Leo Trader Pro Verified real account

I agree with you Fxpro. However, we have seen alot of successful strategies with such a structure and been profitable. i think this is the reason of not having consistance return and alsways require to change or optimize an strategy according to the market.

Fxpro is right about black swans. Any technique, where the loss on losing trades is nearly twice the gain on a winning one might lose sooner or later. Any way. I got to go now. Fascinating discussion. I will come later and see what I can find about this EA on the net.

ops! thanks, I was totally offtopic! About Leo Trader, the system looks really interesting. Volume looks being dependant on the pair trader. I will download the statement and plot it on the chart in order to have an idea of the money management! happy new year! David

it seems they have recently released a new license. also looks like they are trading diffrent pairs such as UDSJPY as well on different account.

Short EURUSD position still open since 30/12/2010

Originally posted by fxproOriginally posted by expertreviewIm not truly certain yet about this. Nevertheless, i have read that they've been uing 5% risk prior to Nov last year. I also intrested to see what they're utilizing now and if they are still on that 5% risk.Any 1 is been yet trading with this bot?

Hello and Happy new year to all.5%?? :D Isnt this too much risk taking for their trades? Anyway, Any strategy where the loss on a losing trade is almost twice the gain on a winning one, spells trouble. Black swan is precisely what occurs to 95% of traders, on equities or currencies or commodities ...

I don't totally agree with you. It's true, that most people are not comfortable with a strategy that has a stop loss bigger than the take profit (including me). But this information is not to be taken alone. We have to combine it with the ratio of winning trades against losing trades...

finally yesterday, the EURUSD is been closed with profit. No new trade yet.

Originally posted by paradiseI don't totally agree with you. It's true, that most people are not comfortable with a strategy that has a stop loss bigger than the take profit (including me). But this information is not to be taken alone. We have to combine it with the ratio of winning trades against losing trades...

I do also belive on that. However, i dont think we should rely very much on it in case there is no stop loss. Otherwise,you will need around 66% win ration in the strategy. 66% ... x=win% to win 1 usd 1-x=lose% and lose 2 usd 1*x +[(1-x)*-2] 0 when x2/3 = 66% the only issue here is, what about after hundreds of trades, we see a correction in the market price? It will be a disaster.

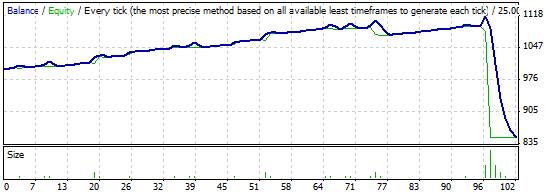

you are right. I have rechecked his history. It seems that the system doesn't only close on SL and TP. Sometimes it closes on a new SL and other trades, I believe, are closed manually. So any calculation would be misleading. I don't know if such an option is available at FXSTAT but it seems not. I got impressed with the low drawdown of this performance but it seems the drawdown is calculated based on balance. It would be more interesting to have a drawdown based on equity. That would change a lot of things! We will see a lot of performances rise and others fall.

What i mean is this:

I can open trades randomly and close any trade that goes into profit. Then, keep open any trade that is in the negative.

If I do that, I will have a 0% drawdown for as long as I can survive. A good shaped balance curve.... All this because the drawdown is based on balance, so it will only record closed trades.

I can keep on doing this until the day where one of my trades goes in deep drawdown and touches the margin call level.

Something like this: