Market Overview by FXCC

Forex Technical & Market Analysis FXCC May 06 2013

EUR/USD still searching for direction after busy week of economic data

After what was an extremely busy week of economic releases and central bank monetary policy meetings, the EUR/USD finished the week up 87 pips at 1.3116. The price action remains extremely choppy with neither side being able to sustain any follow through for a substantial amount of time. Many analysts are now wondering whether or not the “risk on” mentality which was boosted by the better than expected US Jobs data will have any follow through going into upcoming week and how will it influence the foreign exchange market.

According to Kathy Lien of BK Asset Management, “Investors put on their rose colored glasses today and drove currencies and equities sharply higher on the back of stronger job growth in the month of April. At a time when other central banks like the ECB and BoJ are kick starting a new round of easing, the better than expected labor market report will keep the Fed comfortably on hold. The question now is whether the payroll driven rally in FX (and stocks) will last. With far less important data on the calendar next week, we think investors will remain optimistic.”

http://blog.fxcc.com/forex-technical...s-may-06-2013/

FOREX ECONOMIC CALENDAR :

2013-05-06 13:00 GMT | EU.ECB President Draghi's Speech

2013-05-06 14:00 GMT | CA.Ivey Purchasing Managers Index (Apr)

2013-05-06 14:00 GMT | CA.Ivey Purchasing Managers Index s.a (Apr)

2013-05-06 23:30 GMT | AUD.AiG Performance of Construction Index (Apr)

FOREX NEWS :

2013-05-06 04:09 GMT | EUR/USD still searching for direction after busy week of economic data

2013-05-06 03:18 GMT | GBP/JPY notches highest close since August 2009

2013-05-06 01:44 GMT | AUD/USD edges lower after weak Aussie retail sales number

2013-05-06 01:02 GMT | NZD/USD edges higher in early Asia trade

------------------

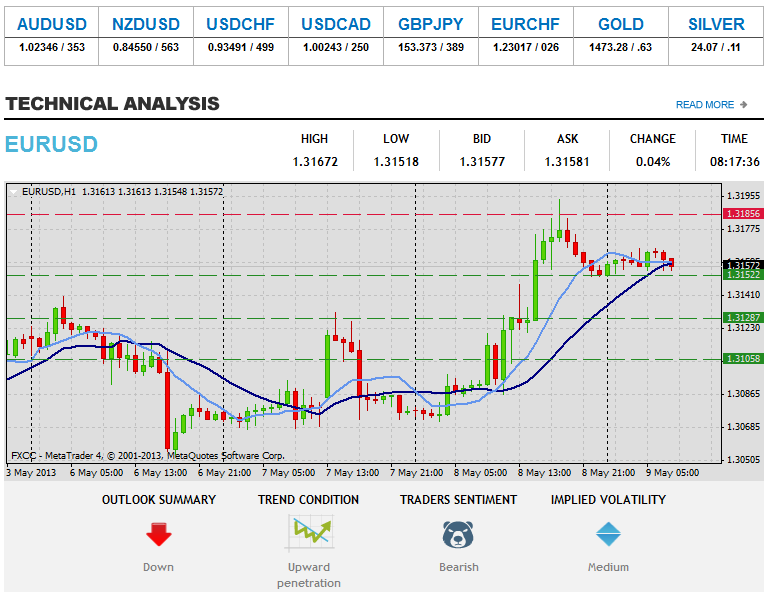

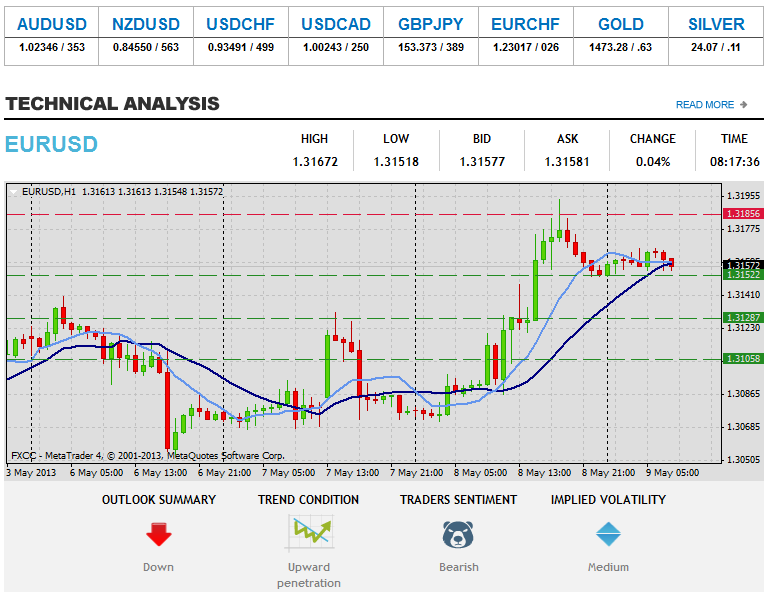

Forex Technical Analysis EURUSD :

MARKET ANALYSIS – Intraday Analysis

Upwards scenario: Possibility of market strengthening is seen above the resistance level at 1.3156 (R1). Clearance here is required to validate next interim target at 1.3185 (R2) and any further rise would then be targeting mark at 1.3219 (R3). Downwards scenario: On the other hand, instrument retests our next support level at 1.3117 (S1) today. Market decline below it would create a stronger bearish sentiment and enable our interim target at 1.3084 (S2). Final support for today locates at 1.3057 (S3).

Resistance Levels: 1.3156, 1.3185, 1.3219

Support Levels: 1.3117, 1.3084, 1.3057

----------------

Forex Technical Analysis GBPUSD :

Upwards scenario: On the upside potential is seen for a break above the resistance at 1.5525 (R1). In such case we would suggest next target at 1.5546 (R2) and any further rise would then be limited to final resistance at 1.5571 (R3). Downwards scenario: Further correction development is limited now to 1.5481 (S1). If the price manages to surpass it we would suggest next intraday targets at 1.5454 (S2) and 1.5426 (S3).

Resistance Levels: 1.5525, 1.5546, 1.5571

Support Levels: 1.5481, 1.5454, 1.5426

----------------

Forex Technical Analysis USDJPY :

Upwards scenario: Possibility of market strengthening is seen above the immediate resistive barrier at 92.02 (R1). Price extension above it is required to validate our next intraday targets at 98.16 (R2) and 98.30 (R3). Downwards scenario: Any downside extension is limited now to the next support level at 97.59 (S1). Break here is required to open a route towards to next target at 97.42 (S2) and then any further easing would be targeting final support at 97.27 (S3).

Resistance Levels: 98.02, 98.16, 98.30

Support Levels: 97.59, 97.42, 97.27

Source: FX Central Clearing Ltd,( Learn Forex Training | ECN Forex Account | forex trader blog | FXCC )

Forex Technical & Market Analysis FXCC May 06 2013

EUR/USD still searching for direction after busy week of economic data

After what was an extremely busy week of economic releases and central bank monetary policy meetings, the EUR/USD finished the week up 87 pips at 1.3116. The price action remains extremely choppy with neither side being able to sustain any follow through for a substantial amount of time. Many analysts are now wondering whether or not the “risk on” mentality which was boosted by the better than expected US Jobs data will have any follow through going into upcoming week and how will it influence the foreign exchange market.

According to Kathy Lien of BK Asset Management, “Investors put on their rose colored glasses today and drove currencies and equities sharply higher on the back of stronger job growth in the month of April. At a time when other central banks like the ECB and BoJ are kick starting a new round of easing, the better than expected labor market report will keep the Fed comfortably on hold. The question now is whether the payroll driven rally in FX (and stocks) will last. With far less important data on the calendar next week, we think investors will remain optimistic.”

http://blog.fxcc.com/forex-technical...s-may-06-2013/

FOREX ECONOMIC CALENDAR :

2013-05-06 13:00 GMT | EU.ECB President Draghi's Speech

2013-05-06 14:00 GMT | CA.Ivey Purchasing Managers Index (Apr)

2013-05-06 14:00 GMT | CA.Ivey Purchasing Managers Index s.a (Apr)

2013-05-06 23:30 GMT | AUD.AiG Performance of Construction Index (Apr)

FOREX NEWS :

2013-05-06 04:09 GMT | EUR/USD still searching for direction after busy week of economic data

2013-05-06 03:18 GMT | GBP/JPY notches highest close since August 2009

2013-05-06 01:44 GMT | AUD/USD edges lower after weak Aussie retail sales number

2013-05-06 01:02 GMT | NZD/USD edges higher in early Asia trade

------------------

Forex Technical Analysis EURUSD :

MARKET ANALYSIS – Intraday Analysis

Upwards scenario: Possibility of market strengthening is seen above the resistance level at 1.3156 (R1). Clearance here is required to validate next interim target at 1.3185 (R2) and any further rise would then be targeting mark at 1.3219 (R3). Downwards scenario: On the other hand, instrument retests our next support level at 1.3117 (S1) today. Market decline below it would create a stronger bearish sentiment and enable our interim target at 1.3084 (S2). Final support for today locates at 1.3057 (S3).

Resistance Levels: 1.3156, 1.3185, 1.3219

Support Levels: 1.3117, 1.3084, 1.3057

----------------

Forex Technical Analysis GBPUSD :

Upwards scenario: On the upside potential is seen for a break above the resistance at 1.5525 (R1). In such case we would suggest next target at 1.5546 (R2) and any further rise would then be limited to final resistance at 1.5571 (R3). Downwards scenario: Further correction development is limited now to 1.5481 (S1). If the price manages to surpass it we would suggest next intraday targets at 1.5454 (S2) and 1.5426 (S3).

Resistance Levels: 1.5525, 1.5546, 1.5571

Support Levels: 1.5481, 1.5454, 1.5426

----------------

Forex Technical Analysis USDJPY :

Upwards scenario: Possibility of market strengthening is seen above the immediate resistive barrier at 92.02 (R1). Price extension above it is required to validate our next intraday targets at 98.16 (R2) and 98.30 (R3). Downwards scenario: Any downside extension is limited now to the next support level at 97.59 (S1). Break here is required to open a route towards to next target at 97.42 (S2) and then any further easing would be targeting final support at 97.27 (S3).

Resistance Levels: 98.02, 98.16, 98.30

Support Levels: 97.59, 97.42, 97.27

Source: FX Central Clearing Ltd,( Learn Forex Training | ECN Forex Account | forex trader blog | FXCC )

Forex Technical & Market Analysis FXCC May 07 2013

EUR/USD still searching for direction after busy week of economic data

After what was an extremely busy week of economic releases and central bank monetary policy meetings, the EUR/USD finished the week up 87 pips at 1.3116. The price action remains extremely choppy with neither side being able to sustain any follow through for a substantial amount of time. Many analysts are now wondering whether or not the “risk on” mentality which was boosted by the better than expected US Jobs data will have any follow through going into upcoming week and how will it influence the foreign exchange market.

According to Kathy Lien of BK Asset Management, “Investors put on their rose colored glasses today and drove currencies and equities sharply higher on the back of stronger job growth in the month of April. At a time when other central banks like the ECB and BoJ are kick starting a new round of easing, the better than expected labor market report will keep the Fed comfortably on hold. The question now is whether the payroll driven rally in FX (and stocks) will last. With far less important data on the calendar next week, we think investors will remain optimistic.”

https://support.fxcc.com/email/technical/06052013/

FOREX ECONOMIC CALENDAR :

2013-05-06 13:00 GMT | EU.ECB President Draghi's Speech

2013-05-06 14:00 GMT | CA.Ivey Purchasing Managers Index (Apr)

2013-05-06 14:00 GMT | CA.Ivey Purchasing Managers Index s.a (Apr)

2013-05-06 23:30 GMT | AUD.AiG Performance of Construction Index (Apr)

FOREX NEWS :

2013-05-06 04:09 GMT | EUR/USD still searching for direction after busy week of economic data

2013-05-06 03:18 GMT | GBP/JPY notches highest close since August 2009

2013-05-06 01:44 GMT | AUD/USD edges lower after weak Aussie retail sales number

2013-05-06 01:02 GMT | NZD/USD edges higher in early Asia trade

-----------------------

EURUSD :

HIGH 1.31408 LOW 1.31084 BID 1.31214 ASK 1.31219 CHANGE 0.05% TIME 08:16:42

OUTLOOK SUMMARY : Up

TREND CONDITION : Downward penetration

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : Medium

MARKET ANALYSIS - Intraday Analysis

Upwards scenario: Possibility of market strengthening is seen above the resistance level at 1.3156 (R1). Clearance here is required to validate next interim target at 1.3185 (R2) and any further rise would then be targeting mark at 1.3219 (R3). Downwards scenario: On the other hand, instrument retests our next support level at 1.3117 (S1) today. Market decline below it would create a stronger bearish sentiment and enable our interim target at 1.3084 (S2). Final support for today locates at 1.3057 (S3).

Resistance Levels: 1.3156, 1.3185, 1.3219

Support Levels: 1.3117, 1.3084, 1.3057

-----------------------

GBPUSD :

HIGH 1.55981 LOW 1.55334 BID 1.55812 ASK 1.55823 CHANGE 0.07% TIME 08:16:42

OUTLOOK SUMMARY : Up

TREND CONDITION : Up trend

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : Low

Upwards scenario: While price is quoted above the moving averages out technical outlook would be positive. Yesterday high offers next resistance level at 1.5598 (R1). Any price action above it would suggest next targets at 1.5629 (R2) and 1.5659 (S3). Downwards scenario: On the downside our attention is shifted to the immediate support level at 1.5573 (S1). Break here is required to enable bearish forces and expose our intraday targets at 1.5550 (S2) and 1.5522 (S3).

Resistance Levels: 1.5598, 1.5629, 1.5659

Support Levels: 1.5573, 1.5550, 1.5522

------------------

USDJPY :

HIGH 99.205 LOW 99.06 BID 99.095 ASK 99.099 CHANGE 0.1% TIME 08:16:43

OUTLOOK SUMMARY : Up

TREND CONDITION : Upward penetration

TRADERS SENTIMENT : Bullish

IMPLIED VOLATILITY : Low

Upwards scenario: Medium term bias remains positive however further market rise is limited now to the key resistive barrier at 99.27 (R1), clearance here is required to enable next resistances at 99.60 (R2) and last one at 99.88 (R3). Downwards scenario: On the short-term perspective the pair might encounter supportive measures at 98.97 (S1). Loss here might change intraday technical structure and opens the way for a test of 98.57 (S2) and 98.15 (S3) later on today.

Resistance Levels: 99.27, 99.60, 99.88

Support Levels: 98.97, 98.57, 98.15

Source: FX Central Clearing Ltd,( Best Forex Trader | Forex Broker Demo Account | Forex Software | FXCC )

Forex Technical & Market Analysis FXCC May 07 2013

EUR/USD still searching for direction after busy week of economic data

After what was an extremely busy week of economic releases and central bank monetary policy meetings, the EUR/USD finished the week up 87 pips at 1.3116. The price action remains extremely choppy with neither side being able to sustain any follow through for a substantial amount of time. Many analysts are now wondering whether or not the “risk on” mentality which was boosted by the better than expected US Jobs data will have any follow through going into upcoming week and how will it influence the foreign exchange market.

According to Kathy Lien of BK Asset Management, “Investors put on their rose colored glasses today and drove currencies and equities sharply higher on the back of stronger job growth in the month of April. At a time when other central banks like the ECB and BoJ are kick starting a new round of easing, the better than expected labor market report will keep the Fed comfortably on hold. The question now is whether the payroll driven rally in FX (and stocks) will last. With far less important data on the calendar next week, we think investors will remain optimistic.”

https://support.fxcc.com/email/technical/06052013/

FOREX ECONOMIC CALENDAR :

2013-05-06 13:00 GMT | EU.ECB President Draghi's Speech

2013-05-06 14:00 GMT | CA.Ivey Purchasing Managers Index (Apr)

2013-05-06 14:00 GMT | CA.Ivey Purchasing Managers Index s.a (Apr)

2013-05-06 23:30 GMT | AUD.AiG Performance of Construction Index (Apr)

FOREX NEWS :

2013-05-06 04:09 GMT | EUR/USD still searching for direction after busy week of economic data

2013-05-06 03:18 GMT | GBP/JPY notches highest close since August 2009

2013-05-06 01:44 GMT | AUD/USD edges lower after weak Aussie retail sales number

2013-05-06 01:02 GMT | NZD/USD edges higher in early Asia trade

-----------------------

EURUSD :

HIGH 1.31408 LOW 1.31084 BID 1.31214 ASK 1.31219 CHANGE 0.05% TIME 08:16:42

OUTLOOK SUMMARY : Up

TREND CONDITION : Downward penetration

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : Medium

MARKET ANALYSIS - Intraday Analysis

Upwards scenario: Possibility of market strengthening is seen above the resistance level at 1.3156 (R1). Clearance here is required to validate next interim target at 1.3185 (R2) and any further rise would then be targeting mark at 1.3219 (R3). Downwards scenario: On the other hand, instrument retests our next support level at 1.3117 (S1) today. Market decline below it would create a stronger bearish sentiment and enable our interim target at 1.3084 (S2). Final support for today locates at 1.3057 (S3).

Resistance Levels: 1.3156, 1.3185, 1.3219

Support Levels: 1.3117, 1.3084, 1.3057

-----------------------

GBPUSD :

HIGH 1.55981 LOW 1.55334 BID 1.55812 ASK 1.55823 CHANGE 0.07% TIME 08:16:42

OUTLOOK SUMMARY : Up

TREND CONDITION : Up trend

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : Low

Upwards scenario: While price is quoted above the moving averages out technical outlook would be positive. Yesterday high offers next resistance level at 1.5598 (R1). Any price action above it would suggest next targets at 1.5629 (R2) and 1.5659 (S3). Downwards scenario: On the downside our attention is shifted to the immediate support level at 1.5573 (S1). Break here is required to enable bearish forces and expose our intraday targets at 1.5550 (S2) and 1.5522 (S3).

Resistance Levels: 1.5598, 1.5629, 1.5659

Support Levels: 1.5573, 1.5550, 1.5522

------------------

USDJPY :

HIGH 99.205 LOW 99.06 BID 99.095 ASK 99.099 CHANGE 0.1% TIME 08:16:43

OUTLOOK SUMMARY : Up

TREND CONDITION : Upward penetration

TRADERS SENTIMENT : Bullish

IMPLIED VOLATILITY : Low

Upwards scenario: Medium term bias remains positive however further market rise is limited now to the key resistive barrier at 99.27 (R1), clearance here is required to enable next resistances at 99.60 (R2) and last one at 99.88 (R3). Downwards scenario: On the short-term perspective the pair might encounter supportive measures at 98.97 (S1). Loss here might change intraday technical structure and opens the way for a test of 98.57 (S2) and 98.15 (S3) later on today.

Resistance Levels: 99.27, 99.60, 99.88

Support Levels: 98.97, 98.57, 98.15

Source: FX Central Clearing Ltd,( Best Forex Trader | Forex Broker Demo Account | Forex Software | FXCC )

Forex Technical & Market Analysis FXCC May 08 2013

What Equity Rally Says About Currencies

Over the past week, all of the action has been in equities. U.S. stocks powered to new record highs while currencies consolidated quietly. The U.S. dollar weakened against the euro and Japanese Yen and strengthened against the British pound, Swiss Franc, Australian and New Zealand dollars. This divergent price action confirms that there isn't one directional interest in currencies. Part of the reason why currencies have not enjoyed the same type of strong trend as equities is because this is a QE driven rally and with central banks around the world engaged in new rounds of easing, the availability of more stimulus has been ambiguously positive for stocks. Unfortunately these simultaneous easing programs has also clouded the outlook for currencies as investors wonder which central bank will win the race to debase.

The rally in stocks and consolidation in currencies also tells us that investors are much more interested in joining the trend in equities than try to figure out whether support or resistance will be broken in currencies. Eventually this will change but for the time being we can't ignore the fact that the big moves are happening in other markets. However what stocks have done for currencies is keep them supported - if not for the equity market rally, we would have probably seen a deeper sell-off in the EUR/USD and AUD/USD.

https://support.fxcc.com/email/technical/08052013/

FOREX ECONOMIC CALENDAR :

2013-05-08 10:00 GMT | EU.Industrial Production s.a. w.d.a. (YoY) (Mar)

2013-05-08 12:15 GMT | CA.Housing Starts s.a (YoY) (Apr)

2013-05-08 17:00 GMT | US.10-Year Note Auction

2013-05-08 22:45 GMT | NZ.Unemployment Rate (Q1)

FOREX NEWS :

2013-05-08 04:35 GMT | EUR/USD unable to find direction as global equities continue higher

2013-05-08 03:32 GMT | GBP/USD rally runs out of steam, finishes day sharply lower

2013-05-08 02:37 GMT | Aussie attempting to claw back some losses during Asia trade

2013-05-08 00:24 GMT | USD/JPY edging lower during early Asia trade

EURUSD :

HIGH 1.30975 LOW 1.30716 BID 1.30926 ASK 1.30932 CHANGE 0.12% TIME 08:12:49

OUTLOOK SUMMARY : Up

TREND CONDITION : Sideway

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : Low

MARKET ANALYSIS - Intraday Analysis

Upwards scenario: While price is quoted above the moving averages out technical outlook would be positive. Yesterday high offers next resistance level at 1.3119 (R1). Any price action above it would suggest next targets at 1.3156 (R2) and 1.3185 (S3). Downwards scenario: Next support level is seen at 1.3072 (S1), any penetration below it might activate downside pressure and enable lower target at 1.3043 (S2). Any further market decline would then be limited to 1.3010 (S3).

Resistance Levels: 1.3119, 1.3156, 1.3185

Support Levels: 1.3072, 1.3043, 1.3010

--------------------------

GBPUSD :

HIGH 1.54891 LOW 1.54704 BID 1.54798 ASK 1.54805 CHANGE -0.02% TIME 08:12:50

OUTLOOK SUMMARY : Down

TREND CONDITION : Downward penetration

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : Low

Upwards scenario: GBP extended its decline versus the USD and determined a negative short-term technical outlook. However above the resistance at 1.5488 (R1) opens a route towards to next resistive measures at 1.5503 (R2) and 1.5522 (R3). Downwards scenario: On the downside our attention is shifted to the immediate support level at 1.5474 (S1). Break here is required to enable bearish forces and expose our intraday targets at 1.5460 (S2) and 1.5449 (S3).

