:41

OUTLOOK SUMMARY : Up

TREND CONDITION : Upward penetration

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : High

Upwards scenario: On the upside potential is seen for a break above the resistance at 1.6465 (R1). In such case we would suggest next target at 1.6493 (R2) and any further rise would then be limited to final resistance at 1.6518 (R3). Downwards scenario: On the other hand, successful retest of our next support level at 1.6428 (S1) might provide sufficient momentum for the price acceleration towards to interim target at 1.6403 (S2). Final aim for today locates at 1.6382 (S3).

Resistance Levels: 1.6465, 1.6493, 1.6518

Support Levels: 1.6428, 1.6403, 1.6382

------------------

USDJPY :

HIGH 103.394 LOW 103.167 BID 103.341 ASK 103.344 CHANGE 0% TIME 08 : 52:41

OUTLOOK SUMMARY : Up

TREND CONDITION : Upward penetration

TRADERS SENTIMENT : Bullish

IMPLIED VOLATILITY : High

Upwards scenario: Upside risk aversion is seen above the next resistance level at 103.38 (R1). Appreciation above it might lead to the positive intraday bias formation towards to our next targets at 103.70 (R2) and 104.03 (R3). Downwards scenario: Possible pull back development is limited now to the key supportive barrier at 102.92 (S1). Only loss here would be considered as a beginning of a retracement expansion. Our intraday targets locates at 102.68 (S2) and 102.47 (S3).

Resistance Levels: 103.38, 103.70, 104.03

Support Levels: 102.92, 102.68, 102.47

Source: FX Central Clearing Ltd,( http://www.fxcc.com )

Forex Technical & Market Analysis FXCC Dec 11 2013

Could USA oil supplies data cause WTI oil to flirt with the critical $100 a barrel level?

Wednesday sees the publication of USA oil supplies data, expected to print at -5.6 bn barrels, whilst the USA federal budget balance is expected to print at $154.6 bn, significantly worsening from the previous month's figure of $91.6 bn. In New Zealand the cash rate is announced, predicted to stay the same at 2.5%. The press conference, the rate statement and the policy statement will accompany the announcement of the base interest rate, finally later that evening the RBNZ governor Wheeler will conduct a conference. Later Australia will announce the change in unemployment and as a consequence publish the unemployment rate; expected to rise to 5.8% with circa 10K new jobs created. Looking towards equity index futures for Wednesday, the DJIA future is down 0.30%, SPX future down 0.33%, NASDAQ down 0.07%. STOXX is down 0.90%, DAX future down 0.84%, CAC down 1.02%, FTSE future down 0.36%. Commodities enjoyed an improvement through Tuesday's sessions. NYMEX WTI oil up 1.20% at $98.51 per barrel, NYMEX nat gas up 0.12% at $4.24 per therm, COMEX gold enjoyed a significant bounce, up 2.18% at $1261.10 per ounce with silver at $201.41 up 3.60% on the day. The euro rose 0.2 percent to $1.3761 late in New York after reaching $1.3795, the strongest since Oct. 29th. The six straight increases were the most since the seven days ending Dec. 18th, 2012. The common currency fell 0.3 percent to 141.53 yen after climbing to 142.17, the highest since October 2008. The dollar fell 0.4 percent to 102.85 yen. The U.S. Dollar Index, tracking the U.S. currency versus its 10 major counterparts, dropped 0.3 percent to 1,012.57, reaching the lowest level since Nov. 1st. The Swiss franc advanced by 0.2 percent to 1.22169 per euro in London's afternoon session after appreciating to 1.22065, the strongest level since May 2nd. The currency rose for a sixth day versus the dollar, gaining 0.4 percent to 88.66 centimes per dollar. The Swiss franc advanced to the strongest level in seven months against the euro as investors weighed improving economic data before the nation’s central bank meets this week.

http://blog.fxcc.com/market-analysis

FOREX ECONOMIC CALENDAR :

2013-12-11 12:00 GMT | USA. MBA Mortgage Applications (Dec 6)

2013-12-11 15:00 GMT | USA. Treasury Sec Lew Speech

2013-12-11 19:00 GMT | USA. Monthly Budget Statement (Nov)

