Market Overview by FXCC

Forex Technical & Market Analysis FXCC Sep 09 2013

EUR/USD higher in early Europe after rising on Friday but still gets no love from ECB

The EUR/USD opened higher the week after having dropped for a second week in a row. Elaborating on, the single currency managed to have a “green” day on Friday due to dismal NFP data, but still closed the week lower against the greenback for a second consecutive week, partly on Draghi’s more than expected dovish stance. ECB Draghi seems to remain very cautious about the Euro zone return to growth and not much enthusiastic about recovery in the Euro land. On the opposite side, despite the dismal NFP, the consensus in the market is for the Fed to announce the commencement of gradual tapering in the meeting of 17th and 18th of September. Traders should bear into consideration the Sentix Investor Confidence which will be released at 8.30 GMT hours and a further improvement in sentiment is anticipated.

As long as the view for tapering remains “on”, any potential EUR/USD rallies will be well capped. Despite the great disappointment on Friday’s NFP release, hints from the Fed points to tapering, even in a small gradual scale such as of $15bililion/$20 billion per month. What’s more, the power-horse of Europe as well depicted in the industrial figures released last week, isn’t strong enough. There are political problems in coalition forces in Italy, a third bailout package in Greece seems inevitable and there is also political uncertainty in Cyprus.

http://blog.fxcc.com/market-analysis

FOREX ECONOMIC CALENDAR :

2013-09-09 08:30 GMT | EMU Sentix Investor Confidence (Aug)

2013-09-09 12:30 GMT | CA Building Permits (MoM) (Jul)

2013-09-09 19:00 GMT | US Consumer Credit Change (Jul)

2013-09-09 23:50 GMT | BoJ Monetary Policy Meeting Minutes

FOREX NEWS :

2013-09-09 05:44 GMT | USD/CHF bouncing modestly ahead of data following bearish reversal Friday

2013-09-09 04:16 GMT | EUR/GBP limited below 0.8430 on Euro weakness

2013-09-09 04:05 GMT | AUD/USD is heading upwards on China data and after weekend elections

2013-09-09 03:38 GMT | Playing USD/JPY from the long side - JPMorgan

EURUSD :

HIGH 1.31812 LOW 1.31642 BID 1.31718 ASK 1.31723 CHANGE -0.05% TIME 08 : 36:45

OUTLOOK SUMMARY : Up

TREND CONDITION : Upward penetration

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : Low

MARKET ANALYSIS - Intraday Analysis

Upwards scenario: Further positive bias development would face next resistive measure at 1.3190 (R1). If the price manages to overcome it we would suggest next intraday targets at 1.3212 (R2) and 1.3234 (R3). Downwards scenario: On the other hand, our bearish expectations remain intact below the key support level at 1.3155 (S1). Price penetration below it would allow further declines towards to lower targets at 1.3134 (S2) and 1.3112 (S3).

Resistance Levels: 1.3190, 1.3212, 1.3234

Support Levels: 1.3155, 1.3134, 1.3112

---------------------

GBPUSD :

HIGH 1.56455 LOW 1.56158 BID 1.56441 ASK 1.56443 CHANGE 0.11% TIME 08 : 36:46

OUTLOOK SUMMARY : Neutral

TREND CONDITION : Sideway

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : Low

Upwards scenario: GBPUSD is approaching our key resistive measure at 1.5651 (R1). If the price manages to overcome it we would suggest next intraday targets at 1.5668 (R2) and 1.5685 (R3). Downwards scenario: Medium-term bias remains sideways orientated. A dip lower the key support measure at 1.5613 (S1) would open a route towards to lower targets at 1.5596 (S2) and 1.5579 (S3).

Resistance Levels: 1.5651, 1.5668, 1.5685

Support Levels: 1.5613, 1.5596, 1.5579

------------------

USDJPY :

HIGH 100.105 LOW 99.49 BID 99.645 ASK 99.649 CHANGE 0.56% TIME 08 : 36:47

OUTLOOK SUMMARY : Up

TREND CONDITION : Upward penetration

TRADERS SENTIMENT : Bullish

IMPLIED VOLATILITY : Medium

Upwards scenario: Measures of resistance might be activating when the pair approaches 100.11 (R1) price level. Break here would suggest next interim target at 100.44 (R2) and If the pair keeps its momentum we would expect an exposure of 100.75 (R3). Downwards scenario: On the downside bearish pressure might push the price below the support at 99.29 (S1). Further downside extension would open road towards to next target at 98.97 (S2) and any further losses would then be limited to 98.64 (S3) mark.

Resistance Levels: 100.11, 100.44, 100.75

Support Levels: 99.29, 98.97, 98.64

Source: FX Central Clearing Ltd,( http://www.fxcc.com )

Forex Technical & Market Analysis FXCC Sep 09 2013

EUR/USD higher in early Europe after rising on Friday but still gets no love from ECB

The EUR/USD opened higher the week after having dropped for a second week in a row. Elaborating on, the single currency managed to have a “green” day on Friday due to dismal NFP data, but still closed the week lower against the greenback for a second consecutive week, partly on Draghi’s more than expected dovish stance. ECB Draghi seems to remain very cautious about the Euro zone return to growth and not much enthusiastic about recovery in the Euro land. On the opposite side, despite the dismal NFP, the consensus in the market is for the Fed to announce the commencement of gradual tapering in the meeting of 17th and 18th of September. Traders should bear into consideration the Sentix Investor Confidence which will be released at 8.30 GMT hours and a further improvement in sentiment is anticipated.

