Market Overview by FXCC

Forex Technical & Market Analysis FXCC Apr 18 2013

Weidmann opens the door to an ECB rate cut and foresees a lost decade in Europe

Jens Weidmann, the Bundesbank’s president, has affirmed that the European Central Bank could cut its interest rates if economic data continues worsening, according to an interview published by WSJ. Market has been speculating about the possibilities of the ECB cutting rates and now with inflation below the 2.0% it seems more than likely in May or June. However, Weidmann said the ECB “might adjust in response to new information," but he doesn’t “think that the monetary policy stance is the key issue."

"A point that I think is important to make, perhaps less for my central bank colleagues than for finance ministers,” Weidmann pointed, “is that the medication monetary policy makers administer only cures the symptoms and that it comes with side-effects and risks." In Weidmann's words, the important thing is the development of the reforms at the national and European level. The Bundesbank president also stated that the European recovery will take as much as a decade. The opinion is contrary to other European leaders who said that the worst of the crisis is over. "Overcoming the crisis and the crisis effects will remain a challenge over the next decade,” Weidmann affirmed.

https://support.fxcc.com/email/technical/18042013/

FOREX ECONOMIC CALENDAR :

24h | G20 Finance Ministers and Central Bank Governors Meeting

2013-04-18 08:30 GMT | UK. Retail Sales (YoY) (Mar)

2013-04-18 12:30 GMT | USA. Initial Jobless Claims (Apr 13)

2013-04-18 14:00 GMT | USA. Philadelphia Fed Manufacturing Survey (Apr)

FOREX NEWS :

2013-04-18 05:58 GMT | EUR/USD flat-lining around 1.3040/45

2013-04-18 03:58 GMT | BoC unlikely to hike rates until H2 2014 - Nomura

2013-04-18 03:17 GMT | Australia activity will soften into the June quarter – NAB

2013-04-18 01:59 GMT | China house prices continue to rise

EURUSD :

HIGH 1.3061 LOW 1.30207 BID 1.30491 ASK 1.30496 CHANGE 0.12% TIME 09:05:28

OUTLOOK SUMMARY : Down

TREND CONDITION : Downward penetration

TRADERS SENTIMENT : Bullish

IMPLIED VOLATILITY : Medium

MARKET ANALYSIS - Intraday Analysis

Upwards scenario: Price consolidates after the initial downtrend development yesterday. Price appreciation is possible above the next resistance level at 1.3061 (R1). Break here is required to enable intraday targets at 1.3081 (R2) and 1.3102 (R3). Downwards scenario: On the other hand, technically important supportive structure lies at 1.3001 (S1). If the price manages to overcome it, we would suggest next initial targets at 1.2979 (S2) and 1.2957 (S3) in perspective.

Resistance Levels: 1.3061, 1.3081, 1.3102

Support Levels: 1.3001, 1.2979, 1.2957

-------------------------

GBPUSD :

HIGH 1.52557 LOW 1.52328 BID 1.52532 ASK 1.52538 CHANGE 0.07% TIME 09:05:29

OUTLOOK SUMMARY : Down

TREND CONDITION : Downward penetration

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : Medium

Upwards scenario: GBPUSD maintained a negative near-term tone though recovery action is possible above the next visible resistance at 1.5270 (R1). Clearance here might initiate bullish pressure and validate our next targets at 1.5287 (R2) and 1.5304 (R3). Downwards scenario: On the downside our focus is shifted to the next support level at 1.5216 (S1). Loss here is required to push the price towards to our next interim targets at 1.5199 (S2) en route towards to final support at 1.5182 (S3)

Resistance Levels: 1.5270, 1.5287, 1.5304

Support Levels: 1.5216, 1.5199, 1.5182

USDJPY :

HIGH 98.367 LOW 97.634 BID 98.064 ASK 98.069 CHANGE -0.05% TIME 09:05:30

OUTLOOK SUMMARY : Neutral

TREND CONDITION : Sideway

TRADERS SENTIMENT : Bullish

IMPLIED VOLATILITY : Medium

Upwards scenario: Next visible fractal level locates at 98.44 (R1). Violation here is required to provide a signal of possible uptrend formation. In such case, resistances at 98.70 (R2) and 98.96 (R3) acts as next attractive points for the bullish oriented traders. Downwards scenario: Negative developments might be settled below the important support level at 97.81 (S1). Any price action below it would then be targeting support at 97.56 (S2) and final target could be exposed at 97.29 (S3) mark.

Resistance Levels: 98.44, 98.70, 98.96

Support Levels: 97.81, 97.56, 97.29

Source: FX Central Clearing Ltd,( FX Central Clearing Ltd )

Forex Technical & Market Analysis FXCC Apr 22 2013

Japan escapes censure on the G-20 meeting

he G-20 communiqué provied little fresh headlines to market participants, with the main take away on FX-relate news being the permissive stance towards Japan's monetary policies to beat deflation. The G20 communiqué is basically echoing the same position by the G7 back in February. As noted by Eamonn Sheridan of Forexlive: "Leading into the G20 meeting market concern was that Japan would come under fire for its deflation-fighting policies (which have, as a side-effect, a weaker yen or are have as a central component the aim of a weaker yen, depending on your point of view). It became clear on Friday that Japan had escaped censure from the G20 over its policies, a position made officially clear at the conclusion of the meetings."