Resistance Levels: 1.5488, 1.5503, 1.5522

Support Levels: 1.5474, 1.5460, 1.5449

-------------------------

USDJPY :

HIGH 99.15 LOW 98.64 BID 98.965 ASK 98.969 CHANGE -0.03% TIME 08:12:51

OUTLOOK SUMMARY : Down

TREND CONDITION : Downward penetration

TRADERS SENTIMENT : Bullish

IMPLIED VOLATILITY : Low

Upwards scenario: Yesterday high offers key resistance level at 99.27 (R1). Clearance here is required to resume uptrend structure towards to next target at 99.43 (R2) and any further price appreciation would then be limited to last resistance for today at 99.63 (R3). Downwards scenario: On the other hand, price pattern suggests bearish potential if the instrument manages to overcome next support level at 98.78 (S1). Possible price regress could expose our initial targets at 98.62 (S2) and 98.40 (S3) in potential.

Resistance Levels: 99.27, 99.43, 99.63

Support Levels: 98.78, 98.62, 98.40

Source: FX Central Clearing Ltd,( FX Central Clearing Ltd )

Forex Technical & Market Analysis FXCC May 09 2013

EUR/USD notches a solid day of gains as ‘risk on’ mentality continues

In a day where risk assets were primarily well bid across the board, the Euro was able to notch some decent gains, finishing up 81 pips at 1.3159. The initial catalyst which seemed to help push the pair higher was the German Industrial Production (MoM) release which came in at 1.2% actual vs. -0.1% forecast. According to analysts at TD Securities, “In Europe, a solid German industrial production release has boosted the EUR. Not significantly though, as the very well established range that has held since early April remains firmly intact. EUR focus remains on the evolving ECB message, which as we heard last week remains open to another rate cut. They have not signaled any balance sheet expanding programs, however, which overall could leave the EUR well supported.”

The German data also seemed to give a boost to both commodities and equities, with oil notching its’ highest close since late March and the S&P 500 closing at a new all time high of 1632.59. The recent behavior of the EUR/USD is beyond confusing as it appears to follow risk assets some days and others have no correlation to outside markets at all. Although it must be noted, the EUR does continue to outperform the commodity currencies such as the AUD and NZD. http://blog.fxcc.com/forex-technical...s-may-09-2013/

FOREX ECONOMIC CALENDAR :

2013-05-09 11:00 GMT | UK.BoE Asset Purchase Facility

2013-05-09 11:00 GMT | UK.BoE Interest Rate Decision (May 9)

2013-05-09 12:30 GMT | US.Initial Jobless Claims (May 3)

2013-05-09 14:00 GMT | UK.NIESR GDP Estimate (3M) (Apr)

FOREX NEWS :

2013-05-09 03:11 GMT | GBP/USD continues to consolidate ahead BOE Rate Decision

2013-05-09 01:19 GMT | Aussie rockets higher after AUD jobs data crushes estimates

2013-05-09 01:19 GMT | EUR/JPY ready for the next leg up?

2013-05-08 23:42 GMT | AUD/JPY finishes slightly lower after narrow range day

------------------------

Forex Technical Analysis EURUSD :

MARKET ANALYSIS – Intraday Analysis

Upwards scenario: Instrument stabilized after the gains provided yesterday. Penetration above the resistive structure at 1.3185 (R1) might encourage protective orders execution and drive market price towards to the next resistive means at 1.3206 (R2) and 1.3226 (R3). Downwards scenario: On a slightly longer term we expect pullback formation. Risk of market depreciation is seen below the next support level at 1.3152 (S1). Clearance here would suggest lower targets at 1.3128 (S2) and 1.3105 (S3) in potential.

Resistance Levels: 1.3185, 1.3206, 1.3226

Support Levels: 1.3152, 1.3128, 1.3105

-------------------------

Forex Technical Analysis GBPUSD :

Upwards scenario: Pair has settled sideways formation on the hourly timeframe. However potential to move higher is seen above the resistance level at 1.5549 (R1) mark. Loss here would suggest next intraday targets at 1.5565 (R2) and 1.5581 (R3). Downwards scenario: Possible downside expansion would attack our support levels at 1.5517(S2) and 1.5498 (S3). However prior reaching our targets, market should manage to overcome the resistive structure at 1.5533 (S1).

Resistance Levels: 1.5549, 1.5565, 1.5581

Support Levels: 1.5533, 1.5517, 1.5498

-----------------------

Forex Technical Analysis USDJPY :

Upwards scenario: USD/JPY tested negative side the past days, however break above the resistance at 99.00 (R1) is liable to stimulate bullish pressure and validate next targets at 99.14 (R2) and 99.27 (R3). Downwards scenario: Loss of our support level at 96.68 (S1) would open road for a market decline towards to our next target at 98.57 (S2). Any further price weakening would then be limited to final support for today at 98.40 (S3).

Resistance Levels: 99.00, 99.14, 99.27

Support Levels: 98.68, 98.57, 98.40

Source: FX Central Clearing Ltd,( Forex Trading Blog | Learn Forex Training | Best Forex Accounts | FXCC )

Forex Technical & Market Analysis FXCC May 09 2013

EUR/USD notches a solid day of gains as ‘risk on’ mentality continues

In a day where risk assets were primarily well bid across the board, the Euro was able to notch some decent gains, finishing up 81 pips at 1.3159. The initial catalyst which seemed to help push the pair higher was the German Industrial Production (MoM) release which came in at 1.2% actual vs. -0.1% forecast. According to analysts at TD Securities, “In Europe, a solid German industrial production release has boosted the EUR. Not significantly though, as the very well established range that has held since early April remains firmly intact. EUR focus remains on the evolving ECB message, which as we heard last week remains open to another rate cut. They have not signaled any balance sheet expanding programs, however, which overall could leave the EUR well supported.”