As long as the view for tapering remains “on”, any potential EUR/USD rallies will be well capped. Despite the great disappointment on Friday’s NFP release, hints from the Fed points to tapering, even in a small gradual scale such as of $15bililion/$20 billion per month. What’s more, the power-horse of Europe as well depicted in the industrial figures released last week, isn’t strong enough. There are political problems in coalition forces in Italy, a third bailout package in Greece seems inevitable and there is also political uncertainty in Cyprus.

http://blog.fxcc.com/market-analysis

FOREX ECONOMIC CALENDAR :

2013-09-09 08:30 GMT | EMU Sentix Investor Confidence (Aug)

2013-09-09 12:30 GMT | CA Building Permits (MoM) (Jul)

2013-09-09 19:00 GMT | US Consumer Credit Change (Jul)

2013-09-09 23:50 GMT | BoJ Monetary Policy Meeting Minutes

FOREX NEWS :

2013-09-09 05:44 GMT | USD/CHF bouncing modestly ahead of data following bearish reversal Friday

2013-09-09 04:16 GMT | EUR/GBP limited below 0.8430 on Euro weakness

2013-09-09 04:05 GMT | AUD/USD is heading upwards on China data and after weekend elections

2013-09-09 03:38 GMT | Playing USD/JPY from the long side - JPMorgan

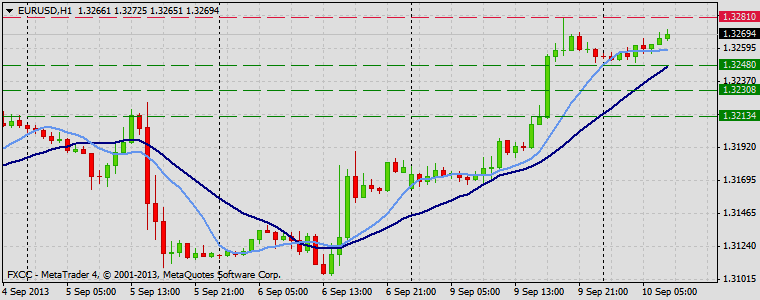

EURUSD :

HIGH 1.31812 LOW 1.31642 BID 1.31718 ASK 1.31723 CHANGE -0.05% TIME 08 : 36:45

OUTLOOK SUMMARY : Up

TREND CONDITION : Upward penetration

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : Low

MARKET ANALYSIS - Intraday Analysis

Upwards scenario: Further positive bias development would face next resistive measure at 1.3190 (R1). If the price manages to overcome it we would suggest next intraday targets at 1.3212 (R2) and 1.3234 (R3). Downwards scenario: On the other hand, our bearish expectations remain intact below the key support level at 1.3155 (S1). Price penetration below it would allow further declines towards to lower targets at 1.3134 (S2) and 1.3112 (S3).

Resistance Levels: 1.3190, 1.3212, 1.3234

Support Levels: 1.3155, 1.3134, 1.3112

---------------------

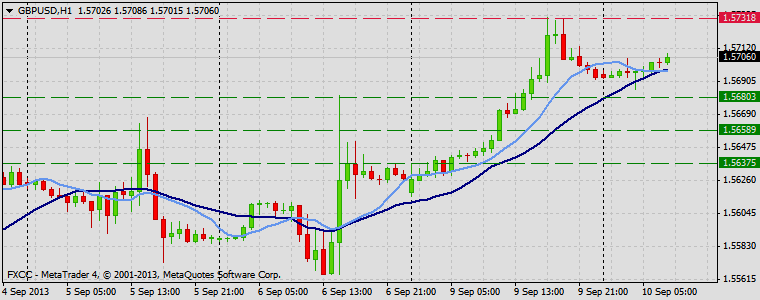

GBPUSD :

HIGH 1.56455 LOW 1.56158 BID 1.56441 ASK 1.56443 CHANGE 0.11% TIME 08 : 36:46

OUTLOOK SUMMARY : Neutral

TREND CONDITION : Sideway

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : Low

Upwards scenario: GBPUSD is approaching our key resistive measure at 1.5651 (R1). If the price manages to overcome it we would suggest next intraday targets at 1.5668 (R2) and 1.5685 (R3). Downwards scenario: Medium-term bias remains sideways orientated. A dip lower the key support measure at 1.5613 (S1) would open a route towards to lower targets at 1.5596 (S2) and 1.5579 (S3).

Resistance Levels: 1.5651, 1.5668, 1.5685

Support Levels: 1.5613, 1.5596, 1.5579

------------------

USDJPY :

HIGH 100.105 LOW 99.49 BID 99.645 ASK 99.649 CHANGE 0.56% TIME 08 : 36:47

OUTLOOK SUMMARY : Up

TREND CONDITION : Upward penetration

TRADERS SENTIMENT : Bullish

IMPLIED VOLATILITY : Medium

Upwards scenario: Measures of resistance might be activating when the pair approaches 100.11 (R1) price level. Break here would suggest next interim target at 100.44 (R2) and If the pair keeps its momentum we would expect an exposure of 100.75 (R3). Downwards scenario: On the downside bearish pressure might push the price below the support at 99.29 (S1). Further downside extension would open road towards to next target at 98.97 (S2) and any further losses would then be limited to 98.64 (S3) mark.

Resistance Levels: 100.11, 100.44, 100.75

Support Levels: 99.29, 98.97, 98.64

Source: FX Central Clearing Ltd,( http://www.fxcc.com )

Forex Technical & Market Analysis FXCC Sep 10 2013

EUR/USD up around 1.3270 on China

The shared currency is extending its ascent on Tuesday, lifting the EUR/USD to the area of 1.3270 on upbeat tone from the Chinese economy.China continues to be the main driver for the risk appetite trends in the first half of the week, after Industrial Production, Retail Sales and Urban Investment figures all surpassed expectations during August, giving extra oxygen to the risk-associated assets in general. In the opinion of Westpac Global Strategy Group, “The 55, 100 and 200 day moving averages have converged in the 1.3140-90 range, with the runup to 1.34 an increasingly distant memory. ECB president Draghi’s mood last week was gloomier than expected, adding to our bias to sell into the 1.32-1.33 region. However, US data has been too soft to inspire much fresh USD buying, leaving 1.3100 intact for now”.