The section in the G20 communique that makes references to currencies, stated: "We reiterate our commitments to move more rapidly toward more market-determined exchange rate systems and exchange rate flexibility to reflect underlying fundamentals, and avoid persistent exchange rate misalignments. We will refrain from competitive devaluation and will not target our exchange rates for competitive purposes, and we will resist all forms of protectionism and keep our markets open." It added: "We reiterate that excess volatility of financial flows and disorderly movements in exchange rates have adverse implications for economic and financial stability. Monetary policy should be directed toward domestic price stability and continuing to support economic recovery according to the respective mandates of central banks. We will be mindful of unintended negative side effects stemming from extended periods of monetary easing."

http://blog.fxcc.com/forex-technical...april-22-2013/

FOREX ECONOMIC CALENDAR :

2013-04-22 08:00 GMT | Switzerland. Monthly Statistical Bulletin

2013-04-22 12:30 GMT | USA. Chicago Fed National Activity Index (Mar)

2013-04-22 14:00 GMT | EMU. Consumer Confidence (Apr)Preliminar

2013-04-22 14:00 GMT | USA. Existing Home Sales Change (MoM) (Mar)

FOREX ECONOMIC CALENDAR :

2013-04-22 04:41 GMT | USD/JPY marches towards 100.00, BOJ rate decision due out end of week

2013-04-22 04:01 GMT | USD and Yen ease post-G20; Napolitano reelected

2013-04-22 03:23 GMT | Prefer to keep selling GBP/USD – RBS

2013-04-22 02:52 GMT | EUR/USD drifting sideways as range bound behavior continues

-----------------------------------------------------------------

Forex Technical Analysis EURUSD :

MARKET ANALYSIS – Intraday Analysis

Upwards scenario: Market remains sideways oriented. Next hurdle on the upside might be found at 1.3084 (R1). Break here would open road towards to our interim aim at 1.3097 (R2) and enable final intraday resistive measure at 1.3110 (R3). Downwards scenario: Failure to establish positive bias today might lead to the recovery action in near term perspective. Next immediate support locates at 1.3046 (S1). Break here is required to enable bearish pressure towards to our targets at 1.3033 (S2) and 1.3020 (S3).

Resistance Levels: 1.3084, 1.3097, 1.3110

Support Levels: 1.3046, 1.3033, 1.3020

--------------------------------------------------------------

Forex Technical Analysis GBPUSD :

Upwards scenario: Upside risk aversion is seen above the next resistance level at 1.5251 (R1). Appreciation above it might lead to the positive intraday bias formation towards to our next targets at 1.5269 (R2) and 1.5287 (R3). Downwards scenario: Negative tendency development might occur below the key support level at 1.5216 (S1). Break here would open road towards to next supportive measure at 1.5198 (S2) and then final supportive bastion could be found at 1.5180 (S3).

Resistance Levels: 1.5251, 1.5269, 1.5287

Support Levels: 1.5216, 1.5198, 1.5180

------------------------------------------------------------

Forex Technical Analysis USDJPY :

Upwards scenario: Intraday market sentiment is shifted to the negative side after the losses provided during the Asian session, however market appreciation is possible above the next resistance at 99.89 (R1). Loss here would suggest next intraday targets at 100.19 (R2) and 100.49 (R3). Downwards scenario: Possibility of the price depreciation is seen below the next support level at 99.37 (S1). Break here could provide sufficient momentum and expose our next intraday targets at 99.05 (S2) and 98.75 (S3).

Resistance Levels: 99.89, 100.19, 100.49

Support Levels: 99.37, 99.05, 98.75

Source: FX Central Clearing Ltd,( Forex Trading System | Forex Trading Software | Best ECN Broker | FXCC )

Forex Technical & Market Analysis FXCC Apr 23 2013

Slovenia Bailout Would Be Spanish-Cypriot Mongrel

The ink on the provisional bailout agreement for Cyprus was hardly dry last month before bond markets shifted their attention to Slovenia, another small euro- area country with a banking problem. The Slovenian government’s borrowing costs subsequently shot up. The fear that Slovenia might be the next Cyprus, with international creditors again forcing losses onto bank bondholders and uninsured depositors, is only partly justified. Slovenia isn’t Cyprus, and its rescue program, when it comes, will probably look like a hybrid between the Spanish-style bailout and the Cyprus-style bail-in.

https://support.fxcc.com/email/technical/23042013/

FOREX ECONOMIC CALENDAR :

2013-04-23 07:28 GMT | Germany. Markit Manufacturing PMI

2013-04-23 07:58 GMT | EMU. Markit Manufacturing PMI

2013-04-23 14:00 GMT | US. New Home Sales

2013-04-23 21:00 GMT | NZ. RBNZ Interest Rate Decision

FOREX ECONOMIC CALENDAR :

2013-04-23 04:19 GMT | Upcoming economic data the catalyst for EUR/USD?

2013-04-23 04:08 GMT | USD remains our currency of choice - JPMorgan

2013-04-23 03:29 GMT | EUR/JPY consolidates around 129.00 support, Eur PMI on tap

2013-04-23 02:52 GMT | USD/JPY breaks below 99.00 bids

--------------------------

EURUSD :

HIGH 1.30677 LOW 1.30328 BID 1.30415 ASK 1.30419 CHANGE -0.19% TIME 08 : 40:20

OUTLOOK SUMMARY : Neutral

TREND CONDITION : Sideway

TRADERS SENTIMENT : Bullish

IMPLIED VOLATILITY : Medium

MARKET ANALYSIS - Intraday Analysis

Upwards scenario: EURUSD determined clear sideways tone on the medium-term timeframe. Possibility of market appreciation is seen above the resistance level at 1.3056 (R1). Break here is required to validate next targets at 1.3069 (R2) and 1.3082 (R3). Downwards scenario: Fresh portion of the economic data releases might increase volatility later on today. The 1.3032 (S1) mark is key support level on the downside. Below here is a route towards to next supports at 1.3019 (S2) and 1.3005 (S3).

