Interactive Price Action Thread

My main strategy:

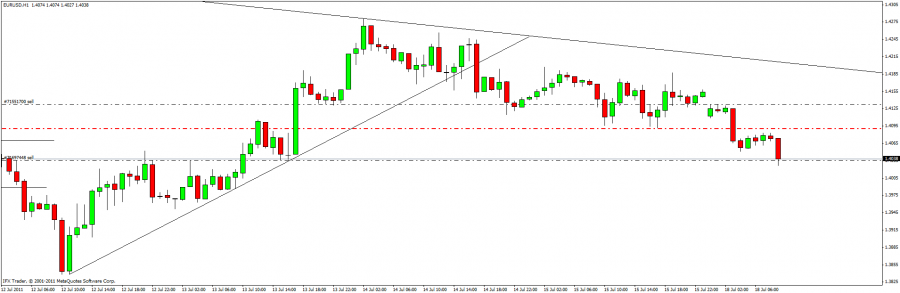

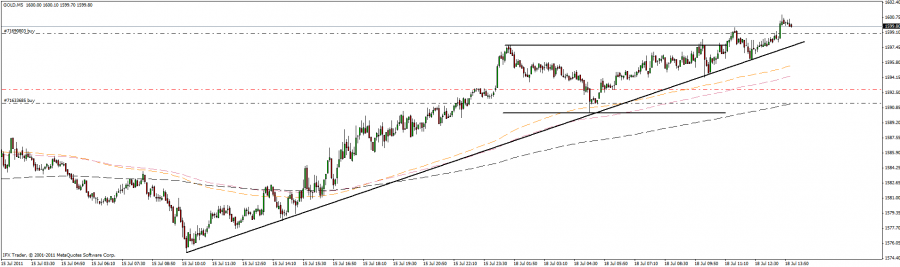

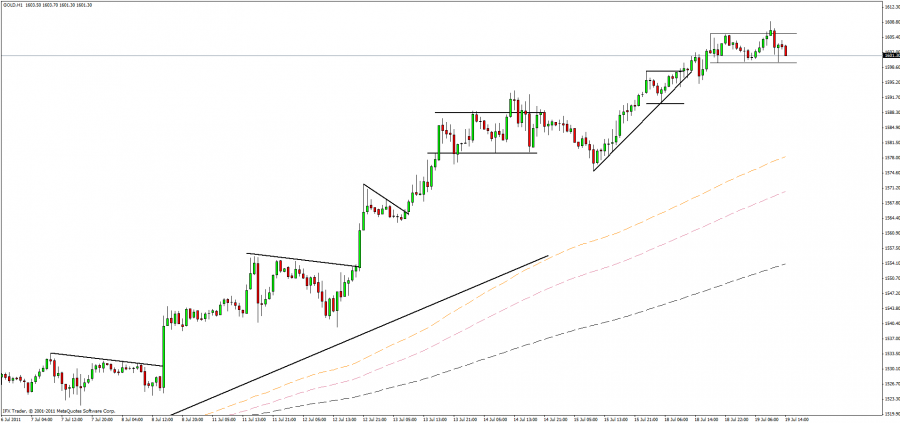

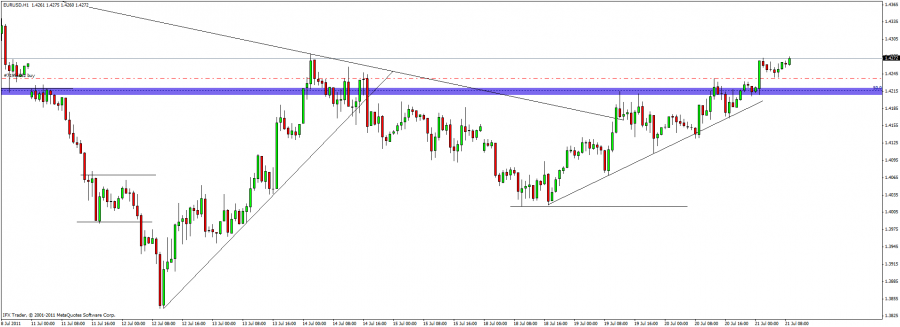

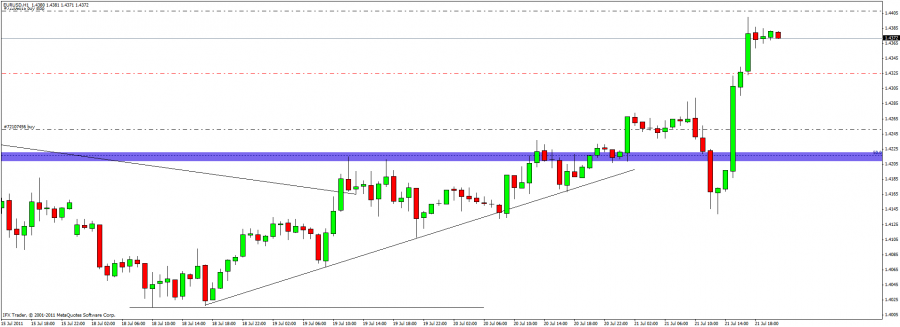

1. There is a trend. Within this trend, countertrend forms. As soon as this countertrend breaks with a H1 candle or enough pips, I enter. Stoploss is at the last high/low, or at the top of the signal candle + 5 pips.

2. Movement continues, I re-enter at the break of last swing high/low. Two postions' stoploss are moved to the 50% between the swing high and the low, or moved to the high/low which is break + X pips according to market levels.

3. Movement continues, I look for countertrend again, and re-enter at all given opportunities, and when a new position is opened: I move all the positions' stoploss.

My alternative strategy is touch-trading. Although I am trading mostly with tight stoplosses, in this case I really. The formula is simple with touch-trading: I seek for possible market reverse considering PPZ's, big round numbers, trendline touches, pinbars, etc. When I am touch-trading(very similar to J16's strategy) I am very picky. I am trying to trade only the high-prob. setups, and levels what are most confluenced with other factors. (backed by the more factors - the better)

Keep it simple stupid