At the moment the pair is gaining 0.09% at 1.3268 with the next resistance at 1.3279 (Kijun Line) ahead of 1.3298 (low Aug.22) and then 1.3322 (low Aug.27). On the downside, a break below 1.3157 (low Sep.9) would target 1.3104 (50% of 1.2755-1.3453) en route to 1.3089 (low Jul.19).

http://blog.fxcc.com/market-analysis

FOREX ECONOMIC CALENDAR :

N/A UK 30-y Bond Auction

2013-09-10 08:00 GMT | IT Gross Domestic Product (YoY) (Q2)

2013-09-10 12:15 GMT | CA Housing Starts s.a (YoY) (Aug)

2013-09-10 17:00 GMT | US 3-Year Note Auction

FOREX NEWS :

2013-09-10 05:40 GMT | Time for another leg up in USD/JPY - RBS

2013-09-10 05:21 GMT | EUR likely to be supported on dips - JPMorgan

2013-09-10 05:02 GMT | AUD/USD, risk is high of a further squeeze up towards 0.9500 - RBS

2013-09-10 04:25 GMT | USD/CHF holding ground above 0.9307 support despite Friday’s bearish candle

---------------

EURUSD :

HIGH 1.32725 LOW 1.32502 BID 1.32676 ASK 1.32681 CHANGE 0.1% TIME 08 : 54:03

OUTLOOK SUMMARY : Up

TREND CONDITION : Up trend

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : Low

MARKET ANALYSIS - Intraday Analysis

Upwards scenario: Current price setup might suggest retracement formation in near term perspective, however, if the price get acceleration on the upside and manages to surpass our resistive measure at 1.3281 (R1), we would suggest next targets at 1.3297 (R2) and 1.3313 (R3). Downwards scenario: Clearance of our support at 1.3248 (S1) is required to determine negative intraday bias and enable lower target at 1.3230 (S2) and then any further market depreciation would suggest final target at 1.3213 (S3).

Resistance Levels: 1.3281, 1.3297, 1.3313

Support Levels: 1.3248, 1.3230, 1.3213

------------------------

GBPUSD :

HIGH 1.57086 LOW 1.56856 BID 1.57056 ASK 1.57059 CHANGE 0.08% TIME 08 : 54:04

OUTLOOK SUMMARY : Up

TREND CONDITION : Upward penetration

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : Low

Upwards scenario: Further positive bias development would face next resistive measure at 1.5731 (R1). If the price manages to overcome it we would suggest next intraday targets at 1.5751 (R2) and 1.5772 (R3). Downwards scenario: Successful retest of our next support level at 1.5680 (S1) might provide sufficient momentum for the price acceleration towards to interim target at 1.5658 (S2) and then final aim for today could be exposed at 1.5637 (S3).

Resistance Levels: 1.5731, 1.5751, 1.5772

Support Levels: 1.5680, 1.5658, 1.5637

----------------------

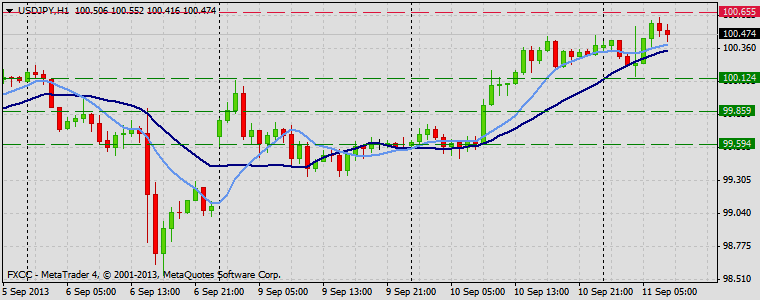

USDJPY :

HIGH 99.757 LOW 99.477 BID 99.628 ASK 99.630 CHANGE 0.06% TIME 08 : 54:05

OUTLOOK SUMMARY : Neutral

TREND CONDITION : Sideway

TRADERS SENTIMENT : Bullish

IMPLIED VOLATILITY : Low

Upwards scenario: Current price setup might suggest range mode development in near term perspective. Though If the price manages to surpass our resistive measure at 99.88 (R1), we would suggest next targets at 100.18 (R2) and 100.47 (R3). Downwards scenario: Possible downside expansion is protected by support level at 99.33 (S1), break here would put bullish oriented traders on hold. Marks at 99.04 (S2) and 98.75 (S3) acts as our initial targets today.

Resistance Levels: 99.88, 100.18, 100.47

Support Levels: 99.33, 99.04, 98.75

Source: FX Central Clearing Ltd,( http://www.fxcc.com )

Forex Technical & Market Analysis FXCC Sep 11 2013

Obama puts Syrian action on hold while diplomacy pursued

President Obama addressed the American people on the Syrian conflict, and where the U.S. goes from here, after headlines for a diplomatic resolution inundated media outlets on Tuesday. Barack Obama started the speech with a strong case for a ‘yes’ vote in Congress, saying "We know Asssad's government was responsible" Iran would be emboldened.... "This is not a world we should accept'' , although making clear that the U.S. "will not put American boots on the ground in Syria."

As the speech progressed, a more conciliatory Obama emerged, saying that after the Russian proposal to place under international control Syria's alleged chemical weapons - which Assad's government agreed to -, he asked Congress to postpone a vote on Syria action while diplomacy is pursued, adding that Assa's initiative has the potential to remove weapons without use of force. Obama also said: "Over the last few days we’ve seen some encouraging signs, in part because of the threat of military action." Since Obama was specific about the slim chances of an immediate attack, the speech supports the recent bid on risk assets.

http://blog.fxcc.com/market-analysis

FOREX ECONOMIC CALENDAR :

N/A | The US Congress votes on military action against Syria

2013-09-11 08:30 GMT | UK Claimant Count Change (Aug)

2013-09-11 15:30 GMT | UK MPC Member Miles Speech

2013-09-11 21:00 GMT | RBNZ Interest Rate Decision

FOREX NEWS :

2013-09-11 05:41 GMT | GBP/JPY still up near the highs and eyeing 158.46 after convincing breakout

2013-09-11 05:25 GMT | USD/CHF on higher levels as geo-political tensions are fading away

2013-09-11 05:05 GMT | EUR/USD tumbling after Obama’s address; 1.3278 resistance looms large

2013-09-11 04:29 GMT | GBP/USD heads into employment report easing away from 1.5737 resistance

-----------------

EURUSD

HIGH 1.32819 LOW 1.32437 BID 1.32491 ASK 1.32493 CHANGE -0.13% TIME 09 : 05:26

OUTLOOK SUMMARY : Down

TREND CONDITION : Downward penetration

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : High

MARKET ANALYSIS - Intraday Analysis

Upwards scenario: Possible upwards extension above the resistance level at 1.3266 (R1) is liable to commence medium-term bullish structure. Important fractal levels offers next targets at 1.3282 (R2) and 1.3298 (R3) in potential. Downwards scenario: As long as price stays below the moving averages our short-term outlook would be negative. Possible extension lower the 1.3240 (S1) is being able to drive market price towards to initial supports at 1.3226 (S2) and 1.3211 (S3).