Resistance Levels: 1.3056, 1.3069, 1.3082

Support Levels: 1.3032, 1.3019, 1.3005

----------------------------

GBPUSD :

HIGH 1.52979 LOW 1.52544 BID 1.52593 ASK 1.52598 CHANGE -0.2% TIME 08 : 40:21

OUTLOOK SUMMARY : Neutral

TREND CONDITION : Downward penetration

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : Medium

Upwards scenario: Neutral tone remains in power on the hourly chart frame. Next resistance is seen at 1.5280 (R1). Clearance here is required for instrument strengthening towards to our initial targets at 1.5297 (R2) and 1.5312 (R3). Downwards scenario: If the price failed to overcome our next resistance level we expect market easing below the support level at 1.5248 (S1). Loss here would shift our technical outlook to the bearish side with expected targets at 1.5232 (S2) and 1.5216 (S3).

Resistance Levels: 1.5280, 1.5297, 1.5312

Support Levels: 1.5248, 1.5232, 1.5216

-----------------------

USDJPY :

HIGH 99.384 LOW 98.589 BID 98.693 ASK 98.695 CHANGE -0.53% TIME 08 : 40:22

OUTLOOK SUMMARY : Down

TREND CONDITION : Downward penetration

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : Medium

Upwards scenario: USDJPY trades under the bearish pressure today and posting new local lows. Though break above the resistance at 99.35 (R1) would suggest next interim target at 99.73 (R1) en route towards to final aim at 100.13 (R3). Downwards scenario: On the other hand, an element of supportive measures is found at 98.53 (S1). Clearance here would suggest further downtrend development towards to possible targets at 98.16 (S2) and 97.76 (S3).

Resistance Levels: 99.35, 99.73, 100.13

Support Levels: 98.53, 98.16, 97.76

Source: FX Central Clearing Ltd,( Automated Forex Trading System | Best ECN Forex Brokers | FXCC )

Forex Technical & Market Analysis FXCC Apr 24 2013

Spain might get EU deficit target extension

The EU signalized on Tuesday that Spain might be granted two more years to reach the deficit target. Additionally, the President of the European Commission José Manuel Durão Barroso said yesterday that 2013 deficit targets for other EU countries could also be eased. EU sources suggested that the European Commission could allow Spain to have a budget deficit of 6.5% this year and that deadline for it to reach 3% could be extended by two more years. Barroso said that the correction of budgetary imbalances in Greece, Portugal and Spain has been very impressive and that the European Commission is considering extending the deadlines for the correction of excessive deficits also for other EU Member States, as the objective is to combine the adjustment of deficits and debt with growth in the short term.

Yesterday weak German PMI data release (47.9 actual vs. 49.1 estimates) fueled more talk of possible ECB rate cuts in the coming months. Although the EURUSD did close below the 1.3000 level, some analysts found the lack of follow through to the downside impressive and believe the key will be to see how it reacts to data in coming sessions. The main report due out today will be the German IFO which is released at 8:00 GMT. Economic data out of the UK is light in the coming session, with Mortgage Approvals due out at 8:30 GMT. The US session will also be fairly quiet with Durable Goods due out at 12:30 GMT.

https://support.fxcc.com/email/technical/24042013/

FOREX ECONOMIC CALENDAR :

2013-04-24 08:00 GMT | Germany. IFO - Business Climate

2013-04-24 08:30 GMT | UK. BBA Mortgage Approvals

2013-04-24 12:30 GMT | USA. Durable Goods Orders

2013-04-24 20:15 GMT | Canada. BoC Governor Mark Carney Speech

FOREX ECONOMIC CALENDAR :

2013-04-24 04:26 GMT | EUR/USD pressured by German PMI data, German IFO on tap next

2013-04-24 03:08 GMT | GBP/USD still forming possible “bear flag” on daily chart

2013-04-24 02:25 GMT | AUD/JPY still range bound after Aussie CPI data disappoints

2013-04-24 02:09 GMT | NZD/USD eases below 0.8450

----------------------------

EURUSD :

HIGH 1.30104 LOW 1.29882 BID 1.30053 ASK 1.30059 CHANGE 0.03% TIME 08:44:38

OUTLOOK SUMMARY : Down

TREND CONDITION : Downward penetration

TRADERS SENTIMENT : Bullish

IMPLIED VOLATILITY : Medium

MARKET ANALYSIS - Intraday Analysis

Upwards scenario: Instrument gained momentum on the downside recently, turning short-term bias to the negative side. However upwards penetration above the resistance at 1.3012 (R1) would enable bullish forces and might drive market price towards to our initial targets at 1.3031 (R2) and 1.3051 (R3). Downwards scenario: Fresh low formed today offers an important supportive mark at 1.2987 (S1). Depreciation below it might shift medium-term tendency to the bearish side and validate our next intraday targets at 1.2970 (S2) and 1.2953 (S3).

Resistance Levels: 1.3012, 1.3031, 1.3051

Support Levels: 1.2987, 1.2970, 1.2953

----------------------------

GBPUSD :

HIGH 1.52502 LOW 1.52265 BID 1.52483 ASK 1.52491 CHANGE 0.08% TIME 08:44:38

OUTLOOK SUMMARY : Neutral

TREND CONDITION : Sideway

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : Medium

Upwards scenario: Upside formation is limited now to the next resistive barrier at 1.5253 (R1). Clearance here is required to provide a space for a move towards to next target at 1.5267 (R2) and then final aim would be 1.5282 (R3). Downwards scenario: On the other side, any prolonged movement below the support at 1.5225 (S1) might enable downside forces and drive market price towards to supportive means at 1.5211 (S2) and 1.5197 (S3) later on today

Resistance Levels: 1.5253, 1.5267, 1.5282

Support Levels: 1.5225, 1.5211, 1.5197

----------------------------

USDJPY :

HIGH 99.761 LOW 99.193 BID 99.386 ASK 99.391 CHANGE -0.06% TIME 08:44:39

OUTLOOK SUMMARY : Up

TREND CONDITION : Upward penetration

TRADERS SENTIMENT : Bullish

IMPLIED VOLATILITY : Medium

Upwards scenario: USDJPY trapped to the consolidation phase after the upside development. Fresh high at 99.77 (R1) offers a good resistance level. Break here is required to take the pair towards to initial targets at 100.13 (R2) and 100.48 (R3). Downwards scenario: On the other hand, prolonged movement below the initial support level at 99.15 (S1) might trigger protective orders execution and drive market price towards to supportive means at 98.77 (S2) and 98.40 (S3).

Resistance Levels: 99.77, 100.13, 100.48

Support Levels: 99.15, 98.77, 98.40

Source: FX Central Clearing Ltd,( ECN Exchange Market FX Brokers | Forex Blog | Currency Converter | FXCC )

Forex Technical & Market Analysis FXCC Apr 25 2013

Enrico Letta named Italian PM

Italian President Giorgio Napolitano, who was reelected to the post last weekend, has given the mandate to form a government to center-left deputy leader Enrico Letta on Wednesday.After accepting the nomination the new Italian Prime Minister said that he would form "a government of service to the country." He stressed that politics in Italy should regain credibility in order to make head against the crisis. He said that the situation in Italy was very difficult at the moment and that the most urgent issues which should be addressed were unemployment, poverty and problems faced by small businesses. He suggested that the Eurozone should not press so much for austerity and rather focus on boosting growth in the area. 46 year old Enrico Letta is the second youngest Prime Minister in the history of Italian politics. He is the nephew of Gianni Letta, Silvio Berlusconi's close ally and despite his young age he has extensive government experience (he held various ministerial positions in the Italian government and served as a Member of the European Parliament for the North-East region) The cabinet formed by Letta will receive support mainly from Berlusconi's People of Freedom (PDL) party, Letta's Democratic Party (PD) and Mario Monti's centrist Civic Choice.

http://blog.fxcc.com/forex-technical...april-25-2013/

FOREX ECONOMIC CALENDAR :

2013-04-25 08:30 GMT | UK. Gross Domestic Product

2013-04-25 12:30 GMT | USA. US Initial Jobless Claims

2013-04-25 14:00 GMT | USA. Treasury Sec Lew Speech

2013-04-25 23:30 GMT | Japan. National Consumer Price Index

FOREX ECONOMIC CALENDAR :

2013-04-25 05:04 GMT | Window still open for the Yen to recover – JPMorgan

2013-04-25 04:31 GMT | EUR/USD – Will next week’s ECB Rate decision end the range bound behavior?

2013-04-25 03:28 GMT | GBP/USD buoyed by Verizon/Vodafone buzz

2013-04-25 02:25 GMT | AUD/USD drifting higher towards resistance at 1.0345

--------------------------------------------------------

Forex Technical Analysis EURUSD

MARKET ANALYSIS – Intraday Analysis

Upwards scenario: Retracement action is reasonable scenario for EURUSD today. Our focus is shifted to the key resistive barrier at 1.3061 (R1). If the price manages to overcome it we would suggest next intraday targets at 1.3079 (R2) and 1.3096 (R3). Downwards scenario: Possible downside expansion would attack our support levels at 1.3017 (S2) and 1.3000 (S3). However prior reaching our targets, market should manage to overcome key resistive structure at 1.3034 (S1).

Resistance Levels: 1.3061, 1.3079, 1.3096

Support Levels: 1.3034, 1.3017, 1.3000

------------------------------------------------------------

Forex Technical Analysis GBPUSD

Upwards scenario: The recent price acceleration on the upside suggests a possible move higher. Next on tap is resistive barrier at 1.5334 (R1) on the way towards to higher targets at 1.5347 (R2) and 1.5361 (R3). Downwards scenario: On the other hand, if the price failed to gain momentum on the upside we expect retest of our next support level at 1.5298 (S1). Clearance here is required to keep the downside extension intact and enable our lower targets at 1.5285 (S2) and 1.5270 (S3).

Resistance Levels: 1.5334, 1.5347, 1.5361

Support Levels: 1.5298, 1.5285, 1.5270

------------------------------------------------------------

Forex Technical Analysis USDJPY

Upwards scenario: Measures of resistance might be activating when the pair approaches the 99.77 (R1) mark. Break here would suggest next interim target at 100.13 (R2) and If the price keeps its momentum we expect an exposure of 100.48 (R3). Downwards scenario: Signal of instrument depreciation would be created below the next support level at 99.15 (S1). In such case we would suggest next interim target at 98.77 (S2) and then our final aim at 98.40 (S3).

Resistance Levels: 99.77, 100.13, 100.48

Support Levels: 99.15, 98.77, 98.40

Source: FX Central Clearing Ltd,( http://www.fxcc.com )

Forex Technical & Market Analysis FXCC Apr 26 2013

All eyes on the ECB

This week's data releases were disappointing on balance. While economic numbers in the US and China continued to come in on a weak(er) note, the eurozone's business climate readings failed to improve again. The UK's GDP report, however, was a nice exception, showing that the economy returned to growth earlier this year. With German business sentiment figures down again (but overall still signaling growth), the French numbers pretty mixed at low levels and Italy's reading (to be released next Thursday) likely up from depressed lows, EMU-wide sentiment does not show signs of recovery after the weakness of the last two months. This should further challenge the ECB's expectations of a stabilization in activity in 1H13 followed by a gradual recovery in the second half of the year. Coupled with recent dovish remarks from Council members and the "lively debate" during the last meeting, this indicates that the central bank should cut the refi rate (but not the deposit rate) by 25bp within the next five weeks. The exact timing of the rate cut is a close call. But our guess is that June is more likely than May, also because the ECB will have the 1Q13 GDP numbers at hand and will have finished its macroeconomic update procedure by then.