The German data also seemed to give a boost to both commodities and equities, with oil notching its’ highest close since late March and the S&P 500 closing at a new all time high of 1632.59. The recent behavior of the EUR/USD is beyond confusing as it appears to follow risk assets some days and others have no correlation to outside markets at all. Although it must be noted, the EUR does continue to outperform the commodity currencies such as the AUD and NZD. http://blog.fxcc.com/forex-technical...s-may-09-2013/

FOREX ECONOMIC CALENDAR :

2013-05-09 11:00 GMT | UK.BoE Asset Purchase Facility

2013-05-09 11:00 GMT | UK.BoE Interest Rate Decision (May 9)

2013-05-09 12:30 GMT | US.Initial Jobless Claims (May 3)

2013-05-09 14:00 GMT | UK.NIESR GDP Estimate (3M) (Apr)

FOREX NEWS :

2013-05-09 03:11 GMT | GBP/USD continues to consolidate ahead BOE Rate Decision

2013-05-09 01:19 GMT | Aussie rockets higher after AUD jobs data crushes estimates

2013-05-09 01:19 GMT | EUR/JPY ready for the next leg up?

2013-05-08 23:42 GMT | AUD/JPY finishes slightly lower after narrow range day

------------------------

Forex Technical Analysis EURUSD :

MARKET ANALYSIS – Intraday Analysis

Upwards scenario: Instrument stabilized after the gains provided yesterday. Penetration above the resistive structure at 1.3185 (R1) might encourage protective orders execution and drive market price towards to the next resistive means at 1.3206 (R2) and 1.3226 (R3). Downwards scenario: On a slightly longer term we expect pullback formation. Risk of market depreciation is seen below the next support level at 1.3152 (S1). Clearance here would suggest lower targets at 1.3128 (S2) and 1.3105 (S3) in potential.

Resistance Levels: 1.3185, 1.3206, 1.3226

Support Levels: 1.3152, 1.3128, 1.3105

-------------------------

Forex Technical Analysis GBPUSD :

Upwards scenario: Pair has settled sideways formation on the hourly timeframe. However potential to move higher is seen above the resistance level at 1.5549 (R1) mark. Loss here would suggest next intraday targets at 1.5565 (R2) and 1.5581 (R3). Downwards scenario: Possible downside expansion would attack our support levels at 1.5517(S2) and 1.5498 (S3). However prior reaching our targets, market should manage to overcome the resistive structure at 1.5533 (S1).

Resistance Levels: 1.5549, 1.5565, 1.5581

Support Levels: 1.5533, 1.5517, 1.5498

-----------------------

Forex Technical Analysis USDJPY :

Upwards scenario: USD/JPY tested negative side the past days, however break above the resistance at 99.00 (R1) is liable to stimulate bullish pressure and validate next targets at 99.14 (R2) and 99.27 (R3). Downwards scenario: Loss of our support level at 96.68 (S1) would open road for a market decline towards to our next target at 98.57 (S2). Any further price weakening would then be limited to final support for today at 98.40 (S3).

Resistance Levels: 99.00, 99.14, 99.27

Support Levels: 98.68, 98.57, 98.40

Source: FX Central Clearing Ltd,( Forex Trading Blog | Learn Forex Training | Best Forex Accounts | FXCC )

Forex Technical & Market Analysis FXCC May 10 2013

Will a busy economic schedule next week be the catalyst for EUR/USD?

The EUR/USD finished the day down 116 pips at 1.3044. Economic data was quiet for the most part but weekly jobless claims out of the US came in better than expected at 323k vs. 3.35k forecast. The US Dollar was well bid across the board, with the majority of action taking place in the USD/JPY which crossed the 100 threshold for the first time in four years. This seemed to help provide additional USD buying against other pairs, and also helped limit advances in commodities which were primarily lower for the day. Economic releases out of the Eurozone in the coming session include German Trade Balance, Italian Industrial Production, and EU Consumer Price Index.

After the better than expected jobs number past Friday, and another week of improvement in continued claims, some analysts view it as a sign the US Dollar could be set up for further gains in coming weeks. Furthermore, if we see continued gains in USD/JPY it could also be a tailwind and help the US Dollar remain well bid in other pairs. https://support.fxcc.com/email/technical/10052013/

FOREX ECONOMIC CALENDAR :

2013-05-10 12:30 GMT | US.Fed's Bernanke Speech

2013-05-10 12:30 GMT | CA.Unemployment Rate (Apr)

2013-05-10 12:30 GMT | CA.Net Change in Employment (Apr)

2013-05-10 12:30 GMT | CA.Participation rate (Apr)

FOREX NEWS :

2013-05-10 04:36 GMT | Kiwi edging lower in Asia trade

2013-05-10 01:59 GMT | USD/JPY, bulls officially staring at 101.00 from the rear mirror

2013-05-10 01:03 GMT | AUD/USD feeling the selling pressure ahead of RBA statement

2013-05-10 00:28 GMT | USD/JPY completes ‘pennant’ pattern on daily chart, further gains ahead?

----------------------

EURUSD

HIGH 1.30467 LOW 1.30214 BID 1.30451 ASK 1.30455 CHANGE 0.03% TIME 08:20:08

OUTLOOK SUMMARY Down

TREND CONDITION Downward penetration

TRADERS SENTIMENT Bullish

IMPLIED VOLATILITY Medium

MARKET ANALYSIS - Intraday Analysis

Upwards scenario: Possibility of market strengthening is seen above the immediate resistive barrier at 1.3056 (R1). Price extension above it is required to validate our next intraday targets at 1.3079 (R2) and 1.3105 (R3). Downwards scenario: Any downside penetration is limited to the initial support level at 1.3010 (S1). A breach of which would open a route towards to next target at 1.2987 (S2) and potentially could expose our final support for today at 1.2965 (S3).

