Interactive Price Action Thread

THIS IS YOUR PLACE IF:

- You have tried almost every indicators, you have tried almost every combinations, you have tried and tested a lot of robots, you have tried a lot of strategy, and the profit is nowhere

- You are interested in naked trading, concenrating on price action

- You are ready to drop to trash all the indicators what confuse you, and start something classical, simple, and profitable

THIS IS NOT YOUR PLACE IF:

- You still believe in indicators and you use more than its meant to

- You are lazy to learn

RULES AND PRINCIPLES

- You are encouraged to post your own chart/sentiment/money management tips/position management tips

- Ask if something is not clear, that's how do we learn

- Charts must be up to date

- Naked charts only

- Charts Charts Charts all the time

- If you see a possible opportunity, share with us - we will do the same

Let's rollin then!

Keep it simple stupid

- You are ready to drop to trash all the indicators what confuse you, and start something classical, simple, and profitable

Does it mean that an innovative idea? or it means that we can use some indicators to create an idea. Please explain what is meant by "classical, simple and profitable". I doubt if it is really a simple thing :).

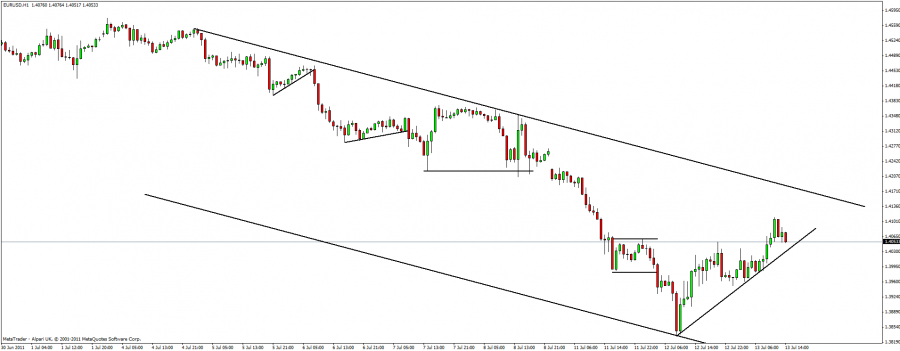

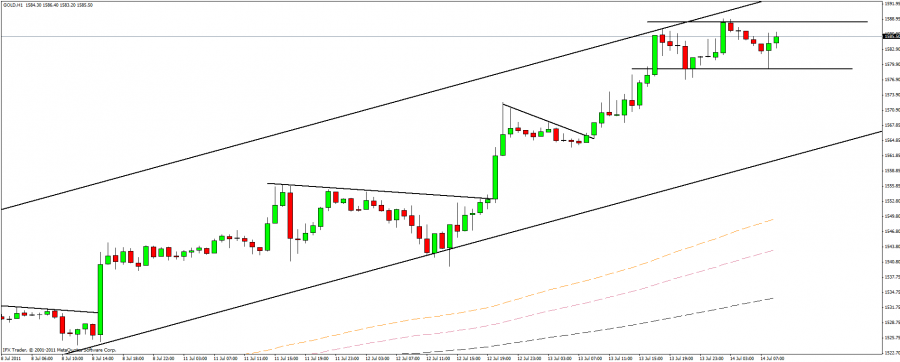

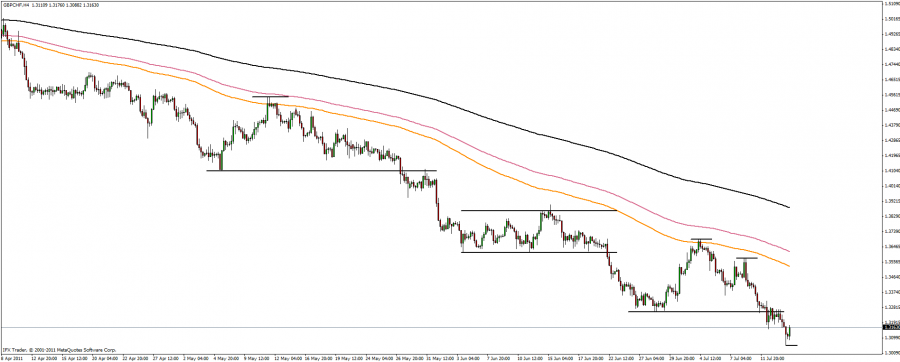

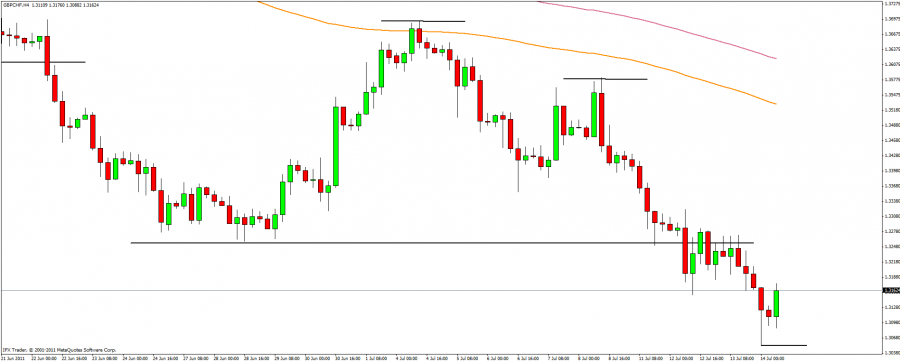

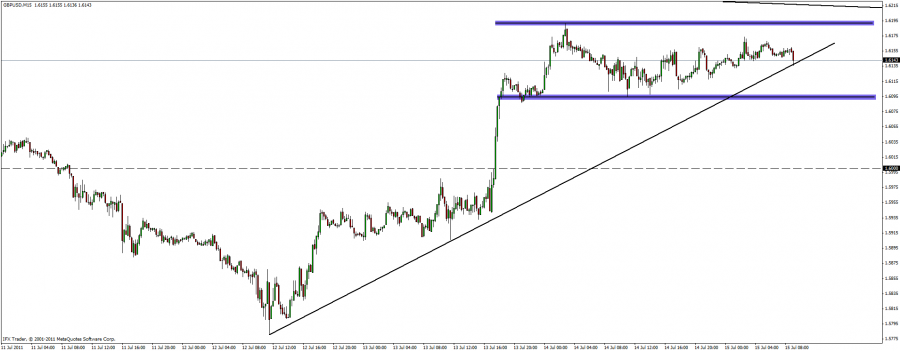

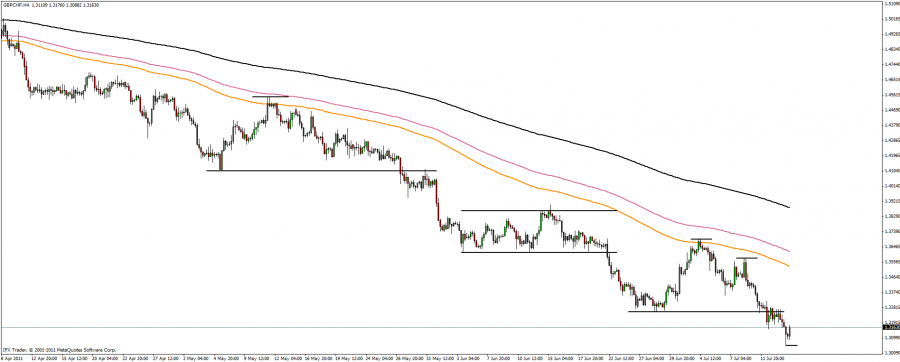

Btw nice trending charts.

Originally posted by illiterate- You are ready to drop to trash all the indicators what confuse you, and start something classical, simple, and profitable

Does it mean that an innovative idea? or it means that we can use some indicators to create an idea. Please explain what is meant by "classical, simple and profitable". I doubt if it is really a simple thing :).

Btw nice trending charts.