https://support.fxcc.com/email/technical/26042013/

N/A | Japan. BoJ Interest Rate Decision

2013-04-26 08:00 GMT | Switzerland. SNB Chairman Jordan Speech

2013-04-26 12:30 GMT | USA. Gross Domestic Product Annualized

2013-04-26 13:55 GMT | USA. US Reuters/Michigan Consumer Sentiment Index

2013-04-26 04:54 GMT | USD/JPY dives lower after Bank of Japan monetary policy release

2013-04-26 04:07 GMT | EUR/USD choppy trade continues, ECB meeting on tap next week

2013-04-26 02:14 GMT | AUD/USD higher on weaker USD and stronger commodities

2013-04-26 02:14 GMT | US Dollar leaking lower during Asia trade

EURUSD :

HIGH 1.30474 LOW 1.29977 BID 1.30294 ASK 1.30301 CHANGE 0.14% TIME 08:45:17

OUTLOOK SUMMARY : Neutral

TREND CONDITION : Upward penetration

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : Medium

MARKET ANALYSIS - Intraday Analysis

Upwards scenario: Price stabilized after the yesterday depreciation. Today we see potential to overcome our next resistance level at 1.3049 (R1). Clearance here might pull the pair towards to eventual targets at 1.3066 (R2) and 1.3082 (R3). Downwards scenario: On the other hand, market bias remains negative. Risk of further decline is seen below the key support level at 1.3017 (S1). Break here is required to validate lower targets at 1.3000 (S2) and 1.2982 (S3).

Resistance Levels: 1.3049, 1.3066, 1.3082

Support Levels: 1.3017, 1.3000, 1.2982

--------------------------

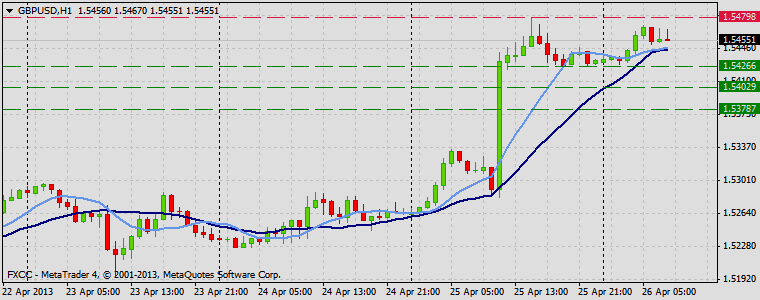

GBPUSD :

HIGH 1.54716 LOW 1.54287 BID 1.54539 ASK 1.54546 CHANGE 0.14% TIME 08:45:17

OUTLOOK SUMMARY : Up

TREND CONDITION : Up trend

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : Medium

Upwards scenario: Current price setup is looking for upwards extension possibility. Risk of the price acceleration is seen above the key resistance level at 1.5479 (R1). Clearance here would put immediate focus on the next targets at 1.5502 (R2) and then 1.5524 (R3). Downwards scenario: Bearish pressure might push the price below the support at 1.5426 (S1). Further correction development would open road towards to next target at 1.5402 (S2) and any further losses would then be limited to 1.5378 (S3) mark.

Resistance Levels: 1.5479, 1.5502, 1.5524

Support Levels: 1.5426, 1.5402, 1.5378

-----------------

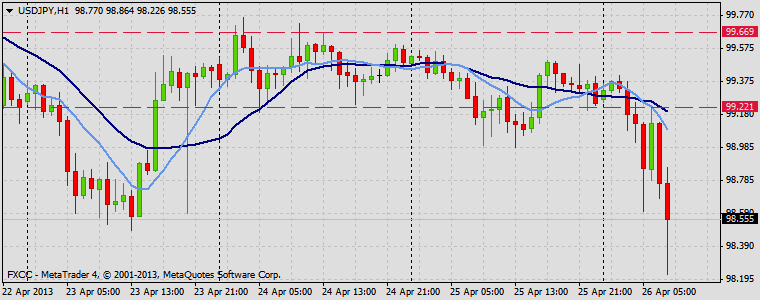

USDJPY :

HIGH 99.411 LOW 98.225 BID 98.552 ASK 98.559 CHANGE -0.7% TIME 08:45:18

OUTLOOK SUMMARY : Down

TREND CONDITION : Downward penetration

TRADERS SENTIMENT : Bullish

IMPLIED VOLATILITY : Medium

Upwards scenario: Price accelerates on the downside though chance of market appreciation is seen above the key resistance at 99.22 (R1). Next targets could be found 99.66 (R2) and 100.07 (R3). Downwards scenario: As long as price stays below the next resistance level our medium-term outlook would be negative. Next on tap is support level at 98.17 (S1). Penetration below this mark would suggest next targets at 97.78 (S2) and 97.39 (S3).

Resistance Levels: 99.22, 99.66, 100.07

Support Levels: 98.17, 97.78, 97.39

Source: FX Central Clearing Ltd,( Forex Trading News | Forex Demo Account | Currency Converter | FXCC )

Forex Technical & Market Analysis FXCC Apr 29 2013

EUR/USD – The week we’ve all been waiting for? ECB and Fed meetings on tap

EUR/USD has started the week off on a strong note, benefiting from the headlines that Enrico Letta has been elected as the new Italian Prime Minister. At one point earlier in the session, the pair had traded as high as 1.3068, but is now back to consolidating near the opening print of 1.3050. According to analysts at FXStreet.com, “After two months of an irreconcilable political deadlock, Enrico Letta, 46, and member of the centre-left Democratic Party (PD), was sworn in as new Italian Prime Minister on Sunday. Letta, who has managed to pull together a 21-member Cabinet, while becoming the third youngest Prime Minister since World War II, nominated an unprecedented seven women to his Cabinet. Fabrizio Saccomanni was appointed finance minister, taking on the responsibility to overlook and bring forward much needed economic reforms to the economy.”