Resistance Levels: 1.3266, 1.3282, 1.3298

Support Levels: 1.3240, 1.3226, 1.3211

-------------------------

GBPUSD :

HIGH 1.57417 LOW 1.57186 BID 1.57190 ASK 1.57197 CHANGE -0.08% TIME 09 : 05:34

OUTLOOK SUMMARY : Up

TREND CONDITION : Downward penetration

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : High

Upwards scenario: GBPUSD is approaching our key resistive measure at 1.5744 (R1). If the price manages to overcome it we would suggest next intraday targets at 1.5767 (R2) and 1.5789 (R3). Downwards scenario: On the downside, currency pair might encounter supportive measures at 1.5711 (S1). Break here would open the way for a test of our next targets at 1.5689 (S2) and 1.5666 (S3) later on today.

Resistance Levels: 1.5744, 1.5767, 1.5789

Support Levels: 1.5711, 1.5689, 1.5666

---------------------

USDJPY :

HIGH 100.609 LOW 100.139 BID 100.430 ASK 100.433 CHANGE 0.04% TIME 09 : 05:35

OUTLOOK SUMMARY : Up

TREND CONDITION : Upward penetration

TRADERS SENTIMENT : Bullish

IMPLIED VOLATILITY : High

Upwards scenario: Mark at 100.65 (R1) acts as next resistive barrier on the way if the instrument keeps it upside potential. Break here is required to achieve higher targets at 100.93 (R2) and 101.19 (R3) later on today. Downwards scenario: Risk of market weakening is seen below the support level at 100.12 (S1). Loss here is required to enable our supportive barrier at 99.85 (S2) en route towards to final target for today at 99.59 (S3).

Resistance Levels: 100.65, 100.93, 101.19

Support Levels: 100.12, 99.85, 99.59

Source: FX Central Clearing Ltd,( http://www.fxcc.com )

Forex Technical & Market Analysis FXCC Sep 12 2013

Barroso calls for quick implementation of Eurozone banking union

Europe is on a road to recovery, but efforts must still be made to prop it up, president of the European Commission José Manuel Barroso said on Wednesday, delivering the annual State of the Union speech. He listed unemployment as the the most burning issue to solve, as its current level is “economically unsustainable, politically untenable and socially unacceptable.” Speaking at the European Parliament in Strasbourg, Barroso pointed to the recent improvements in the European financial markets as well as the better situation in Greece. “For Europe, recovery is within sight. Let's not overestimate the progress, but neither should we underestimate what has been done,” he said.

He called for a quicker implementation of the Eurozone banking union, which would help boost growth and employment. Finalizing discussions on the next EU budget was also listed as a top priority. Furthermore, Barroso stressed the need for a tighter political union, suggesting that “Europe must focus on where it can add most value. It needs to be big on big things and smaller on smaller things.” The European Commission president also referred to the chemical attack in Syria, which the EU condemns but still hopes to see the a conflict resolved through a negotiated settlement.

http://blog.fxcc.com/market-analysis

FOREX ECONOMIC CALENDAR :

2013-09-12 08:00 GMT | ECB Monthly Report

2013-09-12 09:00 GMT | UK Inflation Report Hearings

2013-09-12 11:40 GMT | ECB President Draghi's Speech

2013-09-12 12:30 GMT | US Initial Jobless Claims

FOREX NEWS :

2013-09-12 05:33 GMT | AUD/USD falls apart on softest Australian jobs data

2013-09-12 05:26 GMT | Gold teetering on the brink above 1,351.60 key support

2013-09-12 05:07 GMT | Overbought GBP/USD buoyant at 1.5835 ahead of data / events

2013-09-12 04:50 GMT | EUR/GBP threatening the 0.84 big support

---------------------

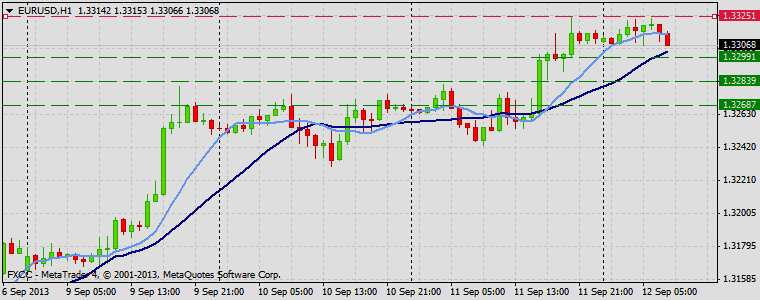

EURUSD

HIGH 1.33241 LOW 1.33041 BID 1.33043 ASK 1.33047 CHANGE -0.05% TIME 08 : 53:11

OUTLOOK SUMMARY : Up

TREND CONDITION : Up trend

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : Medium

MARKET ANALYSIS - Intraday Analysis

Upwards scenario: On the upside potential is seen for a break above the resistance at 1.3325 (R1). In such case we would suggest next target at 1.3339 (R2) and any further rise would then be limited to final resistance at 1.3354 (R3). Downwards scenario: Instrument looks overbought and we expect to see some consolidation pattern ahead. Risk of possible price regress is seen below the support level at 1.3299 (S1). Break here would suggest lower targets at 1.3283 (S2) and 1.3268 (S3) in potential.

Resistance Levels: 1.3325, 1.3339, 1.3354

Support Levels: 1.3299, 1.3283, 1.3268

-------------------

GBPUSD :

HIGH 1.58316 LOW 1.58131 BID 1.58144 ASK 1.58146 CHANGE -0.01% TIME 08 : 53:12

OUTLOOK SUMMARY : Up

TREND CONDITION : Up trend

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : Medium

Upwards scenario: Mark at 1.5837 (R1) acts as next resistive barrier on the way if the pair keeps it upside potential. Break here is required to achieve higher targets at 1.5861 (R2) and 1.5886 (R3) later on today. Downwards scenario: Medium term bias is clearly positive however we expect recovery action if the price manages to overcome key supportive bastion at 1.5800 (S1). In such case we would suggest next intraday targets at 1.5775 (S2) and 1.5748 (S3).