2013-12-11 20:00 GMT | New Zealand. Monetary Policy Statement

FOREX NEWS :

2013-12-11 06:10 GMT | EUR/USD reaches up to 1.3791 Fibo target and finally relents – for now

2013-12-11 03:48 GMT | AUD/USD stuck in the intraday doldrums after sluggish consumer confidence

2013-12-11 03:37 GMT | USD/JPY projected circa 106.00 by Q4 2014 - JPMorgan

2013-12-11 02:26 GMT | GBP/USD pausing after less-than-convincing breakout above 1.6442 previous resistance

EURUSD :

HIGH 1.37654 LOW 1.37468 BID 1.37578 ASK 1.37583 CHANGE 0% TIME 08 : 35:58

OUTLOOK SUMMARY : Down

TREND CONDITION : Up trend

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : High

MARKET ANALYSIS - Intraday Analysis

Upwards scenario: We expect consolidation development after the initial uptrend formation on the hourly chart frame though possible bullish penetration might face next challenge at 1.3775 (R1). Break here is required to establish further bullish pressure, targeting 1.3789 (R2) en route towards to last resistance for today at 1.3806 (R3). Downwards scenario: Further correction development is limited now to the session low - 1.3728 (S1). If the price manages to surpass it we would suggest next intraday targets at 1.3706 (S2) and 1.3684 (S3).

Resistance Levels: 1.3775, 1.3789, 1.3806

Support Levels: 1.3728, 1.3706, 1.3684

-----------------

GBPUSD :

HIGH 1.64579 LOW 1.64306 BID 1.64332 ASK 1.64335 CHANGE 0% TIME 08 : 35:58

OUTLOOK SUMMARY : Down

TREND CONDITION : Sideway

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : High

Upwards scenario: Market having failed to establish directional movement yesterday. Possible price strengthening might arise above the next resistance level at 1.6465 (R1). Our interim target holds at 1.6493 (R2) en route toward to our major aim at 1.6518 (R3). Downwards scenario: We would shift our short-term technical outlook to the negative if the price manage to penetrate below the key support at 1.6421 (S1). Loss here would suggest next initial targets at 1.6403 (S2) and 1.6382 (S3).

Resistance Levels: 1.6465, 1.6493, 1.6518

Support Levels: 1.6421, 1.6403, 1.6382

-------------------

USDJPY :

HIGH 102.948 LOW 102.574 BID 102.732 ASK 102.734 CHANGE 0% TIME 08 : 35:58

OUTLOOK SUMMARY : Down

TREND CONDITION : Sideway

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : High

Upwards scenario: Pair has settled sideways formation on the hourly timeframe. However potential to move higher is seen above the resistance level at 102.93 (R1) mark. Loss here would suggest next intraday targets at 103.15 (R2) and 103.38 (R3). Downwards scenario: Penetration below the support at 102.65 (S1) is liable to put more downward pressure on the instrument in the near-term perspective. As a result our supportive means at 102.47 (S2) and 102.30 (S3) might be triggered.

Resistance Levels: 102.93, 103.15, 103.38

Support Levels: 102.65, 102.47, 102.30

Source: FX Central Clearing Ltd,( http://www.fxcc.com )

Forex Technical & Market Analysis FXCC Dec 12 2013

Markets sell of due to 'taper' rumours, will better than expected unemployment numbers raise a seasonal cheer?

Thursday Mario Draghi speaks, whilst the Swiss publish their monetary policy intentions and assessment with the Libor rate also published. The Swiss bank head Jordan will also hold a conference; the ECB will publish the latest monetary policy in the form of a monthly bulletin. European industrial production is expected to rise to 0.4% from the previous month's fall of -0.5%. In the USA core retail sales data is published, expected in at 0.2%, with retail sales up 0.6%. Unemployment claims are expected in at circa 321K after the surprise fall last week of 289K. Import prices in the USA are expected to fall to -0.7% (month on month). Canada's central bank governor Poloz speaks late on Thursday, whilst the business New Zealand index is published, expected to be similar to the previous month's print of 55.7, whilst Japan's revised industrial production is expected in at 0.5%, identical to the previous month's print. NYMEX WTI oil closed down on Wednesday by 1.13%, at $97.41 per barrel, with NYMEX nat gas closing up 2.43% on the day at $4.34 per therm. WTI advanced 5.3 percent last week, the most in five months, as U.S. crude inventories fell for the first time in 11 weeks and TransCanada Corp. announced plans to start part of its Keystone pipeline to the Gulf Coast from Cushing, Oklahoma, the delivery point for NYMEX futures. COMEX gold closed down 0.61% at $1253.40 per ounce with silver at $20.28 down 0.17% on the day. The DJIA equity index future is (at the time of writing) down 0.89%, SPX down 1.24% NASDAQ down 1.31%. Looking towards Europe's open the STOXX 50 future is down 0.61%, DAX future is down 0.54%, CAC future is down 0.34%, FTSE future down 0.81%.