Resistance Levels: 1.3056, 1.3079, 1.3105

Support Levels: 1.3010, 1.2987, 1.2965

----------------------

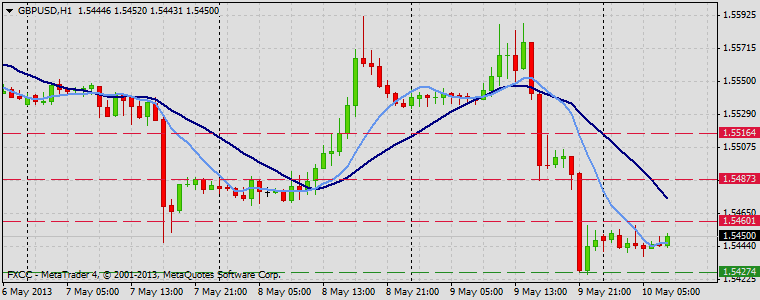

GBPUSD

HIGH 1.54572 LOW 1.54377 BID 1.54487 ASK 1.54490 CHANGE 0.01% TIME 08:20:09

OUTLOOK SUMMARY Down

TREND CONDITION Down trend

TRADERS SENTIMENT Bearish

IMPLIED VOLATILITY Medium

Upwards scenario: Market formed gradual descending move however price appreciation is possible above the next resistance level at 1.5460 (R1). Break here is required to enable next attractive points at 1.5487 (R2) and 1.5516 (R3). Downwards scenario: Penetration below the support at 1.5427 (S1) is liable to put more downward pressure on the instrument in the near-term perspective. As a result our supportive means at 1.5402 (S2) and 1.5380 (S3) might be triggered.

Resistance Levels: 1.5460, 1.5487, 1.5516

Support Levels: 1.5427, 1.5402, 1.5380

----------------------

USDJPY

HIGH 101.197 LOW 100.54 BID 100.937 ASK 100.942 CHANGE 0.32% TIME 08:20:10

OUTLOOK SUMMARY Up

TREND CONDITION Upward penetration

TRADERS SENTIMENT Bearish

IMPLIED VOLATILITY Medium

Upwards scenario: USD/JPY continue its consolidation phase on the hourly chart. Possibility of uptrend evolvement is seen above the next resistance at 101.11 (R1). Violation here might increase bullish pressure and validate next intraday targets at 101.47 (R2) and 101.83 (R3). Downwards scenario: Further correction development is limited now to the session low - 100.56 (S1). If the price manages to surpass it we would suggest next intraday targets at 100.18 (S2) and 99.75 (S3).

Resistance Levels: 101.11, 101.47, 101.83

Support Levels: 100.56, 100.18, 99.75

Source: FX Central Clearing Ltd,( http://www.fxcc.com )

Forex Technical & Market Analysis FXCC May 13 2013

Japan rests re-assured not labeled 'currency manipulator' by G7

Over the weekend, the G7 re-assured the market that Japan is not deliberately weakening the yen in order to create a competitive advantage against other industrialized nations. The group repeated its old same lines about its commitment to avoid artificial currency devaluation for domestic gain purposes, while re-iterating its commitment to avoid volatility in FX rates. According to Mike Paterson, editor at Forexlive: "The general consensus seems to be they accept Japan’s arguments that their dramatic easing on monetary policy is aimed at combating deflation rather than weaker currency advantage." Mr. Paterson thinks the last developments in the G7 meeting "should be the green light for further yen selling when markets re-open given that it takes the uncertainty out of the equation but the announcement was hardly a surprise" he said.

It will be interesting to see just how much weaker it gets in the early stages. Failure to drop too far will suggest that there rightly should be an air of caution after such rapid falls. But as the say goes, all that glitters is not gold, and US, Canada and Germany were all suspiciously more notorious on voicing out a closer monitoring over Japan's next policy actions. As Mr. Paterson rightly points out, "behind the scenes of G7, sure there is not such a united front as they wish to portray." U.S. Treasury Secretary Jack Lew had something to say on yen weakness: “We’ll keep an eye on that”, suggesting that any signs of currency manipulation by Japan will be watch very closely, adding that Japan had “growth issues.” Japan's Finance Minister Mr. Aso confirmed to media reporters that no criticism was noted on Japan’s monetary easing. https://support.fxcc.com/email/technical/13052013/

FOREX ECONOMIC CALENDAR :

24h | EMU. Eurogroup meeting

2013-05-13 12:30 GMT | USA. Retail Sales

2013-05-13 14:00 GMT | USA. Business Inventories (Mar)

2013-05-13 22:45 GMT | New Zeland. Retail Sales

FOREX NEWS :

2013-05-13 04:32 GMT | EUR/USD uncomfortable below 1.30, further definition needed

2013-05-13 04:21 GMT | USD extends gains; Gold takes a hit

2013-05-13 03:34 GMT | Gold selling off sharply below $1430

2013-05-13 03:24 GMT | USD/JPY, expect little pullback in the high 101s - RBS

EURUSD :

HIGH 1.29781 LOW 1.29595 BID 1.29756 ASK 1.29758 CHANGE -0.12% TIME 08 : 04:42

OUTLOOK SUMMARY : Down

TREND CONDITION : Down trend

TRADERS SENTIMENT :Bullish

IMPLIED VOLATILITY :Medium

MARKET ANALYSIS - Intraday Analysis

Upwards scenario: Neutral hourly studies point towards further consolidation, with a break of next resistive structure at 1.3011 (R1) is required to spark stronger upside action. In such scenario we would suggest our next initial targets at 1.3036 (R2) and 1.3062 (R3). Downwards scenario: Medium-term bias is clearly negative. Possible progress below the initial support level at 1.2957 (S1) might expose our intraday targets at 1.2934 (S2) and then 1.2909 (S3).

Resistance Levels: 1.3011, 1.3036, 1.3062

Support Levels: 1.2957, 1.2934, 1.2909

------------------------

GBPUSD :

HIGH 1.53578 LOW 1.53357 BID 1.53519 ASK 1.53529 CHANGE -0.07% TIME 08 : 04:42

OUTLOOK SUMMARY : Down

TREND CONDITION : Down trend

TRADERS SENTIMENT :Bullish

IMPLIED VOLATILITY :Low

Upwards scenario: GBPUSD is consolidating today however we see potential for further appreciation towards to our targets at 1.5403 (R2) and 1.5429 (R3) if the price manages to overcome key resistance measure at 1.5377 (R1). Downwards scenario: Next support level is seen at 1.5334 (S1), any penetration below it might activate further downside pressure and enable lower target at 1.5310 (S2). Any further market decline would then be limited to final support at 1.5284 (S3).