Resistance Levels: 1.5837, 1.5861, 1.5886

Support Levels: 1.5800, 1.5775, 1.5748

------------------------

USDJPY :

HIGH 99.99 LOW 99.394 BID 99.493 ASK 99.495 CHANGE -0.39% TIME 08 : 53:13

OUTLOOK SUMMARY : Down

TREND CONDITION : Downward penetration

TRADERS SENTIMENT : Bullish

IMPLIED VOLATILITY : Medium

Upwards scenario: USDJPY tested negative territory today though appreciation above the resistive structure at 99.69 (R1) might shift short-term tendency to the bullish side and validate our intraday targets at 99.88 (R2) and 100.08 (R3). Downwards scenario: Failure to establish corrective structure might lead to further downtrend evolvement later on today. Penetration below the support at 99.33 (S1) would suggest next intraday targets at 99.14 (S2) and 98.96 (S3) in perspective.

Resistance Levels: 99.69, 99.88, 100.08

Support Levels: 99.33, 99.14, 98.96

Source: FX Central Clearing Ltd,( http://www.fxcc.com )

Forex Technical & Market Analysis FXCC Sep 13 2013

Countdown for QE taper fireworks is on!

The judgment day for the Fed, Sept 17, is nearing, and the market is preparing accordingly for what may represent the most important monetary policy decision taken in years, as the start of QE taper gets kick-started. Even if the next FOMC meeting comes on the back of a rather disappointing NFP past Friday, the communication strategy carried out by Chairman Ben Bernanke & Co. so far suggest that some sort of light taper should be expected, or else the sell-off in the USD might be one that make headlines all over the world. According to Adam Button, Editor at Forexlive, "The market has settled on $10 billion as the most-likely size for the Fed’s taper next week", anticipating that "larger and the dollar will rally hard, smaller and it will fall."

Meanwhile, Treasury traders seem to be perceive the taper being priced in less than 10bln, which makes a bullish case for a stronger USD for those supporting odds for a more aggressive taper. If this scenario happens to be true, some long USD plays vs other G10 currencies such as the NZD, EUR or even the CAD, might be a great play based on this assumption. As Button notes: "I think it’s clear that a taper is coming but the Fed could still change its mind on the size and the messages that accompany it. Two reports in the days ahead could change their thinking: retail sales on Friday and the CPI on Monday."

http://blog.fxcc.com/market-analysis

FOREX ECONOMIC CALENDAR :

24h | EMU EcoFin Meeting

2013-09-13 12:30 GMT | US Retail Sales (MoM) (Aug)

2013-09-13 13:55 GMT | US Reuters/Michigan Consumer Sentiment Index (Sep)

2013-09-13 14:00 GMT | US Business Inventories (Aug)

FOREX NEWS :

2013-09-13 05:17 GMT | GBP/USD little moved after Carney, US job data

2013-09-13 04:52 GMT | NZD/USD faces formidable 0.8150/70 tech resistance

2013-09-13 04:39 GMT | USD stronger ahead of US retail sales; Gold stalls

2013-09-13 04:38 GMT | EUR/USD capped by 1.3300

EURUSD :

HIGH 1.33022 LOW 1.32644 BID 1.32677 ASK 1.32680 CHANGE -0.23% TIME 08 : 40:28

OUTLOOK SUMMARY : Down

TREND CONDITION : Downward penetration

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : Medium

MARKET ANALYSIS - Intraday Analysis

Upwards scenario: Possibility of market strengthening is seen above the immediate resistive barrier at 1.3286 (R1). Clearance here would suggest next interim target at 1.3302 (R2) and then final aim locates at 1.3317 (R3). Downwards scenario: Further downside extension might face next supportive barrier at 1.3256 (S1). Clearance here is required to open the way towards to interim target at 1.3240 (S2) and any further price regress would then be targeting 1.3225 (S3).

Resistance Levels: 1.3286, 1.3302, 1.3317

Support Levels: 1.3256, 1.3240, 1.3225

--------------------

GBPUSD :

HIGH 1.58117 LOW 1.57766 BID 1.57812 ASK 1.57816 CHANGE -0.14% TIME 08 : 40:29

OUTLOOK SUMMARY : Down

TREND CONDITION : Downward penetration

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : Medium

Upwards scenario: GBPUSD tested negative side recently, however we see potential to test resistive barrier at 1.5812 (R1) later on today. Successful penetration above that level would suggest next intraday targets at 1.5838 (R2) and 1.5864 (R3) later on today. Downwards scenario: In terms of technical levels, risk of price depreciation is seen below the support level at 1.5775 (S1). Loss here would suggest to monitor marks at 1.5750 (S2) and 1.5725 (S3) as possible intraday targets.

Resistance Levels: 1.5812, 1.5838, 1.5864

Support Levels: 1.5775, 1.5750, 1.5725

--------------------------

USDJPY :

HIGH 99.976 LOW 99.418 BID 99.861 ASK 99.866 CHANGE 0.33% TIME 08 : 40:29

OUTLOOK SUMMARY : Up

TREND CONDITION : Upward penetration

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : Medium

Upwards scenario: Further price appreciation is a likely scenario for today according to the technical readings. If the pair manages to clear the barrier at 100.08 (R1), we would suggest next targets at 100.24 (R2) and 100.40 (R3). Downwards scenario: Our next supportive barrier lies at 99.72 (S1). Break here is required to enable downside expansion towards to our intraday targets at 99.54 (S2) and 99.36 (S3) in potential.

Resistance Levels: 100.08, 100.24, 100.40

Support Levels: 99.72, 99.54, 99.36

Source: FX Central Clearing Ltd,( http://www.fxcc.com )

Forex Technical & Market Analysis FXCC Sep 17 2013

The Fed to maintain forward guidance with firm tone, says Hilsenrath

The Federal Reserve is struggling to justify extending forward guidance as part of its strategy to maintain the recovery path according to Fedwatcher Jon Hilsenrath in his latest article on the FOMC policy meeting. The FOMC is expected to publish its interest rate and monetary policy decision on Wednesday September 18 and market is widely expecting the Fed to start its cut in the bond buying program. The Fedwatcher affirmed in his piece that "Federal Reserve officials face a communication challenge explaining their interest-rate plans when they gather for a policy meeting this week."