The main event later this week will be the upcoming ECB Monetary Policy meeting on May 2nd at 11:45 GMT. Analysts have been pointing to the weak economic data from Germany, and continued dovish comments from ECB officials as a good reason to expect an adjustment to current policy.

http://blog.fxcc.com/forex-technical...april-29-2013/

FOREX ECONOMIC CALENDAR :

2013-04-29 12:00 GMT DE. Consumer Price Index (YoY) (Apr)Preliminar

2013-04-29 12:00 GMT DE. Consumer Price Index (MoM) (Apr)Preliminar

2013-04-29 12:00 GMT DE. Harmonised Index of Consumer Prices (MoM) (Apr)Preliminar

2013-04-29 12:00 GMT DE. Harmonised Index of Consumer Prices (YoY) (Apr)Preliminar

FOREX NEWS :

2013-04-29 04:14 GMT EUR/USD – The week we’ve all been waiting for? ECB and Fed meetings on tap

2013-04-29 03:58 GMT AUD/USD to stay near 1.05 next few quarters

2013-04-29 03:04 GMT USD/JPY continues to trade lower, breaks through initial support of 97.55

2013-04-29 00:31 GMT GPB/USD adds to gains during Asia session

-----------

Forex Technical Analysis EURUSD :

MARKET ANALYSIS – Intraday Analysis

Upwards scenario: We are not expecting significant volatility increase today however upside risk aversion is seen above the next resistance level at 1.3076 (R1). Price evaluation above this level would suggest next targets at 1.3094 (R2) and 1.3111 (R3). Downwards scenario: Price regress below the support level at 1.3037 (S1) would increase likelihood of failing towards to our key supportive barrier at 1.3026 (S2) and any further market decline would then be targeting final support for today at 1.3014 (S3).

Resistance Levels: 1.3076, 1.3094, 1.3111

Support Levels: 1.3037, 1.3026, 1.3014

--------------

Forex Technical Analysis GBPUSD :

Upwards scenario: On the upside potential is seen for a break above the resistance at 1.5525 (R1). In such case we would suggest next target at 1.5546 (R2) and any further rise would then be limited to final resistance at 1.5571 (R3). Downwards scenario: Further correction development is limited now to 1.5481 (S1). If the price manages to surpass it we would suggest next intraday targets at 1.5454 (S2) and 1.5426 (S3).

Resistance Levels: 1.5525, 1.5546, 1.5571

Support Levels: 1.5481, 1.5454, 1.5426

-----------

Forex Technical Analysis USDJPY :

Upwards scenario: Market comfortably moves in descending channel formation on the hourly chart. If pair gains momentum on the upside and overcome our next resistance at 97.97 (R1), we would suggest next resistances at 98.16 (R2) and 98.34 (R3) as intraday targets. Downwards scenario: On the other hand, successful retest of our next support level at 97.45 (S1) might provide sufficient momentum for the price acceleration towards to interim target at 97.27 (S2). Final aim for today locates at 97.08 (S3).

Resistance Levels: 97.97, 98.16, 98.34

Support Levels: 97.45, 97.27, 97.08

Source: FX Central Clearing Ltd,( Best ECN Forex Brokers | Forex ECN Broker Software | FXCC )

Forex Technical & Market Analysis FXCC May 01 2013

FOMC Meeting -- a major catalyst or non-event?

The EUR/USD finished the day sharply higher, closing up 0.55% at 1.3166. Intra-day the pair traded as high as 1.3186 but was once again unable to take out the 1.3200 level. All eyes will be on the upcoming US session, with both Construction Spending and ISM Manufacturing PMI due out at 14:00 GMT. Following this data, we will get the Federal Reserve Monetary Policy statement at 18:00GMT. However, with all the hype surrounding the upcoming economic data due out of the US, some analysts are saying not to look too much into the release and the effect on the US Dollar might be minimal.

According to Kathy Lien of BK Asset Management, “Given the recent disappointments in economic data, it will be very difficult for the hawks inside the Fed to justify hardening their call for a rate cut. In contrast, the doves will sing louder about the need for maintain the current level of stimulus. However none of these discussions are likely to appear in the FOMC statement.

https://support.fxcc.com/email/technical/01052013/

FOREX ECONOMIC CALENDAR :

2013-05-01 14:00 GMT : USA.ISM Manufacturing PMI (Apr)

2013-05-01 18:00 GMT : USA.Fed Interest Rate Decision (May 1)

2013-05-01 18:00 GMT : USA.Fed's Monetary Policy Statement and press conference

2013-05-01 23:50 GMT : JP.BoJ Monetary Policy Meeting Minutes

FOREX NEWS :

2013-05-01 03:29 GMT : GBP/USD finishes higher for a fifth straight day, closes April +1.41%

2013-05-01 02:40 GMT : AUD/JPY still forming “pennant” pattern on daily chart

2013-05-01 01:53 GMT : EUR/USD quiet during Asia session, resistance at 1.3200 remains in focus

2013-05-01 01:13 GMT : AUD/USD near highs after China PMI

EURUSD :

HIGH 1.3179 LOW 1.31603 BID 1.31643 ASK 1.31649 CHANGE -0.02% TIME 08:13:27

OUTLOOK SUMMARY :

TREND CONDITION : Up trend

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : High

MARKET ANALYSIS - Intraday Analysis

Upwards scenario: Neutral hourly studies point towards further consolidation, with a break of next resistive structure at 1.3185 (R1) is required to spark stronger upside action. In such scenario we would suggest our next initial targets at 1.3213 (R2) and 1.3239 (R3). Downwards scenario: Next support level is seen at 1.3156 (S1), any penetration below it might activate downside pressure and enable lower target at 1.3120 (S2). Any further market decline would then be limited to 1.3084 (S3).