Resistance Levels: 1.5377, 1.5403, 1.5429

Support Levels: 1.5334, 1.5310, 1.5284

------------------

USDJPY :

HIGH 102.151 LOW 101.74 BID 101.751 ASK 101.752 CHANGE 0.14% TIME 08 : 04:43

OUTLOOK SUMMARY : Up

TREND CONDITION : Up trend

TRADERS SENTIMENT :Bearish

IMPLIED VOLATILITY :Low

Upwards scenario: Further uptrend development is possible above the next resistance level at 102.18 (R1). Break here would open route towards to higher target at 102.65 (R2) and any further price advance would then be limited to 103.12 (R3). Downwards scenario: On the other hand, a break of the support at 101.44 (S1) is required to determine negative intraday bias and enable lower target at 101.01 (S2). Clearance of this target would open a path towards to final support for today at 100.57 (S3).

Resistance Levels: 102.18, 102.65, 103.12

Support Levels: 101.44, 101.01, 100.57

Source: FX Central Clearing Ltd,( ECN Broker | Forex Practice Account | Forex Trading Blog | FXCC )

Forex Technical & Market Analysis FXCC May 14 2013

Schäuble suggests revising EU treaties to make way for banking union

German finance minister Wolfgang Schäuble told the Financial Times today that the banking union could not be completed without a modification of EU treaties. The process of changing them however could last several months or even years. According to Schäuble the existing treaties “do not suffice” to allow for forming a strong central resolution authority. Therefore he warned against making promises which the EU cannot keep, as they would directly affect its credibility.

“The EU does not have coercive means to enforce decisions” Schäuble said. “What it has are responsibilities and powers defined by its treaties.” A change to the treaties would provide a better separation of the ECB's monetary and supervisory functions. The German finance minister is conscious that such changes might take a long time, so he proposed a two-step process consisting of a resolution mechanism based on a network of national authorities as well as a network of resolution funds. Even though Schäuble acknowledges that such a structure would not be trons enough in the long term, he believes that it would allow to buy time and create the base for reaching the final objective: a European banking union, which encompasses the entire interior market. https://support.fxcc.com/email/technical/14052013/

FOREX ECONOMIC CALENDAR :

24h | EMU. EcoFin Meeting

2013-05-14 06:00 GMT | Germany. Consumer Price Index

2013-05-14 09:00 GMT | Germany. ZEW Survey - Economic Sentiment

2013-05-14 09:30 GMT | Australia. Budget Release

FOREX NEWS :

2013-05-14 04:28 GMT | Look to get long EUR/JPY into support levels

2013-05-14 03:58 GMT | EUR/USD still range bound ahead of busy economic calendar week

2013-05-14 03:46 GMT | AUD/USD, outlook is bearish but be patient - RBS

2013-05-14 03:11 GMT | GBP/USD completes ‘bear flag’ pattern on daily chart

EURUSD :

HIGH 1.30261 LOW 1.29693 BID 1.30029 ASK 1.30033 CHANGE 0.21% TIME 08:33:12

OUTLOOK SUMMARY : Up

TREND CONDITION : Upward penetration

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : Medium

MARKET ANALYSIS - Intraday Analysis

Upwards scenario: Possibility of uptrend penetration is seen above the next resistance level at 1.3026 (R1). Clearance here might enable bullish pressure and let the price to achieve our intraday targets at 1.3044 (R2) and 1.3062 (R3). Downwards scenario: On the short-term perspective the pair might encounter supportive measures at 1.2992 (S1). Loss here might change intraday technical structure and opens the way for a test of 1.2971 (S2) and 1.2951 (S3) later on today.

Resistance Levels: 1.3026, 1.3044, 1.3062

Support Levels: 1.2992, 1.2971, 1.2951

--------------------

GBPUSD :

HIGH 1.5331 LOW 1.52939 BID 1.53144 ASK 1.53152 CHANGE 0.1% TIME 08:33:12

OUTLOOK SUMMARY : Down

TREND CONDITION : Down trend

TRADERS SENTIMENT : Bullish

IMPLIED VOLATILITY : Medium

Upwards scenario: Possibility of market strengthening is seen above the immediate resistive barrier at 1.5334 (R1). Price extension above it is required to validate our next intraday targets at 1.5358 (R2) and 1.5383 (R3) Downwards scenario: On the other hand if the price manages to overcome our next support barrier at 1.5296 (S1), we expect to see further market decline towards to our target at 1.5272 (S2) and then next stop could be found at 1.5249 (S3) mark.

Resistance Levels: 1.5334, 1.5358, 1.5383

Support Levels: 1.5296, 1.5272, 1.5249

-------------------------

USDJPY :

HIGH 101.849 LOW 101.365 BID 101.439 ASK 101.441 CHANGE -0.37% TIME 08:33:13

OUTLOOK SUMMARY : Up

TREND CONDITION : Downward penetration

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : Medium

Upwards scenario: Medium term bias remains positive however further market rise is limited now to the key resistive barrier at 101.78 (R1), clearance here is required to enable next resistances at 102.22 (R2) and last one at 102.67 (R3). Downwards scenario: Measures of support might be activating when the pair approaches the 101.21 (S1). If it continues to extend its weakening below it we expect next targets to be exposed at 100.77 (S2) and 100.35 (S3) later on.

Resistance Levels: 101.78, 102.22, 102.67

Support Levels: 101.21, 100.77, 100.35

Source: FX Central Clearing Ltd,( ECN Forex Software | The Best Forex Broker | Forex Account | FXCC )