Their challenge is "how to justify the low interest-rate plan when their own estimates suggest an economy regaining its health." According to Hilsenrath, Fed forecasts could show "rates rising but still low" by 2016. The Fed also expects economy at "full employment" by the same year. The decision on QE tapering the $85 billion-a-month bond-buying program is now a close call "on whether to start pulling back on the QE." The Fed is now changing its emphasis from bond buying to the "low-rate pledge."

http://blog.fxcc.com/market-analysis

FOREX ECONOMIC CALENDAR :

2013-09-17 08:30 GMT : UK Consumer Price Index (YoY) (Jul)

2013-09-17 09:00 GMT : EMU ZEW Survey - Economic Sentiment (Aug)

2013-09-17 12:30 GMT : US Consumer Price Index (YoY) (Aug)

2013-09-17 13:00 GMT : US Net Long-Term TIC Flows (Jul)

FOREX NEWS :

2013-09-17 05:29 GMT : NZD/USD downwards in tandem with “Aussie”

2013-09-17 04:43 GMT : EUR/USD sails below EMA20 - extending trading range

2013-09-17 04:43 GMT : EUR/GBP still under the 0.84 handle ahead of German ZEW & UK CPI

2013-09-17 04:16 GMT : AUD/JPY pops up after RBA minutes

-----------------

EURUSD :

HIGH 1.33422 LOW 1.33252 BID 1.33396 ASK 1.33398 CHANGE 0.04% TIME 08 : 56:12

OUTLOOK SUMMARY Up

TREND CONDITION Upward penetration

TRADERS SENTIMENT Bullish

IMPLIED VOLATILITY High

MARKET ANALYSIS - Intraday Analysis

Upwards scenario: Current price setup is looking for upwards extension possibility. Risk of the price acceleration is seen above the key resistance level at 1.3361 (R1). Clearance here would put immediate focus on the next targets at 1.3384 (R2) and then 1.3405 (R3). Downwards scenario: Our next support level is placed at 1.3321 (S1). Possible penetration below it might initiate bearish pressure and gradually push the price towards to our intraday targets at 1.3298 (S2) and 1.3275 (S3).

Resistance Levels: 1.3361, 1.3384, 1.3405

Support Levels: 1.3321, 1.3298, 1.3275

--------------------

GBPUSD :

HIGH 1.59151 LOW 1.58884 BID 1.59091 ASK 1.59098 CHANGE 0.08% TIME 08 : 56:13

OUTLOOK SUMMARY Up

TREND CONDITION Downward penetration

TRADERS SENTIMENT Bearish

IMPLIED VOLATILITY High

Upwards scenario: GBPUSD resumed upwards penetration today and we see potential to expose our intraday targets at 1.5996 (R2) and 1.6030 (R3) if the price manages to overcome key resistance measure at 1.5964 (R1). Downwards scenario: Though, we still keep the bearish scenario in focus. Risk of market decline is seen below the key support level at 1.5888 (S1). Loss here would enable initial targets at 1.5853 (S2) and 1.5818 (S3).

Resistance Levels: 1.5964, 1.5996, 1.6030

Support Levels: 1.5888, 1.5853, 1.5818

-------------------------

USDJPY :

HIGH 99.358 LOW 99.009 BID 99.145 ASK 99.147 CHANGE 0.1% TIME 08 : 56:14

OUTLOOK SUMMARY Down

TREND CONDITION Upward penetration

TRADERS SENTIMENT Bearish

IMPLIED VOLATILITY Medium

Upwards scenario: Price strengthening is possible above the next resistance level at 99.36 (R1). Our interim target holds at 99.56 (R2) en route to our final aim for today at 99.77 (R3). Downwards scenario: However if the price manages to break our key support level at 99.00 (S1) bearish market participants might take the initiative. Our intraday support level locates at 98.79 (S2) and 98.58 (S3).

Resistance Levels: 99.36, 99.56, 99.77

Support Levels: 99.00, 98.79, 98.58

Source: FX Central Clearing Ltd,( http://www.fxcc.com )

Forex Technical & Market Analysis FXCC Sep 17 2013

The Fed to maintain forward guidance with firm tone, says Hilsenrath

The Federal Reserve is struggling to justify extending forward guidance as part of its strategy to maintain the recovery path according to Fedwatcher Jon Hilsenrath in his latest article on the FOMC policy meeting. The FOMC is expected to publish its interest rate and monetary policy decision on Wednesday September 18 and market is widely expecting the Fed to start its cut in the bond buying program. The Fedwatcher affirmed in his piece that "Federal Reserve officials face a communication challenge explaining their interest-rate plans when they gather for a policy meeting this week."

Their challenge is "how to justify the low interest-rate plan when their own estimates suggest an economy regaining its health." According to Hilsenrath, Fed forecasts could show "rates rising but still low" by 2016. The Fed also expects economy at "full employment" by the same year. The decision on QE tapering the $85 billion-a-month bond-buying program is now a close call "on whether to start pulling back on the QE." The Fed is now changing its emphasis from bond buying to the "low-rate pledge."

http://blog.fxcc.com/market-analysis

FOREX ECONOMIC CALENDAR :

2013-09-17 08:30 GMT : UK Consumer Price Index (YoY) (Jul)

2013-09-17 09:00 GMT : EMU ZEW Survey - Economic Sentiment (Aug)

2013-09-17 12:30 GMT : US Consumer Price Index (YoY) (Aug)

2013-09-17 13:00 GMT : US Net Long-Term TIC Flows (Jul)

FOREX NEWS :

2013-09-17 05:29 GMT : NZD/USD downwards in tandem with “Aussie”

2013-09-17 04:43 GMT : EUR/USD sails below EMA20 - extending trading range

2013-09-17 04:43 GMT : EUR/GBP still under the 0.84 handle ahead of German ZEW & UK CPI

2013-09-17 04:16 GMT : AUD/JPY pops up after RBA minutes

-----------------

EURUSD :

HIGH 1.33422 LOW 1.33252 BID 1.33396 ASK 1.33398 CHANGE 0.04% TIME 08 : 56:12

OUTLOOK SUMMARY Up

TREND CONDITION Upward penetration

TRADERS SENTIMENT Bullish

IMPLIED VOLATILITY High

MARKET ANALYSIS - Intraday Analysis

Upwards scenario: Current price setup is looking for upwards extension possibility. Risk of the price acceleration is seen above the key resistance level at 1.3361 (R1). Clearance here would put immediate focus on the next targets at 1.3384 (R2) and then 1.3405 (R3). Downwards scenario: Our next support level is placed at 1.3321 (S1). Possible penetration below it might initiate bearish pressure and gradually push the price towards to our intraday targets at 1.3298 (S2) and 1.3275 (S3).