Resistance Levels: 1.3185, 1.3213, 1.3239

Support Levels: 1.3156, 1.3120, 1.3084

-----------------------

GBPUSD :

HIGH 1.55468 LOW 1.55262 BID 1.55344 ASK 1.55353 CHANGE 0.03% TIME 08:13:27

OUTLOOK SUMMARY :

TREND CONDITION : Up trend

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : High

Upwards scenario: On the upside potential is seen for a break above the resistance at 1.5563 (R1). In such case we would suggest next target at 1.5590 (R2) and any further rise would then be limited to final resistance at 1.5629 (R3). Downwards scenario: Successful retest of our next support level at 1.5527 (S1) might provide sufficient momentum for the price acceleration towards to interim target at 1.5507 (S2). Final aim for today locates at 1.5481 (S3).

Resistance Levels: 1.5563, 1.5590, 1.5629

Support Levels: 1.5527, 1.5507, 1.5481

------------------------

USDJPY :

HIGH 97.465 LOW 97.049 BID 97.276 ASK 97.280 CHANGE -0.14% TIME 08 : 13:28

OUTLOOK SUMMARY : Down

TREND CONDITION : Down trend

TRADERS SENTIMENT : Bullish

IMPLIED VOLATILITY : High

Upwards scenario: Possibility of market strengthening is seen above the immediate resistive barrier at 97.42 (R1). Price extension above it is required to validate our next intraday targets at 97.61 (R2) and 97.82 (R3). Downwards scenario: If the price manages to overcome our next support barrier at 97.11 (S1), we expect to see further market decline towards to our next target at 96.89 (S2) and then next stop could be found at 96.70 (S3) mark.

Resistance Levels: 97.42, 97.61, 97.82

Support Levels: 97.11, 96.89, 96.70

Source: FX Central Clearing Ltd,( Forex Blog | Best Forex Trading Platform | Top ECN Forex Broker | FXCC )

)Forex Technical & Market Analysis FXCC May 02 2013

Will the ECB Kill the EUR Rally?

The euro has performed extremely well leading up to Thursday's European Central Bank monetary policy announcement. In fact, it may be hard for some investors to believe that the majority of economists are looking for the ECB to cut interest rates by 25bp. Traditionally, expectations for easier monetary policy is negative for a currency but in the case of the euro, since the central bank started dropping hints about the potential for lower rates and economic data confirmed the need for more stimulus, the euro appreciated in value, rising to its highest level against the U.S. dollar in 2 months today.

The European Central Bank has done a great job of setting expectations for this month's monetary policy meeting. They are known for preparing the market for any upcoming changes in policy with the hopes of minimizing volatility when the actual change is made. Since the last meeting, we have heard consistently cautious comments from policymakers who all sound as if they are warming to idea of more stimulus if data warrants it and it certainly does given the widespread weakness in German business, consumer and investor confidence along with the decline in manufacturing and service activity. - https://support.fxcc.com/email/technical/02052013/

FOREX ECONOMIC CALENDAR :

2013-05-02 11:45 GMT | EU.ECB Interest Rate Decision (Apr 2)

2013-05-02 12:30 GMT | USA.Initial Jobless Claims (Apr 26)

2013-05-02 12:30 GMT | USA.Trade Balance (Mar)

2013-05-02 23:30 GMT | AUS.AiG Performance of Services Index (Apr)

FOREX NEWS :

2013-05-02 03:00 GMT | GBP/USD - Another day of gains, but unable to take out 1.5600 resistance

2013-05-02 02:23 GMT | AUD/USD continues to lose ground in Asia session

2013-05-02 00:43 GMT | EUR/USD forms a false break at 1.32

2013-05-02 00:08 GMT | USD/JPY slips to session lows post-BoJ minutes

EURUSD :

HIGH 1.31898 LOW 1.31662 BID 1.31709 ASK 1.31713 CHANGE -0.07% TIME 08 : 12:16

OUTLOOK SUMMARY : Down

TREND CONDITION : Up trend

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : High

MARKET ANALYSIS - Intraday Analysis

Upwards scenario: Next barrier on the upside lie at 1.3185 (R1). Surpassing of this level might enable our initial target at 1.3213 (R2) and any further gains would then be limited to last resistive structure at 1.3239 (R3). Downwards scenario: On the other hand, successful retest of our next support level at 1.3156 (S1) might provide sufficient momentum for the price acceleration towards the interim target at 1.3120 (S2). Final aim for today locates at 1.3084 (S3).

Resistance Levels: 1.3185, 1.3213, 1.3239

Support Levels: 1.3156, 1.3120, 1.3084

GBPUSD :

HIGH 1.55724 LOW 1.55409 BID 1.55475 ASK 1.55483 CHANGE -0.05% TIME 08 : 12:17

OUTLOOK SUMMARY : Down

TREND CONDITION : Downward penetration

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : High

Upwards scenario: Possibility of market strengthening is seen above the immediate resistive barrier at 1.5573 (R1). Price extension above it is required to validate our next intraday targets at 1.5598 (R2) and 1.5629 (R3). Downwards scenario: If the price manages to overcome our next support barrier at 1.5527 (S1), we expect to see further market decline towards to our next target at 1.5507 (S2) and then next stop could be found at 1.5481 (S3) mark.