http://blog.fxcc.com/market-analysis

FOREX ECONOMIC CALENDAR :

2013-12-12 09:00 GMT | EU. ECB Monthly Report

2013-12-12 09:00 GMT | Switzerland. SNB press conference

2013-12-12 13:30 GMT | USA. Retail Sales (MoM) (Nov)

2013-12-12 18:05 GMT | Canada. BoC Governor Poloz Speech

FOREX NEWS :

2013-12-12 02:49 GMT | Gold sees a little downside Wednesday; 1268.30 remains resistance

2013-12-12 01:19 GMT | USD/JPY heading to the 100 handle?

2013-12-12 00:41 GMT | AUD/USD spikes

2013-12-12 00:20 GMT | GBP/USD posts bearish reversal candle Wednesday. Could it have a date with 1.6250?

------------------

EURUSD :

HIGH 1.37981 LOW 1.37731 BID 1.37889 ASK 1.37892 CHANGE 0% TIME 08 : 38:32

OUTLOOK SUMMARY : Up

TREND CONDITION : Up trend

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : High

MARKET ANALYSIS - Intraday Analysis

Upwards scenario: Possibility of market strengthening is seen above the immediate resistive barrier at 1.3806 (R1). Price extension above it is required to validate our next intraday targets at 1.3832 (R2) and 1.3860 (R3). Downwards scenario: While instrument trades above the moving averages, our short-term bias would stay positive though penetration below the support level at 1.3757 (S1) might open way towards to lower targets at 1.3728 (S2) and 1.3706 (S3).

Resistance Levels: 1.3806, 1.3832, 1.3860

Support Levels: 1.3757, 1.3728, 1.3706

---------------------

GBPUSD :

HIGH 1.638 LOW 1.63533 BID 1.63654 ASK 1.63659 CHANGE 0% TIME 08 : 38:32

OUTLOOK SUMMARY : Down

TREND CONDITION : Sideway

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : High

Upwards scenario: Market descended, however price appreciation might be possible above the next resistance level at 1.6398 (R1). Break here is required to enable next attractive points at 1.6428 (R2) and 1.6465 (R3). Downwards scenario: Next support level is seen at 1.6346 (S1), any penetration below it might activate downside pressure and enable lower target at 1.6319 (S2). Any further market decline would then be limited to 1.6290 (S3).

Resistance Levels: 1.6398, 1.6428, 1.6465

Support Levels: 1.6346, 1.6319, 1.6290

-----------------------

USDJPY :

HIGH 102.754 LOW 102.387 BID 102.649 ASK 102.651 CHANGE 0% TIME 08 : 38:32

OUTLOOK SUMMARY : Up

TREND CONDITION : Sideway

TRADERS SENTIMENT : Bullish

IMPLIED VOLATILITY : High

Upwards scenario: Any upside actions looks limited to resistance level at 102.93 (R1). Surpassing of this level might enable next target at 103.15 (R2) and any further gains would then be targeting final mark at 103.38 (R3) in potential. Downwards scenario: On the downside our attention is shifted to the immediate support level at 102.30 (S1). Break here is required to enable bearish forces and expose our intraday targets at 102.10 (S2) and 101.92 (S3).

Resistance Levels: 102.93, 103.15, 103.38

Support Levels: 102.30, 102.10, 101.92

Source: FX Central Clearing Ltd,( http://www.fxcc.com )