Resistance Levels: 1.3361, 1.3384, 1.3405

Support Levels: 1.3321, 1.3298, 1.3275

--------------------

GBPUSD :

HIGH 1.59151 LOW 1.58884 BID 1.59091 ASK 1.59098 CHANGE 0.08% TIME 08 : 56:13

OUTLOOK SUMMARY Up

TREND CONDITION Downward penetration

TRADERS SENTIMENT Bearish

IMPLIED VOLATILITY High

Upwards scenario: GBPUSD resumed upwards penetration today and we see potential to expose our intraday targets at 1.5996 (R2) and 1.6030 (R3) if the price manages to overcome key resistance measure at 1.5964 (R1). Downwards scenario: Though, we still keep the bearish scenario in focus. Risk of market decline is seen below the key support level at 1.5888 (S1). Loss here would enable initial targets at 1.5853 (S2) and 1.5818 (S3).

Resistance Levels: 1.5964, 1.5996, 1.6030

Support Levels: 1.5888, 1.5853, 1.5818

-------------------------

USDJPY :

HIGH 99.358 LOW 99.009 BID 99.145 ASK 99.147 CHANGE 0.1% TIME 08 : 56:14

OUTLOOK SUMMARY Down

TREND CONDITION Upward penetration

TRADERS SENTIMENT Bearish

IMPLIED VOLATILITY Medium

Upwards scenario: Price strengthening is possible above the next resistance level at 99.36 (R1). Our interim target holds at 99.56 (R2) en route to our final aim for today at 99.77 (R3). Downwards scenario: However if the price manages to break our key support level at 99.00 (S1) bearish market participants might take the initiative. Our intraday support level locates at 98.79 (S2) and 98.58 (S3).

Resistance Levels: 99.36, 99.56, 99.77

Support Levels: 99.00, 98.79, 98.58

Source: FX Central Clearing Ltd,( http://www.fxcc.com )

Forex Technical & Market Analysis FXCC Sep 19 2013

The Fed decides to maintain the status quo; No taper

The Federal Reserve has decided to maintain its interest rate unchanged at 0.25%. Same story with the bond buying pace at $85Bn as officials need more information that the economy is growing at a sustainable pace. According to a recent press release, the Fed affirms that the pace of bond purchases depends on the economic outlook. The inflation is still low, financial market conditions are tight while the fiscal retrenchment could be damaging, so the FOMC needs more signs of progress.

"Accordingly, the Committee decided to continue purchasing additional agency mortgage-backed securities at a pace of $40 billion per month and longer-term Treasury securities at a pace of $45 billion per month." The Fed has lowered its growth expectations and now officials forecast the US GDP to slowdown in 2016 to 2.5%-3.3% range, from 3.0%-3.5% in 2014. They see 2013 to show a 2.0%-2.3% growth in the United States. The unemployment rate is expected to finish the year around 7.2%-7.3% and to decline to 6.5%-6.8% in 2014, 5.8%-6.2% in 2015 and 5.4%-5.9% in 2016.

http://blog.fxcc.com/market-analysis

FOREX ECONOMIC CALENDAR :

2013-09-19 07:30 GMT | SW SNB Interest Rate Decision

2013-09-19 08:30 GMT | UK Retail Sales (YoY) (Aug)

2013-09-19 14:00 GMT | US Existing Home Sales Change (MoM) (Aug)

2013-09-19 23:50 GMT | JP Foreign investment in Japan stocks (Sep 13)

FOREX NEWS :

2013-09-19 04:52 GMT | USD licking its wounds; China markets closed

2013-09-19 04:34 GMT | USD/CHF slightly lower at 0.9119 ahead of big data; ultimate dowside may be 0.9073

2013-09-19 04:33 GMT | Fed relies heavily on low yields regarding “tapering” – RBS

2013-09-19 04:18 GMT | AUD/USD slightly downwards but still dancing close to 0.9500 area

----------

EURUSD :

HIGH 1.3536 LOW 1.3501 BID 1.35318 ASK 1.35320 CHANGE 0.08% TIME 08 : 40:15

OUTLOOK SUMMARY : Up

TREND CONDITION : Sideway

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : Medium

MARKET ANALYSIS - Intraday Analysis

Upwards scenario: Medium-term bias is clearly bullish oriented, however, to resume ascending structure price is required to clear the barrier at 1.3543 (R1). Next on tap locates our intraday targets at 1.3567 (R2) and 1.3593 (R3).Downwards scenario: On the other hand, our next support measure lies at 1.3499 (S1). Decline below it would enable lower targets at 1.3474 (S2) and 1.3448 (S3).

Resistance Levels: 1.3543, 1.3567, 1.3593

Support Levels: 1.3499, 1.3474, 1.3448

-------------------

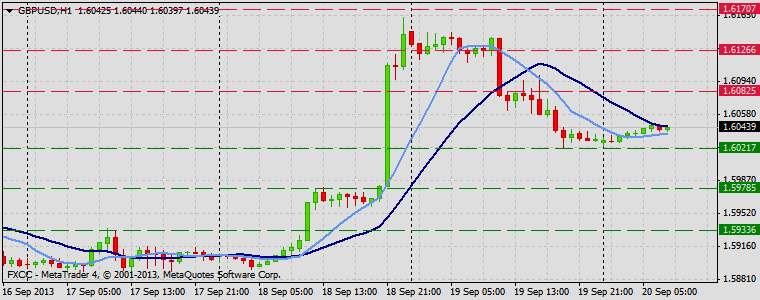

GBPUSD :

HIGH 1.61478 LOW 1.61146 BID 1.61302 ASK 1.61307 CHANGE -0.08% TIME 08 : 40:16

OUTLOOK SUMMARY : Up

TREND CONDITION : Up trend

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : Medium

Upwards scenario: On the upside market might get more incentives above the immediate resistive barrier at 1.6168 (R1). If the price manages to overcome it we would suggest next intraday targets at 1.6215 (R2) and 1.6264 (R3). Downwards scenario: Although market players may prefer to increase exposure on the short positions and push the price below the support level at 1.6089 (S1). Possible price devaluation would suggest initial targets at 1.6040 (S2) and then 1.5989 (S3).