Resistance Levels: 1.5573, 1.5598, 1.5629

Support Levels: 1.5527, 1.5507, 1.5481

USDJPY :

HIGH 97.422 LOW 97.088 BID 97.191 ASK 97.195 CHANGE -0.21% TIME 08 : 12:18

OUTLOOK SUMMARY : Down

TREND CONDITION : Sideway

TRADERS SENTIMENT : Bullish

IMPLIED VOLATILITY : High

Upwards scenario: Pair has settled sideways formation on the hourly timeframe. However potential to move higher is seen above the resistance level at 97.42 (R1) mark. Loss here would suggest next intraday targets at 97.61 (R2) and 97.82 (R3). Downwards scenario: On the other hand, our next support level aligns at 97.11 (S1) and possible price regress below it might encounter downside rally. In such scenario we would suggest next intraday targets to be placed at 96.89 (S2) and 96.70 (S3).

Resistance Levels: 97.42, 97.61, 97.82

Support Levels: 97.11, 96.89, 96.70

Source: FX Central Clearing Ltd,( Forex ECN Broker | Forex Trading Blog | Forex Software | FXCC )

Forex Technical & Market Analysis FXCC May 03 2013

Sustainability of Dollar Rally Hinges on Payrolls

With the European Central Bank's monetary policy announcement behind us, the focus of the forex market will now turn to the non-farm payrolls report. The newly delivered stimulus from the ECB and the better than expected U.S. jobless claims report boosted the attractiveness of the U.S. dollar against all major currencies. Whether or not the sell-off in the EUR/USD and rally in USD/JPY can be sustained will hinge on Friday's non-farm payrolls report. This week's FOMC statement tell us that that Federal Reserve officials aren't overly concerned about the health of the labor market as they completely ignored last month's sharp drop in payrolls, choosing instead to repeat that the labor market is improving.

They better be right or else the dollar and U.S. stocks for that matter will come crashing down. Currently economists are looking for payrolls to rise by 140K in April, up from 88K in March. The drop in jobless claims and consumer confidence supports a stronger release and we believe that as long as payrolls rise by 150K or more, the dollar will rally. By cutting interest rates today and signaling that they are prepared to do more, the ECB has set a low bar for tomorrow's NFP release.

https://support.fxcc.com/email/technical/03052013/

FOREX ECONOMIC CALENDAR :

2013-05-03 12:30 GMT | USA.Nonfarm Payrolls (Apr)

2013-05-03 12:30 GMT | USA.Average Hourly Earnings (MoM)/(YoY) (Apr)

2013-05-03 12:30 GMT | USA.Unemployment Rate (Apr)

2013-05-03 14:00 GMT | CAD.Factory Orders (MoM) (Mar)

FOREX NEWS :

2013-05-03 02:50 GMT | GBP/USD ends six day winning streak, fails again at 1.5600 resistance

2013-05-03 02:12 GMT | GBP/JPY closes higher but remains in consolidation on daily chart

2013-05-03 01:22 GMT | AUD/NZD pressing lower against 1.2050 level

2013-05-03 01:02 GMT | EUR/USD volatile day ends with sharply lower close

------------------------------

EURUSD :

HIGH 1.30775 LOW 1.30555 BID 1.30710 ASK 1.30715 CHANGE 0.05% TIME 08 : 19:12

OUTLOOK SUMMARY : Down

TREND CONDITION : Upward penetration

TRADERS SENTIMENT : Bullish

IMPLIED VOLATILITY : High

MARKET ANALYSIS - Intraday Analysis

Upwards scenario: On the upside potential is seen for a break above the resistance at 1.3084 (R1). In such case we would suggest next target at 1.3120 (R2) and any further rise would then be limited to final resistance at 1.3156 (R3). Downwards scenario: Further correction development is limited now to the session low - 1.3057 (S1). If the price manages to surpass it we would suggest next intraday targets at 1.3037 (S2) and 1.3016 (S3).

Resistance Levels: 1.3084, 1.3120, 1.3156

Support Levels: 1.3057, 1.3037, 1.3016

------------------------

GBPUSD :

HIGH 1.55408 LOW 1.552 BID 1.55240 ASK 1.55248 CHANGE -0.06% TIME 08 : 19:13

OUTLOOK SUMMARY : Down

TREND CONDITION : Downward penetration

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : High

Upwards scenario: Possibility of market strengthening is seen above the resistance level at 1.5573 (R1). Clearance here is required to validate next interim target at 1.5598 (R2) and any further rise would then be targeting mark at 1.5629 (R3). Downwards scenario: We would shift our short-term technical outlook to the negative if the price manage to penetrate below the key support at 1.5522 (S1). Loss here would suggest next initial targets at 1.5489 (S2) and 1.5448 (S3).

Resistance Levels: 1.5573, 1.5598, 1.5629

Support Levels: 1.5522, 1.5489, 1.5448

-------------------------

USDJPY :

HIGH 98.052 LOW 97.881 BID 97.987 ASK 97.991 CHANGE 0.05% TIME 08 : 19:14

OUTLOOK SUMMARY :

TREND CONDITION : Upward penetration

TRADERS SENTIMENT : Bullish

IMPLIED VOLATILITY : High

Upwards scenario: Next actual resistance level is seen at 98.15 (R1). If the market manages to surge higher, our focus would returned to the next target at 98.51 (R2) and further recovery action could be exhausted at 98.85 (R3) intraday. Downwards scenario: Any downside extension is limited now to the next support level at 97.82 (S1). Break here is required to open a route towards to next target at 97.61 (S2) and then any further easing would be targeting final support at 97.42 (S3).

Resistance Levels: 98.15, 98.51, 98.85

Support Levels: 97.82, 97.61, 97.42

Source: FX Central Clearing Ltd,( http://www.fxcc.com )