Actually its nothing inoovative, its a classical trading method which is used widely, its called Price Action. It's classical because its tools are only the basic TA tools and concepts, nothing super, nothing outstanding indicator or tool. It's simple, because its kept simple stupid as you can see on the charts.

I will post more info about this trading technique like how I manage my positions how I enter the market what are my rules etc. It's just my strategy, it just one strategy of the thousands.

Keep it simple stupid

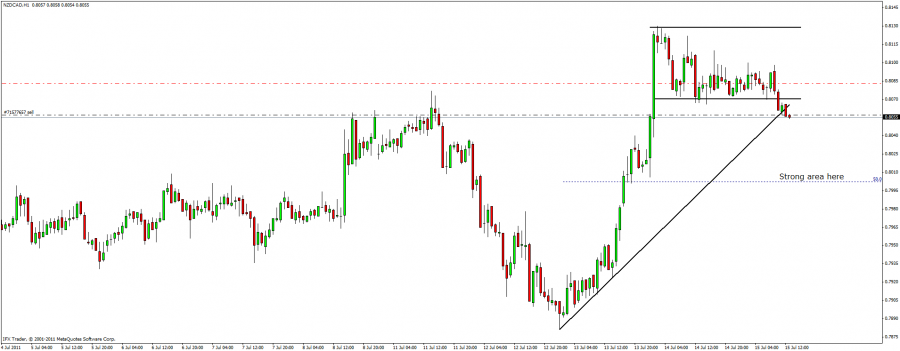

Here is one my entries, short position is opened @ NZDCAD. Downward momentum, and gets below the consolidation zone. SL is tight as its going to be a touch-trade, it's at the top of the breaking candle + 5 pips.

What is important to this strategy: I never use take profit orders. Basically I am a trend trader and as we know: we can't predict when a trend is over. I am trying to remain in the wave as long as I can. So as I mentioned I don't use take profit orders, but I always use stop loss orders. In addition, if price moves to my direction I modify my stop loss order to secure more and more profits - but only if it's necessary, only if we had gone through an important level. Orders have to be ALWAYS related to chart levels.

Keep it simple stupid

A little summary by the weekend:

My NZDCAD position got stopped out last night. Currently I have one open position, an existing EURCAD short. GOLD is in my watchlist for a possible long position next week.

I am planning to re-enter short when the last swing low (black horizontal line) is broken, and secure more profits if the market lets me to do.

By the way I still don't know should I hold my positions over the weekend or not. My money management is quite conservative, low lotsizes, tight stoplosses, but on the other hand market can open with a big gap (opposite my trades direction) and it can result in an overjumped stoploss and possible serious loss. While I close all my positions before the weekend I am not exposed to negative gaps and overjumped orders, but I would also miss a possible profitable gap and miss the dynamic of my trades.

Keep it simple stupid