Resistance Levels: 1.6168, 1.6215, 1.6264

Support Levels: 1.6089, 1.6040, 1.5989

----------------------

USDJPY :

HIGH 98.475 LOW 97.897 BID 98.280 ASK 98.282 CHANGE 0.37% TIME 08 : 40:16

OUTLOOK SUMMARY : Down

TREND CONDITION : Upward penetration

TRADERS SENTIMENT : Bullish

IMPLIED VOLATILITY : Medium

Upwards scenario: USDJPY is approaching our next resistance level at 98.51 (R1), keeping the short-term ascending structure intact. The break here is required for the price appreciation towards to next target at 98.86 (R2) and any further rise would then be targeting to 99.21 (R3). Downwards scenario: Negative developments might be settled below the important support level at 97.76 (S1). Any price action below it would then be targeting support level at 97.46 (S2) and then final target could be exposed at 97.14 (S3).

Resistance Levels: 98.51, 98.86, 99.21

Support Levels: 97.76, 97.46, 97.14

Source: FX Central Clearing Ltd,( http://www.fxcc.com )

Forex Technical & Market Analysis FXCC Sep 20 2013

Asset purchase schemes remaining static.

As the tide went out on the shock decision by the FOMC regarding their asset purchase schemes remaining static, the markets in the USA appeared to pause for thought in Thursday's trading sessions. Looking at high impact news events the improved unemployment data was discounted given the fact that two states, including California, failed to proved jobs data as their computer systems were still off grid. Better news came in the form of house sales reaching a recent high, whilst the Philly Fed number came in off the scale in terms of positivity. The improved housing market news was added to by costs for U.S. home buyers predicted to fall from the highest level in two years after the Federal Reserve increased expectations that it will keep short-term interest rates at about zero percent. Rates on 30-year mortgages reached 4.93 percent in the week ended Sept 6th, the highest level seen since April 2011 and up from a record low of 3.57 percent in December, according to Mortgage Bankers Association data. The rate declined to 4.86 percent last week. Treasuries dropped the day after experiencing the biggest rally in two years as improved economic conditions made investors more certain that the Federal Reserve’s next move will be to reduce monetary stimulus. The 10-year yield rose six basis points or 0.06 percentage point to 2.75 percent late in the New York session. The price of the 2.5 percent note maturing in August 2023 dropped 17/32, or, $5.31 per $1,000 face value, to 97 26/32. The yield slid 16 basis points on Wednesday, the biggest decline since Oct 31st 2011.

http://blog.fxcc.com/market-analysis

FOREX ECONOMIC CALENDAR :

2013-09-20 08:30 GMT | UK Public Sector Net Borrowing (Aug)

2013-09-20 12:30 GMT | CA Consumer Price Index (YoY) (Aug)

2013-09-20 14:00 GMT | EMU Consumer Confidence (Sep)

2013-09-20 16:30 GMT | US Fed's George Speech

FOREX NEWS :

2013-09-20 05:18 GMT | RBA likely to ease again; AUD to trade heavy - NAB

2013-09-20 05:15 GMT | GBP/USD bouncing modestly at 1.6042 after downside correction day Thursday

2013-09-20 05:11 GMT | GBP/JPY finds strong supply at 160 round

2013-09-20 04:38 GMT | EUR/GBP stalling below 0.8450 ahead of Germany elections

---------------------

EURUSD :

HIGH 1.35393 LOW 1.35279 BID 1.35354 ASK 1.35357 CHANGE 0.05% TIME 08 : 47:18

OUTLOOK SUMMARY : Up

TREND CONDITION : Sideway

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : Medium

MARKET ANALYSIS - Intraday Analysis

Upwards scenario: Next hurdle that limit uptrend development lies at 1.3569 (R1). If the break occurs here we would suggest next attractive point at 1.3598 (R2) and any further rise would then be limited to final resistance at 1.3628 (R3). Downwards scenario: We placed our support level right below the local low at 1.3507 (S1). Clearance here is liable to open way towards to our interim target at 1.3474 (S2) and then might expose final aim at 1.3440 (S3).

Resistance Levels: 1.3569, 1.3598, 1.3628

Support Levels: 1.3507, 1.3474, 1.3440

---------------------

GBPUSD :

HIGH 1.60462 LOW 1.60238 BID 1.60450 ASK 1.60454 CHANGE 0.09% TIME 08 : 47:19

OUTLOOK SUMMARY : Down

TREND CONDITION : Downward penetration

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : Medium

Upwards scenario: Immediate resistance at 1.6082 (R1) remains in near-term focus, climb above this level might open way towards to next interim target at 1.6126 (R2) and any further rise would then be limited to final resistive measure at 1.6170 (R3) Downwards scenario: On the downside, next support level locates at 1.6021 (S1). Possible penetration below this mark would open way towards to next target at 1.5978 (S2) and then any further market decline would be limited to last mark at 1.5933 (S3).

Resistance Levels: 1.6082, 1.6126, 1.6170

Support Levels: 1.6021, 1.5578, 1.5933

USDJPY :

HIGH 99.562 LOW 99.174 BID 99.253 ASK 99.257 CHANGE -0.22% TIME 08 : 47:20

OUTLOOK SUMMARY : Up

TREND CONDITION : Upward penetration

TRADERS SENTIMENT : Bullish

IMPLIED VOLATILITY : Medium

Upwards scenario: Possible uptrend development is limited now to the next resistive measure at 99.63 (R1). Clearance here is required to enable our interim target at 99.85 (R2) en route to final aim at 100.06 (R3). Downwards scenario: Penetration below the support level at 99.10 (S1) might maintain a negative tone in near term perspective. In such case we would suggest next supportive measures at 98.87 (S2) and 98.64 (S3) as possible retracement targets.

Resistance Levels: 99.63, 99.85, 100.06

Support Levels: 99.10, 98.87, 98.64

Source: FX Central Clearing Ltd,( http://www.fxcc.com )